USD/INR Sinks to 85.2000, India’s FX Reserves Slide to 5-Week Low Amid Rupee Volatility USD/INR Sinks to 85.2000, India’s FX Reserves Slide to 5-Week Low Amid Rupee Volatility

Key Moments:India’s foreign exchange reserves dropped by $4.9 billion to $685.73 billion last week.The Indian rupee advanced 0.87% against the greenback.Indias 10-year government bond saw its yield de

Key Moments:

- India’s foreign exchange reserves dropped by $4.9 billion to $685.73 billion last week.

- The Indian rupee advanced 0.87% against the greenback.

- India’s 10-year government bond saw its yield decrease by 2 basis points.

FX Reserves Decline Sharply

Figures published by the Reserve Bank of India on Friday showed that during the week ending May 16, India’s foreign exchange reserves declined by $4.9 billion to $685.73 billion. This marks their lowest level in five weeks and sharply contrasts the previous week’s increase of $4.5 billion.

India’s foreign exchange reserves consist of several components, including foreign currency assets, gold holdings, Special Drawing Rights (SDRs), and the Reserve Tranche Position in the International Monetary Fund.

| Component | May 16, 2025 (in million USD) | May 09, 2025 (in million USD) |

|---|---|---|

| Foreign Currency Assets | 581,652 | 581,373 |

| Gold | 81,217 | 86,337 |

| SDRs | 18,490 | 18,532 |

| Reserve Tranche Position | 4,371 | 4,374 |

| Total | 685,729 | 690,617 |

Rupee Rebounds Sharply

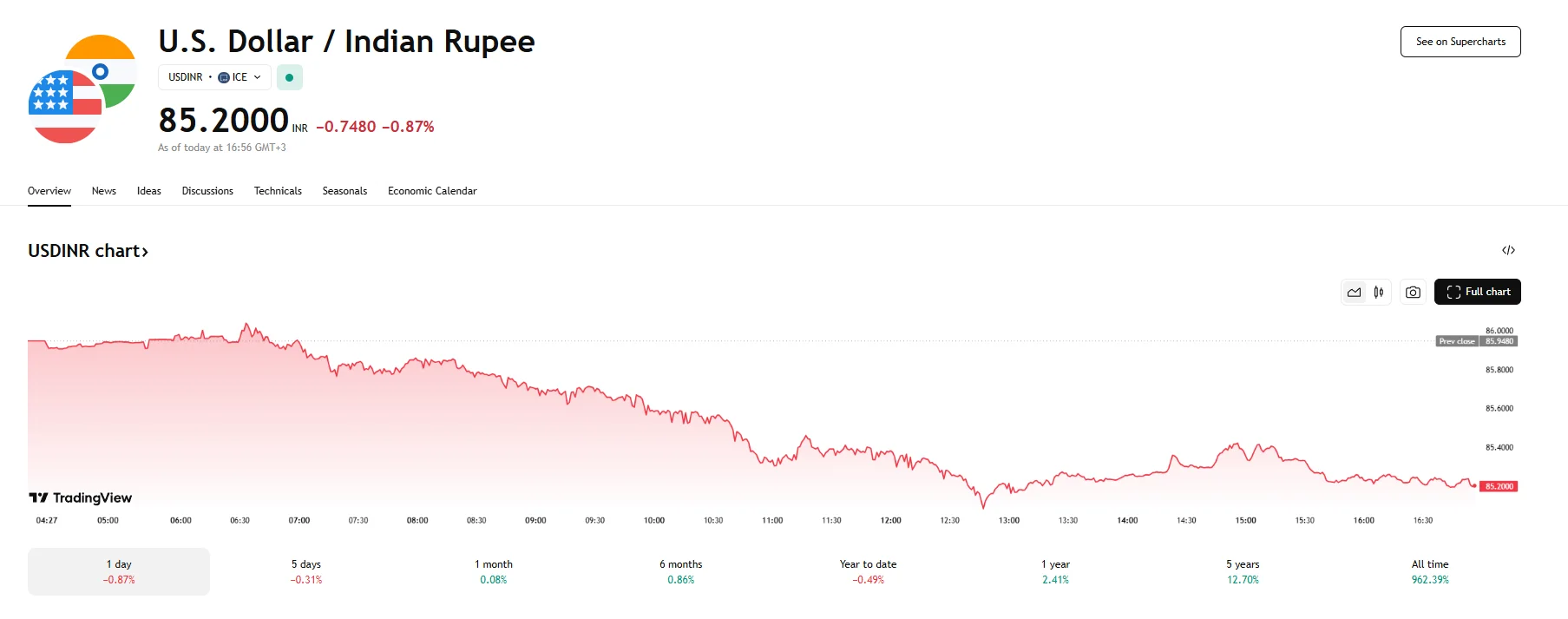

The data was revealed as the rupee enjoyed one of its most successful days against the US dollar in years, which saw the USD/INR exchange rate decline by 0.86% to 85.2000. During the week, the USD/INR currency pair fluctuated, with movements resulting in the pair briefly climbing to 86.0400 as the pair continued being influenced by market reactions surrounding a ceasefire announcement between India and Pakistan. However, the rupee staged a strong comeback on Friday, and today’s trading session even saw the USD/INR pair drop to 85.0810.

Debt Market Developments and Other Data

India’s 10-year government bond closed at 100.87 rupees. Its yield fell by 2 basis points to hit 6.2107% as concerns regarding the US’s own yields were offset by market anticipation regarding rate cuts and the Central Bank of India making a surplus transfer of 2.69 trillion INR ($31.55 billion). Meanwhile, the one-year overnight index swap (OIS) rates fell to 5.53%. The five-year swap rate also eased, reaching 5.63% after shedding 4 basis points.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.