Weilai's fourth-quarter earnings: Deutsche Bank's first glance

Deutsche Bank said NIO reported mixed fourth-quarter results while offering a better-than-expected first-quarter outlook。

Deutsche Bank said NIO reported mixed fourth-quarter results while offering a better-than-expected first-quarter outlook。

NIO (NYSE: NIO) today reported fourth-quarter 2023 earnings, showing revenue for the quarter beat expectations, while gross margin fell short of expectations.。

As usual, Deutsche Bank analyst Edison Yu's team shared their first impressions of the results.。

This is what they have to say。

A Preliminary Study of Fourth Quarter 2023 Earnings

NIO posts mixed Q4 results while offering better-than-expected 1Q24 outlook。

Due to higher average selling prices, deliveries in the fourth quarter have reached 50,045 vehicles, with revenue of RMB17.1 billion, better than DBE / market expectations 16.9 / 16.8 billion yuan。

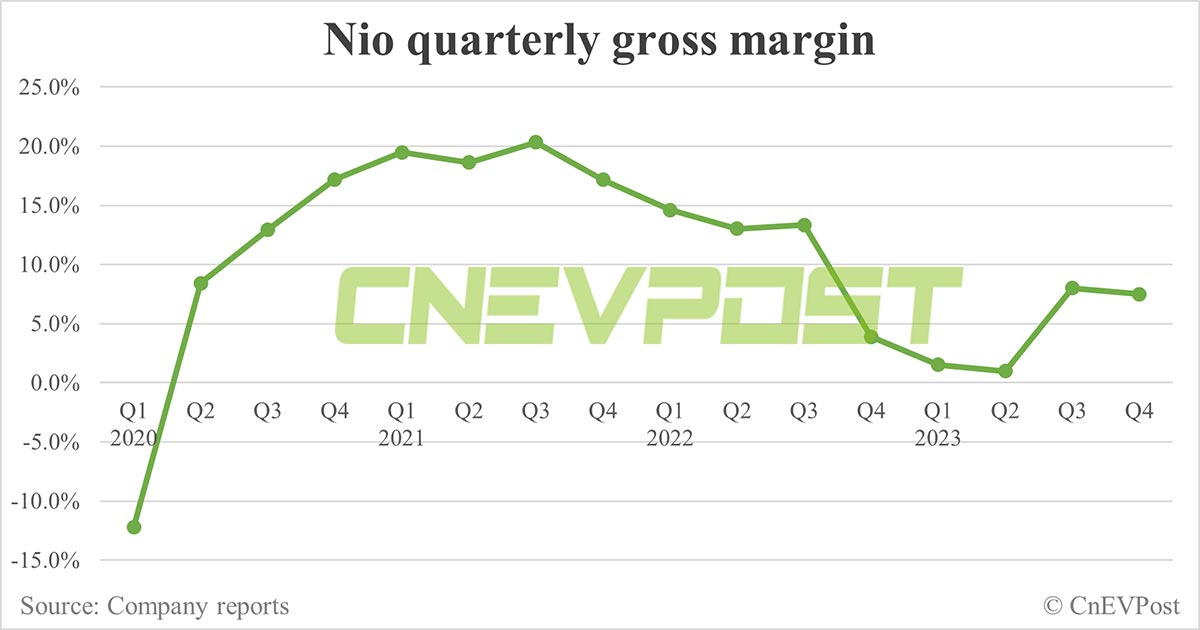

Due to vehicle profit margin (11.9% vs.13.5%) and other margins (-33.6% vs.- 23.0%) is weaker, with a gross margin of 7.5% below our 9.7% forecast (market consensus of 10.2%)。< / p >

Operating expenses were $7.9 billion, higher than our forecast of $7.2 billion, primarily for significantly higher R & D.。

In summary, adjusted EPS (2.81) is only slightly worse than our model (DBe / consensus is -2.69 / -2.70), which benefited from investment income related to the recovery of unrealized gains in other comprehensive income to investment income (nearly 9.800 million yuan)。

Management's better-than-expected forecast for the first quarter of 2024, with expected deliveries of 31,000-33,000 vehicles (revenue of 10.5 - 11.1 billion yuan)。

This compares with our expectations for 20,000 units, indicating a significant rebound in March from February's 8,132 units.。

Implied Average Selling Price Declines Significantly QoQ Due to Inventory Incentives in 2023。

Management expects auto margins to come under pressure in the first quarter but recover to 15-18% in the second quarter, driven by higher volumes, 2024 model mix and cost optimisation.。

R & D expenses are expected to be approximately $3 billion per quarter in 2024, and full-year capital expenditures should be significantly lower than the same period last year.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.