Hong Kong's IPO market will recover at an alarming rate in 2025.

The Ernst & Young report shows that in the first half of the year, Hong Kong's IPO fundraising amounted to HK$108.7 billion, a year-on-year surge of 7.11 times, accounting for 24% of the total global IPO fundraising, temporarily ranking first in the world.

Industry data shows that the average issued market value of nearly 10 listed new shares is 35.984 billion yuan, with the largest market value being Haitian Flavor and the smallest market value being Xiangjiang Electric; the average issued PE is 18.74 times, and PE is at the mid-to-high level; The average number of subscribers is 117,996, and the average subscription multiple is 707.47 times; the average cornerstone proportion is 44.98%, and the average cornerstone proportion fluctuates between.

IPO summer is coming.According to data from Metropolitan Exchange, in the last week of June alone, the Hong Kong Stock Exchange welcomed a busy scene with 32 companies submitting statements, 8 new shares listing, and 10 companies entering the IPO stage. The number of statements submitting in a single week hit a peak during the year.Mainland companies have become the absolute main force, contributing 95% of the number of Hong Kong stock IPOs and 96.7% of the total fundraising.Under the combined effect of factors such as the high enthusiasm of A-share companies to go to Hong Kong, the implementation of the "Science-Enterprise Special Line", and the return and warming of China-listed stocks, the Hong Kong stock IPO market has formed a virtuous cycle.

The following are the profiles of 32 companies compiled by Doo Financial. The companies are comprehensively ranked based on revenue, technical barriers and other indicators:

The first echelon: industry leader

1. Longqi Technology (A+H)

The global leader in intelligent product ODM and a core partner of Xiaomi's ecological chain, with revenue of 46.4 billion yuan (year-on-year +70%) and net profit of 500 million yuan in 2024.The business covers the R & D and manufacturing of mobile phones, tablets and AIoT equipment. It is jointly sponsored by Citigroup and Haitong International and plans to achieve dual A+H listings.

2. Blue cursor (A+H)

The largest marketing service group in China, with revenue of 60.8 billion yuan (net loss of 300 million yuan) in 2024 and A stock market value of 22.8 billion yuan.The layout of meta-universe marketing and AI content generation technology was sponsored by three major investment banks such as Huatai International to impact Hong Kong stocks to expand international business.

3. Haowei Group (A+H)

One of the world's top three image sensor giants (formerly Weil shares), with revenue of 25.7 billion yuan (year-on-year +22.5%) and net profit of 3.28 billion yuan (year-on-year +502%) in 2024.The core technology covers iPhone cameras and in-vehicle sensors, and domestic substitution leads.

4. Stone Technology (A+H)

The global leader in sweeping robots, with revenue of 11.9 billion yuan in 2024, a gross profit margin of 50.4%, and overseas revenue accounting for more than 60%. The technical barrier lies in LDS laser navigation and AI obstacle avoidance algorithms.

The second echelon: high-growth technology companies

5. Easy to control intelligent driving

The world's largest Kuangqu driverless solution provider, L4 full-stack self-developed technology, will have revenue of 986 million yuan in 2024 (a compound growth rate of 305% in three years), and its gross profit will turn positive for the first time.Received strategic investment from Ningde Times and Zijin Mining, and was exclusively sponsored by Haitong International.

6. Stander Robot (18C)

Leading industrial mobile robot solutions, with revenue of 251 million yuan in 2024 (compound annual growth rate of 61%).Xiaomi holds 8.4% of the first robot company to be declared under the 18C special technology rules of the Hong Kong Stock Exchange, and is co-sponsored by CITIC Securities.

7. Meijia Technology

The head manufacturer of autonomous agents will have revenue of 930 million yuan in 2024 (year-on-year +40%), and R & D investment will account for 43%.Innovation Works and Pleasure Capital invested capital, sponsored by four major investment banks such as Morgan Stanley, and the technology focuses on industrial automation AI.

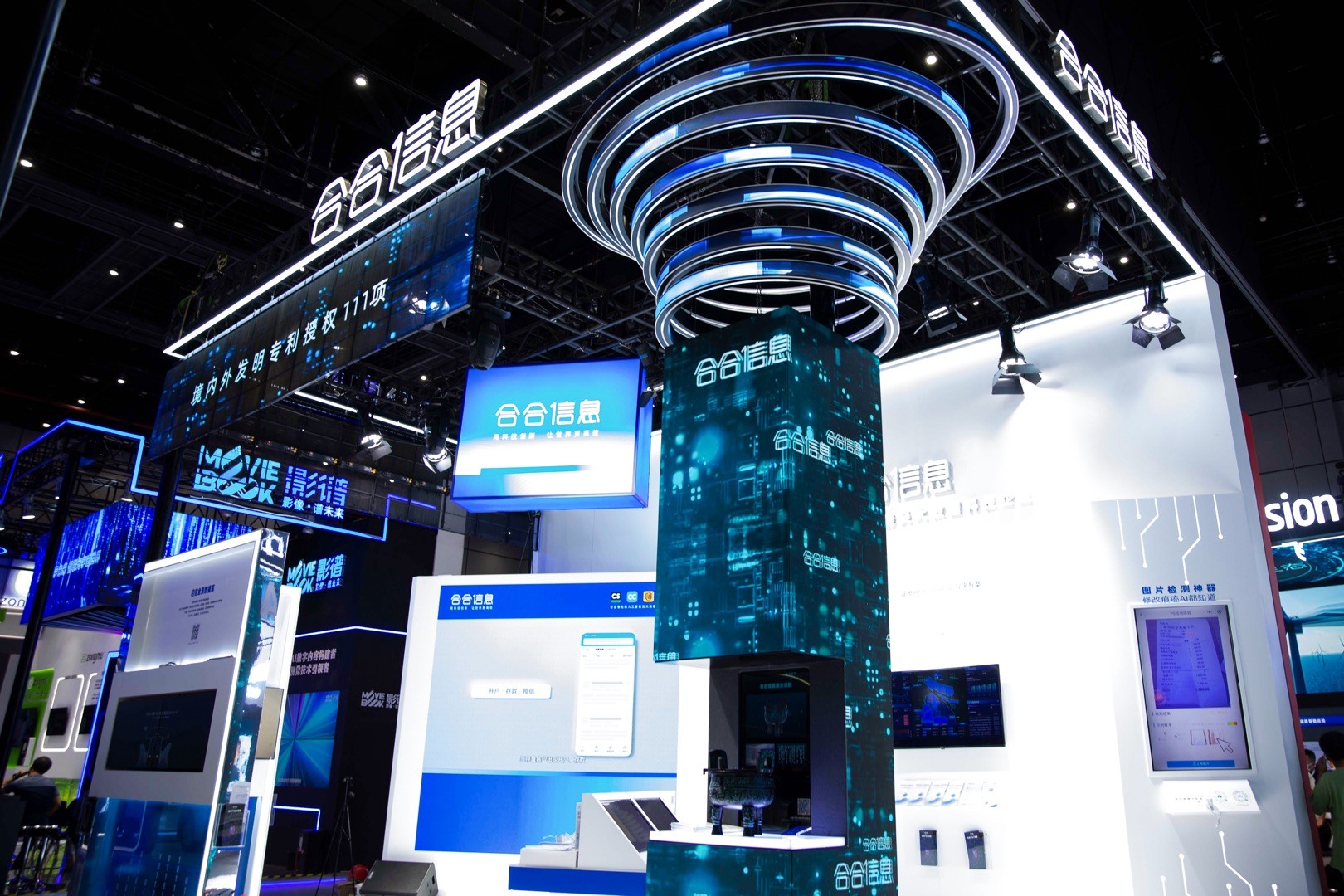

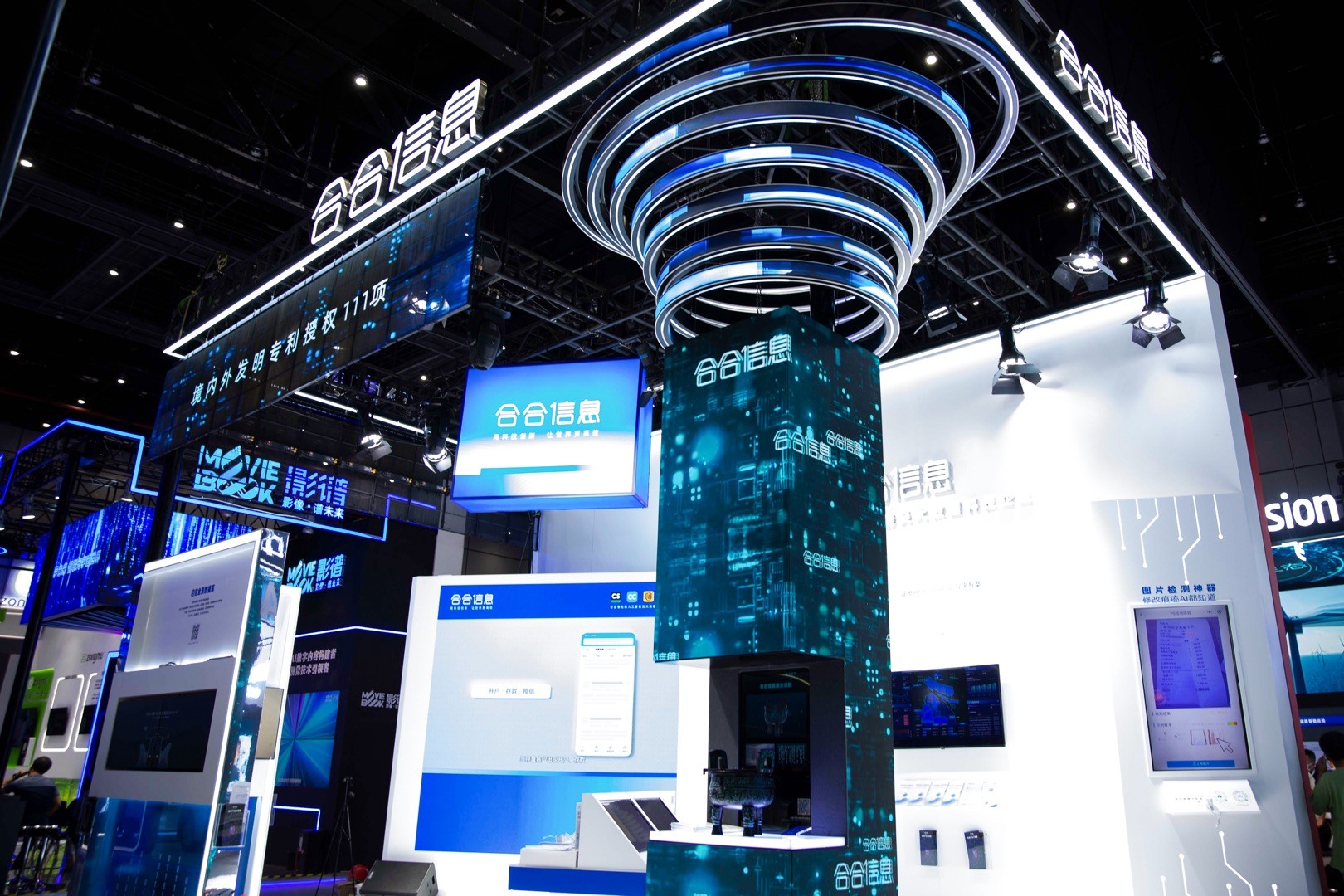

8. Cooperation Information (A+H)

The world leader in AI Optical Character Recognition technology, with more than 1 billion "Scan Almighty King" users, with revenue of 1.44 billion yuan in 2024 and a gross profit margin of 85.6%.Sponsored by CICC, the A+H structure strengthens data compliance layout.

Third echelon: vertical track

9. Shangmi Technology (A transfer to Hong Kong)

The leader in commercial Internet of Things hardware, with revenue of 3.456 billion yuan and net profit of 181 million yuan in 2024.Ant Group, Meituan and Xiaomi participated in the investment, covering more than 2 million merchant terminal equipment worldwide.

10. Yunyinggu

AMOLED display driver chip unicorn will have revenue of 891 million yuan in 2024 (year-on-year +24%), and its customers include BOE and TCL.Domestic replacement key technology breakthroughs, sponsored by CITIC Securities.

11. Chengtai Technology (18C)

The vehicle-mounted millimeter-wave radar ranks first in China and is a core supplier of BYD and NIO. The gross profit margin will be 34% in 2024. The technology is adapted to the L2+ intelligent driving system.

12. Kailors

Intelligent logistics robot expert, Cainiao, Jingdong Asia No. 1 warehouse service provider, will have revenue of 721 million yuan in 2024 (year-on-year +31%). He has independently developed tailored intelligent technology to restructure supply chain efficiency.

The fourth echelon: biomedicine and emerging companies

13. Jingze Shengwu

The leader of assisted reproductive drugs, the core product JZB30 (ovulation promoting drug) was approved for marketing in April 2025, benchmarking against the US$9.5 billion aflibercept market and has strong commercialization potential.

14. Jinfang Medicine

Oncology/self-immunity innovative pharmaceutical companies, 5 clinical pipelines, the core product GPH925 (KRAS inhibitor) entered Phase III, and CITIC Securities sponsored it twice.

15. Weimai Company

The AI medical full-course management platform covers 4700 hospitals, with revenue of 653 million yuan in 2024.The CareAI platform enables dynamic deployment of optimal model combinations, with significant technical barriers.

16. National Technology (A+H)

Platform-based IC design companies will have revenue of 1.168 billion yuan in 2024, ranking among the top three in the world's 32-digit MCU market in China.There is no actual controller structure, and Chairman Sun Yingtong holds only 2.65% of the shares.

Selected from other companies submitting the bill

|

company |

core positioning |

Financial/technical anchors |

|

Guoen Shares (A+H) |

New Materials Comprehensive Group |

Revenue was 19.2 billion yuan, net profit was 721 million yuan |

|

Kusai Intelligent |

Second place in global mobile phone solutions |

Shipments exceeded 50 million units, with revenue of 2.717 billion yuan |

|

Eston (A+H) |

China leads the way in industrial robots |

Gross profit margin of 28.3%, sponsored by Huatai International |

|

qiyunshan |

The market share of southern jujube food exceeds 70% |

Net profit of 53 million yuan |

|

Hongji Chuangneng |

Global leader in hydrogen fuel cell membrane electrodes |

CCM technology breaks US and Japan monopoly |

In addition to the above-mentioned companies that have submitted statements, three other companies, Wei Lizhibo-B, Volkswagen Oral, and Shougang Langze, passed the hearing.At present, a total of 8 companies have passed the hearing and are awaiting IPO, namely Shougang Langze, Dazhong Dental, Wei Lizhibo, Jizhijia Technology, Lansi Technology, Xunzhong Communications, Fengyu Technology, and BenQ Hospital.