Epic Buy or Big Trap? Retail Traders Chase S&P Swings

Retail traders are doubling down on U.S. stocks, snapping up shares at a pace that's outstripping even the most bullish Wall Street forecasts. Since April 2, 2024, these everyday investors have poured

Retail traders are doubling down on U.S. stocks, snapping up shares at a pace that's outstripping even the most bullish Wall Street forecasts.

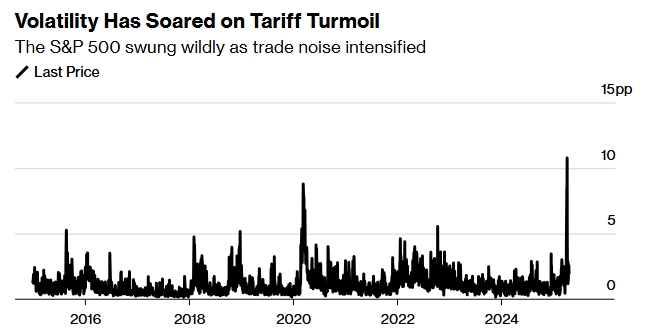

Since April 2, 2024, these everyday investors have poured over $30 billion into American equities and ETFs, undeterred by the S&P 500's 4% slide and its wildest swings in years. What's their mantra? Buy the dip, and buy it hard. However, as the index lurches between steep losses and fleeting rallies, the question looms: is this a golden opportunity or a trap for the unwary?

What Retail Traders Are Doing and Why?

Retail investors, everyday individuals without the institutional backing of Wall Street, have emerged as a powerful force in the U.S. equity markets this year.

While professional money managers have adopted a defensive posture, retail traders have taken the opposite approach, aggressively buying stocks and exchange-traded funds (ETFs). Since April 2, they've invested over $30 billion in American equities, according to JPMorgan Chase & Co.'s global quantitative and derivatives strategist, Emma Wu.

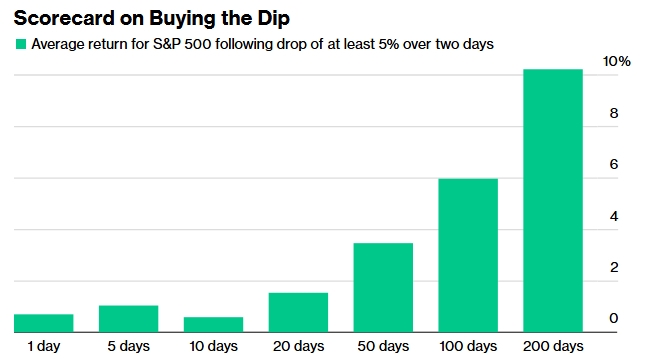

A hallmark of retail trader behavior has been their tendency to buy the dip. On days when the market drops significantly, these investors step in with substantial purchases. For example, on a recent Monday when the S&P 500 fell 2.4%, retail traders scooped up more than $3 billion in shares. This was the 14th such instance this year, with five occurring since April 2 alone.

Their targets include a mix of individual stocks, such as tesla Inc. and nvidia Corp., which account for nearly half of the 60% of inflows directed to single stocks, and ETFs tracking major indices like the S&P 500 and Nasdaq 100, which make up the remaining 40%.

Retail investors like Mike Schiemer, a 39-year-old digital marketing specialist from a Boston suburb, exemplify this strategy.

Schiemer has been buying aggressively, focusing on dividend-paying mega-caps like alphabet inc., microsoft Corp., Apple Inc., and Meta Platforms Inc., as well as Pfizer Inc., Dell Technologies Inc., and broad-market ETFs. Meanwhile, others, like Girish Shenoy, a 48-year-old IT professional from Dallas, are diversifying into sectors such as manufacturing, pharmaceuticals, and oil and gas, alongside their tech holdings.

The driving force behind this buying spree is a belief that the current volatility offers a rare chance to acquire top-tier companies at bargain prices. Schiemer sees parallels to the 2020 market downturn, which he regrets not capitalizing on more fully, and views this as a "long-term potential wealth-building" opportunity. He argues, "The best companies in the world are on sale, many that have survived 1989, 2001, 2008, 2020, et cetera, and thrived." This sentiment is shared widely among retail traders, particularly among social media platforms, where the "Magnificent Seven" tech giants enjoy a devoted following that rallies to buy during dips.

Additionally, some retail investors are motivated by a steadfast confidence in the market's long-term upward trajectory. "In the long term the market is undefeated and always comes back," one of the retail investors says, dismissing the idea of holding cash during downturns.

This conviction is bolstered by steady inflows from retirement accounts, such as 401(k)s and IRAs, which totaled $44 trillion as of December 31, 2023, according to the Investment Company Institute—ensuring consistent investment regardless of short-term market swings.

The Real Buying Opportunity Or Potential Risk?

Since April 2, 2024, the day Trump announced his tariff plans, the S&P 500 has been a rollercoaster.

The index is down approximately 4.6% overall, despite a notable rally on Tuesday and Wednesday this week. Over the 14 trading sessions since April 2, it has seen five drops exceeding 2% and two gains surpassing 2%. Tuesday's rally provided a brief reprieve, followed by Wednesday's dramatic surge of up to 3.4%, though the day's gains later moderated to half that amount by the close.

For individual investors, the wild swings raise a critical question: does this volatility signal a buying opportunity? The answer hinges on two factors: investment horizon and risk tolerance. Historically, the S&P 500 has trended upward over the long term, supporting the "buy the dip" strategy favored by retail traders. Kevin Jestice, senior vice president at Nationwide Financial's investment management group, notes, "People who have a long-term view of their investment portfolio are more comfortable buying this dip." He adds that committing capital becomes easier when not trying to "perfectly time the absolute bottom."

However, the risks are real. The dotcom bubble serves as a cautionary tale: investors who bought the S&P 500 at its peak in early 2000 waited until mid-2007 to break even. Today's volatility, with its rapid ups and downs, underscores the challenge of timing entries and exits. For retail traders like Schiemer, who targets stable, dividend-paying giants, or Shenoy, who balances tech with diversified sectors, the focus is on enduring short-term turbulence for long-term gains. Others embrace higher risk for potential "magic" rewards.

Retail traders see the S&P 500's wild swings as an epic buying opportunity, fueled by optimism about the market's long-term resilience and the chance to own premier companies at reduced prices. Their recent $30 billion investment reflects a bold, dip-buying strategy that contrasts with the caution of professional managers. Whether this proves a winning trade depends on their ability to ride out the storm.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.