空头预计股价可能下跌40%,BONK价格面临压力

由于超买信号和市场枯竭表明价格将出现回调,Bonk s(BONK)价格可能下跌40%。

- 由于市场指标表明疲惫不堪,Bonk(BONK)在最近上涨50%后可能面临40%的价格回调。

- 期货兴趣下降和超买信号引发了人们对BONK势头潜在下滑的担忧。

- 获利回吐可能会推动BONK在0.000022美元重新测试阻力位,如果抛售压力加大,可能会在0.000015美元获得支撑位。

热门表情包BONK最近火爆,过去一周价格飙升近50%。虽然这让许多持有者受益,但市场已经变得过热,一些指标表明价格即将回调。

如果买家精疲力尽,模因币的价格可能会下跌40%。这项分析深入探讨了原因。

BONK Market Heats Up

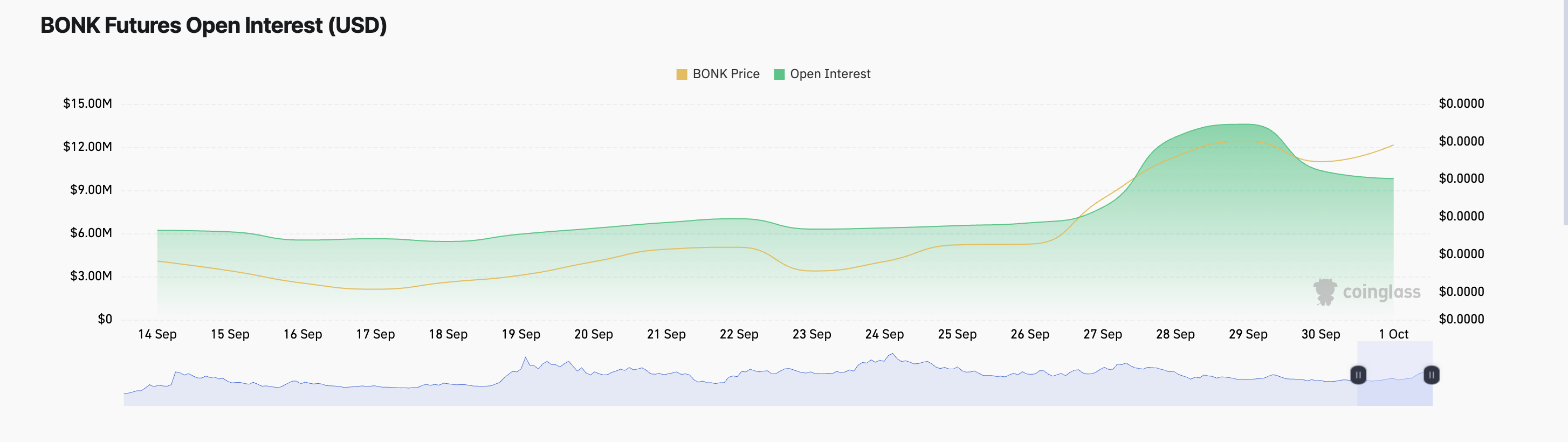

对BONK衍生品市场的评估显示,过去几天该代币的期货未平仓兴趣有所下降。自9月29日攀升至1500万美元的三个月高点以来,追踪未偿期货合约数量的模因币期货未平仓利息已下降29%。截至本文撰写时,这一数字为1000万美元。

阅读更多:如何购买Solana Meme Coins:分步指南

有趣的是,BONK一直保持上升趋势,在此期间上涨了13%。代币未平仓利率下降而价格上涨表明进入市场的新参与者越来越少。这表明其上涨趋势可能正在减弱,如果新买家不支持涨势,那么涨势可能不会持续太久。

此外,BONK的两位数涨势伴随着市场波动性的大幅飙升,其布林带指标的扩大就是证明。截至本文撰写时,BONK的交易价格略高于该波动率标记的上带。

一般来说,当这种情况发生时,意味着当前的市场趋势(BONK的情况下是上升趋势)可能会持续下去,至少在短期内是这样。然而,随着价格在这个上带之外移动得太远,这表明资产已经超买,这可能会导致近期的回调或回调。

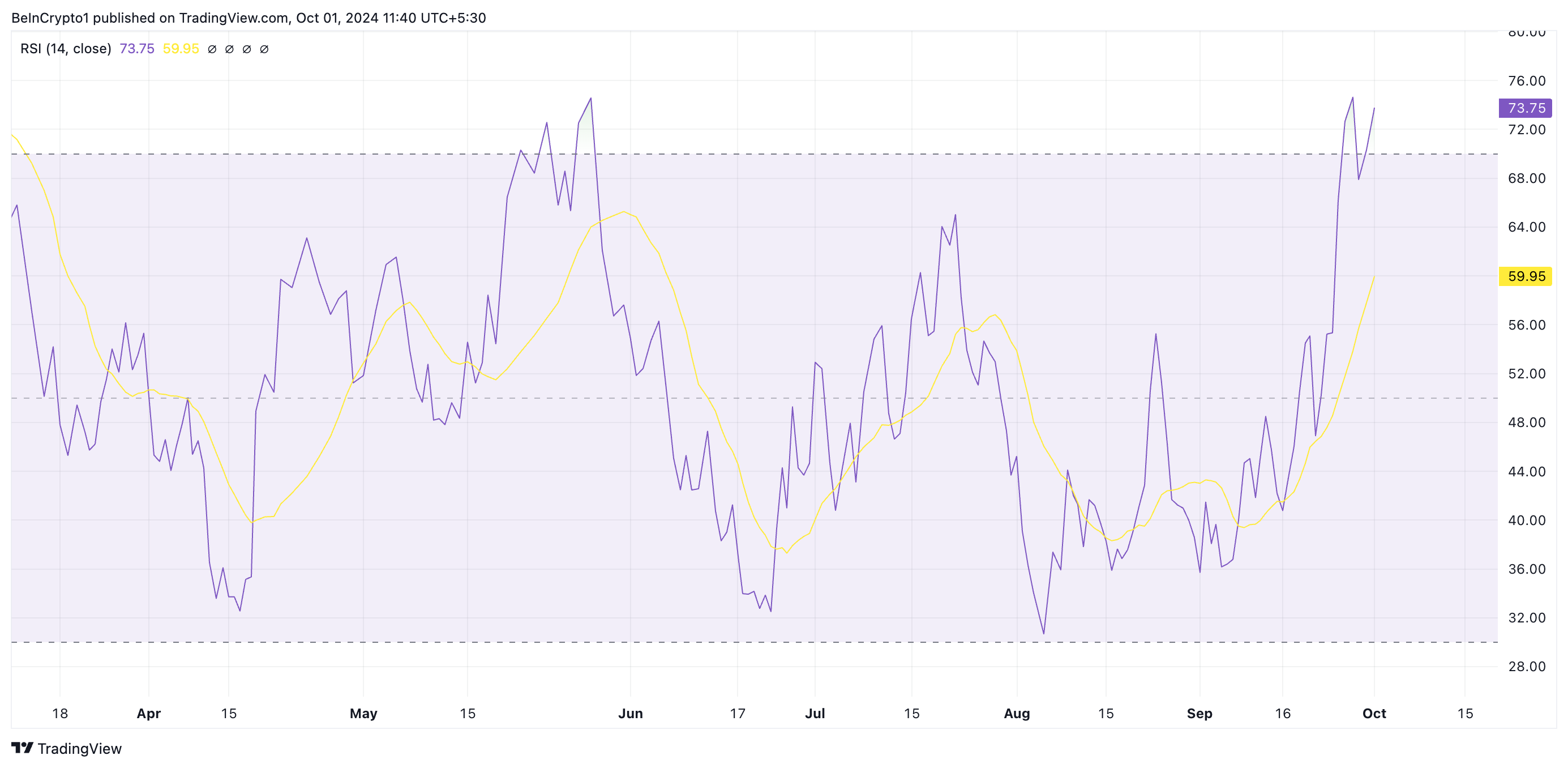

BONK的相对强弱(RTI)证实了这一前景。在74.33处,该指标衡量资产的超卖或超买市场状况,表明模因币已超买。RJ读数为73.75,暗示买家即将耗尽,随后往往会出现价格下跌。

BONK价格预测: All Lies With the Bears

随着BONK价格创下新高,获利回吐活动激增,可能会导致回调。如果发生这种情况,模因币可能会尝试在0.000022美元水平重新测试阻力。如果届时抛售压力加剧,BONK可能会继续下跌,在0.000015美元附近寻求支撑。

阅读更多:2024年9月值得关注的11款Solana Meme硬币

然而,成功重新测试阻力位可能会导致BONK恢复上涨趋势,强化对另类币的看涨情绪。在这种情况下,BONK的价格可能会上涨至0.000033美元,可能为四个月高点0.000044美元扫清道路。

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。