Retail Traders Buy the Dip Again: Record Buys Save Markets from Brink

In the days leading up to Moody's unexpected downgrade of the U.S. credit rating, the financial markets hummed with an uneasy calm, as investors braced for potential turbulence. The S&P 500 hovered ne

In the days leading up to Moody's unexpected downgrade of the U.S. credit rating, the financial markets hummed with an uneasy calm, as investors braced for potential turbulence.

The S&P 500 hovered near record highs, buoyed by a resilient economy, yet whispers of fiscal uncertainty loomed large. Amid this backdrop, retail traders—once dismissed as peripheral players—were quietly amassing influence, their growing presence on digital platforms signaling a shift in market dynamics. Little did the financial world know, these individual investors were poised to seize a historic moment, ready to reshape the narrative of a market on the brink.

Market Activity: S&P 500 Defies Downgrade with Slim Gains

On Monday, the S&P 500 eked out a slim gain of 0.09%, closing at 5,963.60, marking its sixth consecutive winning session. This modest increase came despite Moody's downgrade of the U.S. credit rating from aaa to Aa1, driven by concerns over the federal government’s growing budget deficit and high borrowing costs. Treasury yields spiked initially, with the 30-year U.S. bond yield surpassing 5% and the 10-year yield exceeding 4.5%, briefly pressuring equities. The S&P 500 fell about 1% at its low, while the Dow Jones Industrial Average dropped over 300 points. However, as yields retreated, the major indices recovered. The Dow rose 0.32% to 42,792.07, buoyed by an 8% rebound in unitedhealth shares, and the Nasdaq Composite edged up 0.02% to 19,215.46. Investors largely shrugged off the downgrade, focusing on broader economic resilience.

Retail Traders’ Historic Dip Buying Spree Calms Jumpy Markets

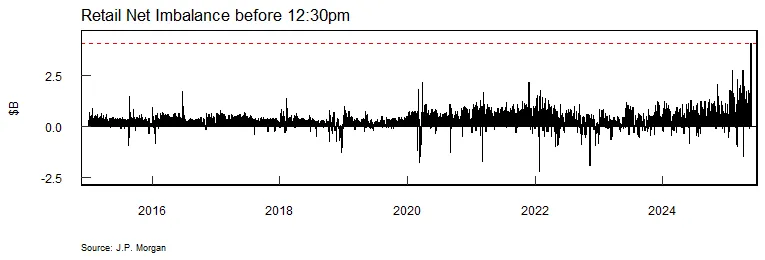

Retail traders have emerged as a formidable force in today’s financial markets, a reality vividly demonstrated on Monday when they turned an early 1% drop in the S&P 500 into a near-flat close. Triggered by the U.S. credit downgrade, individual investors launched a record-breaking dip buying spree, purchasing a net $4.1 billion in U.S. stocks by 12:30 p.m. in New York—the largest midday inflow ever recorded, per jpmorgan chase & Co. data. This surge, representing an unprecedented 36% of trading volume, flipped the S&P 500 from a 1.1% loss to positive territory by afternoon, before it settled at a 0.09% gain.

This wasn’t a fluke but a milestone in the evolution of retail trading. Historically, retail investors were minor players—often caricatured as impulsive latecomers, selling into downturns and missing rallies. That perception began to shift with the advent of commission-free trading platforms and the proliferation of financial discussions on social media platforms. The COVID-19 pandemic supercharged this transformation, drawing millions of new traders into the market. Armed with stimulus checks and time at home, many embraced a “buy the dip” strategy, viewing volatility as opportunity rather than risk.

Monday’s event builds on a pattern of bold retail action. Since April’s tariff-induced selloff, small investors have been aggressively buying during dips, undeterred by macroeconomic noise. With the S&P 500 approaching a 20% gain—a threshold signaling a bull market—retail enthusiasm contrasts sharply with the caution of institutional “smart money.” Frank Monkam, head of macro trading at Buffalo Bayou Commodities, observed, “Retail has learned the hard way, getting left behind during previous recoveries… There is almost an unwavering commitment from retail to never make that mistake again.” This shift marks a departure from past cycles, where retail panic often amplified market declines. Today, they’re a stabilizing force, stepping in when others waver.

Wall Street is paying attention. Morgan Stanley’s head of analysis and development team highlighted how the U.S.-China trade truce has reduced recession fears, framing dips as buying opportunities. One of HSBC’s analyst echoed this, urging investors to increase exposure during pullbacks. Researchers from Clough Capital Partners lauded retail traders’ acumen, noting, “They’re savvy enough to pick up on the area of opportunity” amid declining inflation and strong corporate earnings. These endorsements underscore a growing respect for retail’s market instincts.

The breadth of retail influence was striking on Monday. Beyond stabilizing the S&P 500, they targeted specific assets: $675 million flowed into Tesla, $439 million into Palantir, and significant sums into Bitcoin ETFs, while Nvidia saw outflows. Single stocks accounted for $2.5 billion of purchases, with exchange-traded funds (ETFs) comprising $1.5 billion, per JPMorgan. This precision suggests a sophistication that belies the “amateur” label, as retail traders leverage real-time data and trends to shape their moves.

The $4.1 billion midday inflow dwarfed prior records, and the 36% trading volume share eclipsed even the 2021 meme stock mania, signaling retail’s ascent from participants to market movers.

A New Era for Retail Trading

Monday’s historic dip buying spree cements a seismic shift in market dynamics. Retail traders, once sidelined as noise, are now a counterweight to institutional hesitancy.

Their swift, decisive action during the downgrade-induced dip showcases a confidence and skill that upends old stereotypes. This trend poses big questions: Can retail sustain its role as a market stabilizer, or might unchecked enthusiasm spark future volatility? At least at the moment, their impact is undeniable—they’re not just reacting to markets; they’re shaping them. As trading continues to democratize, retail traders are poised to remain a central force, heralding a new chapter in financial markets.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.