Coinbase Reveals 2 Altcoins For Potential Listing, Tokens Jump 37%

Coinbase adds ETHFI and TAO to its listing roadmap, sparking a 30% price surge. Traders react to increased liquidity and accessibility.

- Coinbase plans to list Ether.fi (ETHFI) and Bittensor (TAO), signaling strong compliance and security standards.

- Both tokens spiked over 30% post-announcement before retracing, mirroring past exchange listing reactions.

- Coinbase’s move enhances trading volume, increasing trust and demand for these altcoins.

Coinbase, the largest US-based crypto exchange, indicated the addition of Ether.fi (ETHFI) and Bittensor (TAO) to its listing roadmap.

ETHFI is a decentralizedprotocoltoken offeringliquidstakingandrestakingsolutions for Ethereum. Meanwhile, Bittensor’s TAO has multiple purposes within the ecosystem, acting as a utility token and a reward mechanism.

Traders React to Coinbase Listing Announcement

Coinbase only supports two types of assets: native assets on their network and tokens that adhere to a supported token standard. Based on this standard, the exchange has added ETHFI and TAO to its listing roadmap.

The exchange posted the update on X (Twitter), suggesting that ETHFI and TAO meet its listing threshold. The US-based exchange alsosharedthe contract addresses for the two tokens.

“Assets added to the roadmap today: Ether.fi (ETHFI), and Bittensor (TAO),” the post read.

Coinbase’s decision to add ETHFI and TAO to its listing roadmap follows what the exchange describes as a “thorough processes and standards evaluation for legal, compliance and technicalsecurity.” The criteria do not consider a project’s market cap or popularity.

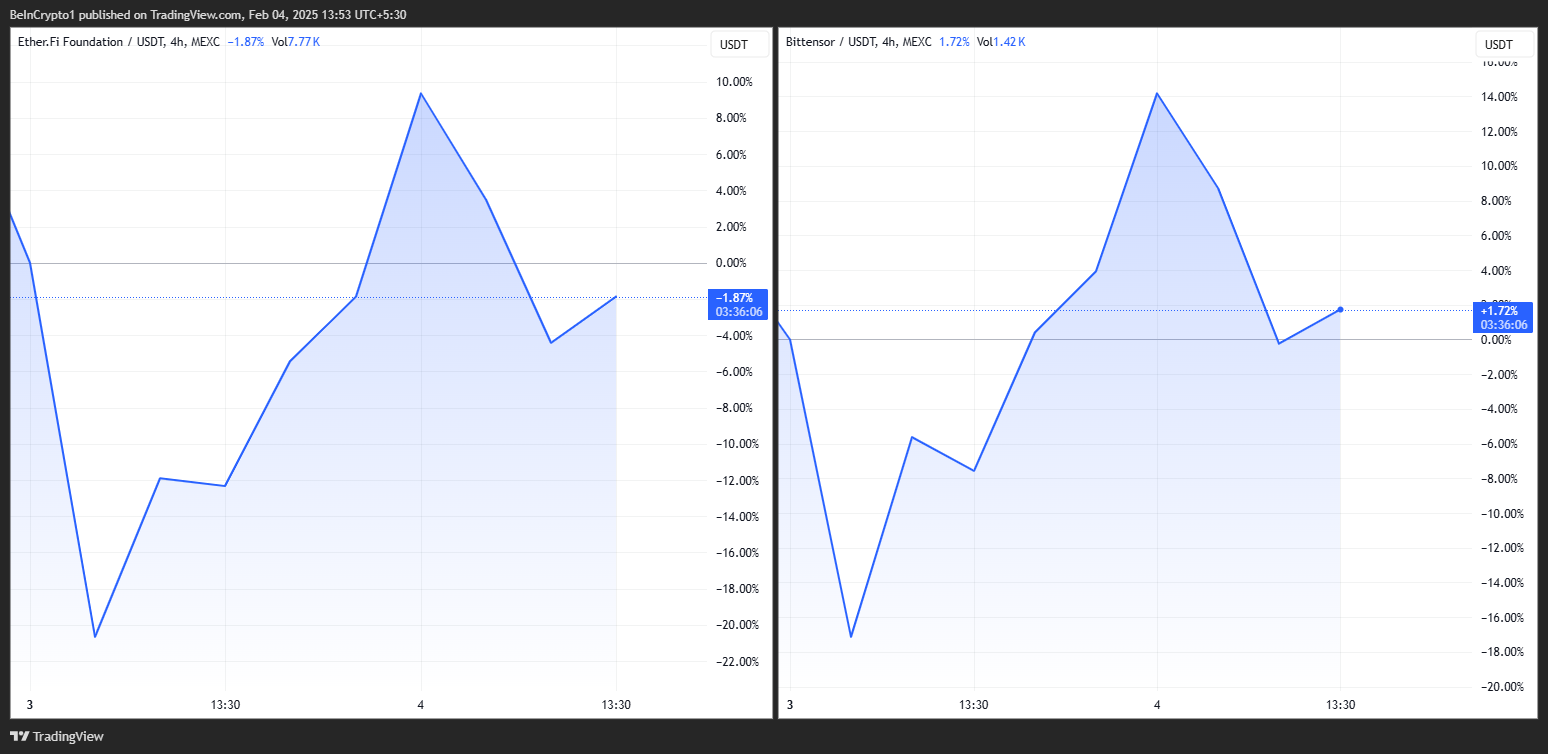

After the Coinbase listing announcement, ETHFI and TAO token prices reacted, soaring by over 30% each before profit booking kicked in.

The surge was expected, coming off as a typical reaction of tokens following listing announcements on popular crypto exchanges. For instance, the Base tokenTOSHI recently skyrocketed by 70%when Coinbase added it to its listing roadmap. The same reaction happens following Binance exchange’s listing announcements.

Such reactions come amid the “buy-the-rumor, sell-the-event” situation and the expectation of increased liquidity. Itis worth noting thatBinanceis the largest crypto exchange in terms of trading volume metrics. Meanwhile, Coinbase is the largest US-based crypto exchange. Given their high trading volumes and liquidity, it becomes easier for traders to buy and sell the tokens on these platforms.

Higher liquidity often leads to price appreciation, reducing pricevolatilityand making it easier for traders to enter and exit positions. Other factors at play include increased accessibility, increasing demand, credibility, and trust.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.