Berkshire's Latest 13F: Buffett Dumped Bank Stocks – What's the Mystery Holding Hiding in His Portfolio?

Warren Buffett’s berkshire hathaway has recently captured attention with a combination of secretive investments and bold portfolio adjustments, showcasing the conglomerate’s disciplined yet dynamic ap

Warren Buffett’s berkshire hathaway has recently captured attention with a combination of secretive investments and bold portfolio adjustments, showcasing the conglomerate’s disciplined yet dynamic approach to capital allocation.

From building a confidential stock position to doubling down on consumer goods and scaling back on financials, Berkshire’s latest moves reflect Buffett’s timeless investment philosophy, even as he’s retirement is set to come effective by the end of this year: patience, scale, and a keen eye for long-term value.

A Secret Stock Position Signals a Big Bet

Berkshire Hathaway is quietly amassing a significant stake in an undisclosed company, with regulators granting special permission to keep the investment confidential for now, as revealed in its recent 13-F filing with the Securities and Exchange Commission(SEC). This strategic secrecy shields Berkshire from market volatility, allowing the firm to build its position without tipping off other investors or inflating the stock price prematurely. The tactic echoes last year’s playbook when Berkshire discreetly accumulated shares in insurer chubb, a move that paid off by avoiding market disruption.

Given Berkshire’s massive equity portfolio—valued at approximately $275 billion—a meaningful new investment would likely require billions of dollars and months of careful accumulation. The confidentiality request hints at the scale of this bet, sparking speculation about the target. Many analysts point to an industrial company as a likely candidate, given Berkshire’s storied history with giants like burlington northern Santa Fe, the railroad titan it acquired in 2010. While details remain under wraps, this move underscores Berkshire’s knack for making substantial, calculated plays that align with its long-term vision.

Doubling Constellation, Shedding Financials

Alongside its covert investment, Berkshire has made waves with its publicly disclosed portfolio shifts.

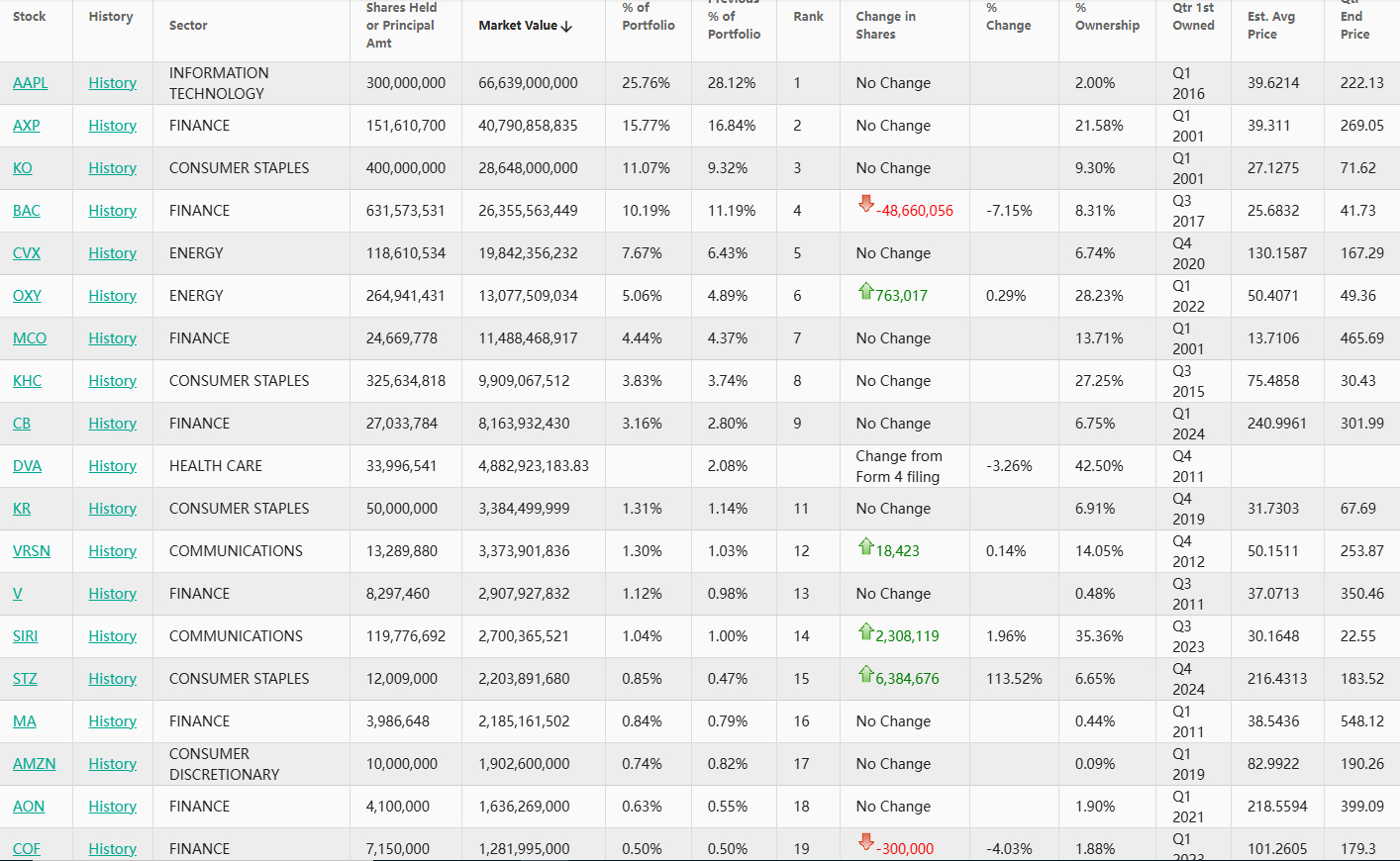

The conglomerate more than doubled its stake in constellation brands, a powerhouse in the alcoholic beverage industry known for brands like Corona, Modelo Especial, and Robert Mondavi wines. Berkshire now owns approximately 12 million shares, valued at $2.2 billion, representing a 6.6% stake in the company. The market responded positively, with Constellation’s shares climbing 2.7% in after-hours trading following the disclosure—a testament to the “Buffett bump” that often accompanies his investments.

In contrast, Berkshire has pulled back from the financial sector. The company fully exited its three-year stake in Citigroup and shed its position in the parent company of Nubank, a Brazilian fintech lender. It also trimmed its holdings in Bank of America, dropping from 1.03 billion shares last July to 632 million, and reduced its stake in Capital One, which is poised to acquire Discover Financial Services. These sales signal a deliberate pivot away from financial services, redirecting capital toward sectors like consumer goods where Berkshire sees stronger growth potential.

Berkshire’s quarterly filings reveal a broader trend: the company has been a net seller of stocks for the 10th consecutive quarter. Between January and March, it purchased $3.18 billion in equities while offloading $4.68 billion, leaving it with a record-breaking $347.7 billion in cash and equivalents. At the annual shareholder meeting on May 3, Buffett addressed this growing cash pile, emphasizing that prime investment opportunities are rare. “We would rather have conditions that are developed where we would have like $50 billion” in cash, he said, “but that just isn’t the way the business works.” This conservative stance ensures Berkshire is poised to pounce when the right deal emerges.

Despite its net selling, Berkshire remains anchored by its largest holding: a 300 million-share stake in Apple, valued at $66.6 billion. The conglomerate has also deepened its international footprint, steadily increasing its investments in five Japanese trading houses, a move that diversifies its portfolio beyond U.S. borders.

These portfolio decisions stem from the collective expertise of Buffett, portfolio managers Todd Combs and Ted Weschler, and future CEO Greg Abel, who has taken on a larger role in capital allocation. While individual contributions remain undisclosed, the moves reflect a unified strategy honed over decades.

Berkshire Hathaway’s latest actions paint a picture of a conglomerate balancing ambition with prudence. The secret stock position—likely a multi-billion-dollar wager on an industrial titan—highlights its appetite for transformative investments. Meanwhile, doubling its stake in constellation Brands and retreating from financials demonstrate a tactical reallocation of resources. With nearly $350 billion in cash and a sprawling empire of nearly 200 businesses—including Geico, BNSF, and a host of energy and retail firms—Berkshire remains a formidable force under Buffett’s stewardship. At 94, the world’s fifth-richest person continues to prove why he’s regarded as the gold standard in investing.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.