Trump-Musk fallout, Tesla Plunges—Buy the Dip or Run Away?

Donald Trump and Elon Musk publicly clashed in a bitter exchange, nearly reaching full-blown political and personal rupture. Tesla’s stock plummeted 14% in a single day, wiping out $153 billion in mar

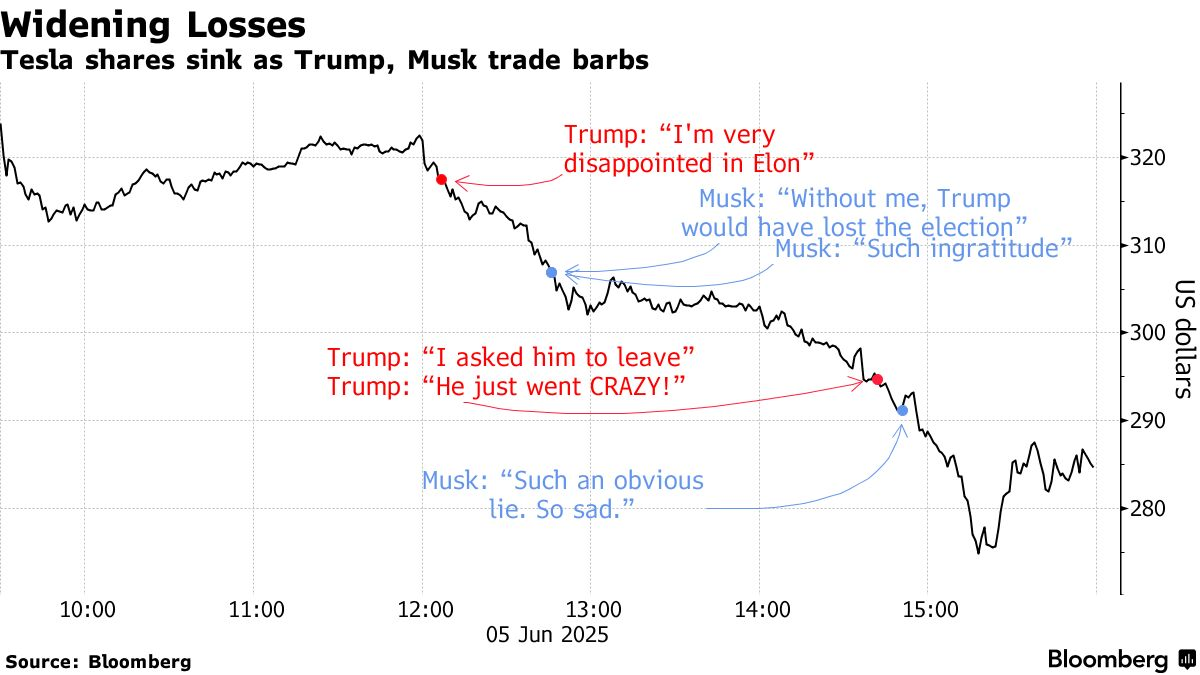

Donald Trump and Elon Musk publicly clashed in a bitter exchange, nearly reaching full-blown political and personal rupture. Tesla’s stock plummeted 14% in a single day, wiping out $153 billion in market value.

The chart below shows Tesla’s stock performance in real-time alongside the intensifying feud between the two.

The fallout began with Trump’s “Great Beautiful Act,” a sweeping fiscal proposal that, if passed, would increase the U.S. federal deficit by trillions over the coming years. Meanwhile, Musk’s proposed “Department of Government Efficiency” had aimed to save only a few hundred billion—an effort that not only appeared futile in contrast but also damaged both Musk’s and Tesla’s reputations. If the bill passes, Musk’s efforts risk being seen as a joke, while the reputational loss could be irreversible.

As tensions escalated, Trump threatened that the easiest way to cut government spending would be to terminate contracts and subsidies with Musk’s companies. He further mocked electric vehicles, claiming “no one wants to buy them,” and bragged that it was he who forced Musk out of the White House circle.

Musk hit back fiercely, first accusing Trump of being ungrateful and warning that the “Great Beautiful Act” would bankrupt America. He questioned why Trump targeted green energy while sparing oil and gas subsidies. He then suggested Trump should be impeached and replaced by Vice President Vance. Finally, Musk dropped a bombshell: the reason Jeffrey Epstein’s client list hasn’t been made public is because Trump is on it.

After witnessing the explosive “Trump vs. Musk” drama, investors had no choice but to return to the markets.

Is Tesla Now a Bargain — or Just Riskier Than Ever?

Tesla shares had surged after Trump’s election—a natural honeymoon rally. But Tesla’s underlying fundamentals have been weakening. Musk’s “DOGE” cost-cutting initiative, which involved massive layoffs and spending cuts, has tanked the public image of both Musk and tesla. A backlash against the company has erupted across Europe and the U.S.

Latest data shows Tesla sales in major European markets have nearly halved. While China remains unaffected by DOGE, fierce competition from BYD and other EV startups is closing in. BYD has overtaken Tesla to become the world’s top-selling EV brand. Musk’s ambitious visions for robotaxis, the Optimus humanoid robot, and energy storage still require years before becoming profitable.

Wall Street Analysts Turn Sharply Bearish

“This is just stupid. Someone in that position shouldn’t act like a child,” said Wayne Kaufman, Chief Market Analyst at Phoenix Financial Services. “Tesla and Musk are inseparable—its valuation is directly tied to his image. If Tesla really had deep intrinsic value, it wouldn’t collapse this hard. It’s always been a speculative bet, never traded on fundamentals.”

Ross Gerber, CEO of wealth management firm Gerber Kawasaki, added: “It’s clear that Musk and Trump are no longer aligned—this uncertainty is what’s driving the selloff. If it comes down to a fight, Trump will win. Buying in now is a gamble. Yes, the falling stock could lead to a more reasonable valuation, but I can’t in good conscience say it’s cheap.”

“This is a disaster for Musk, far beyond what any rational businessman would do. I can’t believe he just turned Trump into an enemy,” Gerber continued. “The Tesla board is doing nothing to protect shareholders. The only way to protect yourself is to sell—I sold some Tesla stock today. We’ve been sellers for years and will keep selling.”

Dave Mazza, CEO of Roundhill Financial, noted: “Short-term outlook for Tesla is clearly bearish. This conflict adds unnecessary complexity. Previously, investors were willing to overlook falling sales for the promise of robotaxis. Now, with both Musk and robotaxis under attack, that ‘dream premium’ is collapsing—this 14% drop proves it.”

A U.S. Government–Musk Split Would Cut Both Ways

Of course, a total fallout with Musk would hurt the U.S. too. Tom Orlik, Chief Economist at Bloomberg Economics, said that a crackdown on Musk’s companies could jeopardize America’s global technological leadership. Musk’s enterprises give the U.S. a strategic edge across multiple fields. Abandoning them would be an enormous loss.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.