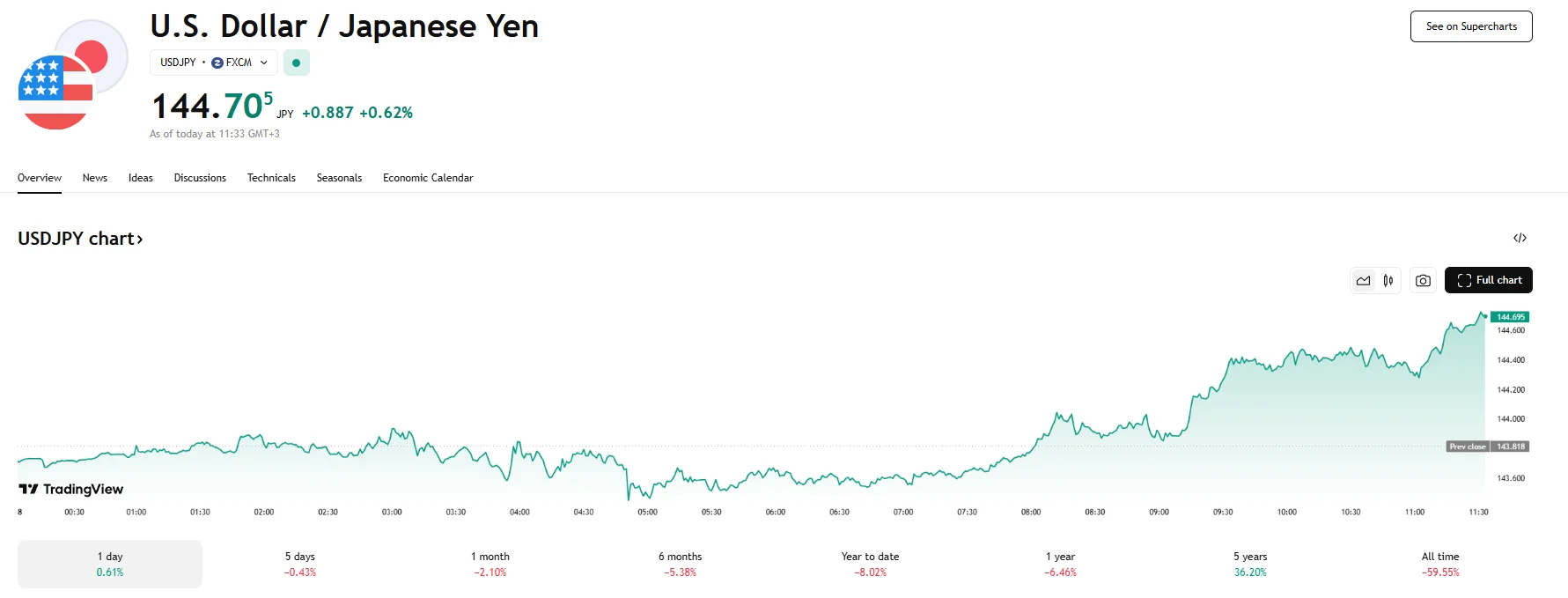

USD/JPY Rises 0.62% to 144.70, Dollar Index Hits 100 USD/JPY Rises 0.62% to 144.70, Dollar Index Hits 100

Key Moments:The US Dollar Index managed to reach the 100 mark.The yen extended its Wednesday decline into Thursday, depreciating 0.62% against the greenback.Market expectations regarding a potential B

Key Moments:

- The US Dollar Index managed to reach the 100 mark.

- The yen extended its Wednesday decline into Thursday, depreciating 0.62% against the greenback.

- Market expectations regarding a potential BoJ rate increase could aid the yen.

The USD/JPY advanced on Thursday, climbing by 0.62% to 144.70 amid renewed optimism around US trade negotiations. US President Donald Trump’s comments regarding a major trade deal, along with his claim that it would be “the first of many,” reduced the appeal of safe-haven currencies like the JPY and bolstered risk appetite.

Fed Rate Stability Boosts Dollar

The US Dollar Index was successful in reaching the 100 threshold, with the greenback attracting buyer interest after the Federal Reserve opted to refrain from rate hikes. However, the central bank maintained a hawkish tone in its guidance, reinforcing expectations of prolonged elevated borrowing costs.

The index is currently hovering near the 100.100 mark as opposed to accelerating its climb due to the unpredictability of future US tariff plans. Fed Chair Jerome Powell noted uncertainty remains when it comes to trade issues and advised a wait-and-see approach for monetary policy actions. Moreover, while markets responded positively to Trump’s promise of a major trade agreement with a “highly respected” country, the lack of progress when it comes to the trade dispute between Washington and Beijing continues to temper hopes for a swift resolution and exert pressure on the dollar.

The BoJ’s Stance Amid Turbulence

BoJ Governor Kazuo Ueda has commented on concerns about rising food prices on core inflation. In addition, according to recently released footage from the Bank of Japan’s policy meeting, which took place on March 18th and 19th, the BoJ is still disposed to tighten monetary policy further should inflation and growth projections stay sustained. Officials also emphasized the need for caution given rising global uncertainties linked to US tariffs and trade policies. The potential for rate hikes could serve to cushion further declines of the yen.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.