EUR/USD Up 0.7% to 1.1392 as Euro Gains Ground on Positive German Business Sentiment EUR/USD Up 0.7% to 1.1392 as Euro Gains Ground on Positive German Business Sentiment

Key momentsThe EUR/USD climbed 0.7% on Thursday.Concurrently, the US Dollar Index fell 0.52% to 99.262.According to an IFO report, the German Business Climate Index rose to 86.9 this month.EUR/USD Str

Key moments

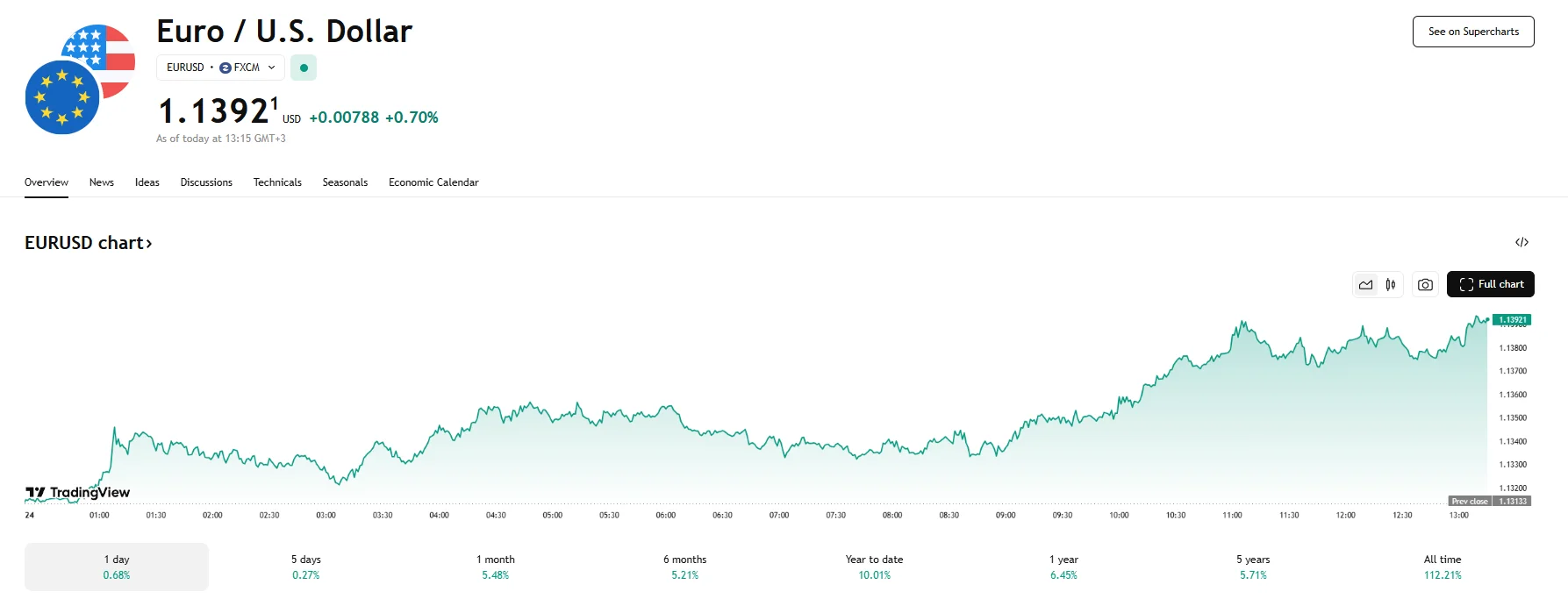

- The EUR/USD climbed 0.7% on Thursday.

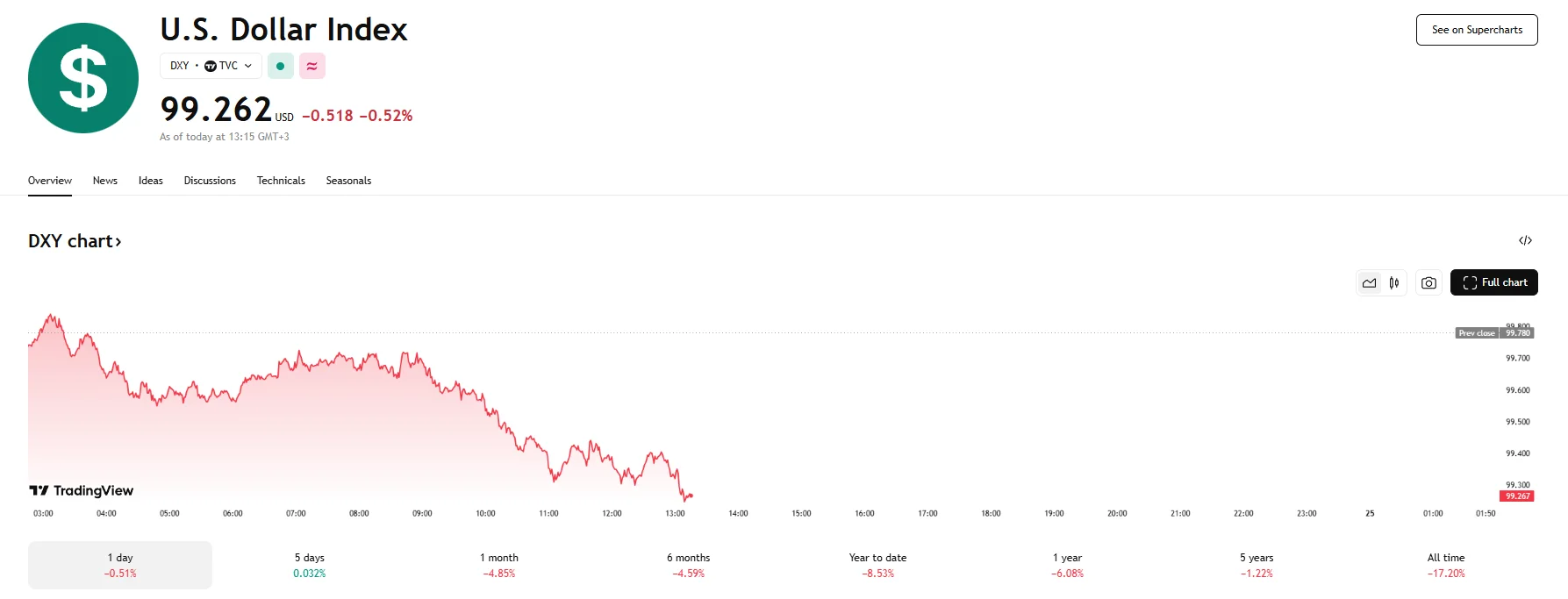

- Concurrently, the US Dollar Index fell 0.52% to 99.262.

- According to an IFO report, the German Business Climate Index rose to 86.9 this month.

EUR/USD Strengthens After Favorable German Economic News

The exchange rate between the euro and the US dollar saw an uptick on Thursday, with the single European currency gaining ground. The EUR/USD pair rose by 0.7%, reaching a level of 1.1392 during the trading session.

This positive shift for the euro was notably supported by the release of promising economic data from Germany, the Eurozone’s largest economy. A key indicator of business sentiment in Germany showed unanticipated improvement in April, as the Institute for Economic Research’s (IFO) Business Climate Index rose to 86.9 for the month. This figure defied forecasts from WSJ economists, who had predicted the index would decline by 1 point.

Although expectations for the future edged slightly lower to 87.4, this decline was less pronounced than anticipated by market analysts, who had expected the ongoing concerns over US trade disputes and economic stagnation to weigh on sentiments. This surprising resilience in German business morale provided a boost for the euro, suggesting underlying stability despite broader economic uncertainties.

Meanwhile, the upward trajectory that the US dollar had been on recently appeared to lose some momentum. The US Dollar Index, which serves as an indicator of the dollar’s performance against a basket of currencies, suffered a 0.52% decline to 99.262. This pause in the greenback’s ascent provided a favorable backdrop for the euro to appreciate, recovering from earlier declines that saw the EUR/USD pair near 1.1300.

The broader currency market remains sensitive to shifts in global trade dynamics and central bank posturing. Discussions surrounding international trade agreements, particularly between the United States and major partners, continue to influence market sentiment and currency valuations. Similarly, any indications regarding the future path of interest rates from key central banks can prompt significant currency movements.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.