Dollar Weakness and UK-EU Trade Deal Lift GBP/USD by 0.72% Dollar Weakness and UK-EU Trade Deal Lift GBP/USD by 0.72%

Key Moments:The British pound climbed above 1.3360 on Monday, reaching its highest level in 12 days.A tentative defense contract agreement between the UK and the EU lifted market sentiments.Moodys low

Key Moments:

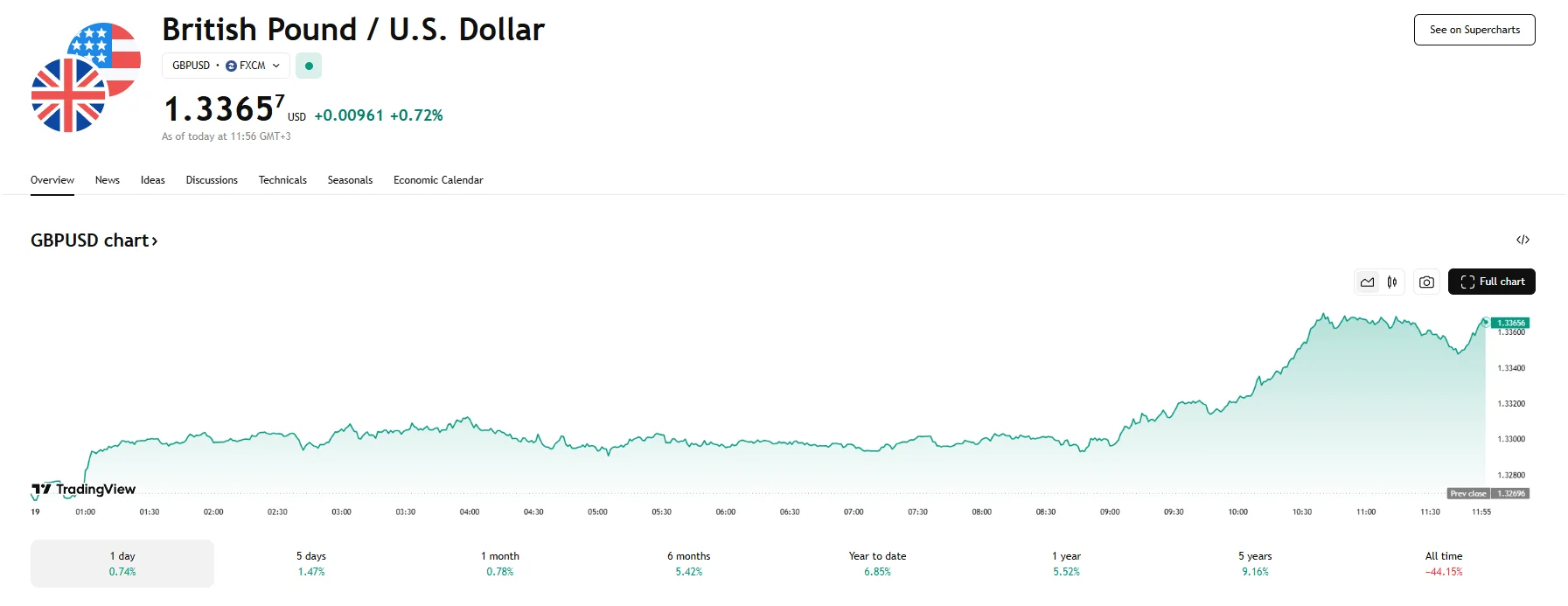

- The British pound climbed above 1.3360 on Monday, reaching its highest level in 12 days.

- A tentative defense contract agreement between the UK and the EU lifted market sentiments.

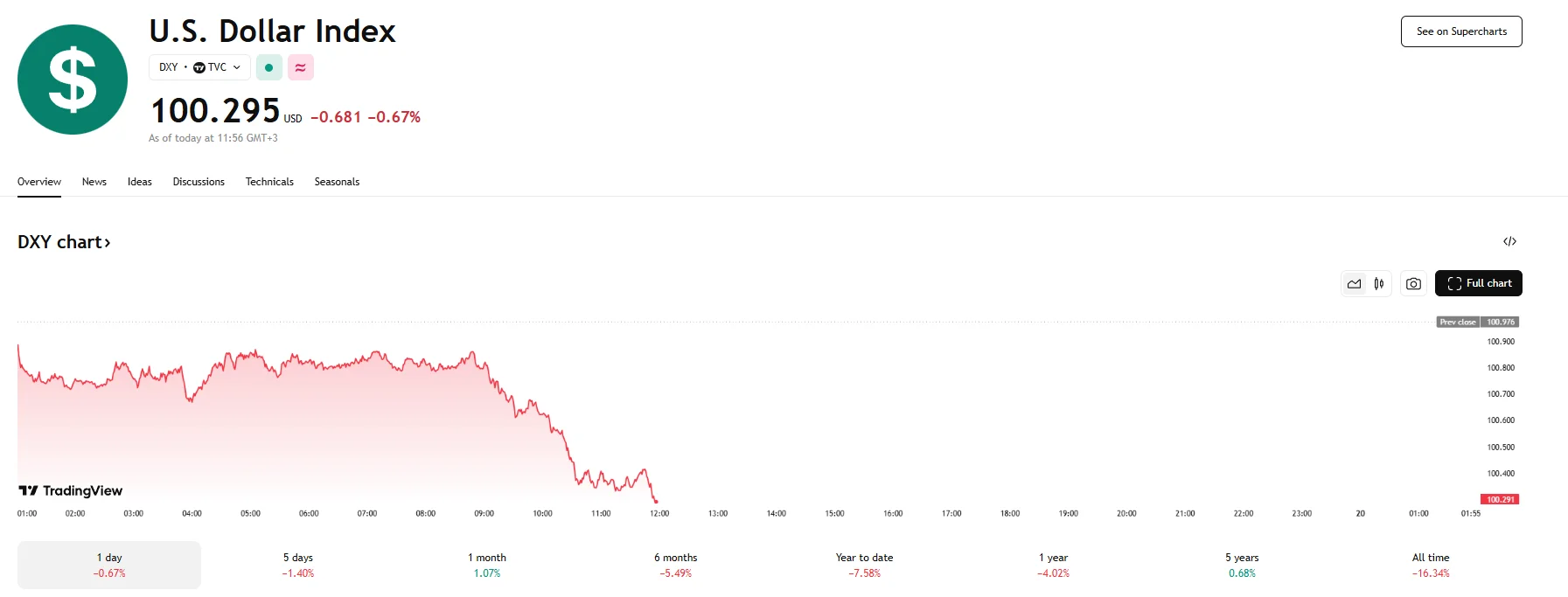

- Moody’s lowered its US credit rating to Aa1, which exerted pressure on the greenback, pushing the US Dollar Index lower by 0.67% .

UK-EU Agreement Aids British Pound

The sterling gained ground on reports that the United Kingdom and the European Union have achieved new momentum in trade negotiations just before a summit in London. The agreement reportedly addresses longstanding issues such as fishing rights and regulatory supervision of agricultural goods, signaling improved alignment between the two sides. As a result, the GBP/USD rose by 0.72% to 1.3365. ING analyst Chris Turner noted that, according to the bank’s expectations, any unforeseen positive outcome could push the GPB as high as 1.3400.

ING analyst Chris Turner noted in a client note that “Closer UK-EU alignment is sterling positive.” The bank had anticipated that any unexpected breakthrough would push the euro below 0.8400 pounds while sending GBP as high as $1.3400.

The proposed Common Understanding text is currently being reviewed by the EU’s 27 member nations. If finalized, this breakthrough could open opportunities for British companies to bid on large-scale EU defense projects, further deepening cooperation between the UK and Europe following Brexit.

US Credit Rating Downgrade Weighs on Dollar

Another factor assisting the sterling was the greenback’s decline, seeing as the US Dollar Index dropped by nearly 0.7% on Monday, below the 100.30 threshold. This followed Moody’s recent downgrade of the US government’s sovereign credit rating from Aaa to Aa1. Increasing debt levels and persistent fiscal deficits were presented as Moody’s main reasoning behind the decision.

The move triggered concern over potential economic instability in the US and dampened investor sentiment toward American assets. Moreover, Moody’s has projected that US federal debt would rise to 134% of GDP by 2035. This would mark a 36% increase from 2024’s debt level.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.