Circle首席业务官解释稳定币如何重塑高通胀经济

稳定币通过降低通胀和增强金融包容性来改变新兴市场的金融。

- 稳定币在新兴市场,特别是那些经历高通胀的市场越来越受欢迎,因为它们提供稳定的价值储存并促进更便宜、更快的跨境交易。

- 拉丁美洲和非洲正在见证稳定币的大量采用,这是由不断发展的金融科技生态系统、强大的开发者基础以及克服金融排斥的需要等因素推动的。

- 稳定币广泛采用的主要挑战包括监管不确定性、互联网接入有限和金融知识差距。

In regions that experience significant economic volatility and currency devaluation, stablecoins provide a lifeline. This stability makes them an appealing alternative for individuals and businesses in countries where their wealth is subject to inflation.

Unlike conventional currencies, which can experience rapid fluctuations, stablecoins maintain a consistent price by being pegged to assets such as the US dollar or commodities. This price stability drives their increasing adoption in regions like Sub-Saharan Africa and Latin America.

稳定币在地方经济中的作用

不同的金融机构、企业和个人利用稳定币来简化国际支付和流动性管理等流程,并利用它们来缓解不利的货币波动。

Circle首席商务官Kash Razzaghi在接受BeInCrypto采访时解释说,这些实例通过促进比传统金融系统更快、更具成本效益的交易,推动了全球稳定币的采用。

“在新兴市场,加密货币和稳定币的监管环境正在变化,”他说。

The introduction of stablecoins in 2014 effectively merged the technological advantages of blockchain with the financial stability needed for widespread adoption.

While blockchain technology facilitates transparency and efficiency, the stablecoin itself addresses the issue of cryptocurrency price volatility. As a result, stablecoins attract an audience beyond financial trading and speculative investors, reaching retail and institutional sectors.

In the coming years, stablecoin adoption will spread even further, Razzaghi added.

他说:“随着时间的推移,我们预计,随着政策制定者寻求在创新与金融稳定和合规之间取得平衡,我们可能会出现更正式的许可制度、强大的KKC/反洗钱框架以及与更广泛的CBDC战略的潜在整合。”

Razzaghi particularly referred to countries in Sub-Saharan Africa as driving forces behind stablecoin adoption.

As of 2021, a World Bank index reported that less than half of the region’s adult population had a bank account. As a result, cryptocurrency became highly appealing to nations like Nigeria, Ethiopia, Kenya, and South Africa.

DeFi在非洲的采用

除了稳定币的兴起之外,当地的DeFi计划在尼日利亚等非洲国家也获得了显着的关注,尼日利亚是全球加密货币采用的主导力量。根据Chainalysis最近的一份报告,尼日利亚体现了这一趋势,去年DeFi服务收到的价值超过300亿美元。

“随着DeFi DeFi生态系统的不断扩大,基于稳定的信贷贷款、可节省的信贷产品和可汇款的信贷解决方案在新兴的信贷市场中越来越容易被用户使用。这赋予了历史上被排除在传统银行系统之外的个人权力,以获取金融产品和服务,促进包容性,并允许他们与全球经济互动,”拉扎吉强调。

Yellow Card, a Nigerian-born stablecoin on/off ramp, actively provides customers across greater Africa secure, liquid, and cost-effective access to stablecoins such as USDT and USDC and tokens like BTC and ETH, making direct transactions using local currencies easier

Other countries in the region have also created phone-friendly services for users who lack internet access. In 2020, Kenya’s leading mobile network operator, Safaricom, and communications company, Vodacom Group, established M-PESA Africa.

The platform allows users to access stablecoin-fiat services such as Binance. It has also extended its operations to other African countries, including Tanzania, Mozambique, Ethiopia, Egypt, and Ghana.

“稳定币解决方案正在通过开发移动友好平台和其他交易功能来适应有限的互联网访问和基础设施的挑战。例如,一些项目正在探索使用基于短信的交易和与当地电信提供商的合作伙伴关系,以将其影响力扩展到服务不足的社区,”Razzaghi告诉BeInCrypto。

这些努力旨在增加农村地区服务不足的社区获得稳定币服务的机会,从而促进金融包容性。

高通胀国家的稳定币

在恶性通货膨胀超过100%的阿根廷,公民使用USDT和USDC等与美元挂钩的稳定币来保护自己的储蓄免受贬值的影响。每当比索贬值或政府实施新的货币管制时,当地交易所的稳定币需求就会激增。

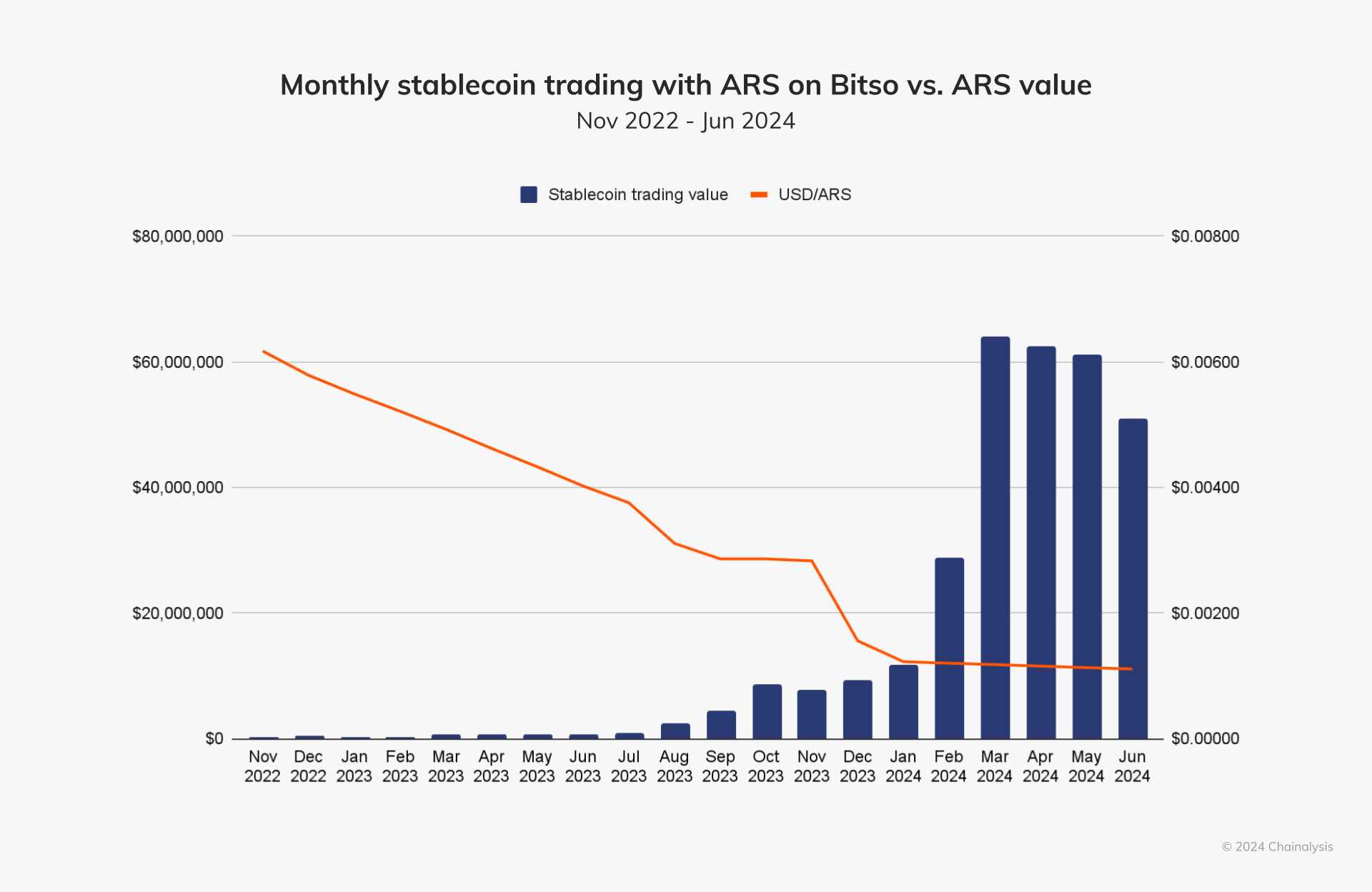

根据2024年Chainalysis报告,当阿根廷比索价值于2023年7月跌破0.004美元时,次月稳定币交易额飙升至100万美元以上。2023年12月也发生了同样的事情,当时米莱总统宣布,作为最初紧缩计划的一部分,他将使货币贬值50%。当月,阿根廷比索跌破0.002美元,次月稳定币交易额突破1000万美元。

按资产类型列出的拉丁美洲零售规模交易量与全球平均水平的份额。资料来源:Chainalysis。

在委内瑞拉,稳定币也已成为主要的交换媒介,取代了过度膨胀的玻利瓦尔。个人积极使用点对点平台进行日常交易,包括购买商品和服务以及利用稳定币来实现稳定。

拉扎吉解释说:“由于对美元的高需求,拉丁美洲已成为数字资产用例的中心,人们使用USDC等美元挂钩稳定币作为价值储存手段。”

近一百万开发商为这一增长做出了贡献,其中许多人为美国公司从事离岸项目。这些熟练的劳动力推动了当地创新,金融科技公司和新银行大幅改善了拉丁美洲消费者的金融准入并降低了成本。

拉扎吉说:“这种广泛采用的部分原因是,该地区3000万数字银行客户中有四分之三是以前没有银行账户或银行账户不足的个人和中小企业。”

Razzaghi强调AirTM是一家提供USDC支持账户的金融科技提供商,是稳定币成功整合的一个例子。这些账户使企业能够快速进行低成本付款,并允许收款人轻松将USDC兑换为当地货币。

他补充说:“这对于该地区正在努力应对跨境支付成本高和当地货币不稳定的企业来说特别有帮助,同时使工人能够快速且负担得起的美元工资。”

因此,当地加密货币交易所使个人能够在当地金融状况充满挑战的情况下维持经济活动。

稳定币采用面临的挑战

Despite several benefits, certain conditions can complicate widespread stablecoin adoption, particularly in developing countries. While DeFi projects have made it easier to sidestep regulatory uncertainty in some countries, a broader implementation is difficult without the accompanying framework.

Beyond that, individuals who live in rural areas experience limited internet access. Financial literacy gaps across different regions also make accessibility more difficult. As a result, informational workshops and educational resources have become indispensable for adopting stablecoin.

“稳定币项目和当地社区正在积极开展研讨会、网络研讨会和社区外展计划等教育举措,以提高人们的认识,并提供有关如何安全有效地使用数字资产的实用知识。这些教育举措对于在金融知识水平较低的地区建立信任和促进稳定币的采用至关重要,”Razzaghi告诉BeInCrypto。

Some of these initiatives continue to be active. Nigeria’s Yellow Card, for example, designed an academy that provides free digital asset courses to individuals and organizations across Africa.

SMS transactions via platforms like M-Pesa also help streamline transaction capabilities for underserved communities. However, additional barriers, such as lack of access to mobile devices and computers, render these initiatives deficient.

拉扎吉补充道:“随着时间的推移,更明确的政策、更广泛的连接性和持续的金融扫盲努力将推动更广泛的稳定币使用,从而利用稳定币提供的安全性和全球访问的固有好处。”

更多地实施志同道合的努力对于稳定币的广泛采用至关重要。

稳定币与央行数字货币

Another aspect that raises uncertainty around stablecoin adoption is the recent incorporation of Central Bank Digital Currencies (CBDCs). These currencies are a digital form of money issued and regulated by a central bank. It’s not intended to replace physical cash but rather to coexist with it.

A key distinction between CBDCs and cryptocurrencies lies in their issuers. CBDCs are issued and backed by governments, ensuring their value is stable and supported by the issuing nation. In contrast, private entities issue and manage cryptocurrencies, making their value subject to significant market fluctuations.

According to the Atlantic Council’s CBDC tracker, the Bahamas, Jamaica, and Nigeria are among the nations that have fully launched CBDCs. In Nigeria and the Bahamas, CBDC issuance witnessed significant growth. All three countries are currently prioritizing the expansion of their retail CBDC adoption within their respective markets.

Every G20 country is also exploring a CBDC, with 19 in the advanced stages of CBDC exploration. Of those, 13 countries are already in the pilot stage, including Brazil, Japan, India, Australia, Russia, and Turkey.

Though CBDCs and stablecoins could compete for dominance in digital payments, each mechanism has its unique advantage.

“我们看到USDC和CBDC等合规稳定币之间存在很多协同效应,稳定币在支持点对点跨境交易方面发挥着至关重要的作用,例如,这一功能尚未被纳入大多数CBDC的核心设计中,”他说。正在开发中。

尽管如此,拉扎吉相信这两个体系可以共存而不是竞争。

“USDC和其他私营部门创新已经实现了CBDC希望提供的东西。CBDC的许多好处已经通过基于区块链的支付系统由私营部门的创新来实现,”拉扎吉补充道。

Examining these dynamics sheds light on how emerging markets adopt stablecoins and CBDCs, highlighting their potential to reshape the global financial sector with greater inclusivity.

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。