Nvidia Rises to Record on AI, Reclaims Largest Stock Title Amidst Robotics Ambitions

Nvidia Corp. has once again captured the spotlight on Wall Street, with its shares soaring to an all-time high on Wednesday, June 25, 2025. The leader in artificial intelligence chips extended its rem

Nvidia Corp. has once again captured the spotlight on Wall Street, with its shares soaring to an all-time high on Wednesday, June 25, 2025.

The leader in artificial intelligence chips extended its remarkable advance, cementing its position as one of the most valuable companies in the world. This surge not only underscores Nvidia's dominance in the AI market but also highlights its ambitious ventures into robotics, as articulated by CEO Jensen Huang. As the company reclaims the title of the world's largest stock, investors and analysts alike are keenly watching its next moves in the rapidly evolving tech landscape.

Nvidia's Stock Performance and Market Capitalization

Nvidia's stock rose 4.3% to $154.31, surpassing its previous all-time high set in January. This milestone is the latest in a series of achievements for the company, which has seen its shares rally 63% from an April low, adding nearly $1.5 trillion to its market capitalization. With this gain, Nvidia now stands as the world's largest stock, boasting a market cap of approximately $3.77 trillion, overtaking Microsoft Corp.'s $3.66 trillion.

The stock's performance is a testament to Nvidia's resilience and growth trajectory. Despite challenges such as restrictions on advanced semiconductor sales in China, the company has continued to deliver robust earnings. Recent financial reports have shown strong growth, with analysts pointing to even more strength ahead. Nvidia's valuation metrics also paint an attractive picture: it trades at 31.5 times expected 12-month earnings, below its 10-year average and comparable to the Nasdaq 100 Index's multiple of 27. Moreover, its PEG ratio of about 0.9 is the lowest among the Magnificent Seven, indicating a favorable balance between growth and valuation.

Wall Street remains optimistic about Nvidia's prospects, with nearly 90% of analysts recommending a buy. The stock currently trades 12% below the average analyst price target, suggesting potential for further upside. Interestingly, despite its size and performance, Nvidia remains under-owned by market professionals compared to peers like Amazon, Apple, and Microsoft, indicating room for additional buying interest.

Dominance in the AI Market

Nvidia's ascent to the top is largely driven by its leadership in the AI chip market. The company's graphics processing units (GPUs) are the backbone of sophisticated AI applications, including OpenAI's ChatGPT. Nvidia's sales have skyrocketed from $27 billion in fiscal 2023 to $130.5 billion last year, with analysts projecting nearly $200 billion in sales this year.

Key customers such as Microsoft, Meta Platforms, Alphabet, and Amazon—collectively accounting for over 40% of Nvidia's revenue—continue to invest heavily in AI infrastructure. This sustained demand has bolstered confidence in Nvidia's growth trajectory. Michael Smith, co-portfolio manager at Allspring Global Investments, noted, "My confidence in Nvidia’s growth is higher than it was a couple months ago, and it seems the AI arms race will continue through 2025 and probably 2026."

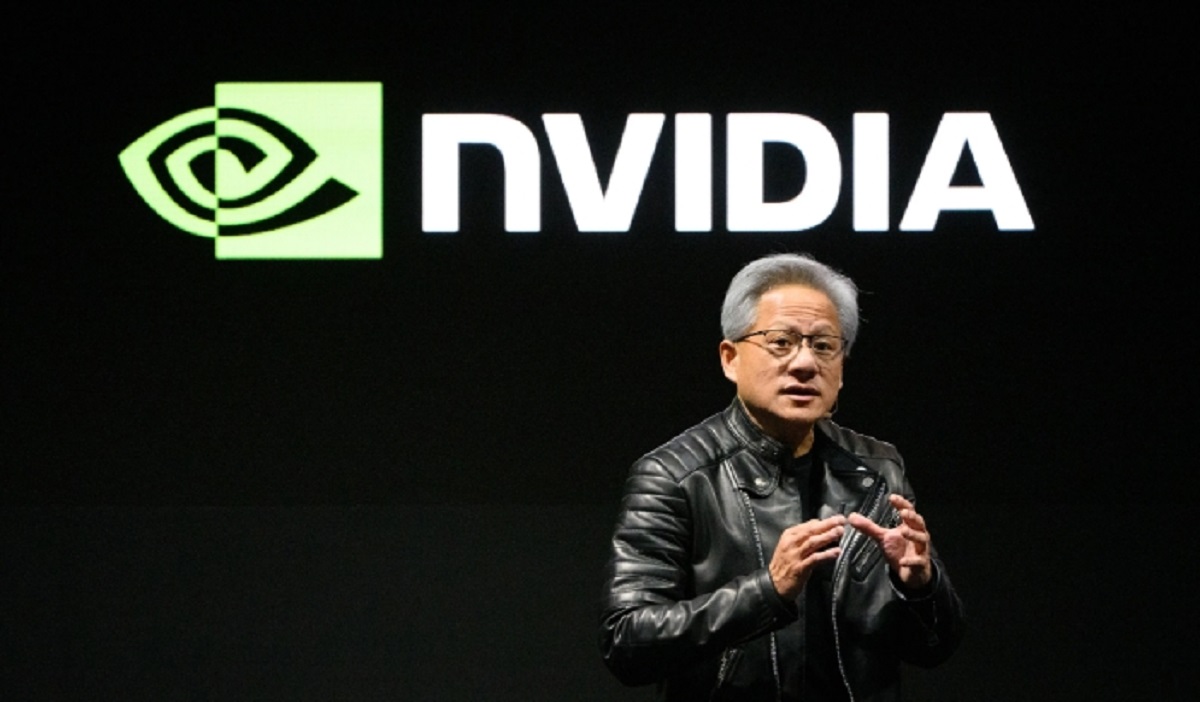

At Nvidia's shareholder meeting on Wednesday, CEO Jensen Huang reassured investors of the company's strong demand and reiterated his belief that the computer industry is only at the beginning of a massive AI infrastructure upgrade. This sentiment underscores Nvidia's pivotal role in shaping the future of technology.

Robotics: The Next Frontier

While AI remains Nvidia's core strength, Jensen Huang has identified robotics as the company's biggest opportunity for future growth. Speaking at the shareholder meeting, Huang emphasized, "We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity."

Nvidia's foray into robotics is not entirely new. A year ago, the company reorganized its business units to group automotive and robotics together. This division, though currently small—contributing $567 million in quarterly sales, or about 1% of total revenue—has shown impressive growth, up 72% annually.

Huang highlighted that self-driving cars would be the first major commercial application for robotics technology. Nvidia's Drive platform, which includes chips and software for autonomous vehicles, is already being utilized by companies like Mercedes-Benz. Additionally, the recent release of AI models for humanoid robots, named Cosmos, signals Nvidia's expanding ambitions in this space.

"We’re working towards a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories that can be powered by Nvidia technology," Huang envisioned. This bold outlook reflects the company's commitment to leveraging its AI expertise to revolutionize the robotics industry.

Business Units and Revenue Streams

Nvidia's business model has evolved significantly over the years. Once primarily known as a chipmaker, the company now positions itself as an "AI infrastructure" or "computing platform" provider. This transformation is evident in its diversified offerings, which include software, a cloud service, and networking chips designed to integrate AI accelerators.

The automotive and robotics division, while still nascent, is poised for growth. Huang explained that robotics applications will require both data center AI chips for software training and specialized chips for deployment in self-driving cars and robots. This dual approach ensures that Nvidia's technology is embedded throughout the robotics ecosystem.

Despite the immense potential, Huang acknowledged the uncertainties ahead. One top analyst at a portfolio management team offered his take on NVIDIA, "I’m bullish on this year and next, but like everyone else, we don’t know what will happen after that". The duration of Nvidia's growth will hinge on how long its customers continue to increase their investments in AI and robotics. Any slowdown in spending could introduce volatility, a risk that investors must consider.

Strategic Evolution and Shareholder Meeting Outcomes

Nvidia's strategic shift is not just about expanding into new markets but also about deepening its integration within existing ones. By offering complementary technologies alongside its AI chips, the company is creating a more comprehensive ecosystem. This approach enhances its value proposition and strengthens its competitive moat.

At the annual shareholder meeting, investors approved the company’s executive compensation plan and reelected all 13 board members. However, outside shareholder proposals for a more detailed diversity report and changes to shareholder meeting procedures did not pass. These outcomes reflect the confidence shareholders have in Nvidia's current leadership and strategic direction.

Conclusion

Nvidia's recent stock surge and its reclamation of the largest stock title underscore its unparalleled position in the tech industry. With a market cap of $3.77 trillion, the company is not only a leader in AI but also a trailblazer in the emerging field of robotics. CEO Jensen Huang's vision for the future, coupled with the company's robust financial performance and strategic initiatives, positions Nvidia for continued growth.

However, as with any high-flying stock, there are risks. The sustainability of Nvidia's growth depends on the ongoing demand for AI and robotics technologies. While the current trajectory is promising, investors should remain vigilant about potential shifts in market dynamics.

For now, Nvidia stands at the forefront of technological innovation, with its sights set on a future where AI and robotics converge to reshape industries and everyday life. As Huang aptly put it, "We stopped thinking of ourselves as a chip company long ago." Indeed, Nvidia is now a cornerstone of the AI revolution, with robotics as its next frontier.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.