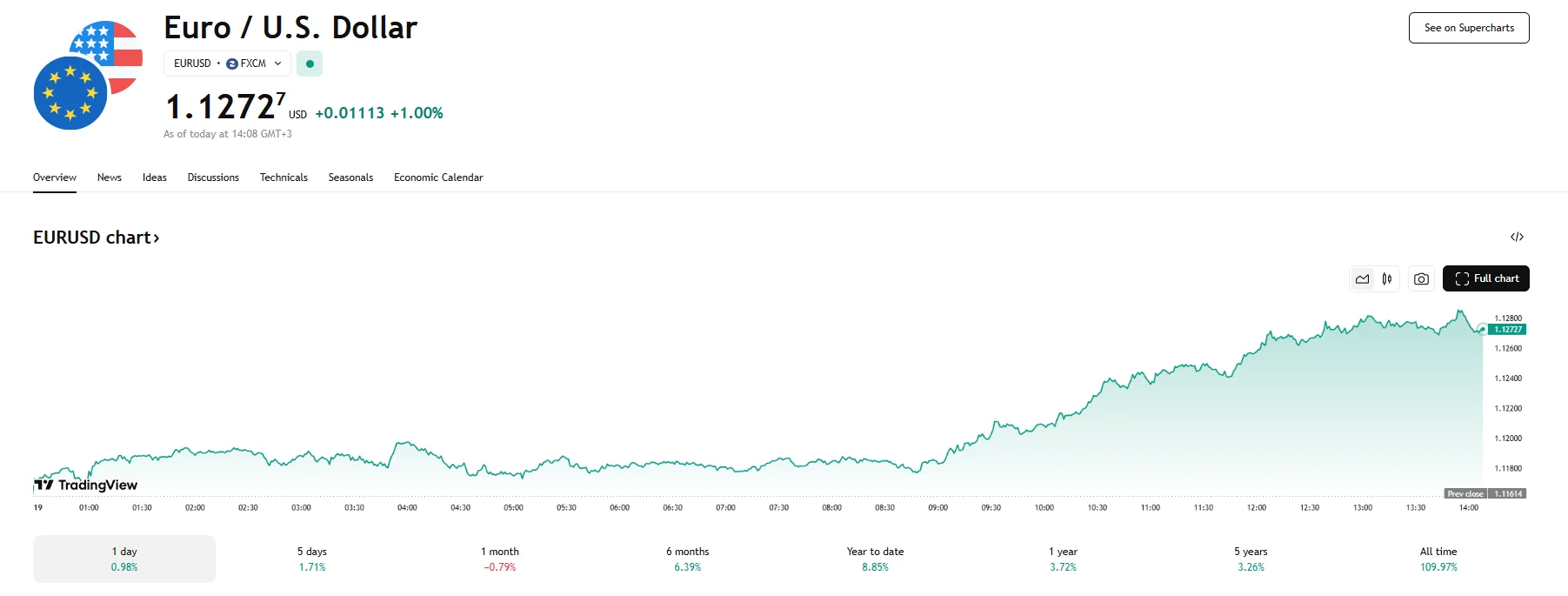

EUR/USD Jumps 1% to 1.1272 EUR/USD Jumps 1% to 1.1272

Key Moments:EUR/USD climbed above 1.1270 on Monday.The US Dollar Index weakened following Moody’s downgrade of US sovereign credit to Aa1.Market consensus indicates the Federal Reserve is unlikely to

Key Moments:

- EUR/USD climbed above 1.1270 on Monday.

- The US Dollar Index weakened following Moody’s downgrade of US sovereign credit to Aa1.

- Market consensus indicates the Federal Reserve is unlikely to cut rates over the next two policy meetings

Dollar Softens After US Credit Downgrade, Euro Gains Ground

The EUR/USD pair surged to 1.1272 during Monday’s European session as the US dollar sharply declined following a downgrade of the United States’ sovereign credit rating. Moody’s lowered the country’s long-term issuer and senior unsecured ratings to Aa1. Growing fiscal concerns, which analysts believe the current administration is unlikely to resolve in the near term, were cited as being among the key factors.

The US Dollar Index retreated to around 100.70 as a consequence of the downgrade. In addition, yields on 10-year US Treasuries rose 2.3% to approximately 4.54%, reflecting investors’ demand for higher compensation amid expanding fiscal risks. Further upward pressure on yields may come from a new fiscal measures bill under consideration by the Trump administration.

In addition, expectations regarding near-term Federal Reserve rate cuts have shifted among market participants, many of whom are now convinced that the central bank will hold off on cutting interest rates during its next two policy meetings. This perception is fueled by forecasts regarding persistent inflation, which remain elevated due to import duties.

Positive Momentum for Euro on EU-UK Trade Deal Expectations

Alongside Dollar weakness, the Euro is also benefiting from its relative strength against other major currencies at the start of the week. EUR/USD advances have been underpinned by optimism around a potential trade deal between the European Union and the United Kingdom. The deal, which could be the first major pact since Brexit.

Further monetary easing is expected in the Eurozone following weekend comments from National Bank of Belgium Governor and member of the ECB’s Governing and General Council, Pierre Wunsch. In an interview with the Financial Times, Wunsc indicated interest rates could fall below 2% due to downside risks to growth and inflation driven, in part, by US-imposed tariffs. Though he ruled out an unusually large rate cut, his remarks strengthen the case for a more dovish ECB stance.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.