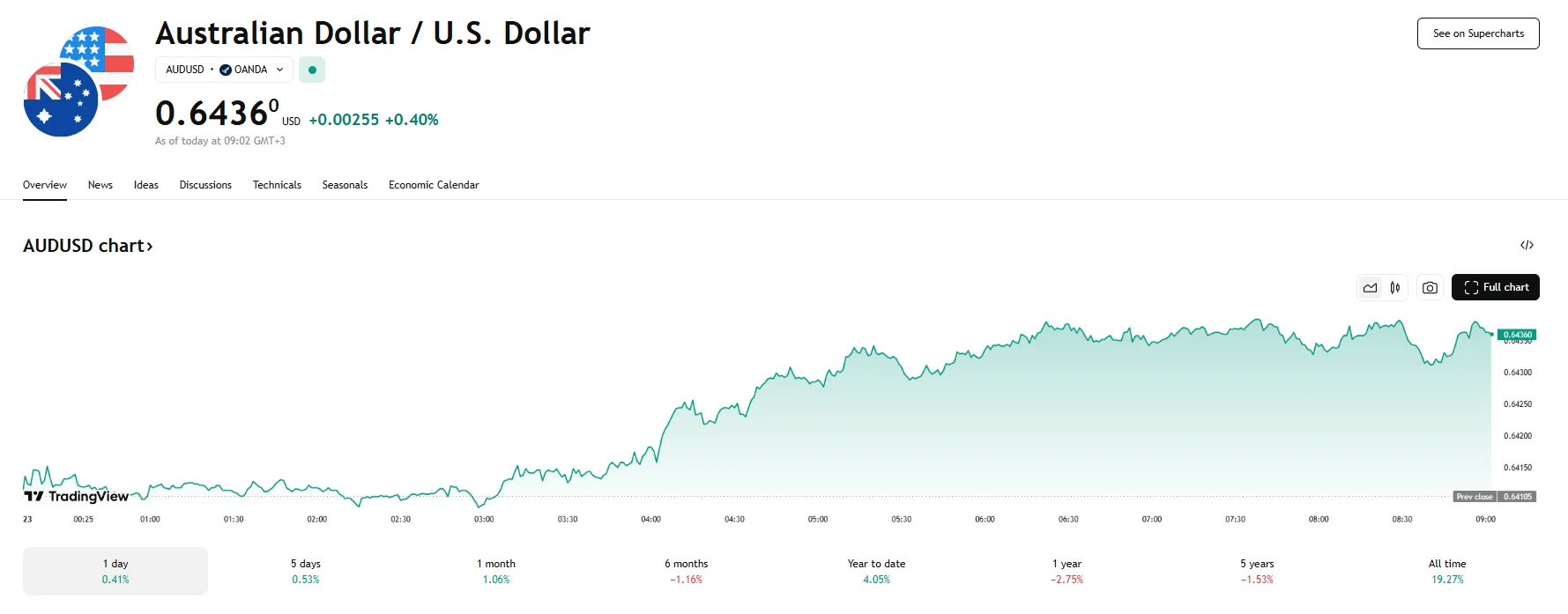

AUD/USD Advances 0.4% to 0.6436 as US Yields Fall AUD/USD Advances 0.4% to 0.6436 as US Yields Fall

Key Moments:The Australian dollar rebounded 0.4% against the greenback as long-term treasury yields fell.Reserve Bank of Australia Governor Michele Bullock expressed openness to additional rate cuts.T

Key Moments:

- The Australian dollar rebounded 0.4% against the greenback as long-term treasury yields fell.

- Reserve Bank of Australia Governor Michele Bullock expressed openness to additional rate cuts.

- The US Dollar Index dropped 0.33% to 99.563 on Friday.

Greenback Retreats Amid Political and Fiscal Uncertainty

The AUD/USD advanced by 0.4% on Friday, reaching 0.6436 as the US dollar weakened under the weight of falling Treasury yields and renewed fiscal concerns. The yield on the 30-year US Treasury note fell to 5.03%, down from the two-year high of 5.15%.

Market sentiment was further impacted by political developments, as the US House of Representatives narrowly approved President Donald Trump’s “One Big Beautiful Bill.” The bill triggered concerns over the magnification of the nation’s fiscal deficit, with the Congressional Budget Office projecting an additional shortfall of $3.8 billion stemming from tax relief on tipped wages and incentives for American-made auto purchases.

Mixed Fundamentals Pressure the US Dollar

On Thursday, the US dollar had temporarily gained strength after upbeat data from S&P Global’s May PMI report. The Composite PMI climbed to 52.1 from 50.6, while manufacturing and services both rose to 52.3. The figures indicate broad-based expansion across sectors.

However, upward momentum was mitigated by the continued impact of the recent decision by Moody’s to lower the US credit rating to Aa1, citing mounting fiscal deficits, among other issues. According to Moody’s, US federal debt is set to balloon to approximately 134% of GDP by 2035. The budget deficit, meanwhile, could expand to almost 9% of the country’s GDP.

Adding to the dovish narrative, Federal Reserve Governor Christopher Waller commented Thursday that if tariffs remain elevated at 10%, the economy might remain resilient into the second half of the year. Thus, 2025 interest rate cuts could still be on the table. Today, the US Dollar Index slipped 0.33% to 99.563, still below the 100.00 threshold.

RBA Lowers Interest Rates, Soft Domestic PMIs Provide Mixed Signals

The Reserve Bank of Australia (RBA) cut its Official Cash Rate by 25 basis points to 3.85% this week. Governor Michele Bullock was in favor of the proactive move and hinted at further easing if needed due to inflation and macroeconomic conditions. In spite of this, the AUD gained traction, bolstered by a weaker US dollar and improving global sentiment, including optimism surrounding the ongoing 90-day trade agreement between the US and China.

Recent PMI data from Australia offered a mixed economic picture. The Manufacturing PMI for May came in unchanged at 51.7, while the Services PMI slipped from 51.0 and hit 50.5. The Composite PMI followed suit, dropping to 50.6 compared to last month’s 51.0. While still above the 50 threshold that separates expansion from contraction, the softening trend highlights both resilience and ongoing headwinds in the Australian economy.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.