Bitcoin Nears $85,000 Mark With 1.1% Gain Bitcoin Nears $85,000 Mark With 1.1% Gain

Key momentsBitcoins value enjoyed a modest climb of 1.1% on Thursday, nearly hitting $85,000.The cryptocurrency’s surge occurred as investors were shaken by remarks from Fed Chair Powel, who commented

Key moments

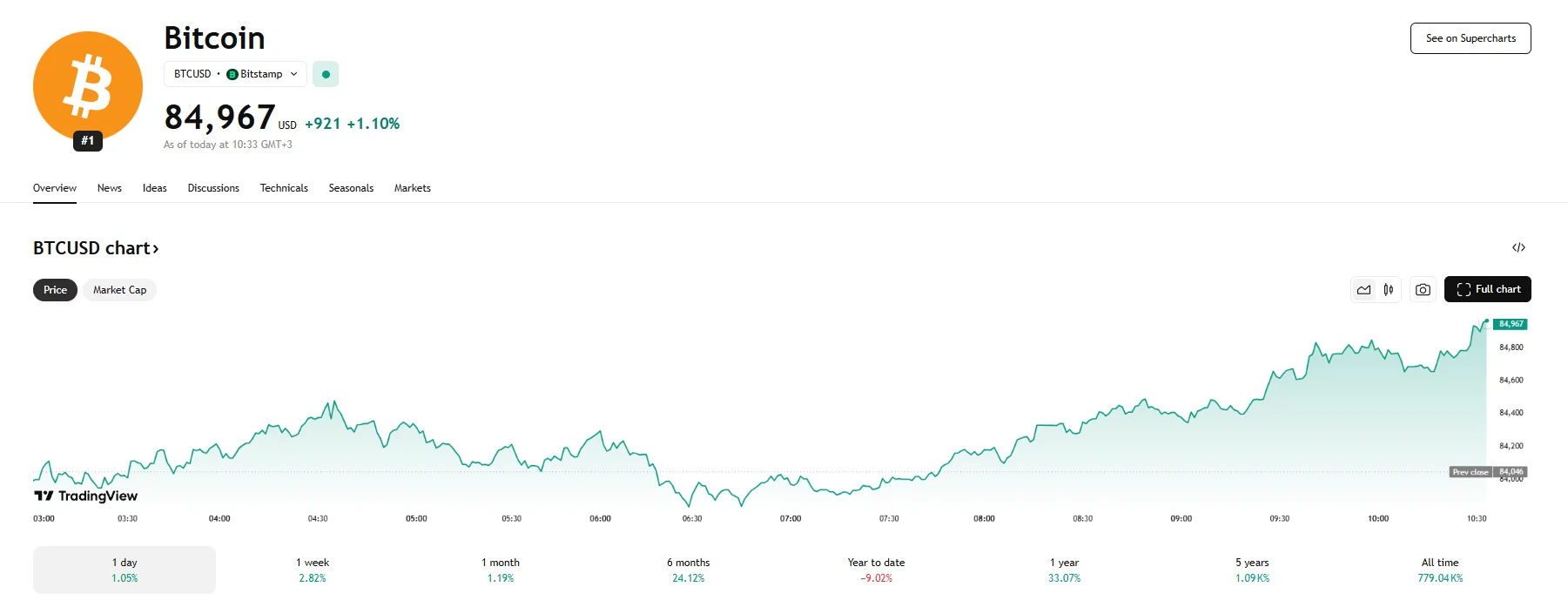

- Bitcoin’s value enjoyed a modest climb of 1.1% on Thursday, nearly hitting $85,000.

- The cryptocurrency’s surge occurred as investors were shaken by remarks from Fed Chair Powel, who commented on the potential impact of US tariffs and dismissed the prospect of swift interest rate cuts.

- A CryptoQuant report underscored a disconnect between Bitcoin’s price appreciation and the crypto futures market.

Bitcoin Up 1.10% to $84,967 Amid Market Jitters

On Thursday, Bitcoin experienced an upward valuation shift, appreciating by 1.1% to almost reach a price point of $85,000. This increase occurred as evolving macroeconomic factors continued influencing the cryptocurrency landscape.

Earlier in the day, the broader cryptocurrency market demonstrated a recovery trend following a previous downturn, as digital assets exhibited positive price movement. Bitcoin, in particular, managed to breach the $84,000 threshold and hit $84,967.

This upward momentum occurred in the shadow of comments made by US Federal Reserve Chair Jerome Powell, which tempered expectations for imminent interest rate reductions. Powell emphasized the necessity of evaluating the potential consequences of recently imposed US tariffs on the global economic framework. This statement introduced an element of caution into the financial markets, as the implications of these tariffs, potentially leading to increased inflation and slower economic growth, were yet to be fully understood. The specter of “stagflation,” characterized by sluggish growth coupled with high inflation, loomed as a possible outcome.

It should be noted that crypto enthusiasts often see Bitcoin as a safe-haven asset similar to gold amid market uncertainty, and this confidence was among the factors that helped propel Bitcoin on Thursday. However, despite Bitcoin’s recent price stability in the mid-$80,000 range, an analysis of cryptocurrency futures by CryptoQuant presented a contrasting perspective.

In the CryptoQuant report, it was highlighted that despite Bitcoin’s consistent upward trajectory from November 2024 to February 2025, which saw the cryptocurrency reach $101,000, the sentiment within the futures market did not reflect this same level of bullishness. Instead, tariff-related announcements led to risk-associated assets, including Bitcoin, experiencing a notable decline in the long run as the sentiment surrounding its futures contracts went on a downward trend starting in February. This divergence between the spot price holding near recent highs and the cooling enthusiasm in the futures market suggested growing apprehension among investors, according to CryptoQuant contributor AbramChart.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.