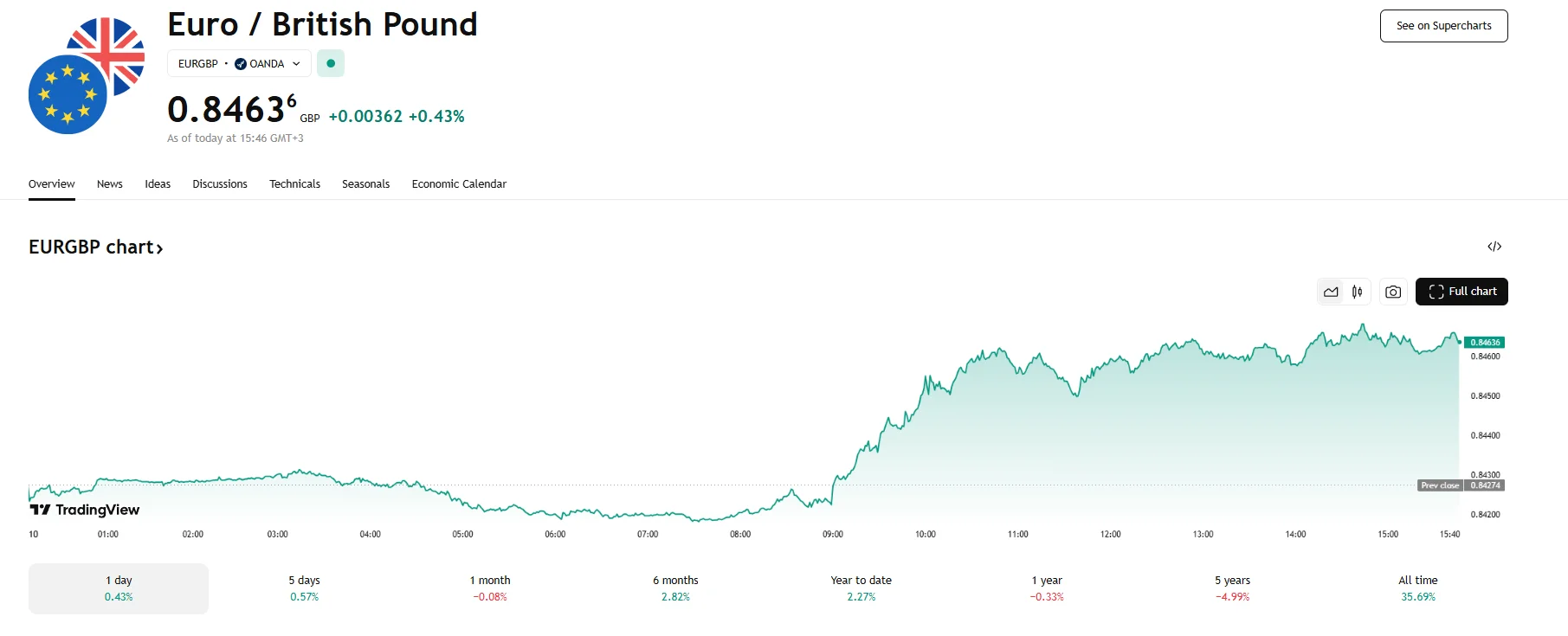

EUR/GBP Surges 0.43% to 0.8463 EUR/GBP Surges 0.43% to 0.8463

Key Moments:UK unemployment rose to 4.6% in May, according to data published on Tuesday.Last month also witnessed wage growth slow to 5.2%.EUR/GBP jumped past the 0.8460 mark on Tuesday.EUR/GBP Gains

Key Moments:

- UK unemployment rose to 4.6% in May, according to data published on Tuesday.

- Last month also witnessed wage growth slow to 5.2%.

- EUR/GBP jumped past the 0.8460 mark on Tuesday.

EUR/GBP Gains Amid UK Labor Market Weakness

On June 10th, the euro achieved notable gains versus the pound sterling. The EUR/GBP currency pair rose by 0.43% and breached the 0.8460 level. The surge was driven by disappointing UK labor market data and more encouraging indicators out of the Eurozone.

The critical resistance zone between 0.8450 and 0.8460 marks the neckline of an inverted Head and Shoulders pattern, suggesting a potential bullish reversal. However, a failure to sustain gains and a drop below the 0.8360 threshold could lead to a decline below 0.8330.

UK Wage Growth Slows, Jobless Claims Surge

Figures released earlier in the day showed that the UK’s unemployment rate rose to 4.6% in May, marking the highest level in four years. Notably, the number of individuals who claimed jobless benefits jumped by 33,100, far exceeding analysts’ forecasts of a 9,500 increase.

Wage growth also lost momentum, slowing to 5.2% in May from April’s 5.5%. It also came in below the projected 5.4%. These weak signals reinforced the case for further monetary easing by the Bank of England, resulting in broad-based pressure on the Pound.

Eurozone Confidence and ECB Comments Support Euro

Meanwhile, upbeat economic surprises from the Eurozone helped lift the euro. Investor confidence reached its highest level in a year, and Italian industrial production significantly outpaced expectations.

Additionally, remarks from ECB officials Rehn and Villeroy regarding the bank’s future monetary policy served to further support the euro. “We will remain pragmatic and data-driven, and as agile as necessary,” stressed Villeroy as reported by media giant Bloomberg.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.