SGX Adds 6 New Hong Kong and Thai Singapore Depository Receipts: Here's What You Should Know

Singapore Stock

2025-06-26 17:49:52

2.39W

Investors now have an expanded range of Hong Kong and Thai stocks to choose from.

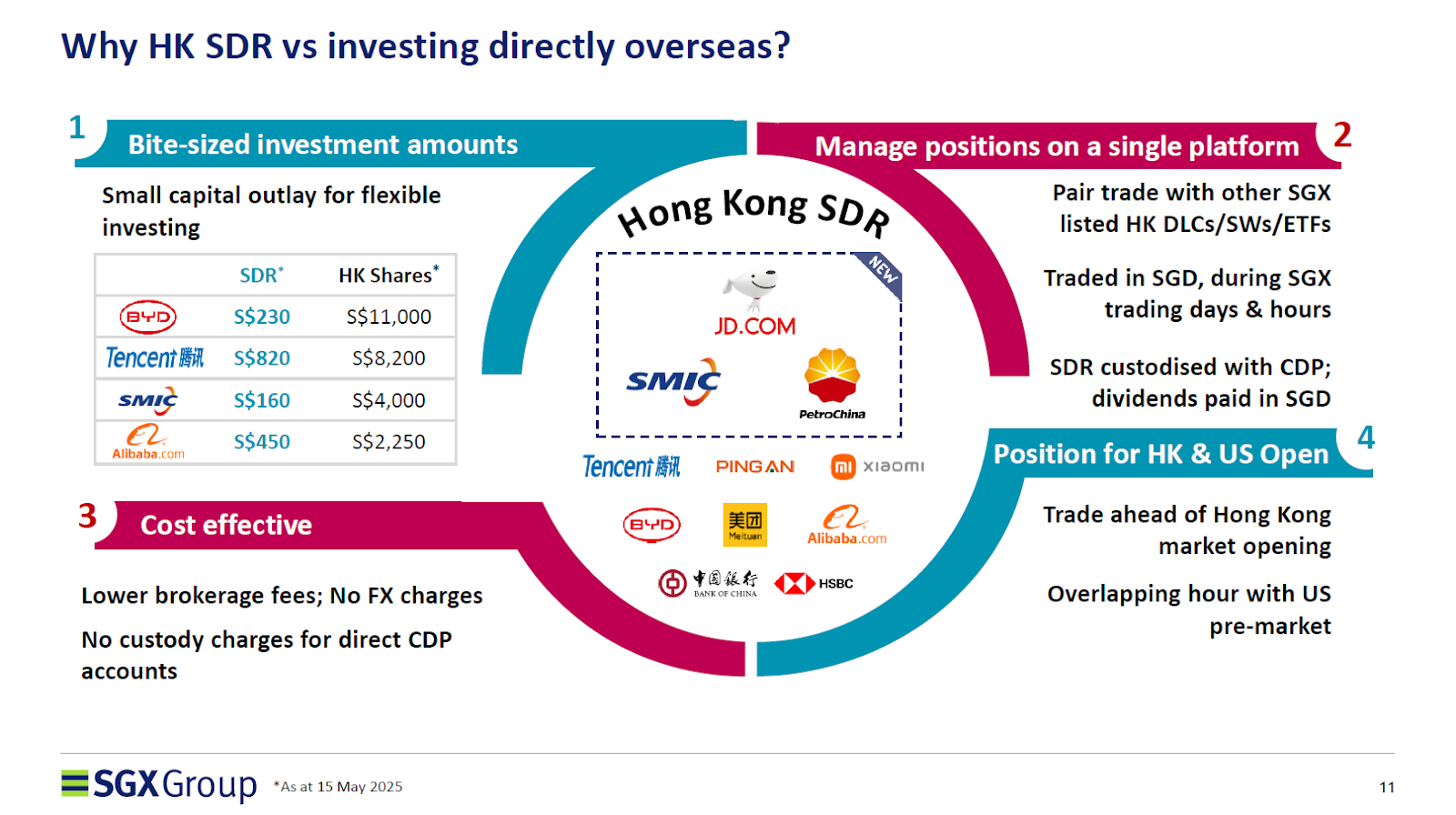

A recap: key benefits of SDRs

Before we introduce the new SDRs, let’s take a look at the key benefits that these securities bring.These benefits are summarised in the graphic below.

The six new additions

SGX introduced three new Hong Kong SDRs, namely SMIC (SGX: HSMD), JD.com (SGX: HJDD), and PetroChina (SGX: HPCD).SMIC, which stands for Semiconductor Manufacturing International Corporation, is China’s largest chipmaker and is also the third-largest chipmaker globally.For the first quarter of 2025 (1Q 2025), SMIC saw revenue climb 28.4% year on year to US$2.2 billion.Net profit leapt 162% year on year to US$188 million.JD.com is an e-commerce giant in China with more than 600 million annual active customers.For 1Q 2025, the e-commerce outfit saw revenue rise 15.8% year on year to RMB 301.1 billion while net profit surged 52.7% year on year to RMB 10.9 billion.PetroChina is the largest oil and gas producer in China.The company reported a mixed set of earnings for 1Q 2025.Revenue dipped 7.3% year on year to RMB 753.1 billion, but net profit inched up 2.3% year on year to RMB 46.8 billion.For the Thai SDRs, Bangkok Dusit Medical Services (SGX: TBDD), or BDMS, CP Foods (SGX: TPFD) and Gulf Development (SGX: TGUD) were added.BDMS is the largest private hospital operator in Thailand.The healthcare player reported a steady set of earnings for 1Q 2025, with revenue rising 5.7% year on year to THB 28.5 billion.Net profit increased by 6.7% year on year to THB 4.3 billion.CP Foods is a vertically-integrated agro-industrial and food conglomerate in the Asia-Pacific region.The group saw total revenue creep up 2.9% year on year to THB 145.5 billion.Net profit soared more than sevenfold year on year to a new record of THB 8.5 billion.Gulf Development is the result of a merger between Gulf Energy (a previous SDR) and the telecommunication company InTouch Holdings.The group runs an infrastructure business that deals with power plants, renewable energy, and LNG.For 1Q 2025, the energy company saw revenue dip by 2.6% year on year to THB 30.8 billion.Net profit, however, surged nearly 65% year on year to THB 7.9 billion.Increased interest and expanded market access

These six new additions further expand investors’ access to quality names in both Hong Kong and Thailand.The graphic below shows how the suite of 21 SDRs covers half of the Hang Seng Index and the Stock Exchange of Thailand (SET) 50 Index.Furthermore, investors now have access to a broad range of industries, ranging from technology and healthcare to financials, utilities, and industrials.

Get Smart: More SDRs in the pipeline?

The SDRs have allowed investors to gain broad access to a wider range of companies beyond Singapore’s shores.Investors can now affordably invest in Hong Kong stocks while gaining exposure to interesting sectors on the Thai stock exchange.There could be more SDRs in the pipeline as SGX works to broaden investors’ options.It would also be helpful if SGX could include a third country in its SDR mix to further expand options for investors and fund managers.If you’re nervous, confused, or worried about buying your first stock, then our latest beginner’s guide to investing can help. It’s easy to read yet packed with valuable insights. Download it for free today, and buy your first stock in the next few hours. Click here to get started.Follow us on Facebook, Instagram and Telegram for the latest investing news and analyses!Disclosure: Royston Yang owns shares of Singapore Exchange Limited.Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.