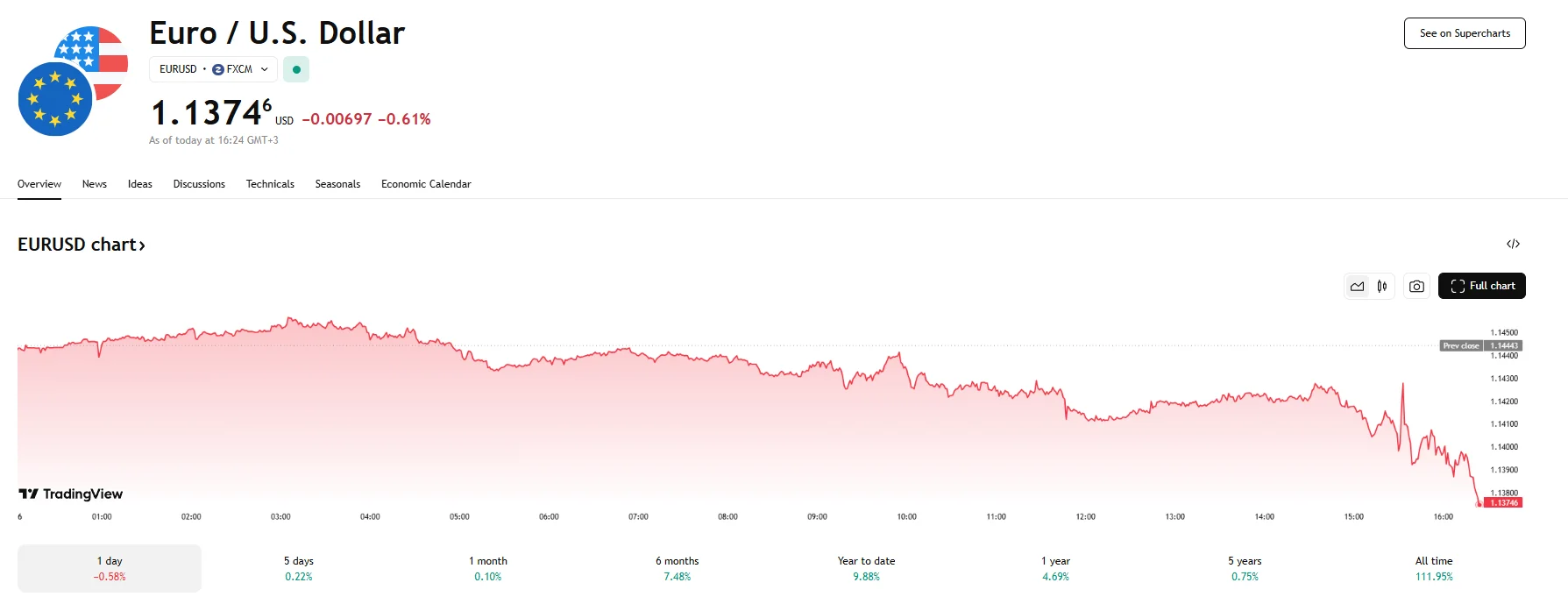

Resilient Job Market Tempers Fed Cut Expectations, EUR/USD Drops 0.61% to 1.1374 Resilient Job Market Tempers Fed Cut Expectations, EUR/USD Drops 0.61% to 1.1374

Key Moments:US nonfarm payrolls rose by 139,000 in May, higher what was anticipated but marking a slowdown.The unemployment rate remained unchanged at 4.2%.EUR/USD fell by 00.61% amid the dollars reco

Key Moments:

- US nonfarm payrolls rose by 139,000 in May, higher what was anticipated but marking a slowdown.

- The unemployment rate remained unchanged at 4.2%.

- EUR/USD fell by 00.61% amid the dollar’s recovery.

Hiring Slows but Labor Market Remains Steady

Employers in the United States added 139,000 jobs in May, representing a slight pullback from April’s downwardly revised growth of 147,000 positions, according to data from the Department of Labor. The latest figures came in ahead of the 130,000 job increase forecast by economists surveyed by Reuters but still signaled a cooling in hiring activity. Art Hogan of B Riley Wealth noted that while the labor market appears to be decelerating, it is not collapsing, and “that’s the good news.”

The nation’s unemployment rate stayed flat at 4.2%. This aligned with economists’ expectations and suggested a still-resilient labor market.

Interest Rate Expectations Adjust

The jobs data has prompted traders to scale back expectations for aggressive monetary easing. Market pricing now suggests that the Federal Reserve is unlikely to move on interest rates before September. Futures contracts indicate just a single rate cut by December, with bets on a third cut by year-end fading.

As a result of the revised forecasts, the US Dollar Index advanced 0.63% to 99.330. The greenback’s recovery served to push the EUR/USD significantly lower and erase yesterday’s gains. At press time, the pair is trading below the 1.1400 mark.

Meanwhile, yields on benchmark US 10-year Treasury notes increased 7.3 basis points to 4.468%. As for 2-year notes, they mirrored that rise by gaining 7.3 bps to reach 3.997%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.