这就是PEPE与历史新高之间的差距

PEPE在关键阻力位附近挣扎,存在获利回吐风险。如果不超过0.00001369美元,不太可能突破0.0001725美元。

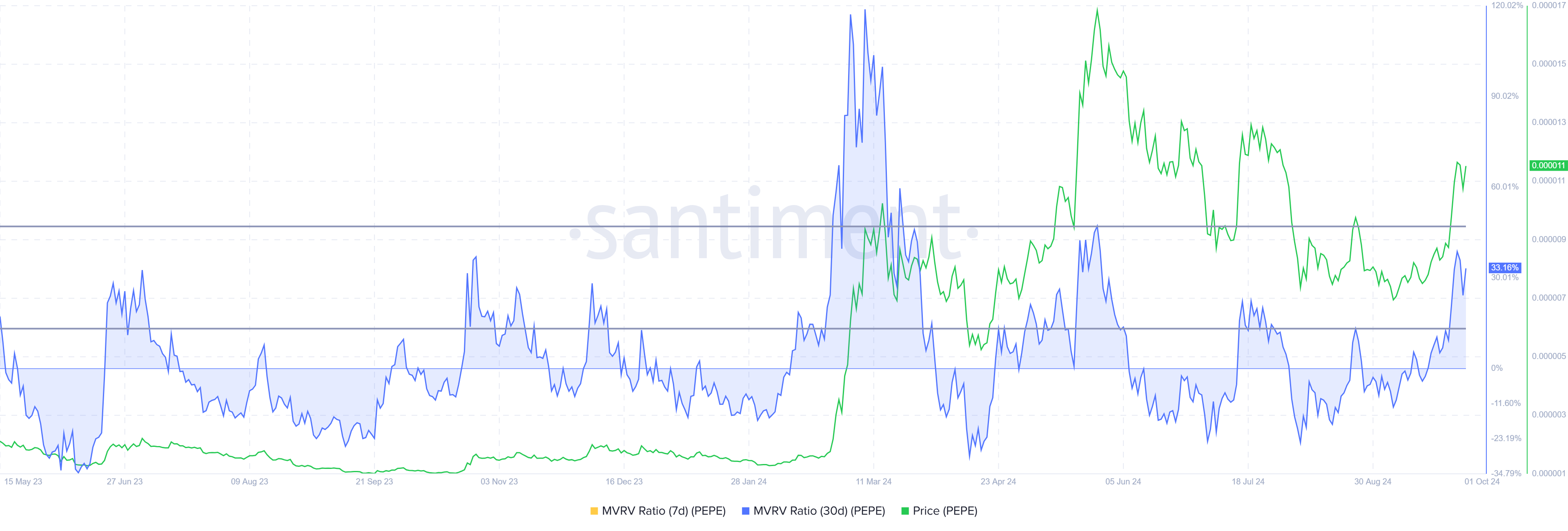

- PEPE在临界阻力位附近苦苦挣扎,由于危险区MVRV比率很高,获利回吐风险迫在眉睫。

- 盈利活跃的投资者发出潜在抛售压力的信号,增加了短期回调的机会并阻碍了突破。

- PEPE需要突破0.00001369美元才能反弹,但失败可能会导致0.00000989美元至0.00001369美元之间的盘整。

PEPE价格是一种流行的模因硬币,一直在努力获得关键的支撑水平,这可能会引发上涨至0.00001725美元的历史高位。然而,该硬币面临着巨大的阻力和获利回吐的威胁,这可能会阻碍其上涨势头。

模因币目前徘徊在临界水平附近,有可能在阻力点下方突破或继续挣扎。

PEPE面临获利回吐

PEPE的市值与实现价值(MVRV)比率为33%,目前处于危险区域。13%至47%之间的区域通常表明更正风险较高。这是因为,在这个水平上,大量投资者获利,这可能会导致广泛抛售。当利润变得充足时,投资者通常会锁定收益,从而给价格带来下行压力。

PEPE投资者应该牢记这种潜在的抛售压力,因为当MVRV比率达到这些水平时,调整的可能性更大。如果获利回吐加速,可能会进一步巩固阻力,使模因硬币更难突破。

阅读更多:佩佩:关于它是什么以及如何运作的全面指南

PEPE的宏观势头也显示出令人担忧的信号。活跃地址的历史数据表明,37%的参与投资者目前处于盈利状态。这个比例令人担忧,因为当超过25%的投资者处于绿色状态时,获利回吐的机会就会急剧上升。这些条件加上MVRV比率表明,市场的很大一部分可能正在准备出售,从而限制了PEPE的上涨能力。

盈利投资者的强劲存在增强了短期调整的可能性。如果足够多的持有者选择出售,PEPE可能会面临整合,而不是许多投资者所希望的突破。

PEPE价格预测:历史高点已经过去

PEPE目前的交易价格为0.00001118美元,略低于当地阻力位0.00001146美元。虽然突破这一阻力是可能的,但考虑到当前的市场状况,上涨幅度似乎不太可能超过0.0001369美元。PEPE与这种阻力的斗争已经持续了四个月,克服它绝非易事。

0.00001369美元的阻力位是阻止PEPE在0.00001725美元上方形成历史新高的关键水平。由于众多投资者准备获利回吐,突破这一障碍将是一项挑战。如果PEPE未能超过0.00001369美元,那么在可预见的未来,它可能会在该阻力位和0.00000989美元之间保持盘整。

阅读更多:佩佩(PEPE)价格预测2024/2025/2030

然而,如果PEPE在看涨情况下成功突破0.00001369美元,则可能会出现反弹。这一突破将使当前的熊市前景无效,并可能重新点燃投资者的乐观情绪。

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。