Massive Yen Carry Trade Unwind Sends $250 Billion Shockwave through Global Markets

The financial world is on edge as a massive unwinding of the carry trade continues to reverberate through global markets. This popular trading strategy, which involves borrowing in low-interest cur...

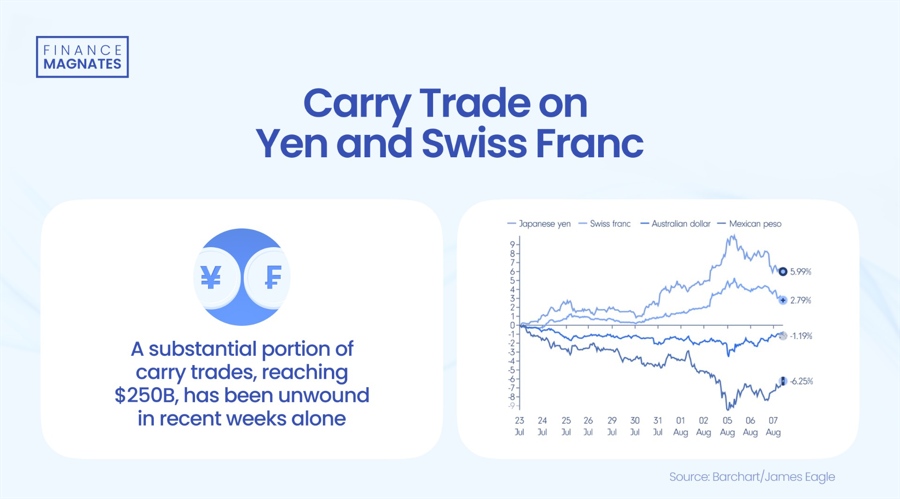

The financial world is on edge as a massive unwinding of the carry trade continues to reverberate through global markets. This popular trading strategy, which involves borrowing in low-interest currencies like the Japanese yen and investing in higher-yielding assets, is experiencing a significant reversal that has caught many investors off guard.

Yen Carry Trade Unwind Sends Ripples through Global Markets

The Japanese yen has surged against major currencies in recent weeks, appreciating nearly 7% against the US dollar since mid-July. This rapid move has forced many traders to liquidate their carry trade positions, leading to increased volatility across various asset classes.

At the beginning of last month, one dollar was worth more than 160 yen, the highest value in several decades. However, a month later, the same dollar was exchanged for only 142 yen, the lowest since the beginning of the year.

Market experts are closely monitoring the situation, with some suggesting that the unwinding process may only be halfway complete. Historically, Japan's negative interest rates and a weakening yen made it an attractive proposition for investors seeking higher returns. By borrowing yen at low rates and investing in higher-yielding assets, traders could profit from both interest rate differentials and potential currency appreciation.

“However, this dynamic has shifted dramatically in recent months,” explained Michał Stajniak, the Deputy Director of the XTB Analysis Department. “Speculation is rife that the Bank of Japan (BoJ) could raise interest rates as high as 1% in the coming months, while according to market the Federal Reserve is expected to cut rates by 100 basis points this year.”

Central banks are now facing a challenging balancing act. The Federal Reserve, in particular, finds itself in a precarious position. While economic data might suggest the need for interest rate cuts, such moves could potentially exacerbate the carry trade unwind and lead to further market instability.

What is more the persistence of carry trade unwinding is supported by the behavior of yen futures contracts. “The extreme short positioning in yen futures, which had ballooned to around 240,000 contracts, has contracted to 140,000. In contrast, long positions have surged to 65,000 from a mere few thousand in 2020,” continued Stajniak.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.