Ethereum Holder Sold Over $570 Million in 48 Hours – What’s Next for ETH?

Ethereum price struggles near $2,500 after $570 million selling; MACD bearish crossover signals short-term volatility and risk of decline.

- Ethereum faces heavy selling with $570 million worth of ETH offloaded in 48 hours, signaling investor profit-taking.

- MACD shows a bearish crossover after seven weeks, indicating possible price decline and increased volatility ahead.

- ETH price hovers near $2,500 support; breaking below risks a drop to $2,344, while resistance at $2,654 must be breached to reverse bearish trend.

Ethereum (ETH) has shown little price movement over the past two weeks despite the broader cryptocurrency market displaying bullish momentum.

This stagnation in ETH’s price comes at a time when selling activity has intensified. These factors suggest a cautious short-term outlook for Ethereum as the week continues.

Ethereum Investors Secure Their Profits

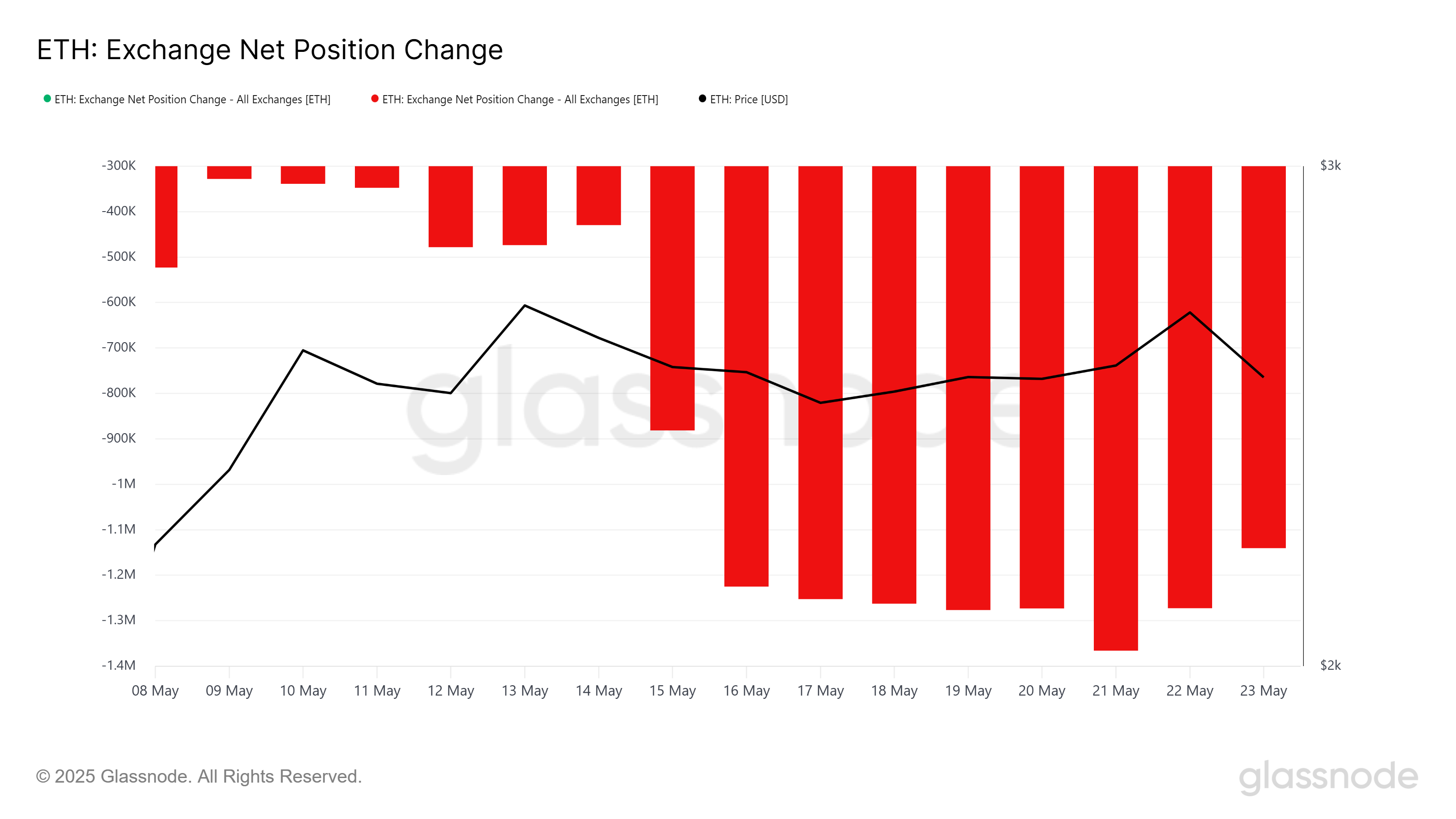

Recent data indicates significant selling pressure on Ethereum. Over the last 48 hours, investors have sold more than 225,779 ETH tokens. This volume translates to a supply worth approximately $576 million, reflecting a rapid pace of offloading.

Such extensive selling indicates reduced investor confidence. Many appear to be securing profits amid doubts about further price appreciation. This behavior often signals a shift toward risk aversion in the short term.

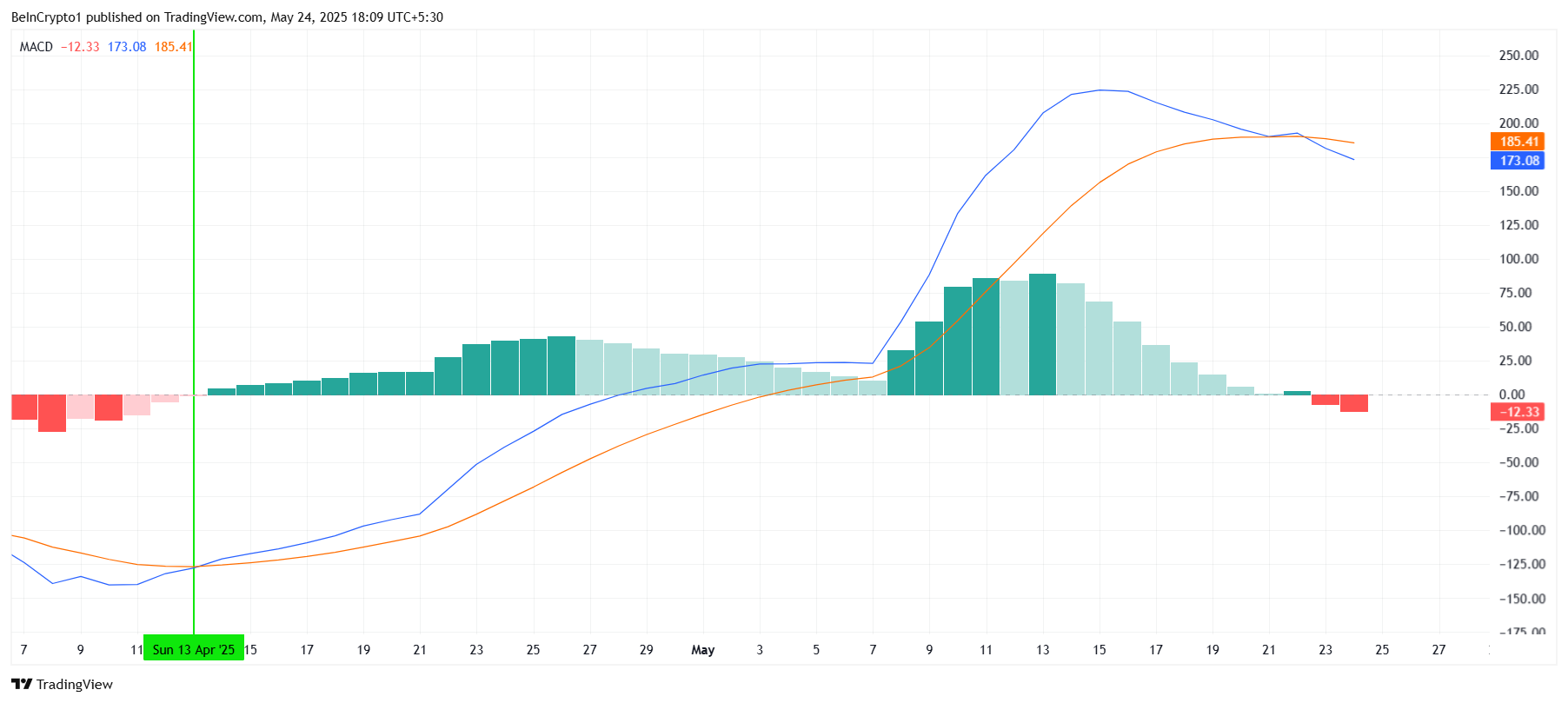

Technical indicators add to the bearish sentiment surrounding Ethereum. The Moving Average Convergence Divergence (MACD) shows a bearish crossover after nearly seven weeks of bullish momentum. This change often precedes a price decline or increased volatility.

Losing bullish momentum weakens Ethereum’s price support. Without fresh buying interest, ETH may face further downward pressure as traders adjust positions in response to technical signals.

ETH Price is Stuck

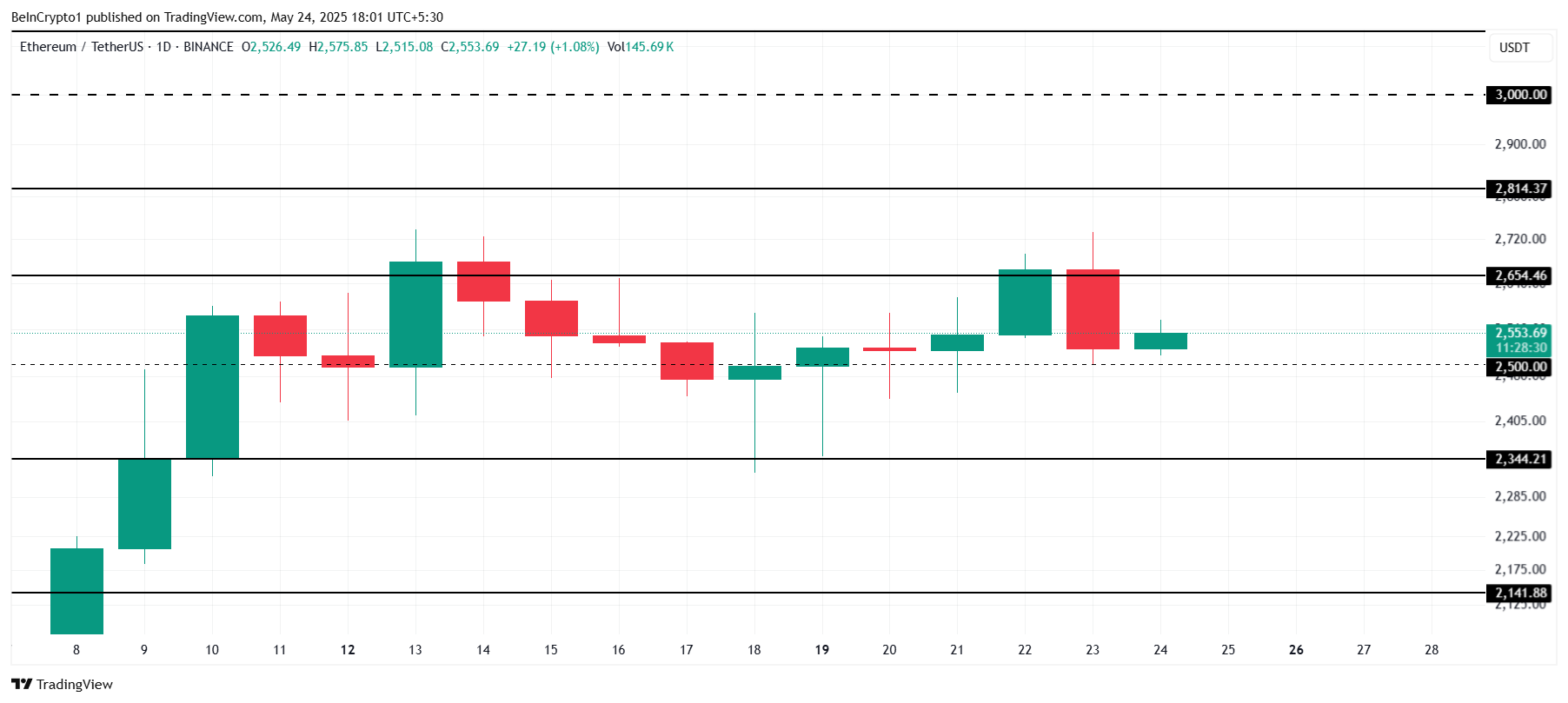

Ethereum is currently trading near $2,553, maintaining a critical support level of around $2,500. The altcoin king has hovered above this threshold for some time, but its ability to hold this level is being tested.

If bearish pressures continue, Ethereum could break below $2,500 and move lower toward the next support at $2,344. However, if buying interest returns, ETH may consolidate between $2,500 and the resistance level of $2,654 for a period.

For the short-term bearish outlook to change, Ethereum must breach the resistance near $2,654. A sustained move beyond this point could push the price up toward $2,814, reigniting investor optimism and supporting further gains.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.