Is Forex Trading Legal in Malaysia? 2025 Regulations Explained

Is forex trading legal in Malaysia? Discover regulations from Bank Negara and the Securities Commission, and learn how to trade through licensed brokers.

I. Is Foreign Exchange Trading in Malaysia Legal? Policy Interpretation and Legal Basis

Foreign exchange trading, that is, the buying and selling of currencies, is the world's largest financial market. For Malaysian investors, a common question is: "Is it legal to trade foreign exchange in Malaysia?"

The answer is: It is legal, but strictly regulated.

Foreign exchange trading is not prohibited in Malaysia, but investors (especially local residents) must comply with the Foreign Exchange Policy Notices formulated by the Central Bank of Malaysia (BNM, Bank Negara Malaysia). According to the policy:

-

Foreign exchange trading is not illegal, but illegal trading activities are illegal.

-

Investors need to clarify their identities (residents/non-residents) and the sources of funds.

BNM manages Malaysian residents (individuals or companies) in two categories:

1. No Domestic Ringgit Borrowing

-

There are almost no restrictions on investing in foreign currency assets, and transactions can be directly carried out through banks or licensed foreign exchange platforms.

-

It is possible to invest in foreign currency assets, offshore funds, stocks, options, etc.

2. Ringgit Borrowers (such as mortgages, car loans, credit cards)

-

Investment limits:

-

Individual investors: Up to RM1,000,000 equivalent in foreign currency assets per year

-

Corporate investors: Up to RM50,000,000

-

-

And only funds from specified sources (such as legally exchanged funds, foreign currency accounts, asset exchanges, etc.) can be used.

BNM is not concerned about whether you invest, but whether your funds are compliant and whether they affect the country's capital flow.

In addition, BNM also clearly prohibits the following behaviors:

-

Using illegal leverage platforms;

-

Unauthorized foreign exchange dealers;

-

Local funds leaving the country without declaration or non-compliance with the quota regulations.

Therefore, if you plan to invest in foreign exchange, you must give priority to licensed and compliant trading platforms and ensure the transparency of the source of funds.

II. A Comprehensive Analysis of the Foreign Exchange Regulatory System in Malaysia

Malaysia's financial regulatory system has unique characteristics, and two institutions are responsible for managing the foreign exchange market:

1. Central Bank of Malaysia (BNM): Regulator of Compliance for Local Investors

BNM's regulatory objects mainly include:

-

Malaysian residents (individuals, companies)

-

Source and Use of Funds (such as RM converted into foreign currency, assets flowing out of the country)

-

Anti-Money Laundering and Counter-Terrorist Financing Behaviors

BNM has established the Foreign Exchange Policy Notices (the latest version includes Notice 1~5), among which:

-

Notice 3 clarifies the restrictions on Malaysian residents' investment in foreign currency assets;

-

Notice 4 standardizes the use of foreign currency accounts and capital flows.

BNM does not directly regulate foreign exchange brokers, but it determines whether you "can legally invest in a certain platform".

2. Labuan Financial Services Authority (Labuan FSA): Regulator of Licensed Foreign Exchange Platforms

Labuan is one of the federal territories of Malaysia and has been built into a International Offshore Financial Center (IOFC). Its regulatory agency Labuan FSA is specifically responsible for:

-

Approving and regulating offshore financial companies;

-

Issuing Money Broking License, Fund Management License, etc.;

-

Setting regulatory standards for platform compliance, customer protection, and anti-money laundering processes.

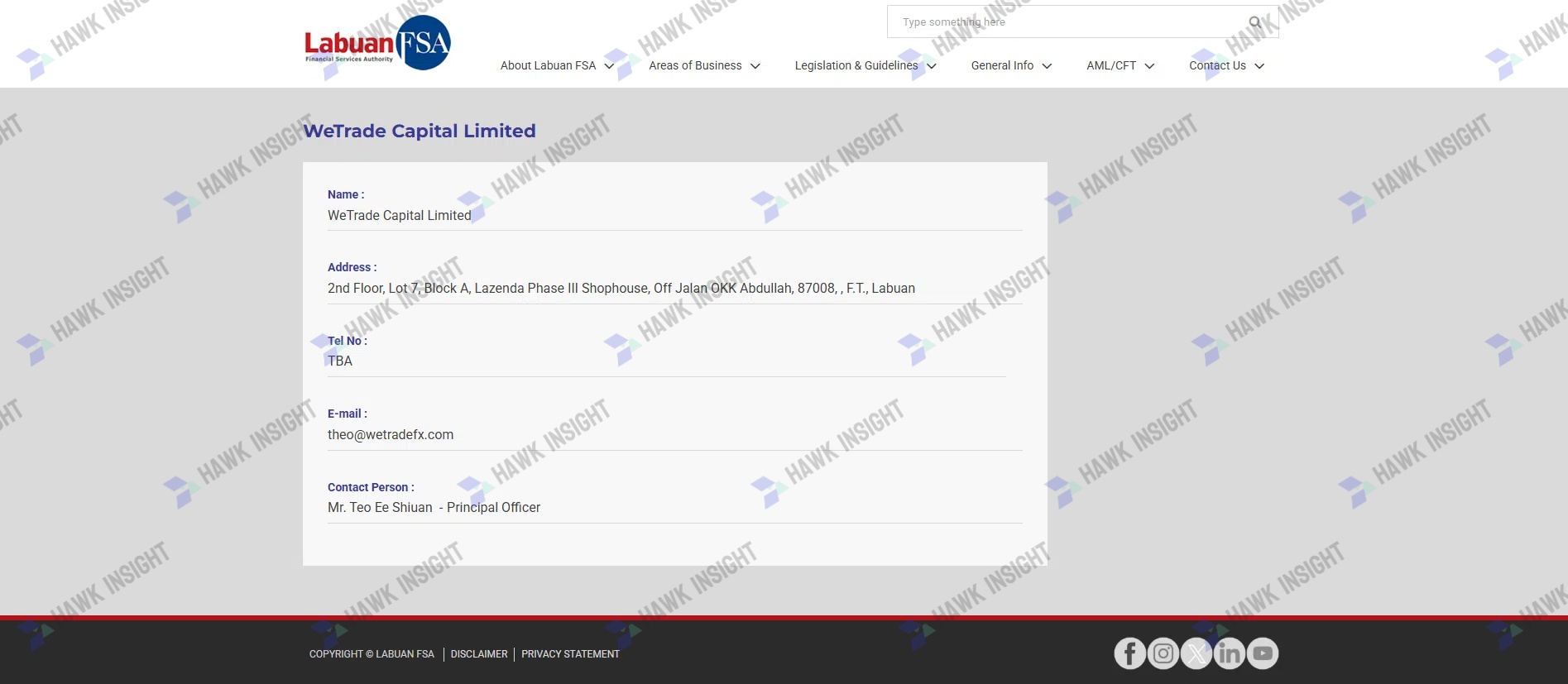

Many well-known foreign exchange platforms providing services in Malaysia, such as Deriv, Doo Financial, WeTrade, etc., are registered in Labuan and have obtained FSA legal licenses.

Why are Labuan platforms more popular?

| Advantages | Explanation |

|---|---|

| Clear regulation | Licensed platforms can be found on the official website of Labuan FSA |

| Global service | Serving international customers with flexible transactions |

| Tax benefits | Corporate income tax is only 3%, or capped at RM20,000 |

| Support for multi-currency accounts | Customers can open accounts in US dollars, euros, Japanese yen, etc. |

| Legal provision of MT4/MT5 platform services | Widely accepted |

III. Legal vs. Illegal Foreign Exchange Platforms: How to Identify and Verify?

Five Characteristics of Legal Platforms

-

Holding a valid license from BNM or Labuan FSA (Can be found on the official website);

-

Disclosing company information, license number, and place of registration on the official website;

-

Providing a real connection to the MT4/MT5 platform (The server is not virtual);

-

Legal and clear channels for depositing and withdrawing funds, such as bank transfer, wire transfer, wallet, etc.;

-

Customer service is accessible, supporting Malay or Chinese services.

Common Tricks of Illegal Black Platforms

-

Claiming to be "overseas regulated", but there is no such license;

-

Guiding people to join "Telegram signal groups" and "guaranteeing monthly returns";

-

Requiring transfer of funds into the account via Bitcoin, USDT, etc.;

-

The platform page is gorgeous, but it is impossible to withdraw funds, and the customer service is out of touch;

-

Illegal behaviors such as forced copying of trades, locking positions, blowing up positions, and EA controlling the market.

How to Verify Whether a Platform is Compliant?

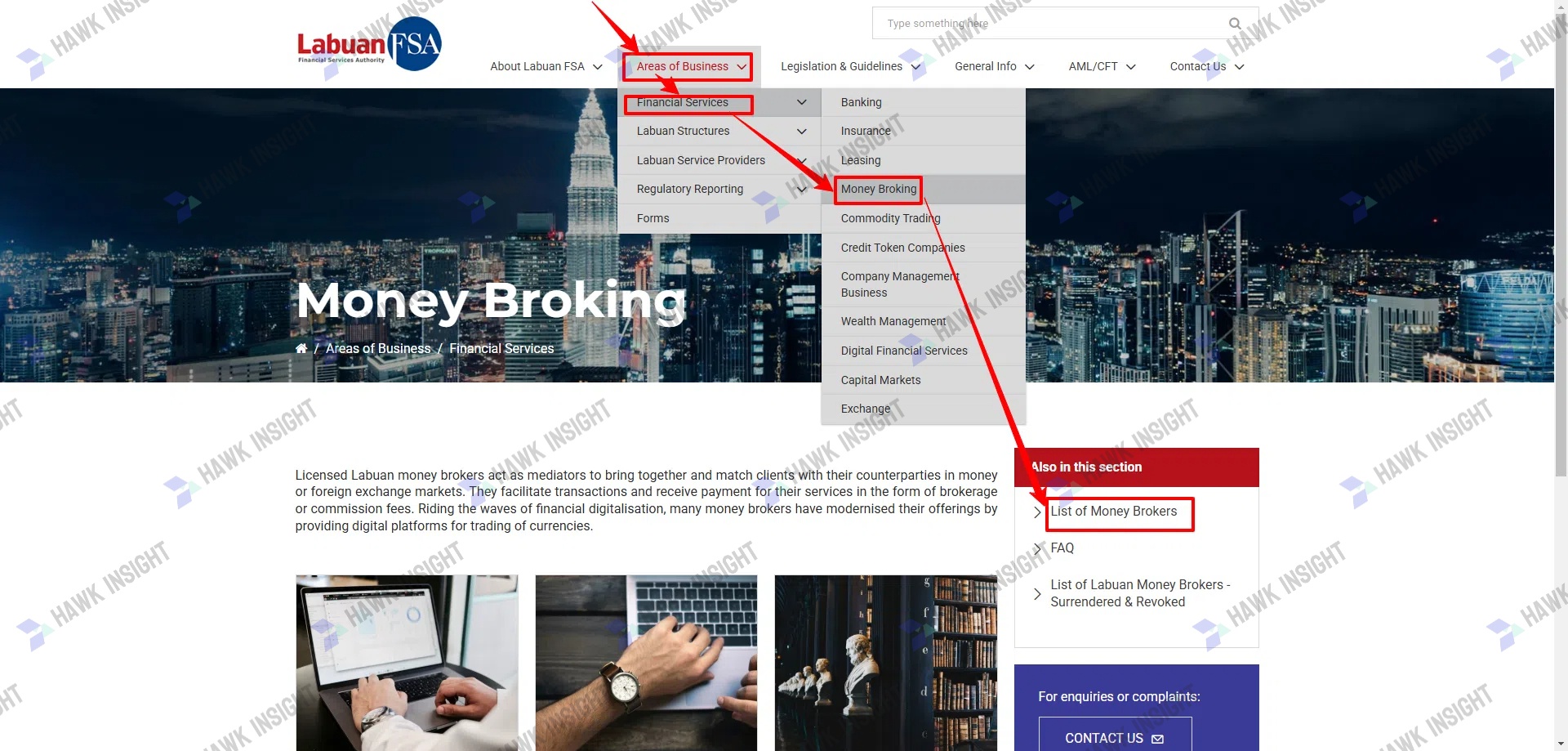

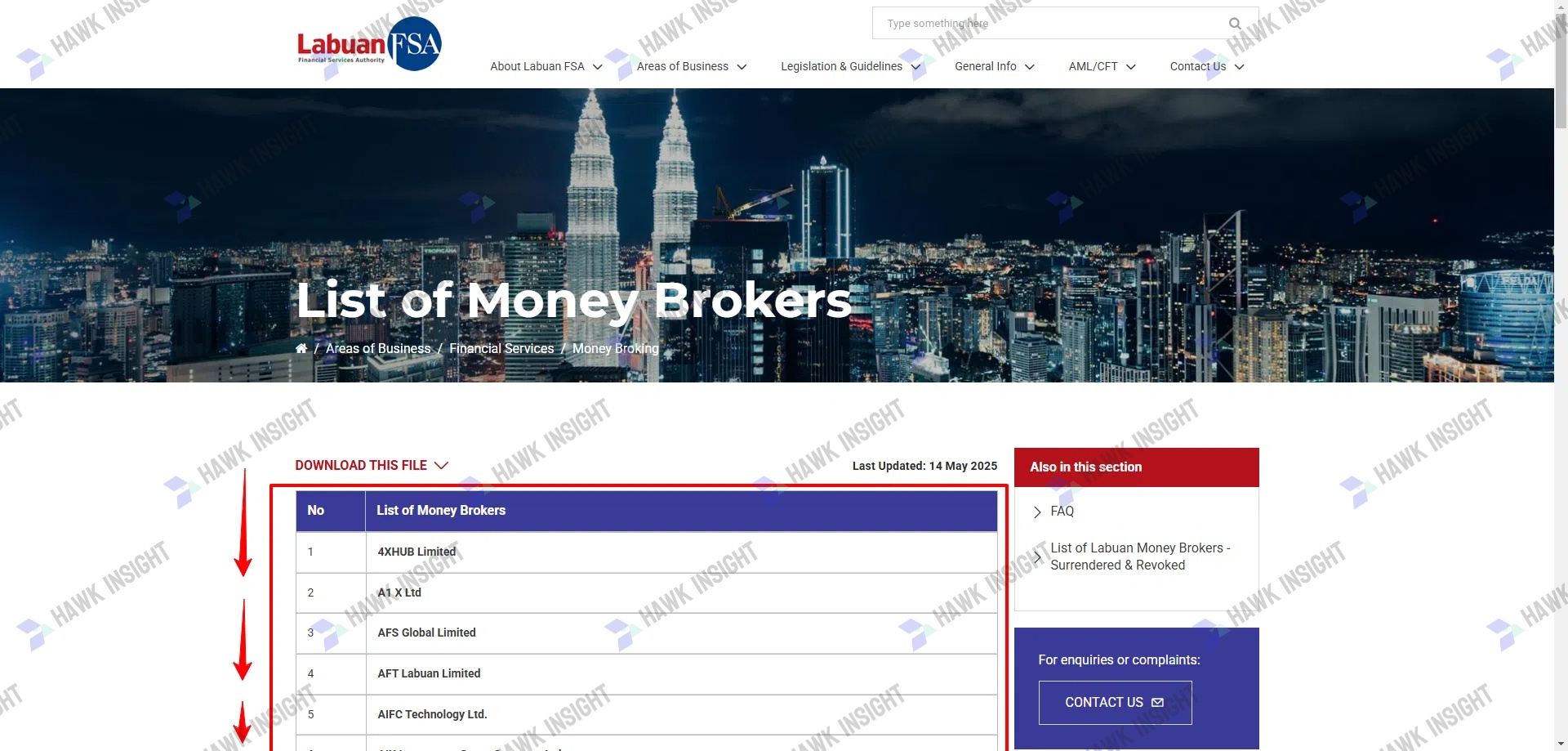

1. Go to the official website of Labuan FSA → https://www.labuanfsa.gov.my ;

2. Click on 「Areas of Business」→「Financial Services」→「Money Broking」;

3. Click on 「List of Money Brokers」 to view the list of all regulated licensed money brokers;

4. Search for the platform name in the list to verify whether the license name is consistent with the registered company name and other information

Examples: Deriv Ltd, WeTrade Capital, etc. can be found.

IV. Detailed Explanation of Malaysian Islamic Accounts (Shariah-Compliant Forex)

As a country with a Muslim majority, Islamic foreign exchange accounts (Swap-Free Account) are particularly important in Malaysia.

What is an Islamic Account?

Islamic accounts comply with Shariah (Islamic law), and their main features are:

-

No overnight interest (Swap) is charged, which is in line with the religious doctrine that prohibits "interest (Riba)";

-

Transactions that do not involve the nature of gambling (Gharar);

-

Trading of non-halal assets is prohibited, such as alcohol, gambling stocks, some cryptocurrencies, etc.

Which platforms support Islamic accounts?

Most licensed platforms registered in Labuan provide Islamic account services, such as:

-

Amana (AFS Global) – Clearly positioned as a Shariah-compliant investment platform;

-

Doo Financial – Offers Islamic account options and supports automatic conversion;

-

NCM Investment – Supports Halal trading structures;

-

WeTrade, Ventura Prime FX – Eligible for interest-free accounts.

Notes

Although the platform offers "Swap-Free" accounts, some platforms may indirectly charge fees by widening the spread or charging handling fees. Investors should read the terms carefully and confirm with the customer service.

V. Recommendations and Comparisons of Malaysian Foreign Exchange Trading Platforms in 2025

The following platforms all hold a valid license from Labuan FSA and have the qualification for compliant operation, which is suitable for Malaysian residents or international customers for investment. Next, we will first introduce the basic background of each platform, and then conduct a horizontal comparison of them by dimension.

Brief Introduction of Each Platform

WeTrade

Headquartered in Labuan, it focuses on the Chinese-speaking market in the Asia-Pacific region, provides both MT4/MT5 platforms, has a Chinese-speaking team for support, and is suitable for beginners and medium to high-frequency traders.

Doo Financial (都会金融)

Affiliated to Doo Group, it is a large licensed financial group in multiple regions. The platform has high stability and supports trading in multiple markets (US stocks/Hong Kong stocks/foreign exchange, etc.), which is suitable for diversified investors.

LIRUNEX LIMITED

Positioned as a cost-effective broker, it features floating spreads and fast deposit and withdrawal, supports Islamic accounts, and its main customer groups are in Southeast Asia and the Middle East.

NCM Investment

Focusing on the Middle East and Southeast Asian markets, it supports the MT5 platform, and its products cover foreign exchange, cryptocurrencies, and commodities, with a clear regulatory background.

Ngel Partners

Relatively small in scale but with clear compliance, it features high leverage and a low minimum deposit threshold, making it suitable for novice traders to test the waters.

Amana (AFS Global)

Specifically designed for the Islamic market, it is 100% Shariah-compliant, supports Halal asset trading, and features transparent products and outstanding compliance.

Deriv (FX) Ltd

A well-known established platform, formerly Binary.com, it provides a self-developed Deriv trading platform with extremely low spreads, suitable for automated traders.

Cerus Markets

It offers a variety of combinable asset trading, including foreign exchange, options, and indices, suitable for advanced traders and supported by educational resources.

Forexer Limited

A medium-sized trading platform that supports MT4, provides basic trading of metals and foreign exchange, and has simple platform operation.

Ventura Prime FX

It has a rich variety of trading products, flexible spreads, and fast withdrawal speed, targeting experienced trading users.

Platform Comparison: Comparison of Basic Trading Parameters

| Platform Name | Minimum Deposit | Platform Type | Spread Type | Trading Products | Leverage |

|---|---|---|---|---|---|

| WeTrade | $100 | MT4/MT5 | Floating | Foreign Exchange, Gold, Indices | 1:500 |

| Doo Financial | $50 | Doo Prime | Low Spread | Foreign Exchange, US Stocks, CFDs | 1:400 |

| LIRUNEX | $50 | MT4 | Moderately Floating | Foreign Exchange, Metals | 1:500 |

| NCM | $100 | MT5 | Floating | Foreign Exchange, Energy, Cryptocurrencies | 1:300 |

| Ngel Partners | $50 | MT4/MT5 | Floating | Multi-Asset | 1:1000 |

| Amana | $100 | Exclusive Platform | Fixed | Halal Assets | 1:200 |

| Deriv | $10 | Deriv Platform | Extremely Low | Foreign Exchange, Contracts | 1:1000 |

| Cerus Markets | $50 | MT5 | Variable | Foreign Exchange, Options, Stock Indices | 1:200 |

| Exfor | $100 | MT5 | Highly Floating | Foreign Exchange, Cryptocurrencies | 1:100 |

| Forexer | $50 | MT4 | Moderate | Foreign Exchange, Metals | 1:400 |

| Ventura Prime FX | $100 | MT5 | Flexible | Multi-Asset | 1:500 |

Platform Comparison: Compliance and User Service

| Platform Name | Labuan License Number | Support for Islamic Accounts | Customer Service Language | Local Office | Withdrawal Speed |

|---|---|---|---|---|---|

| WeTrade | MB/21/0001 | ✅ | Chinese/English | ✅ (Kuala Lumpur) | 24-48 hours |

| Doo Financial | MB/20/0028 | ✅ | Chinese/English/Malay | ✅ | Within 24 hours |

| LIRUNEX | MB/20/0033 | ✅ | English/Chinese | ❌ | 48 hours |

| NCM | MB/21/0018 | ✅ | English/Arabic | ✅ | 1-2 working days |

| Ngel Partners | MB/22/0010 | ✅ | English | ❌ | 2-3 working days |

| Amana | MB/21/0005 | ✅ (Shariah Certified) | Arabic/English | ✅ | 24 hours |

| Deriv | MB/18/0024 | ✅ | English/Partial Chinese | ❌ | Fast (On the same day) |

| Cerus | MB/22/0007 | ✅ | English | ❌ | 2 working days |

| Exfor | MB/23/0002 | ❌ | English | ❌ | 1-3 working days |

| Forexer | MB/20/0011 | ✅ | English | ❌ | 2-3 working days |

| Ventura | MB/21/0014 | ✅ | English/Malay | ✅ | Within 24 hours |

Platform Comparison: Technology and Mobile Experience

| Platform Name | Has App | App Rating (Google Play) | Supports Automated Trading (EA) | Educational Resources | Demo Account |

|---|---|---|---|---|---|

| WeTrade | ✅ | 4.2 / 5 | ✅ | Basic Video Courses | ✅ |

| Doo Financial | ✅ | 4.6 / 5 | ✅ | Simulated Portfolio, Tutorials | ✅ |

| LIRUNEX | ✅ | 4.1 / 5 | ✅ | Web Articles | ✅ |

| NCM | ✅ | 4.3 / 5 | ✅ | Video + Text Mixture | ✅ |

| Ngel | ✅ | 4.0 / 5 | ✅ | Not Much | ✅ |

| Amana | ✅ | 4.5 / 5 | ✅ | Shariah Education Center | ✅ |

| Deriv | ✅ | 4.7 / 5 | ✅ | Highly Modular | ✅ |

| Cerus | ✅ | 3.9 / 5 | ✅ | English Blog Provided | ✅ |

| Exfor | ✅ | 4.0 / 5 | ✅ | Video Explanation | ✅ |

| Forexer | ✅ | 4.0 / 5 | ✅ | Average | ✅ |

| Ventura | ✅ | 4.2 / 5 | ✅ | English Learning Center | ✅ |

-

For beginners, WeTrade, Doo Financial, and Deriv have a user-friendly interface and customer service support.

-

Users with requirements for Islamic compliance can give priority to Amana, NCM, and Doo Financial.

-

Traders who prefer cryptocurrency assets or high leverage can consider Exfor and Ngel Partners.

-

Users who focus on brand and long-term stability can consider large platforms such as Deriv and Doo Financial.

VI. Instructions for Investors' Actual Operations

Before choosing a foreign exchange platform in Malaysia, it is recommended that you:

Do these 3 things:

- Verify the regulation: Check the legality of the platform through the websites of BNM or Labuan FSA.

- Understand the investment amount limit: Is there any borrowing in Ringgit? Does it meet the limit of RM 1M / 50M?

- Test with a demo account first: Understand the smoothness of the platform, trading slippage, and the quality of customer service.

Avoid the following risk traps:

-

Being guided by unregistered "signal groups" or "live order-calling" to cause a margin call;

-

Being attracted by high rebates and ignoring whether the platform is legal;

-

Blindly using leverage to trade gold and oil, especially with credit card funds or borrowed funds.

Conclusion: Choose a Compliant Platform to Protect Your Principal

The foreign exchange trading market in Malaysia will continue to grow in 2025, and the regulation is becoming more and more rigorous. Whether you are a novice or an experienced trader:

-

Choose a legally regulated platform;

-

Comply with the BNM's capital compliance limits;

-

Comprehensively consider multiple dimensions such as the platform services, App, and customer service language support.

📢 Friendly reminder: Compliance does not mean no risk. Only trading knowledge + risk control awareness can ensure long-term survival.

[Related reading] A Complete Guide to Opening a Bank Account in Malaysia: Comparison of All Banks + Tips to Avoid Pitfalls When Opening an Account

[Related reading] Malaysia 2025 Top 5 Bank Account Opening Tips

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.