Top 10 Stellar Wallets Hold Nearly 80% of XLM Circulating Supply, Sparking Concerns

Stellar’s top wallets hold 77% of XLM. Rising exchange balances and RWA growth reveal risks and adoption in 2025.

- The top 10 Stellar wallets control nearly 80% of the circulating supply, raising concerns about decentralization and potential market volatility.

- Binance’s XLM balance surged from 180 million to 1 billion since late 2023, signaling higher trading activity and possible sell pressure.

- Stellar's RWA tokenization market grew 84% in 2025, driven by partnerships with Franklin Templeton and Circle’s USDC.

Stellar (XLM), an open-source blockchain known for fast and low-cost cross-border payments, is drawing the attention of both retail and institutional investors in 2025.

However, the concentrated distribution of XLM supply and its potential for real-world asset (RWA) applications present opportunities and challenges.

What Does the Concentrated Supply and Rising Exchange Balances Mean?

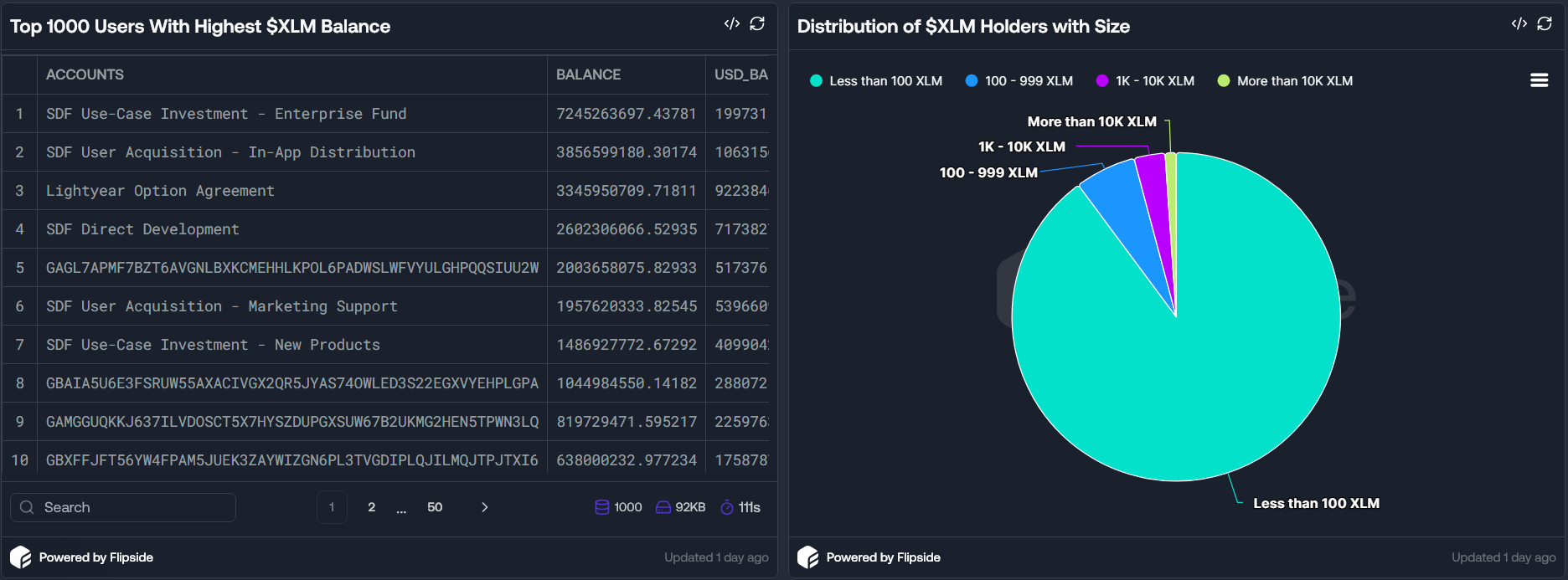

One major concern about Stellar is the concentration of XLM supply. According to Flipside Crypto, the top 10 XLM wallets hold approximately 25 billion XLM. The total circulating supply is 30.9 billion XLM, meaning nearly 80% of the supply belongs to a small group.

This raises questions about decentralization. A few entities holding large amounts of tokens could significantly influence the market. Meanwhile, about 90% of XLM holders own less than 100 XLM.

This imbalance shows that most retail investors have little impact on price. As a result, the market faces volatility risks if “whales” decide to sell.

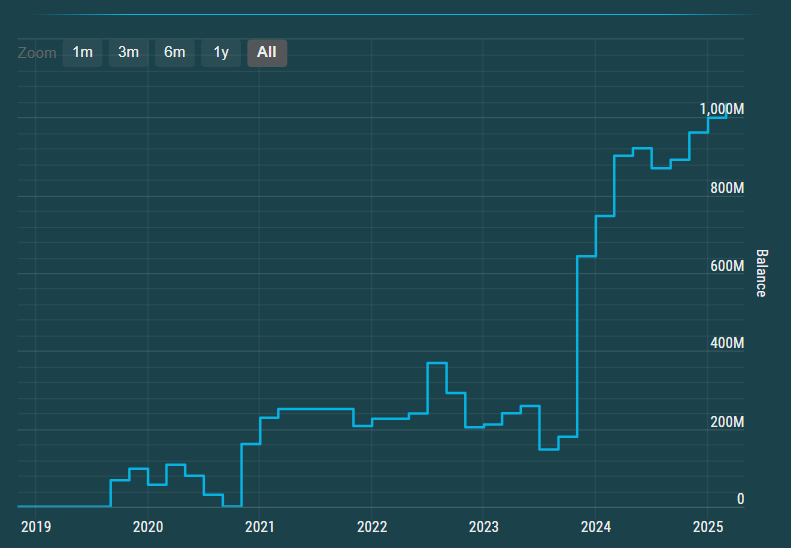

Additionally, data from stellar.expert shows that XLM balances on Binance have risen steadily since late 2023, from 180 million XLM to 1 billion XLM. This increase reflects growing demand for trading and signals potential sell pressure if negative news emerges.

At first glance, this kind of data often seems negative for a network’s outlook. However, XLM investors argue that increased circulating supply can indicate growing adoption.

“This isn’t a random distribution — it’s a deliberate strategy… Supply growth is measured and controlled while adoption skyrockets,” an XLM investor commented.

On-chain data further supports this view. Stellar’s active accounts grew from 7.2 million in 2023 to 9.5 million by May 2025. On average, the network adds about 5,000 new wallet addresses daily. This ever-increasing demand helps absorb the circulating XLM.

Signs of Rising XLM Demand in Real World Asset (RWA) Sector

Stellar is establishing its position in the real-world asset space — one of crypto’s hottest trends.

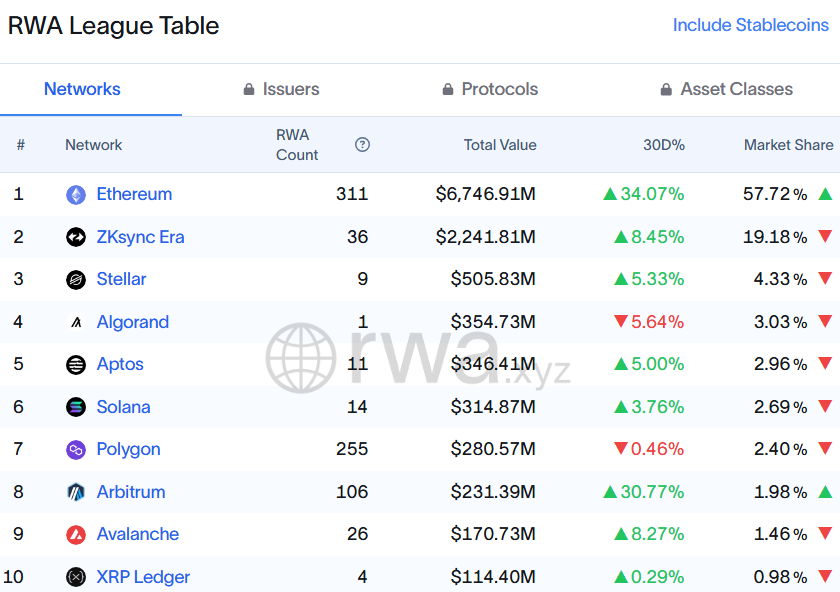

Currently, Stellar ranks as the third-largest protocol in RWA market capitalization, behind only Ethereum and ZKsync Era. Notable players in Stellar’s RWA ecosystem include the Franklin Templeton OnChain US Government Money Fund (valued at $497 million) and Circle’s USDC stablecoin, which holds $345 million on the Stellar network.

The total value of RWAs on Stellar has grown nearly 84% in 2025. It rose from $275 million to over $500 million by May. This growth reflects Stellar’s increasing appeal for real-world asset tokenization.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.