June CPI Ticks Up as Expected, With Trump’s Tariffs Starting to Warm Up Prices

U.S. consumer prices ticked up in June, in line with expectations, though signs of early inflationary pressure from Trump’s new tariffs are beginning to emerge.The Consumer Price Index (CPI) rose 2.7%

U.S. consumer prices ticked up in June, in line with expectations, though signs of early inflationary pressure from Trump’s new tariffs are beginning to emerge.

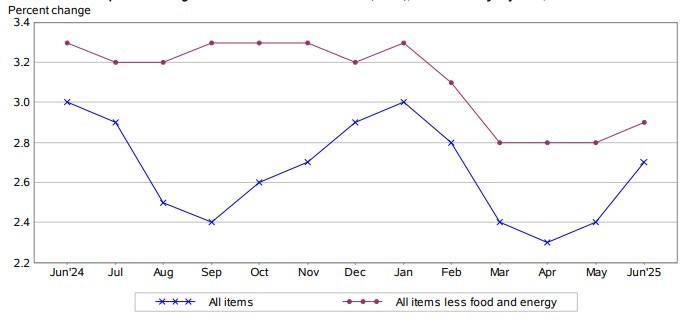

The Consumer Price Index (CPI) rose 2.7% year-over-year, slightly above the 2.6% estimate, and accelerated on a monthly basis by 0.3%, up from 0.1% in May.

The core CPI, which excludes food and energy, increased 2.9% year-over-year, matching forecasts. On a monthly basis, core prices rose 0.2%, just below the expected 0.3%, but still above the previous 0.1% reading—suggesting a mild uptick in underlying inflation.

The index for shelter rose 0.2% in June, making it the largest contributor to the overall monthly increase. Energy prices rose 0.9%, driven by a 1.0% increase in gasoline prices. Meanwhile, food prices rose 0.3%, with both food at home and food away from home contributing 0.3% and 0.4%, respectively.

The core CPI also rose 0.2% for the month, mainly came from categories such as household furnishings, medical care, recreation, apparel, and personal care. Offsetting those gains were declines in used cars and trucks, new vehicles, and airline fares.

This report marks the first CPI reading to reflect the early impact of President Trump’s newly implemented tariffs—raising questions about how these trade measures may influence broader inflation in the coming months. Federal Reserve Chair Jerome Powell has cautioned that tariff-driven inflation could add uncertainty to the economic outlook, stating: “We think that the prudent thing to do is to wait and learn more and see what those effects might be.”

With the Fed eyeing a potential rate cut in July, the June CPI report could play a pivotal role. While inflation remains largely in check, any sustained acceleration—especially from tariff-related price increases—could complicate the central bank's path forward.

FedWatch still prices in a 97% chance of no rate cut in July, as the warm-up in CPI suggests the path ahead remains uncertain. However, given the figures so far, investors may still have reason to cheer.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.