RBI Delivers 50-bps Rate Cut, USD/INR Slides to 85.740 RBI Delivers 50-bps Rate Cut, USD/INR Slides to 85.740

Key Moments:The Reserve Bank of India reduced its key policy repo rate by 50 basis points to 5.5%.The central bank also announced a 100-basis-point cut to the cash reserve ratio, to be implemented in

Key Moments:

- The Reserve Bank of India reduced its key policy repo rate by 50 basis points to 5.5%.

- The central bank also announced a 100-basis-point cut to the cash reserve ratio, to be implemented in stages until December.

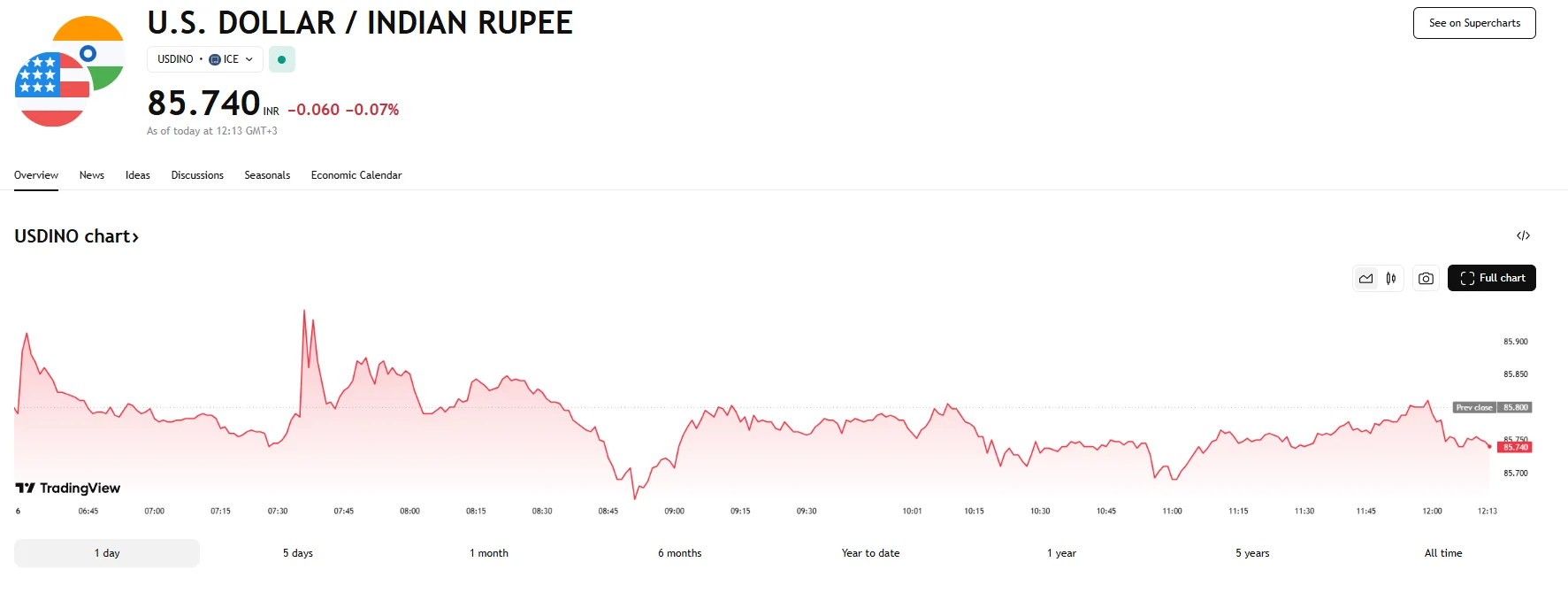

- The USD/INR dropped below the 85.800 mark.

Monetary Policy Shift Comes Amid Uncertain Global Backdrop

The Reserve Bank of India (RBI) announced a larger-than-anticipated 50-basis-point cut to its benchmark repo rate on Friday, reducing it to 5.5%. This marks the third trimming of rates since the start of 2025.

Officials also slashed the banks’ cash reserve ratio by 100 basis points (3%). This change will be rolled out in four phases from September through December. The measures come as inflation expectations remained subdued at 3.7%.

The central bank also stated that its monetary stance had shifted from accommodative to neutral. During a press conference following the policy announcement, Malhotra explained that the front-loading of rate cuts was necessitated by the need for certainty amidst prevailing uncertainty. He added that the committee now sees limited room for additional stimulus, having eased rates by a total of 100 basis points over a short span.

Rupee Dips Amid Growth and Inflation Projections

Financial markets reacted sharply to the rate reduction, as India’s benchmark 10-year government bond yield initially dropped by 10 basis points before settling at 6.19%. Equity benchmarks rose approximately 0.9%, led by bank stocks. Meanwhile, the rupee fluctuated and the USD/INR fell 0.07% to 85.740.

India’s Q1 GDP expanded by 7.4%, and the central bank maintains its projection of 6.5% growth for the fiscal year. Malhotra signaled aspirations for even stronger growth, saying that Friday’s policy decisions were designed to push growth onto a more ambitious path, targeting expansion in the 7% to 8% range.

The RBI now sees inflation averaging 3.7% for the year, down from its earlier estimate of 4%. Inflation fell to 3.16% in April, almost hitting a low unseen in six years. The MPC noted that price levels are trending lower across key sectors and indicated inflation could fall slightly below target.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.