可能将比特币推至70,000美元的2个关键因素

比特币可能会突破历史新高,但投资者的乐观情绪表明谨慎。突破67,504美元阻力位是上涨至70,000美元的关键。

- 比特币正在形成看涨双底格局,暗示有可能上涨20%,可能突破历史新高。

- 乐观的投资者情绪历来预示着看跌风险,但交易所的强劲净流出表明长期乐观。

- 比特币需要突破67,504美元的阻力才能上涨至70,000美元,可能超过之前73,780美元的高点。

比特币最近的价格走势引发了有关突破73,780美元历史新高的可能性的讨论。看涨双底格局的形成表明,突破这一水平是可以实现的。

然而,比特币需要克服巨大的阻力障碍才能发生。市场正在密切关注这些信号是否与更广泛的市场线索一致,从而推动BTC上涨至70,000美元。

比特币投资者的乐观情绪是致命的

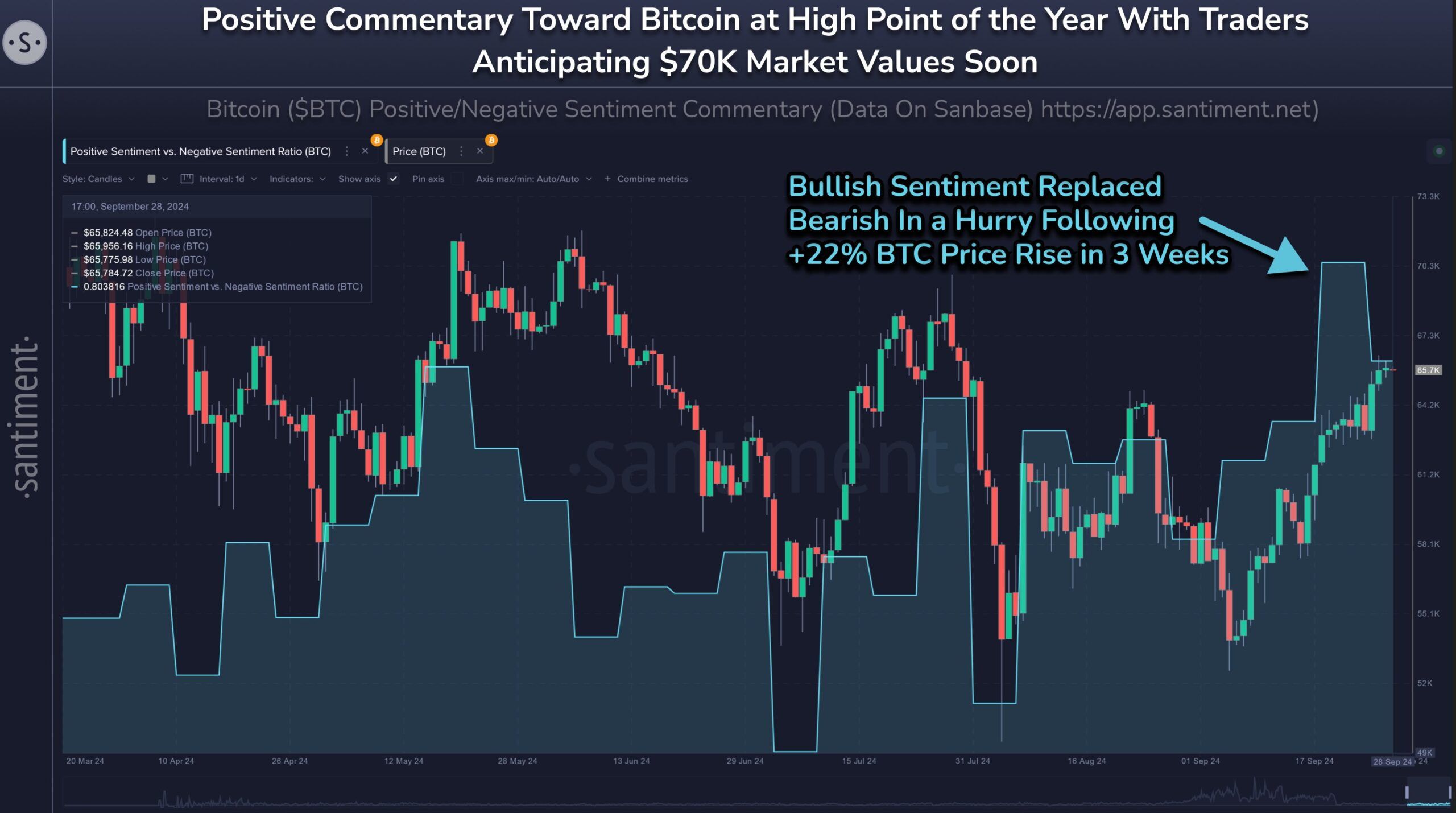

历史模式表明比特币可能正处于逆转的边缘。来自Envement的数据表明,投资者和交易员的积极评论通常是加密货币的熊市信号。过去,价格下跌是在整体市场情绪变得过于乐观之后发生的。这一趋势可能会再次出现,尽管价格模式看涨,但投资者仍持谨慎态度。

每当投资者情绪达到顶峰时,通常会出现大幅调整。如果这种格局保持不变,比特币短期内可能面临下行压力。虽然双底格局为突破带来了希望,但积极的市场情绪可能会起到反作用,阻止比特币创下新高。

阅读更多:上次比特币减半时发生了什么?2024年预测

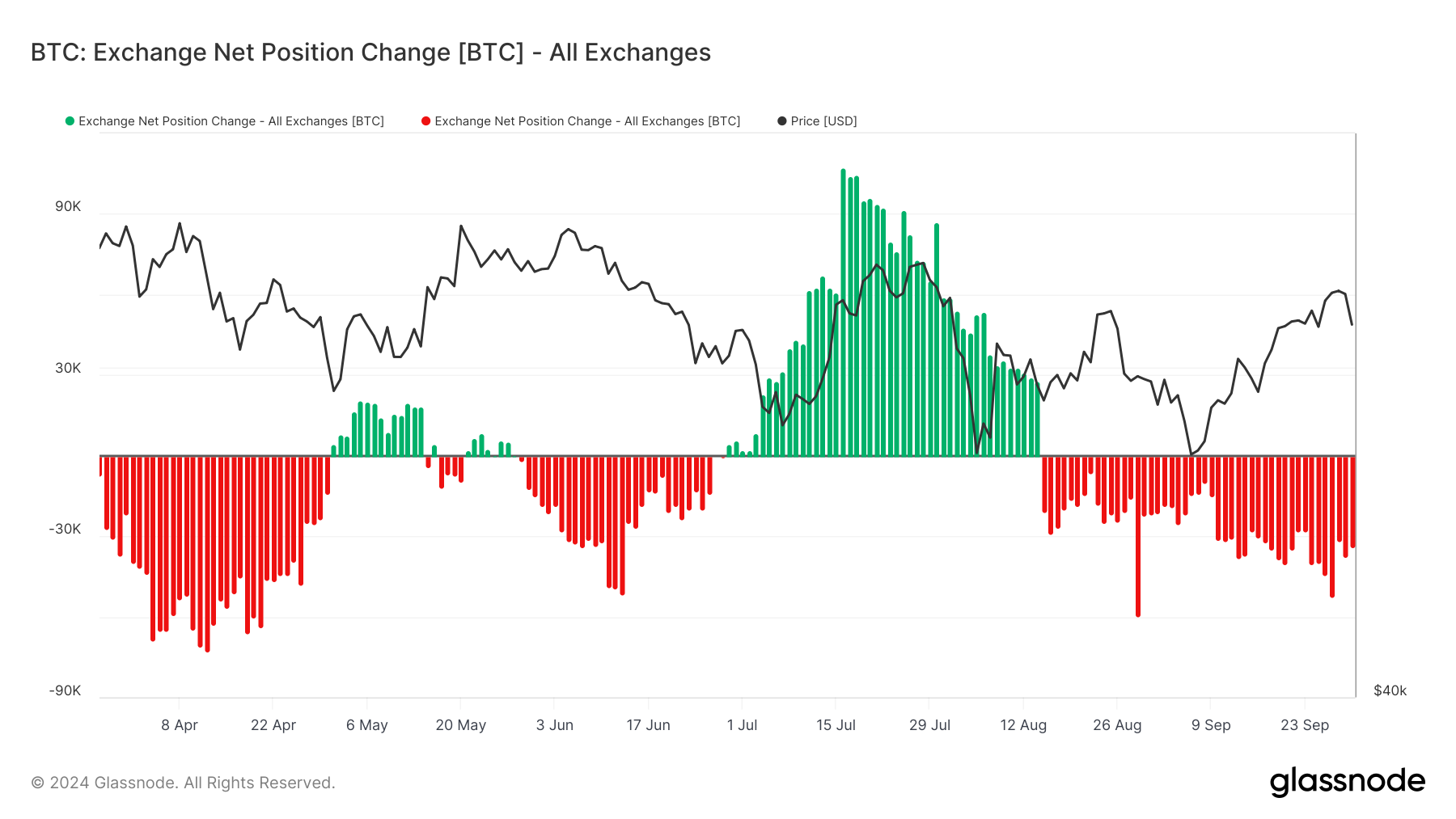

另一方面,比特币更广泛的宏观势头仍然强劲。交易所的净头寸变化跟踪比特币进出交易所钱包的流动,显示出持续的资金外流。这通常被视为一个看涨指标,因为它表明投资者正在将比特币移出交易所,并可能长期持有。

这些持续的资金外流意味着投资者对比特币的价格轨迹持乐观态度,抵消了更广泛的市场熊市情绪暗示。虽然这并不能保证比特币会上涨,但这表明许多投资者对比特币的未来表现仍然充满信心,这可能有助于稳定价格。

BTC价格预测:关键突破

比特币在短暂上涨后,周一小幅下跌,目前交易价格为63,928美元。看涨双底格局表明突破后可能上涨20.44%,目标价格为75,979美元。这将推动比特币突破之前的历史新高。

然而,市场状况表明,整合可能比持续上涨更有可能。比特币已经反弹至63,068美元,但仍需突破67,504美元的阻力位。鉴于这种阻力的强度,比特币短期内可能难以突破。

阅读更多:比特币历史减半:您需要了解的一切

如果比特币确实成功突破67,504美元的阻力位,则有可能上涨至70,000美元。这将使当前的看空中性前景无效,并放大投资者利润,为进一步的上涨动力奠定基础。

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。