Bybit Expands Into US Stocks and Commodities to Attract Institutional Investors

Bybit is expanding its trading platform to include US stocks, commodities, and indices, marking a strategic shift beyond crypto.

- Bybit is expanding beyond crypto by adding trading options for US stocks, commodities like gold and crude oil, and market indices.

- The move aims to attract both retail and institutional investors by integrating traditional assets into its high-leverage trading platform.

- The crypto exchange is regaining user confidence and aligning its strategy with broader market trends and favorable US policy shifts.

Crypto exchange Bybit is broadening its scope beyond digital assets as it prepares to launch new trading options, including US equities, commodities, and indices.

The exchange, known for its crypto leverage products, aims to introduce these offerings before the end of the current quarter.

Trump-Era Pro-Crypto Policies Fuel Bybit’s Move Into Equities

On May 3, Bybit CEO Ben Zhou confirmed the development during a Livestream event. He noted that users will soon be able to trade instruments such as gold, crude oil, and leading US stocks like Apple and MicroStrategy.

These additions significantly shift Bybit’s product strategy and reflect the platform’s ambition to serve a wider set of retail and institutional investors.

The trading features will integrate with Bybit’s current infrastructure. This includes the MetaTrader 5 (MT5) platform, which already supports leveraged gold trading. Users can access up to 500x leverage on select instruments, a feature that appeals to high-risk traders.

Notably, gold and oil trading have been available on the platform in a limited form. So, adding US stocks poses a more direct challenge to platforms like Robinhood, which merge crypto with traditional finance.

Meanwhile, Bybit’s move reflects a larger trend in the financial industry where the boundaries between crypto-native platforms and traditional brokerages are becoming less defined.

In recent months, several traditional trading platforms have signaled interest in offering crypto products. At the same time, exchanges like Bybit are adding traditional assets to match investor demand.

The shift also follows growing policy support for digital assets under President Donald Trump’s current administration.

Trump has adopted a more favorable stance toward crypto innovation. This has resulted in a policy environment that is driving firms like Bybit to diversify and remain competitive.

Meanwhile, this product expansion move follows a major security breach in February. The platform was recently targeted in an exploit that resulted in the theft of 500,000 ETH, valued at approximately $1.5 billion.

Zhou acknowledged that a portion of the stolen funds—roughly 28%—have become untraceable due to the attacker’s laundering efforts. However, the exchange is working with the broader community to trace the remaining funds.

Despite this setback, Bybit appears to be regaining momentum.

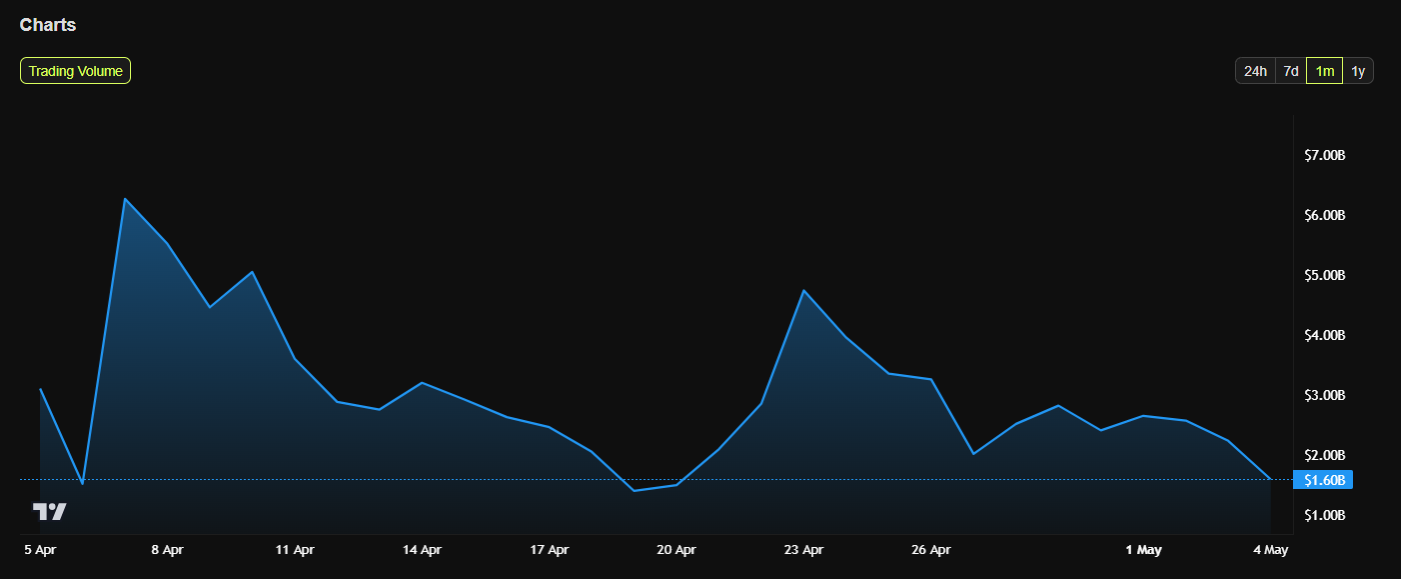

According to data from BeInCrypto, user activity and trading volume are climbing back to levels seen before the exploit, suggesting that confidence in the platform is returning.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.