Currently, AI development is in a critical period of transition from "model innovation" to "scale application." As a "computing power arms dealer", Nvidia has both certainty and flexibility.

On April 21, according to fund manager information, the positions of Blue Whale Capital LLP, a well-known British hedge fund, quietly changed dramatically.The fund, with a management scale of US$1.34 billion, bucked the trend and increased its holdings of Nvidia while clearing the two major technology giants, Meta and Microsoft. The adjustment of its position involved US$10 billion.

Taking history as a guide to liquidate Meta Microsoft is approaching the "capital cost critical point"

For Meta's clearance decision, Blue Whale Capital gave a dual interpretation framework: the direct cause was the possible global economic slowdown triggered by the comprehensive tariff policy announced by the Trump administration in April 2025.As a company that accounts for 95% of digital advertising revenue (the industry average is 60%), Meta's lifeblood lies in the activity of global business activities.

Historical data shows that during the Sino-US trade friction in 2018, the growth rate of Meta advertising revenue dropped sharply from 49% to 26%. This strong cyclical characteristic was significantly amplified under the shadow of tariffs.A deeper concern comes from the mismatch between AI investment and output-although Meta continues to add AI in personalized advertising algorithms and metaverse scenarios, only 32% of its R & D spending in 2024 directly translates into revenue growth, far lower than Microsoft's 41% and Google's 38%(according to Saasverse's 2024 Q4 Industry Report).The "sunk cost effect" of this technology investment constitutes a risk exposure that is difficult to quantify in the eyes of capital.

Microsoft's exit points to financial discipline in the AI arms race.According to internal calculations by Blue Whale Capital, Microsoft's capital expenditures on AI infrastructure in 2024 will reach US$50 billion, accounting for approximately 58% of its annual operating cash flow.Although Copilot's smart office suite has generated US$1.9 billion in new revenue, considering the return cycle between subscription pricing of US$120 per user per year and data center construction costs, fund manager Stephen Yiu believes that "the return on cash flow has dropped from 12.1% in 2023 to 8.5%, approaching the critical point of capital cost."

Against the market, Nvidia Blue Whale has long been optimistic about the prospects of artificial intelligence

The decision to increase Nvidia's holdings perfectly explains the investment philosophy of "greed when others are afraid."Although the stock fell 24% in the first four months of 2025, its dominant position in the AI computing power market has become increasingly solid-90% of the world's generative AI training tasks rely on its GPUs, and data center revenue in 2024 increased year-on-year by 126% to $47.6 billion.

Currently, AI development is in a critical period of transition from "model innovation" to "scale application." As a "computing power arms dealer", Nvidia has both certainty and flexibility.In terms of financial indicators, although the P/E ratio of 34.52 is higher than the semiconductor industry average, the valuation is still attractive compared with the return on assets (ROA) of 82.2% and the return on net assets (ROE) of 119.18%.This characteristic of "high growth digesting high valuation" can often generate excess returns during the capital expenditure cycle.

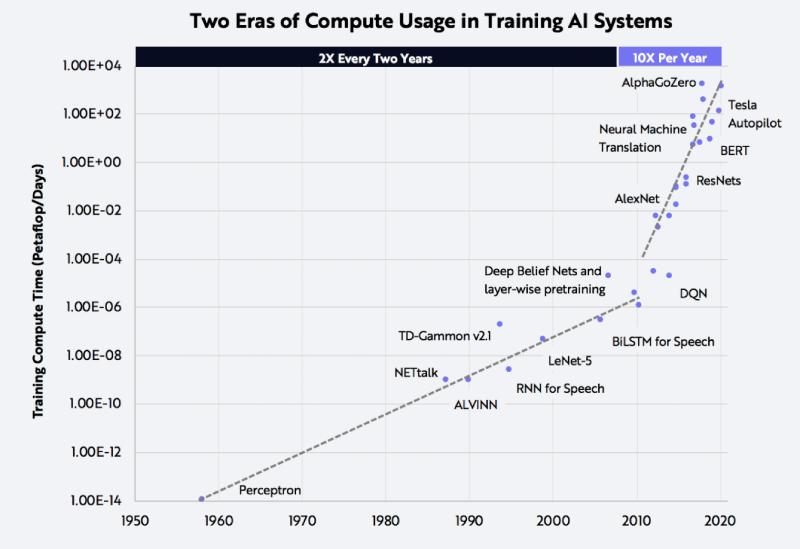

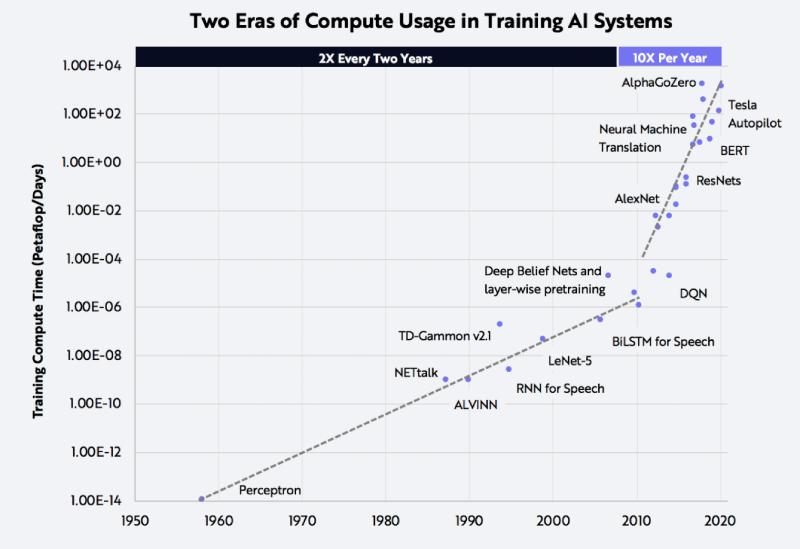

According to Gartner's report in the first quarter of 2025, the median return on investment cycle of global enterprises in the AI application layer has been extended to 5.2 years, an increase of 19 months from 2023; while the marginal revenue of hardware infrastructure continues to rise due to the shortage of computing power. The spot premium of Nvidia's H100 chip once reached 300% of the official price at the end of 2024.

This divergence trend has forced investors to re-examine the "hardware first" law-just as during the Internet bubble of the 1990s, Cisco router manufacturers had a much higher survival rate than portal websites.Blue Whale Capital's adjustment of its position structure is essentially a vote on the industrial logic of "computing power is power." Its operation of increasing Nvidia's holdings to 10% of its portfolio weight has astonishing historical similarities with Tiger Fund's heavy position in Intel in 1999.

According to ARK Invest estimates, AI training costs are declining at a rate of 50% per year, but reasoning costs remain rigid due to model complexity-this scissors effect continues to benefit Nvidia, which has CUDA ecological barriers, while software companies that rely on API calls are faced with uncertainty in profit models.When Microsoft pays its partners US$0.30 for every US dollar it earns in AI revenue, Nvidia generates US$0.65 in gross profit for every US dollar of GPU it sells-this difference in value capture capabilities ultimately results in the valuation system of the capital market. Fault lines are formed in the system.

AI logic has changed dramatically. How can ordinary people invest?

From the data point of view, the growth momentum of the semiconductor industry is accelerating from consumer electronics to AI infrastructure.IDC data shows that the global semiconductor market is expected to grow by 11% in 2025, with demand for AI-related chips becoming the core driving force, as evidenced by the year-on-year surge of 192% in Nvidia's data center business in the first three quarters.

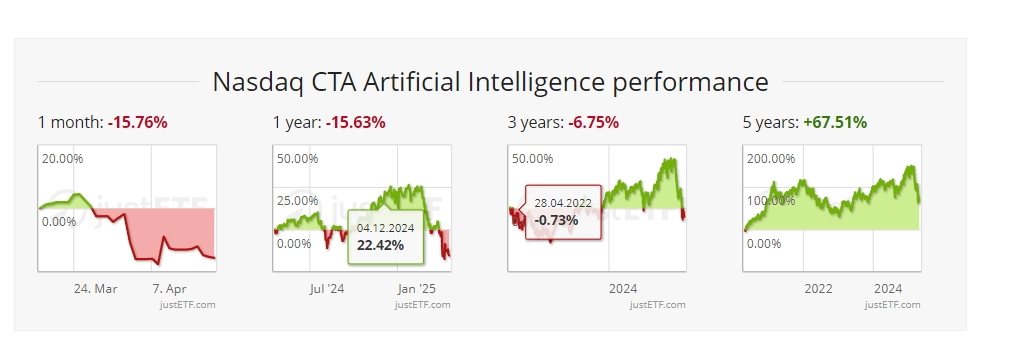

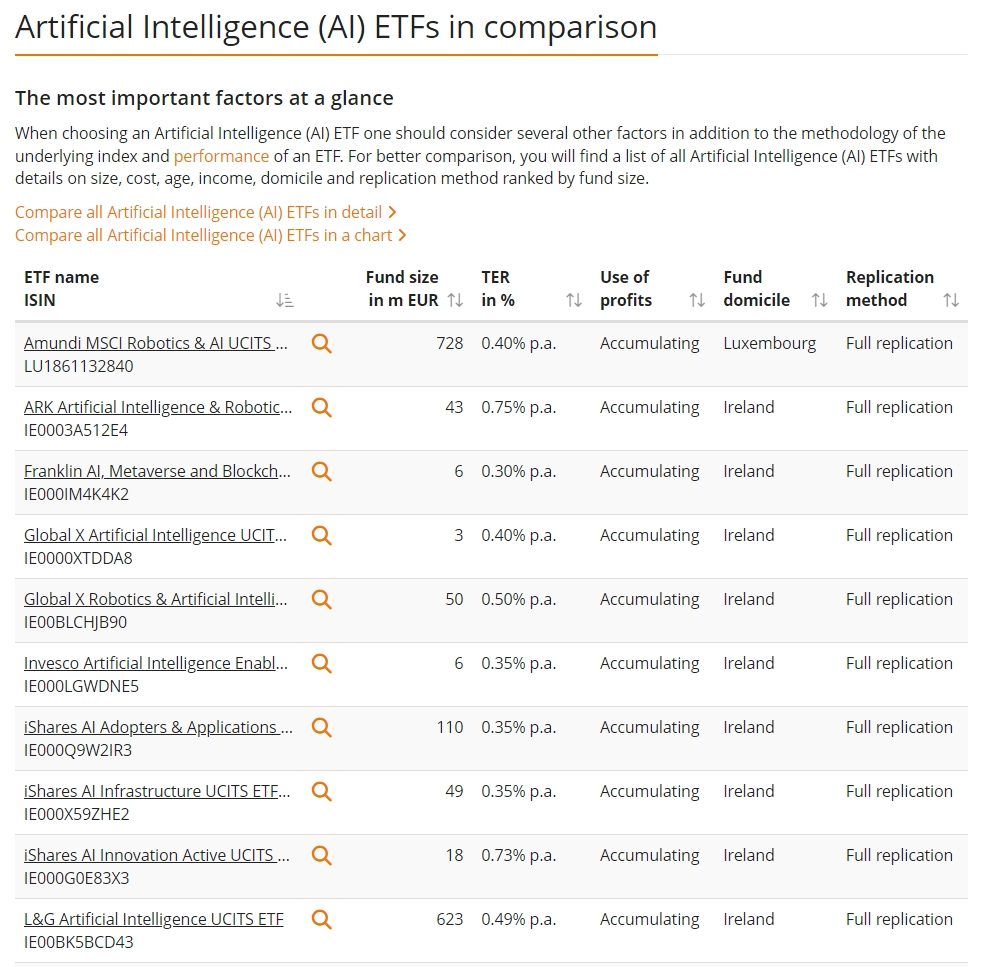

Buying semiconductors, artificial intelligence-related ETFs may be more suitable for ordinary people who do not have time to conduct in-depth research and have small amounts of capital.

Because the stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc., the capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

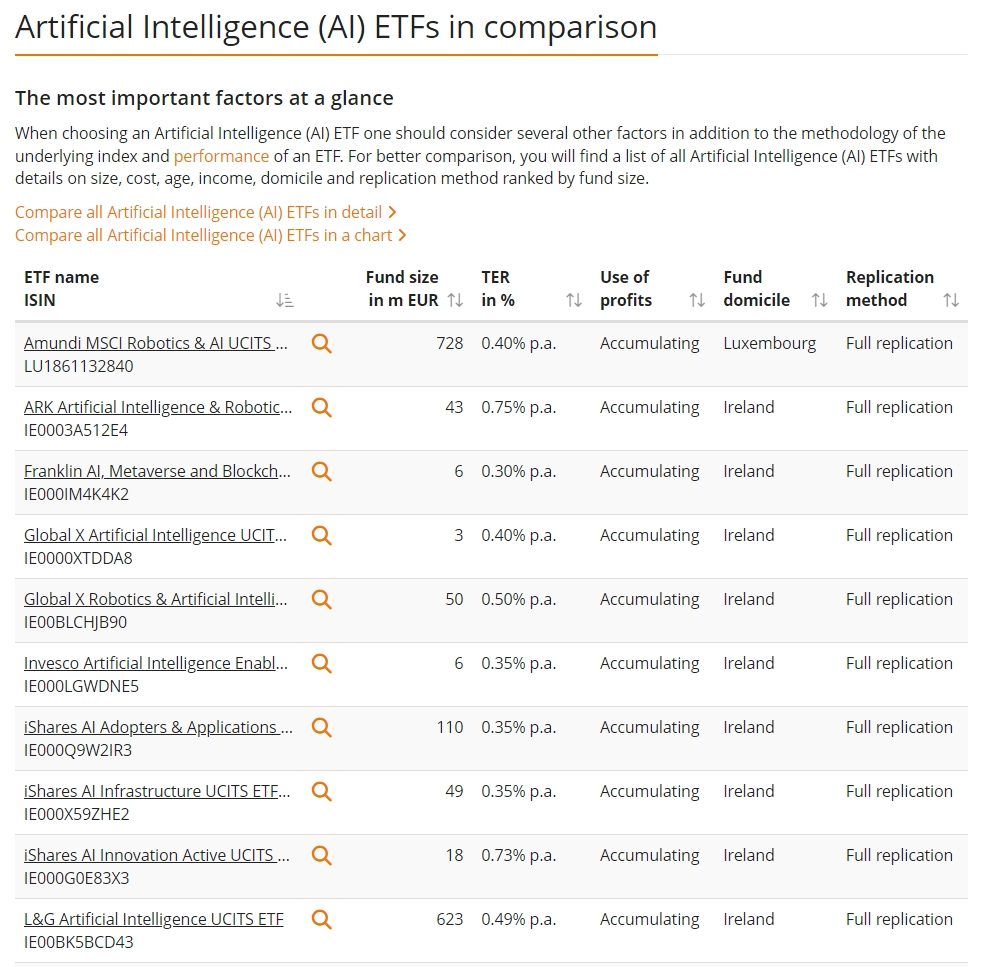

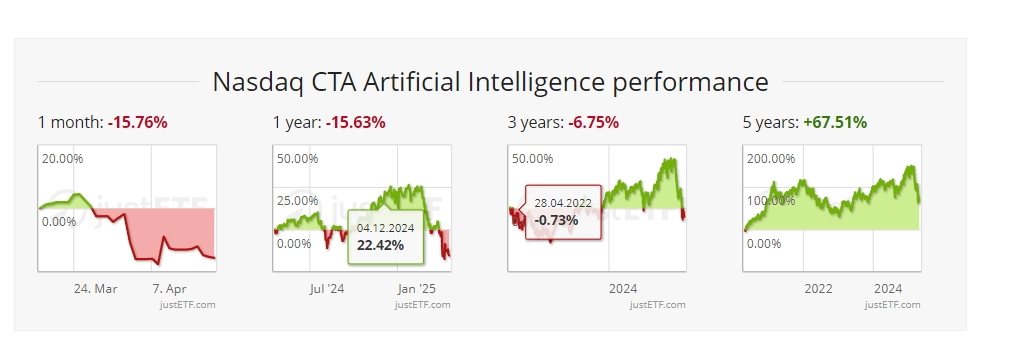

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Originally, the emergence of Deepseek caused a hidden worry in the market's demand for computing power.DeepSeek caused panic because it demonstrated the possibility of training AI models at a fraction of the cost of other models.This could reduce the need for data centers and expensive, advanced chips.But in fact, DeepSeek has pushed the AI industry to develop reasoning models that require greater resource requirements, which means computing infrastructure is still necessary.

In the future, according to projections, while AI's future demand for computing power will be only a fraction of what it is today, the increased demand for reasoning models to answer user questions may compensate for this.As businesses discover that new AI models are more powerful, they increasingly invoke them.This shifts the need for computing power from training models to using models, or "reasoning" in the AI industry.

Venture capitalist Tomasz Tunguz said investors and large technology companies are betting that demand for AI models could increase by a trillion times or more over the next decade due to the rapid spread of inference models and AI.

This shows that the era of artificial intelligence infrastructure continues.