Qualcomm, which has just renewed its contract with Apple for three years, has been revealed to be laying off large-scale employees in China.

As soon as the front foot and Apple renewed the next three years 5G baseband and RF system supply agreement, the back foot was revealed to be in China will be large-scale layoffs, Qualcomm in these two days did earn enough eyeballs。

As soon as the front foot and Apple renewed the next three years 5G baseband and RF system supply agreement, the back foot was revealed to be in China will be large-scale layoffs, Qualcomm in these two days did earn enough eyeballs。

Qualcomm's winter is not over yet

The signing of the supply agreement with Apple is due to Apple's original plan to use its own 5G baseband program in 2024, which has been largely declared bankrupt due to the chip's power consumption and energy efficiency performance not as good as expected.。The market expects Apple to use a completely self-designed 5G chip until at least 2025。Until then, Apple's 5G chips will still rely on chip giant Qualcomm。

Since the start of 5G chip development in 2018, Apple, which has not even developed its own Arm architecture chip, has repeatedly suffered setbacks on the project.。During this period, Qualcomm, as one of the few suppliers in the market, has become a hot spot for the head manufacturers, Xiaomi, OPPO, Huawei, Vivo, Glory and other Chinese mobile phone manufacturers, as well as most of the new energy vehicle manufacturers, are Qualcomm's customers.。

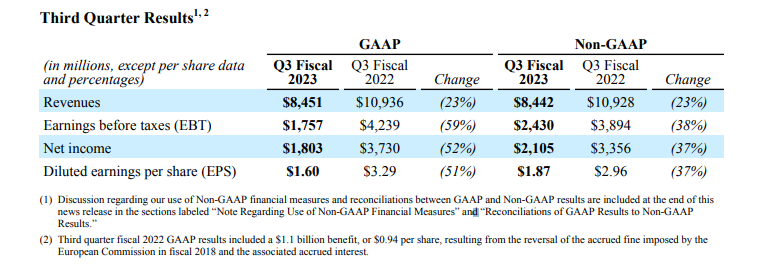

Despite the market's favor, Qualcomm's recent earnings performance has not been satisfactory。According to Qualcomm's third-quarter results released in August this year, Qualcomm's revenue during the reporting period was only 84.$5.1 billion, down 23% YoY; net profit 18.$03 billion, a 52% year-on-year plunge, with data directly halved。

Among them, the performance of the mobile phone business, which accounts for more than 50% of Qualcomm's total revenue, is even more surprising, with revenue down 22% year-on-year, which has the most direct impact on the company's performance.。Although Qualcomm recorded double-digit growth in its automotive business during the reporting period, the business accounted for only a mere 5% of Qualcomm's business composition and was unable to reverse Qualcomm's decline.。

The decline in Qualcomm's mobile phone business is closely related to the downturn in the global smartphone market.。According to data from Canalys, global smartphone shipments in the first half of this year were only about 5.254.3 billion units, down about 72.77 million units from the same period last year.。

Simply from the point of view of year-on-year shipments, the first half of this year, the major mobile phone brand manufacturers without exception, year-on-year shipments declined, of which only OPPO, Apple declined the smallest。

In addition, according to Counterpoint Research's global smartphone AP (application processor) market report for the second quarter of 2023, global smartphone AP / SoC chipset shipments fell 39% year-on-year in the second quarter of 2023.。

By manufacturer, MediaTek ranked first with a 30% share, Qualcomm ranked second with a 29% share, and Apple ranked third with a 19% share.。In fact, since the third quarter of 2020, MediaTek has surpassed Qualcomm for three consecutive years to become the world's largest chip supplier.。

Analysts believe that Qualcomm is still in the trough of performance。Since more than 50% of the company's revenue comes from the mobile phone business, Qualcomm is still a veritable "mobile phone stock."。Although the inventory of the mobile phone industry chain has shown obvious signs of decline, the current weak demand is still suppressing shipments.。In other words, Qualcomm's winter is not over yet。

Qualcomm's road to layoffs may continue

In a conference call with analysts, Qualcomm's CEO confirmed that Qualcomm would cut costs further, with layoffs as one of the measures, after handing over fiscal 2023 third-quarter financial results that saw both revenue and net profit plunge。It is understood that in the last fiscal quarter, Qualcomm spent as much as 2.$8.5 billion, mostly in severance payments。

In June of this year, Qualcomm's U.S. headquarters in San Diego reduced its workforce by about 415.。Shortly thereafter, Qualcomm in other regions was also exposed by the media, and the proportion of layoffs is not small, the intensity is very large.。Now, this blazing fire of layoffs has burned to Shanghai, China。

This week, there have been rumors that Qualcomm Shanghai R & D department will lay off a large area, leaving only the personnel department and some other personnel, the compensation standard started at N + 4, for employees without a fixed term, will compensate N + 7, there is no limit of three times the cap.。This layoff is only the beginning, not the end, and will be followed by layoffs.。

According to public information, Qualcomm China has R & D centers in Beijing and Shanghai。Qualcomm Shanghai was established in 2010, the business scope includes regional network chips, wired, wireless communication terminal chips and their software testing and maintenance, the company currently has 393 employees.。

In response to rumors of layoffs, Qualcomm said on September 21 that Qualcomm raised in its third-quarter earnings call that, given the continued uncertainty in the macroeconomic and demand environment, the company expects to take further adjustment measures to achieve continued investment in important growth opportunities and business diversification.。

Qualcomm said that although the corresponding plan is still being developed, but the main measures are expected to include layoffs, but the market rumors of "mass layoffs," "office closure," "withdrawal from Shanghai" and other exaggerated.。

Qualcomm also said it expects to incur significant additional adjustment costs related to actions such as layoffs, a large portion of which is expected to occur in the fourth quarter of fiscal 2023.。

This suggests that Qualcomm's path to layoffs may continue.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.