Recommendations for Hong Kong Foreign Exchange Trading Platforms | Comparative Analysis of 5 Regularly Regulated Brokers

Find out whether foreign exchange trading in Hong Kong is legal and which brokers are regulated by the SFC. Hawk Insight's latest evaluation helps you find a safe and low - cost foreign exchange platform in Hong Kong.

As one of the world's leading international financial centers, Hong Kong plays a pivotal role in the global financial market. And the Hong Kong dollar (HKD), the official currency of Hong Kong, is one of the most traded currencies in the world.

Foreign exchange trading in Hong Kong is overseen by the Securities and Futures Commission (SFC) of Hong Kong. The SFC ensures that brokers and financial institutions operate within a framework of transparency and integrity, aiming to maintain Hong Kong's reputation as a reliable and secure venue for investment and trading activities.

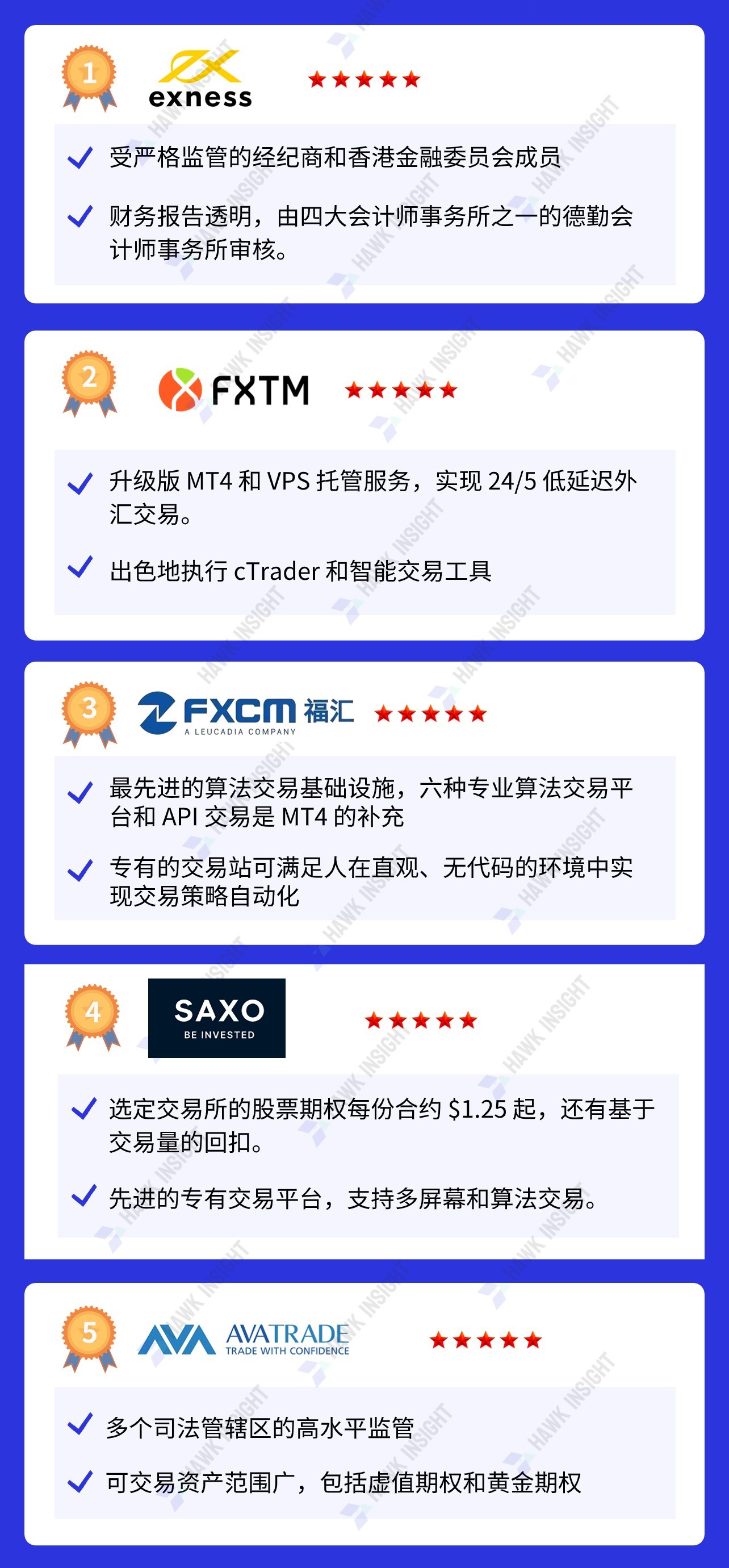

The following are the best foreign exchange brokers in Hong Kong in 2024 selected by Hawkinsight:

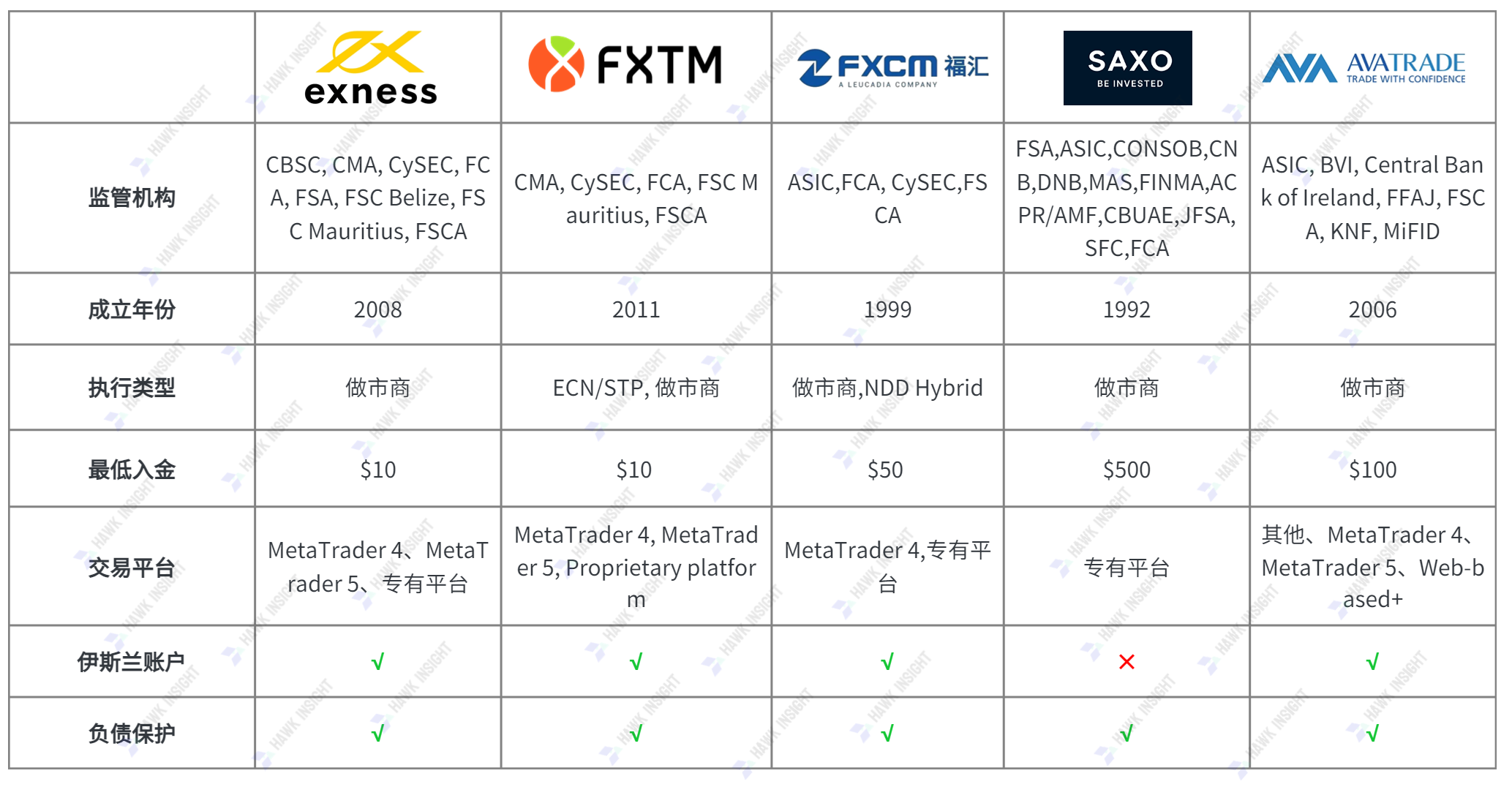

Comparison of the Best Hong Kong Brokers

Exness

ExnessThe official website of Exness has been localized into 15 languages, and the customer service covers 13 languages. Among them, the service time of 11 languages is 24 hours a day, 5 days a week; while the English and Chinese customer services are 24 hours a day, 7 days a week.

Exness uses leading trading platforms in the global trading market, including MT4/MT5 and web terminals. Traders can develop and implement trading strategies of various levels of complexity through MetaTrader 4, and submit most types of trading orders by using two order execution methods, namely instant execution and market execution.

| Advantages | Disadvantages |

|

√24/7 multilingual customer service |

×No education for beginners |

| √A broker subject to multiple regulations, with excellent order and trading volume statistics | |

| √High transparency and financial audit by Deloitte, one of the Big Four accounting firms | |

| √Instant withdrawals from a trusted broker with numerous payment processors |

FXTM

FXTM is one of the most competitive foreign exchange brokers in Hong Kong. Depending on the monthly trading volume, the trading fee per lot ranges from $0.80 to $4.00. The larger the trading volume, the lower the trading fee, and the fee level is far ahead in the industry. The mobile platform is very popular in the Indonesian market, and foreign exchange traders can use the upgraded MT4/MT5 trading platform and the FXTM Trader mobile APP to trade.

| Advantages | Disadvantages |

|

√Excellent foreign exchange pricing environment & transparency based on commissions |

×No cryptocurrencies, limited choice of commodities |

| √Upgraded MT4/MT5 trading platform and FXTM Trader mobile APP | |

| √Provide high-quality market research and educational content for novice traders | |

| √Internal copy trading service FXTM Invest, with low minimum deposit + high leverage |

FXCM

FXCM (Forex Capital Markets) is an international foreign exchange broker founded in 1999. The company is headquartered in New York, the United States, and provides foreign exchange and contract for difference (CFD) trading services worldwide.

FXCM provides a variety of trading platforms, including their self-developed Trading Station platform and MetaTrader 4. These platforms provide real-time quotes, chart analysis tools, trade execution and other functions, making it convenient for traders to conduct market analysis and place orders.

FXCM usually provides foreign exchange trading services without trading commissions, which means that no additional commission fees are charged in the transaction. However, traders need to pay attention to the spread (the difference between the buying price and the selling price), etc.

| Advantages | Disadvantages |

|

√ A large number of trading platforms are available, and it specially supports algorithmic trading |

×Commission-free but high foreign exchange trading costs |

| √ Deep liquidity, transparent order execution and monthly slippage statistics | |

| √ Low commission cost structure, providing a rebate program based on trading volume | |

| √ Provide high-quality research and education through FXCM Plus |

SAXO

Saxo Bank offers option contracts listed on 20 exchanges and is one of the best option brokers. The trading tools tailored by Saxo Bank for option trading are also quite remarkable, including option chains, strategy generators, option roll functions, and comprehensive risk data. By default, Saxo Bank only allows traders to buy options. Traders with an account balance of over $5,000 and who have signed a written risk confirmation can also sell options.

In addition to listed stock, index, and futures options, Saxo Bank also provides foreign exchange out - of - the - money options. Traders can easily switch options by linking the option chain to the watchlist.

| Advantages | Disadvantages |

| √A large - scale banking institution | ×Does not accept US traders |

| √Comprehensive regulation |

AvaTrade

AvaTrade is an ECN/STP broker based in Dublin, Ireland, founded in 2006. AvaTrade is one of the world's largest foreign exchange brokers and a highly reliable and regulated trading platform. The main regulatory authorities include the Australian Securities and Investments Commission (ASIC), the Japanese Financial Services Agency (JFSA), and the Investment Industry Regulatory Organization of Canada (IIROC). However, AvaTrade enjoys a high level of regulation in multiple regions such as Australia, Japan, South Africa, the British Virgin Islands, and the European Union. It also utilizes the most advanced trading options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTradeGO, and WebTrader.

| Advantages | Disadvantages |

|

√Provides high - quality educational services through SharpTrader |

×The trading costs are competitive but not particularly outstanding |

| √Multiple trading platforms are available to meet various trading needs | |

| √A wide range of asset choices and cross - asset diversification opportunities | |

| √Under the supervision of the central bank, the broker is well - regulated and trustworthy |

Is Foreign Exchange Trading Legal in Hong Kong?

Foreign exchange trading is completely legal in Hong Kong.

Foreign exchange trading in Hong Kong is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The SFC is responsible for ensuring the stability of the capital market and overseeing financial securities and derivatives. Traders in Hong Kong can choose brokers regulated by the Hong Kong SFC or brokers regulated by international regulatory authorities. When choosing a broker, its security features such as segregated funds, liability protection, and participation in compensation schemes must be considered.

Although the SFC does not require brokers to provide negative balance protection, it contributes to the Investor Compensation Fund (ICF), providing up to HK$500,000 in insurance for retail traders. In addition, the SFC has set the upper limit of retail leverage at 1:20, a measure aimed at reducing trading risks.

How Should Hong Kong Traders Choose a Foreign Exchange Broker?

When trading in Hong Kong, there are several key points to note when choosing a foreign exchange broker. The following are some important tips for your reference:

1. Give priority to brokers regulated in Hong Kong

Local regulation by the SFC not only means that you have a reliable regulatory authority to serve you, but also if the broker is locally regulated, any problems or challenges can be resolved more easily.

2. Liability protection

Since negative balance protection is not mandatory in Hong Kong, not every broker provides liability protection. This means that if you do wish to have this feature, you should look for a broker that offers it.

3. Choose a broker with a high - quality demo account

Any kind of trading involves risks. Especially if you are a novice trader, if you trade using leverage, the risks are even greater. Therefore, you must try to take advantage of some of the excellent demo accounts provided by the above - mentioned brokers. This is a risk - free way to learn.

4. Segregation of client funds

Brokers must deposit client funds in a separate bank account, separate from the company's funds account. This is crucial for reducing the risk of accounting errors.

5. Limit market risk

Limiting market risk can protect traders from adverse price fluctuations. This is why the maximum leverage ratio allowed by most top - tier regulatory authorities is capped at 1:30, while less strict regulatory authorities may allow leverage ratios as high as 1:2000.

6. Compensation schemes

Depending on the jurisdiction where the broker is located, compensation schemes can also protect clients from the company's credit risks and liabilities. For example, brokers regulated by the Cyprus Securities and Exchange Commission (CySEC) all participate in the Investor Compensation Fund (ICF).

In the event of the company's bankruptcy, traders can receive a maximum compensation of €20,000. The Financial Services Compensation Scheme (FSCS) under the UK Financial Conduct Authority (FCA) can provide up to £85,000 in protection for traders.

How to Verify Whether a Foreign Exchange Broker is Regulated in Hong Kong

You can take several steps to verify whether a broker is regulated and determine the regulatory authority that regulates the broker.

After visiting the broker's website, scroll down to the bottom of the page and find the legal name of the entity. The regulatory information is usually here. You need to look for the reference/license number, and then log in to the official website of the Hong Kong Securities and Exchange Commission (https://www.sfc.hk) and check its register of authorized entities to verify the entity.

You also need to assess the transparency of the broker in order execution and whether it can be trusted not to manipulate price movements. You need to check whether the broker has a "best execution policy", whether it regularly publishes execution quality statements, and whether it states its average execution speed.

What are the Local Characteristics of Trading in Hong Kong?

There is a significant time difference between the 2 - hour window when the Asian trading session overlaps with the European and US trading sessions. During this period, trading activities usually peak, providing the most viable opportunities. However, this peak period often occurs after 11 p.m. Hong Kong time, which is not ideal for local traders who prioritize a good night's sleep. To better suit their lifestyle, I suggest that traders resident in Hong Kong choose brokers that offer a variety of trading tools for local markets, especially the Hong Kong Stock Exchange.

Frequently Asked Questions

1. Are Foreign Exchange and Contracts for Difference Allowed in Hong Kong?

Yes, foreign exchange and contracts for difference (CFD) trading are allowed in Hong Kong.

2. Who Regulates the Foreign Exchange and CFD Markets in Hong Kong?

The Securities and Futures Commission (SFC) of Hong Kong regulates the local foreign exchange and CFD markets, ensuring that brokers and financial service providers comply with strict regulatory standards to protect traders and investors.

3. Can International Traders Participate in the Hong Kong Foreign Exchange Market?

Yes, there are no legal barriers preventing international traders from participating in financial derivatives trading in Hong Kong.

4. Is Tax Levied on Foreign Exchange Trading in Hong Kong?

In Hong Kong, profits from foreign exchange trading are generally not taxable. This is because Hong Kong does not levy capital gains tax, while in many jurisdictions, capital gains tax applies to profits from foreign exchange trading. In addition, Hong Kong's tax system is territorial, which means that only income sourced from Hong Kong is taxable. Profits from foreign exchange trading are usually considered to be sourced outside Hong Kong and generally do not fall within the scope of taxable income. For more information, please consult a professional tax advisor.

5. What is the Difference in Protection between Brokers Regulated by the SFC and Offshore - regulated Brokers?

Brokers regulated by the Hong Kong SFC comply with strict financial regulations and provide strong investor protection, such as the Investor Compensation Fund and strict audit standards. In contrast, offshore - regulated brokers may have different levels of regulatory stringency and investor protection schemes, often lacking the strict regulation of the SFC.

6. Can I Trade with an Offshore - regulated Broker in Hong Kong?

Yes, in Hong Kong, you can trade with an offshore - regulated broker. However, it is important to note that these brokers may not be subject to the same strict regulatory standards and investor protection as those regulated by the Hong Kong Securities and Futures Commission (SFC). As a trader, you should conduct due diligence and understand the different levels of risks involved when choosing an offshore - regulated broker.

7. Can Cryptocurrency Trading be Conducted in Hong Kong?

Yes, cryptocurrency trading is allowed in Hong Kong.

8. Can I Conduct Foreign Exchange Trading in Hong Kong without a Broker?

In Hong Kong, it is impossible to conduct foreign exchange trading without a broker. Brokers provide the necessary access to the foreign exchange market, trading platforms, and liquidity, making them essential for executing foreign exchange transactions.

Conclusion

Choosing the right foreign exchange broker is crucial for traders, especially in the highly developed and strictly regulated Hong Kong market. Whether you are an experienced professional investor or a novice just entering the market, the above - mentioned platforms have demonstrated their unique advantages in different dimensions. It is recommended to combine your own trading needs and financial situation to choose the most suitable trading partner, so as to obtain more stable growth opportunities in the global foreign exchange market.

[Related readings] Best Forex Trading Platform Recommendations for 2025: Full Analysis of Regulatory Compliance and Trading Costs

[Related readings] Forex VS Stocks VS Indices Trading: Which Is Right for You?

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.