AMD Soars on AI Accelerator Price Hike and Regulatory Tailwinds

Advanced Micro Devices (AMD) is riding a wave of momentum, with its stock surging 4.32% on Monday. The rally comes on the heels of two major catalysts: a bold 67% price hike for its Instinct MI350 AI

Advanced Micro Devices (AMD) is riding a wave of momentum, with its stock surging 4.32% on Monday.

The rally comes on the heels of two major catalysts: a bold 67% price hike for its Instinct MI350 AI accelerator, jumping from $15,000 to $25,000, and a pivotal Department of Commerce decision greenlighting AI chip exports to China. As the chipmaker gears up to release its Q2 FY2025 earnings on August 5, investors are buzzing with anticipation, eager for clues about revenue growth, margin expansion, and AMD’s next moves in the red-hot AI and data center markets.

Stock Price Surge: Pricing Power and Regulatory Boost

The spark behind AMD’s latest climb is its decision to flex pricing muscle on the Instinct MI350 AI accelerator. The $10,000 increase reflects booming demand for AI hardware and signals AMD’s confidence in its competitive positioning against rivals like Nvidia. This isn’t just a pricing tweak—it’s a statement. With hyperscalers and enterprises clamoring for AI infrastructure, AMD is poised to see a hefty lift in revenue and margins, a move that’s already winning over Wall Street. Analysts from BofA and Wells Fargo have responded by hiking their price targets, citing AMD’s “resolute momentum” in the data center space and its sharp strategic execution.

Adding fuel to the fire, the Department of Commerce handed U.S. chipmakers a golden ticket: the ability to resume AI chip sales to China. For AMD, this means restarting shipments of its MI308 GPU, a development that sent shares up 6% in a single session. The Trump administration’s clearance opens a door to the massive Chinese market, a lifeline for growth amid earlier export restrictions. It’s a rare regulatory tailwind in a sector often battered by geopolitical headwinds, and investors are betting it’ll translate into meaningful top-line gains. The optimism is palpable—AMD’s market appeal is surging, and the stock’s upward trajectory feels far from over.

Earnings Preview: Data Center Strength in Focus

All eyes now turn to August 5, when AMD drops its Q2 FY2025 earnings after the bell. Analysts are projecting revenue of $7.41 billion, a robust 27% jump year-over-year, though earnings per share are expected to dip 30% to $0.48. The contrast tells a story: AMD is scaling revenue fast, but profitability may be taking a breather as it invests heavily in AI and data center expansion. Still, the company’s track record suggests it could surprise to the upside—Q1 saw sales hit $7.44 billion, up 36%, with non-GAAP EPS of $0.96 crushing estimates by nearly 4.5%.

The data center segment is the star of the show, raking in $3.7 billion last quarter—a 57% leap—thanks to roaring demand for fifth-gen EPYC Turin processors and Instinct GPU accelerators. AMD’s notched over 30 new cloud instances with heavyweights like AWS, Google Cloud, and Tencent, a sign it’s carving out serious turf in the hyperscaler arena. Client and gaming revenue also shone, up 28% to $2.9 billion, driven by high-end Ryzen CPUs, though embedded sales slipped 3% to $823 million.

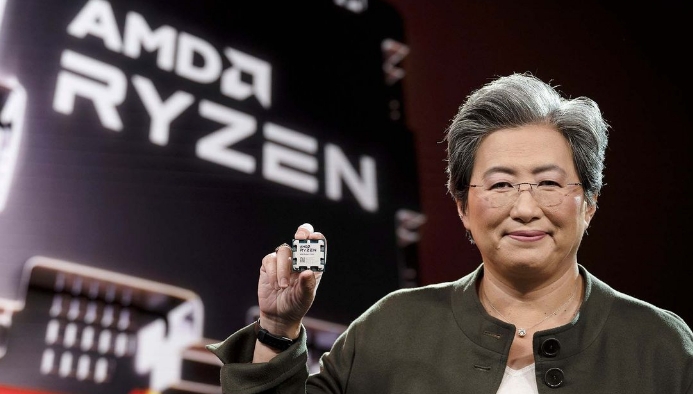

Investors will be laser-focused on guidance. Management’s likely to tackle the elephant in the room: export license delays. AMD flagged a $1.5 billion full-year sales hit from prior restrictions, but pending approvals could claw back $700 million in the near term. CEO Lisa Su has doubled down on AI as the company’s “top priority,” a stance bolstered by the recent ZT Systems acquisition to juice up its rack-scale solutions. Analysts are bullish, expecting another revenue beat, even if EPS growth cools off. With data center and AI demand showing no signs of slowing, AMD’s server-CPU share gains could steal the spotlight.

Valuation and Risks: High Stakes, High Rewards

But it’s not all smooth sailing. AMD’s valuation is raising eyebrows, trading at a forward P/E of ~40, a price-to-free-cash-flow ratio near 98, and a PEG around 1.3. These aren’t outlier numbers for a high-growth tech name, but they scream that the market’s priced in a lot of future success. Any stumble—be it an earnings miss, production hiccups at TSMC (its manufacturing partner), or delays in scaling its ROCm software to rival Nvidia’s CUDA—could trigger a nasty pullback. Margin pressure is another worry, though AMD’s 54% adjusted gross margin in Q1 shows it’s still churning out healthy profits.

Technically, the stock’s testing resistance at $175, its 52-week high. A strong Q2 could propel it toward $200–$215, levels last seen in March 2024’s intraday peaks. On the flip side, support sits at $135, with $115 as a deeper cushion if tech takes a broader hit. Swing traders and momentum chasers will be watching these levels closely—AMD’s a high-beta name, and volatility comes with the territory.

The Road Ahead: Growth vs. Challenges

AMD’s on a tear, and the combo of the MI350 price hike and China export clearance has lit a fire under its stock. The August 5 earnings report will be a crucible, testing whether the company can keep delivering on its data center and AI promises. The fundamentals look solid—revenue growth is humming, and Su’s laser focus on AI infrastructure is paying off. Yet, the lofty valuation and execution risks loom large. Can AMD scale fast enough to justify the hype, or will production snags and competition from Nvidia throw a wrench in the works?

For now, the bulls are in charge. AMD’s carving out a bigger slice of the AI and server markets, and the China wildcard could supercharge its trajectory. But in a sector this cutthroat, perfection’s the bar—and any misstep could send sentiment crashing. As the earnings call nears, one thing’s clear: AMD’s playing a high-stakes game, and the next chapter could be a blockbuster—or a cautionary tale.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.