In addition to the good news, institutions prefer Ningde's excellent cash flow creation capabilities and substantial breakthroughs in globalization.

On July 9, Hong Kong stocks continued to rise by more than 5% in Ningde Times, and their market value hit a record high.

On the news front, Ningde Times has recently deepened cooperation agreements with Geely Automobile.The two sides will take this signing as an opportunity to further deepen cooperation in the direction of power battery technology collaboration, product platform integration and supply chain system construction, promote the in-depth coordinated development of the entire industry chain, and build a more efficient and stable cooperation mechanism.

Since the establishment of a cooperative relationship between the two parties in 2013, the cooperation between Geely and Ningde Times has gone beyond a simple buying and selling relationship, pointing directly to the right to define the next generation battery technical standards.The two parties jointly developed 800V high-voltage fast charging technology, with the goal of shortening the charging time to 15 minutes; after integrating Ningde Times CTP 3.0 technology with Geely's safety protection solution, the battery pack volume utilization rate has been increased to 72%, directly reducing unit costs and increasing energy density.

What is more imaginative is the large-scale implementation of the power exchange model-the "chocolate power exchange block" of the Ningde era will be adapted to Geely's multi-brand models, realizing the flexible configuration of "one electric vehicle, multiple vehicles".Currently, the two sides share more than 300 power exchange stations, and plan to expand to 5000 by 2025 to build one of the largest power exchange networks in the world.This deep integration has greatly shortened the technology commercialization cycle and provided mass production exports for cutting-edge technologies such as Ningde Times solid-state batteries.

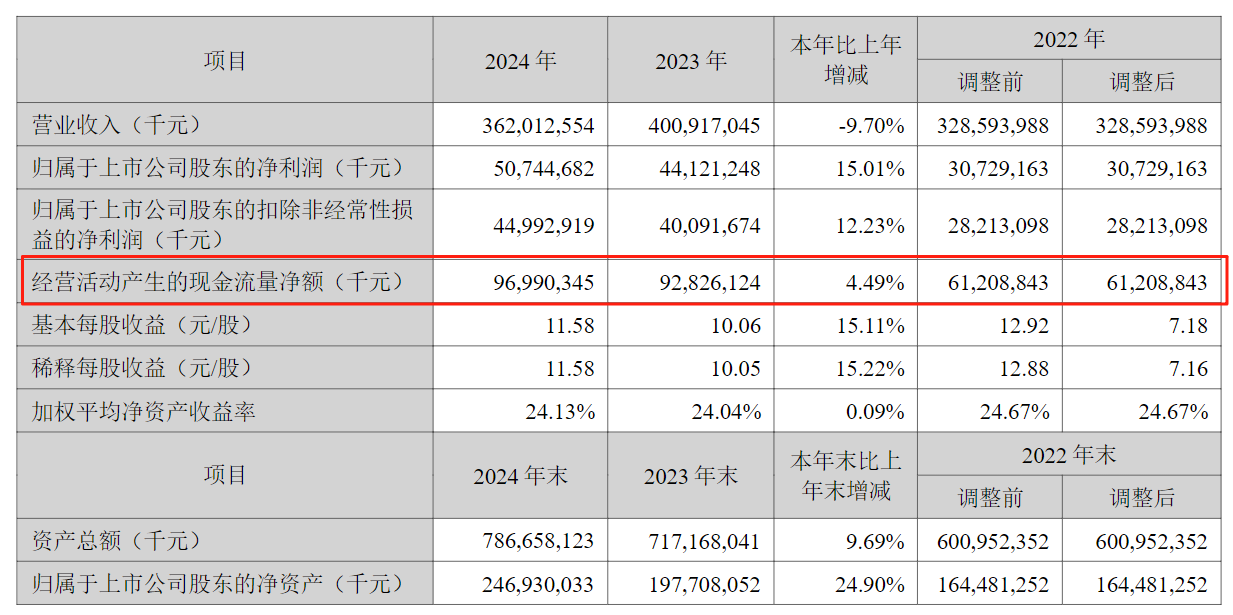

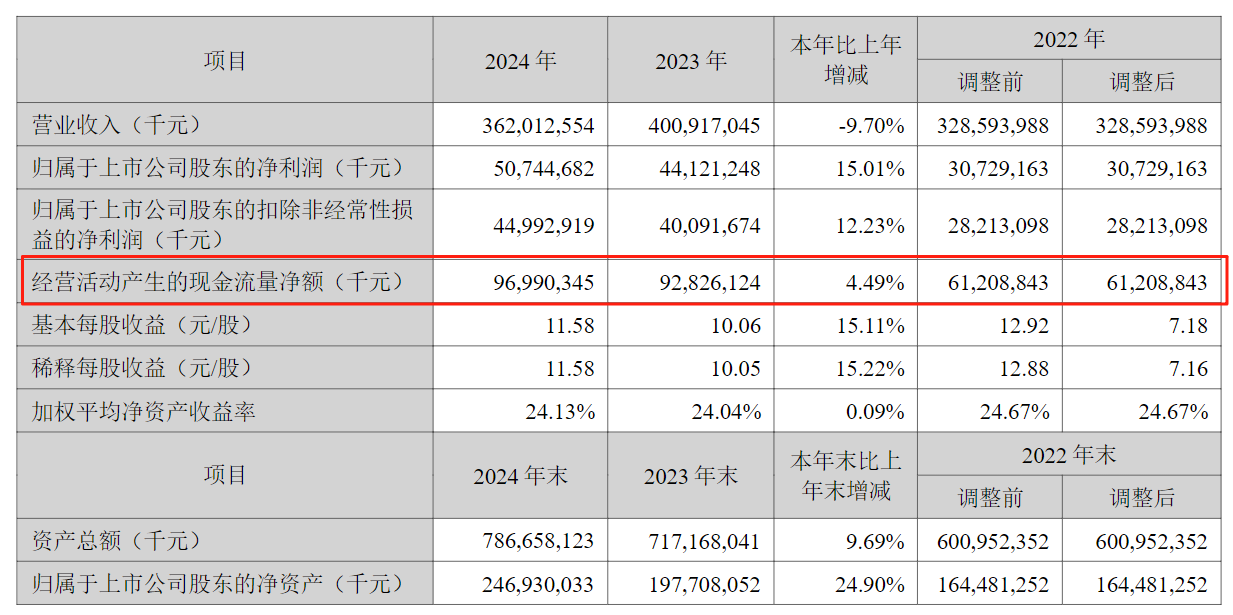

Capital is smart. In addition to good news, institutions prefer the excellent cash flow creation capabilities and substantial breakthroughs in globalization in the Ningde era.Financial report data shows that in 2024, Ningde's net cash flow from operating activities will reach 96.99 billion yuan, equivalent to 1.9 times of net profit, showing the characteristics of a cash cow of "earning 1 yuan and getting 2 yuan".

Its Hong Kong stock listing raised more than HK$60 billion, mainly investing in projects such as factory expansion in Hungary and joint construction of 50GWh production capacity with Stellantis in Spain.This layout is strategically forward-looking: by circumventing the trade barriers of the EU's New Battery Law through localized production in Europe, the Ningde era's market share of the European power battery will reach 38% in 2024.What is more noteworthy is that its H shares once had a premium of more than 10% over A shares, reflecting international capital's premium recognition of its technical gap and globalization capabilities.

According to the latest equity disclosure information of the Stock Exchange, on July 3, 2025, Ningde Times obtained JPMorgan Chase & Co. to increase its long position by 851,600 shares at an average price of HK$340.638 per share, involving approximately HK$290 million.After increasing its holdings, JPMorgan Chase's latest number of long positions was 8,203,831 shares, and its long position ratio increased from 4.71% to 5.26%.

In addition to Morgan Stanley, in the past half a month, five top international investment banks have given a "buy" rating, with target prices significantly higher than current prices:

Morgan Stanley: On June 25, it issued a rating on Ningde Times H shares for the first time, giving it an overallocation rating, with a target price of HK$390.

Goldman Sachs: It released a research report on June 25, reiterating its "Buy" rating on Ningde Times A-shares with a target price of 323 yuan. At the same time, it initially gave Ningde Times a target price of 343 Hong Kong dollars for H-shares with a "Buy" rating.

UBS: Covering Ningde Times for the first time on June 26, with a "buy" rating and a target price of H-shares of HK$390, equivalent to a forecast consolidated P/E ratio of 20.5 times for the 2026 fiscal year.

HSBC: A research report was released on June 10, giving Ningde Times an initial rating for buying H shares, with a target price of HK$359.

Lyon: After Ningde Times announced the mass production delivery of 587Ah batteries, Lyon reiterated its "highly confident of outperforming the market" rating and raised its target price for Hong Kong stocks from HK$385 to HK$447.