Revolut Leads Digital Banking Surge in The UK as Downloads Top Legacy Banks

UK neobanks have surpassed traditional banks in mobile app downloads for the first time, with digital challengers reaching 71.78 million Android users compared to legacy banks' 71.

UK neobanks have surpassed traditional banks in mobile app downloads for the first time, with digital challengers reaching 71.78 million Android users compared to legacy banks' 71.58 million, according to new data from SplitMetrics.

The digital banking surge has been particularly pronounced in 2024, with neobanks adding 18.6 million users compared to traditional banks' 7.5 million.

UK Neobanks Surpass Legacy Rivals for First Time

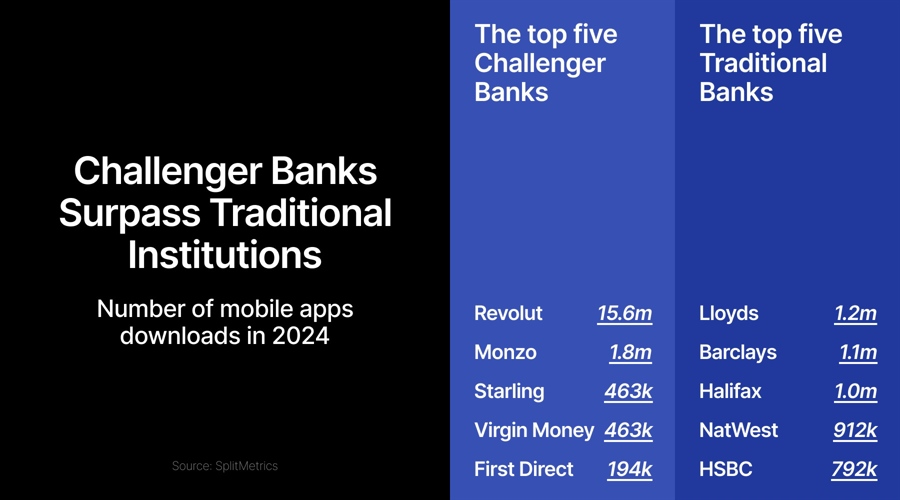

Revolut has emerged as the clear leader among digital challengers, accumulating 15.6 million downloads in 2024. Monzo followed with 1.8 million downloads, while Starling Bank secured 463,000 new users. Traditional banks showed more modest growth, with Lloyds leading at 1.2 million new downloads, followed by Barclays with 1.1 million.

It often comes down to innovation. Monzo, for instance, became the first bank in the UK to offer customers Apple Pay monthly payments. The company recently secured additional funding from Google, increasing its valuation to $5 billion.

"Fintech is no longer a challenger but a dominant force in the industry," said Thomas Kriebernegg, General Manager at SplitMetrics. "Will this growth continue into 2025 and beyond? Time will tell, but the work is not over for fintech Fintech Financial Technology (fintech) is defined as ay technology that is geared towards automating and enhancing the delivery and application of financial services. The origin of the term fintechs can be traced back to the 1990s where it was primarily used as a back-end system technology for renowned financial institutions. However, it has since grown outside the business sector with an increased focus upon consumer services.What Purpose Do Fintechs Serve?The main purpose of fintechs would be to suppl Financial Technology (fintech) is defined as ay technology that is geared towards automating and enhancing the delivery and application of financial services. The origin of the term fintechs can be traced back to the 1990s where it was primarily used as a back-end system technology for renowned financial institutions. However, it has since grown outside the business sector with an increased focus upon consumer services.What Purpose Do Fintechs Serve?The main purpose of fintechs would be to suppl Read this Term apps - the hard work of retaining those hard-earned new users begins now."

Revolut also has ambitious plans for 2025, including smart ATMs, AI-powered banking, and mortgages, positioning itself ahead of more traditional competitors in terms of product offerings.

The broader fintech sector has also demonstrated visible growth. Trading apps reached a new milestone with 11 million new Android users globally in 2024, surpassing the previous record set in 2022. Trade Republic led the trading segment with 2.2 million new users, followed by eToro with 2 million.

In the money management category, UK-based apps attracted 1.1 million new Android users, with Plum and Moneybox leading the pack. The cryptocurrency sector showed resilience, recording 5.6 million Android downloads, with Luno and Nexo emerging as the top performers among European crypto apps.

Neobanks Gain Attention

The data suggests a current transformation in how UK consumers interact with financial services, as digital-first solutions continue to gain mainstream acceptance. This shift poses both challenges and opportunities for traditional banks as they compete with more agile, technology-driven competitors in an increasingly digital banking landscape.

For example, In 2024, neobanking transaction values are expected to exceed $6.37 trillion, outpacing the GDP of Japan, the world's third-largest economy. Moreover, in the first half of this year, fintech investments in the UK soared to over $7 billion, increasing from just $2.5 billion a year earlier.

“We are expecting to see growing investment interest in AI and its use in the fintech and regtech space,” Hannah Dobson, Partner and UK Head of Fintech at KPMG UK, said. “Regulation remains a key focus in the EU, particularly with crypto and digital asset businesses as they navigate the new EU’s Markets in Crypto Assets regulation Regulation Like any other industry with a high net worth, the financial services industry is tightly regulated to help curb illicit behavior and manipulation. Each asset class has its own set of protocols put in place to combat their respective forms of abuse.In the foreign exchange space, regulation is assumed by authorities in multiple jurisdictions, though ultimately lacking a binding international order. Who are the Industry’s Leading Regulators?Regulators such as the UK’s Financial Conduct Authority ( Like any other industry with a high net worth, the financial services industry is tightly regulated to help curb illicit behavior and manipulation. Each asset class has its own set of protocols put in place to combat their respective forms of abuse.In the foreign exchange space, regulation is assumed by authorities in multiple jurisdictions, though ultimately lacking a binding international order. Who are the Industry’s Leading Regulators?Regulators such as the UK’s Financial Conduct Authority ( Read this Term.”

The data shows UK consumers are rapidly adopting digital banking services, with traditional banks now facing increased competition from technology-focused challengers. Legacy institutions must adapt to changing customer preferences in an increasingly digital market.

UK neobanks have surpassed traditional banks in mobile app downloads for the first time, with digital challengers reaching 71.78 million Android users compared to legacy banks' 71.58 million, according to new data from SplitMetrics.

The digital banking surge has been particularly pronounced in 2024, with neobanks adding 18.6 million users compared to traditional banks' 7.5 million.

UK Neobanks Surpass Legacy Rivals for First Time

Revolut has emerged as the clear leader among digital challengers, accumulating 15.6 million downloads in 2024. Monzo followed with 1.8 million downloads, while Starling Bank secured 463,000 new users. Traditional banks showed more modest growth, with Lloyds leading at 1.2 million new downloads, followed by Barclays with 1.1 million.

It often comes down to innovation. Monzo, for instance, became the first bank in the UK to offer customers Apple Pay monthly payments. The company recently secured additional funding from Google, increasing its valuation to $5 billion.

"Fintech is no longer a challenger but a dominant force in the industry," said Thomas Kriebernegg, General Manager at SplitMetrics. "Will this growth continue into 2025 and beyond? Time will tell, but the work is not over for fintech Fintech Financial Technology (fintech) is defined as ay technology that is geared towards automating and enhancing the delivery and application of financial services. The origin of the term fintechs can be traced back to the 1990s where it was primarily used as a back-end system technology for renowned financial institutions. However, it has since grown outside the business sector with an increased focus upon consumer services.What Purpose Do Fintechs Serve?The main purpose of fintechs would be to suppl Financial Technology (fintech) is defined as ay technology that is geared towards automating and enhancing the delivery and application of financial services. The origin of the term fintechs can be traced back to the 1990s where it was primarily used as a back-end system technology for renowned financial institutions. However, it has since grown outside the business sector with an increased focus upon consumer services.What Purpose Do Fintechs Serve?The main purpose of fintechs would be to suppl Read this Term apps - the hard work of retaining those hard-earned new users begins now."

Revolut also has ambitious plans for 2025, including smart ATMs, AI-powered banking, and mortgages, positioning itself ahead of more traditional competitors in terms of product offerings.

The broader fintech sector has also demonstrated visible growth. Trading apps reached a new milestone with 11 million new Android users globally in 2024, surpassing the previous record set in 2022. Trade Republic led the trading segment with 2.2 million new users, followed by eToro with 2 million.

In the money management category, UK-based apps attracted 1.1 million new Android users, with Plum and Moneybox leading the pack. The cryptocurrency sector showed resilience, recording 5.6 million Android downloads, with Luno and Nexo emerging as the top performers among European crypto apps.

Neobanks Gain Attention

The data suggests a current transformation in how UK consumers interact with financial services, as digital-first solutions continue to gain mainstream acceptance. This shift poses both challenges and opportunities for traditional banks as they compete with more agile, technology-driven competitors in an increasingly digital banking landscape.

For example, In 2024, neobanking transaction values are expected to exceed $6.37 trillion, outpacing the GDP of Japan, the world's third-largest economy. Moreover, in the first half of this year, fintech investments in the UK soared to over $7 billion, increasing from just $2.5 billion a year earlier.

“We are expecting to see growing investment interest in AI and its use in the fintech and regtech space,” Hannah Dobson, Partner and UK Head of Fintech at KPMG UK, said. “Regulation remains a key focus in the EU, particularly with crypto and digital asset businesses as they navigate the new EU’s Markets in Crypto Assets regulation Regulation Like any other industry with a high net worth, the financial services industry is tightly regulated to help curb illicit behavior and manipulation. Each asset class has its own set of protocols put in place to combat their respective forms of abuse.In the foreign exchange space, regulation is assumed by authorities in multiple jurisdictions, though ultimately lacking a binding international order. Who are the Industry’s Leading Regulators?Regulators such as the UK’s Financial Conduct Authority ( Like any other industry with a high net worth, the financial services industry is tightly regulated to help curb illicit behavior and manipulation. Each asset class has its own set of protocols put in place to combat their respective forms of abuse.In the foreign exchange space, regulation is assumed by authorities in multiple jurisdictions, though ultimately lacking a binding international order. Who are the Industry’s Leading Regulators?Regulators such as the UK’s Financial Conduct Authority ( Read this Term.”

The data shows UK consumers are rapidly adopting digital banking services, with traditional banks now facing increased competition from technology-focused challengers. Legacy institutions must adapt to changing customer preferences in an increasingly digital market.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.