Today, WSJ has big news that Shanghai-based MiniMax has secretly applied for an IPO in Hong Kong, which will be listed as soon as this year.

Let's start with a brief introduction to MiniMax.

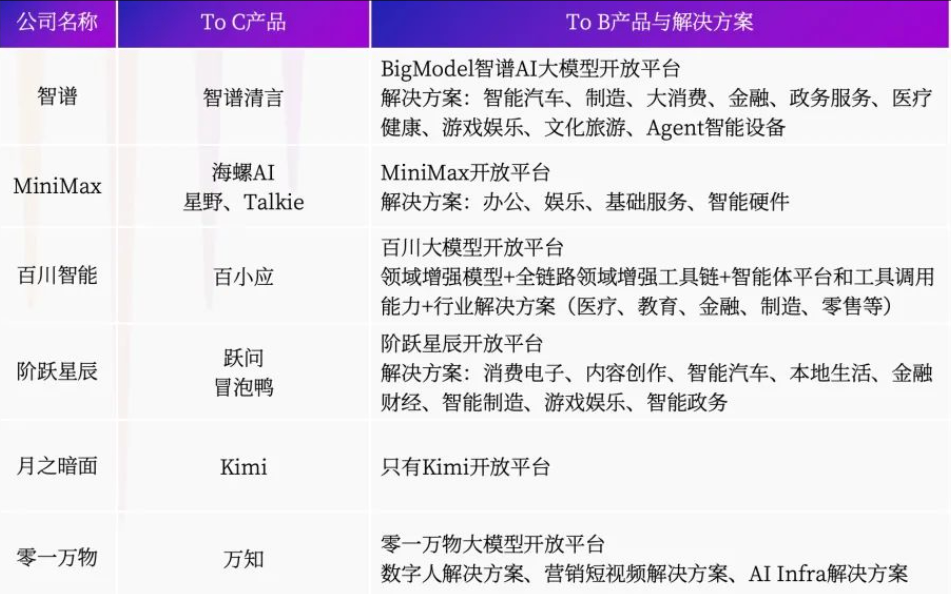

The company was established in Shanghai in December 2021, focusing on the development of general artificial intelligence technology that integrates text, speech, and vision multi-modal, and launches ABAB series of large models and application products such as Glow and Conch AI.The company was founded by Yan Junjie, a former Shangtang Technology executive, and received investment from Tencent, Alibaba, etc. In June 2023, it was promoted to a unicorn after completing US$250 million in financing. In December of the same year, it released China's first MoE architecture model.

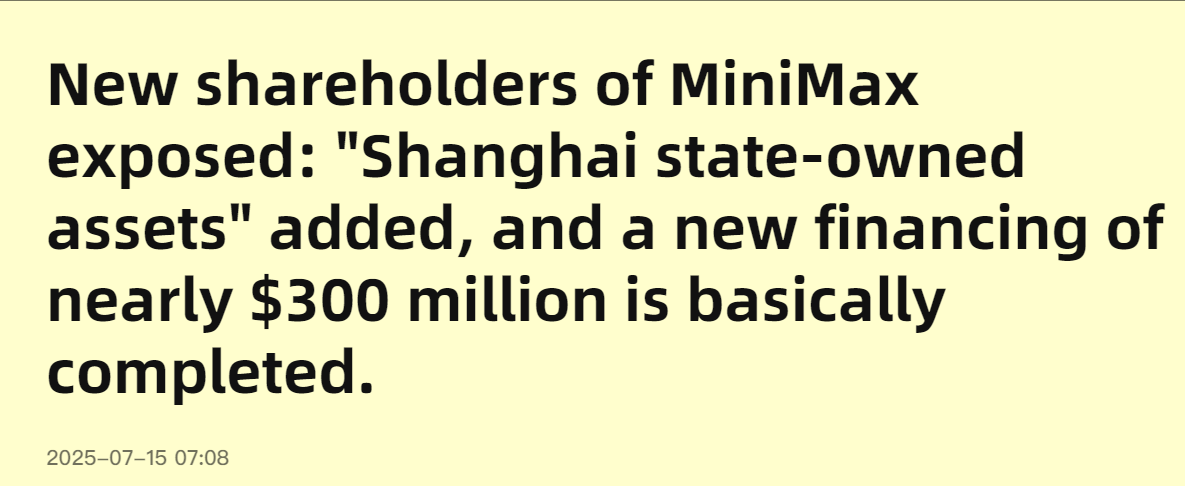

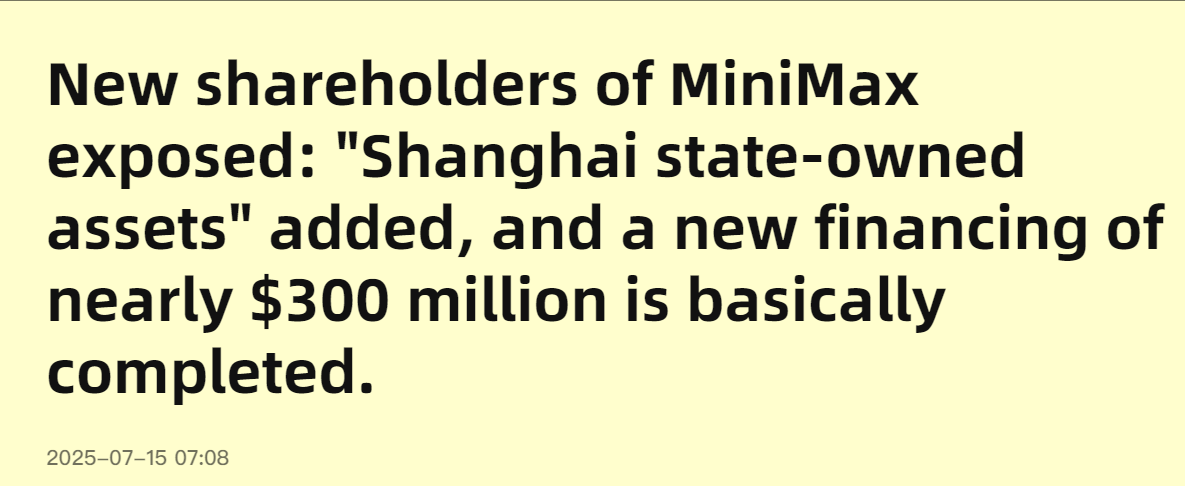

Only half a year after the previous round of financing, it has recently obtained US$300 million + state-owned assets injection

It is worth noting that MiniMax had just completed a round of financing valued at US$3 billion at the end of last year.Just recently, the company is also close to completing another round of US$300 million in financing. For the first time in this round of capital, a large-scale state-owned assets platform, Shanghai State-owned Assets, has appeared in the capital lineup. Together with listed companies and cross-funds, it forms a diversified shareholder structure, marking its capital The narrative has shifted from pure technology venture investment to strategic resource integration integrating industry and finance.

The significance of official admission is not only the endorsement of funds, but also the recognition of policy compliance and paving the way for the subsequent commercialization of MiniMax.

Before July, MiniMax had received US$600 million in Series B financing from Alibaba and US$250 million in Series A financing from Tencent. Early investors also included leading institutions such as Yunqi Capital, Hillhouse Ventures, IDG and Mihayou.It is not an exaggeration to describe MiniMax as a big family.

It is not easy for MiniMax to obtain two rounds of financing in a row.Against the background of the difficult production of DeepSeek 2.0 and the cooling of financing in the AI industry, this company, which has only been more than three years old, has experienced a valuation increase of US$1 billion in half a year. Together with Smart Vision, it has become the only two in China that have exceeded a valuation of 30 billion yuan. A large model enterprise, and has become the only two successful survivors of this year's "AI Six Tigers".

But capital investment requires a return, and the more expensive the money, the greedier the greed.Take the initial shareholders (Alibaba, Tencent, Mihayou, etc.) as an example. The freezing of capital has been delayed and there is an urgent need for liquidity exports.In particular, Alibaba and Tencent-Ali is betting on AI and the dark side of the moon at the same time, and there is internal competition for resource collaboration; Tencent has increased its own and developed a mixed model, which may also weaken its ecological support for MiniMax.

Secondly, MiniMax also urgently needs to use Hong Kong stock financing channels to bridge the valuation gap with domestic and foreign counterparts.Compared with similar companies in the United States, Anthropic is valued at US$61.5 billion, Perplexity is valued at US$14 billion. Among China's "AI Six Tigers", only Intelligent Spectrum is valued at RMB 32 billion (approximately US$4.4 billion), while MiniMax's valuation barely reached US$4 billion even after this round of investment.

Technological breakthroughs have become a key fulcrum supporting valuation

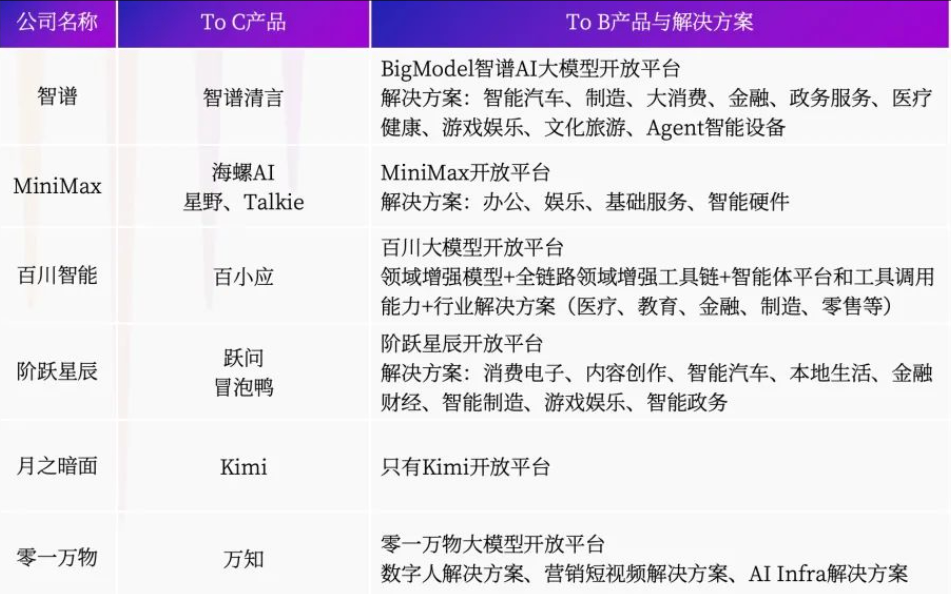

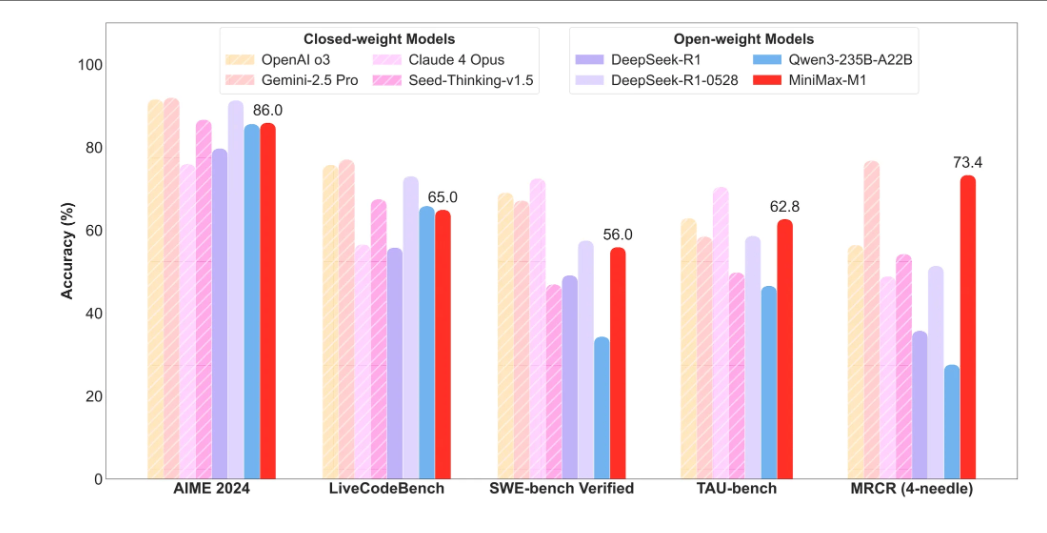

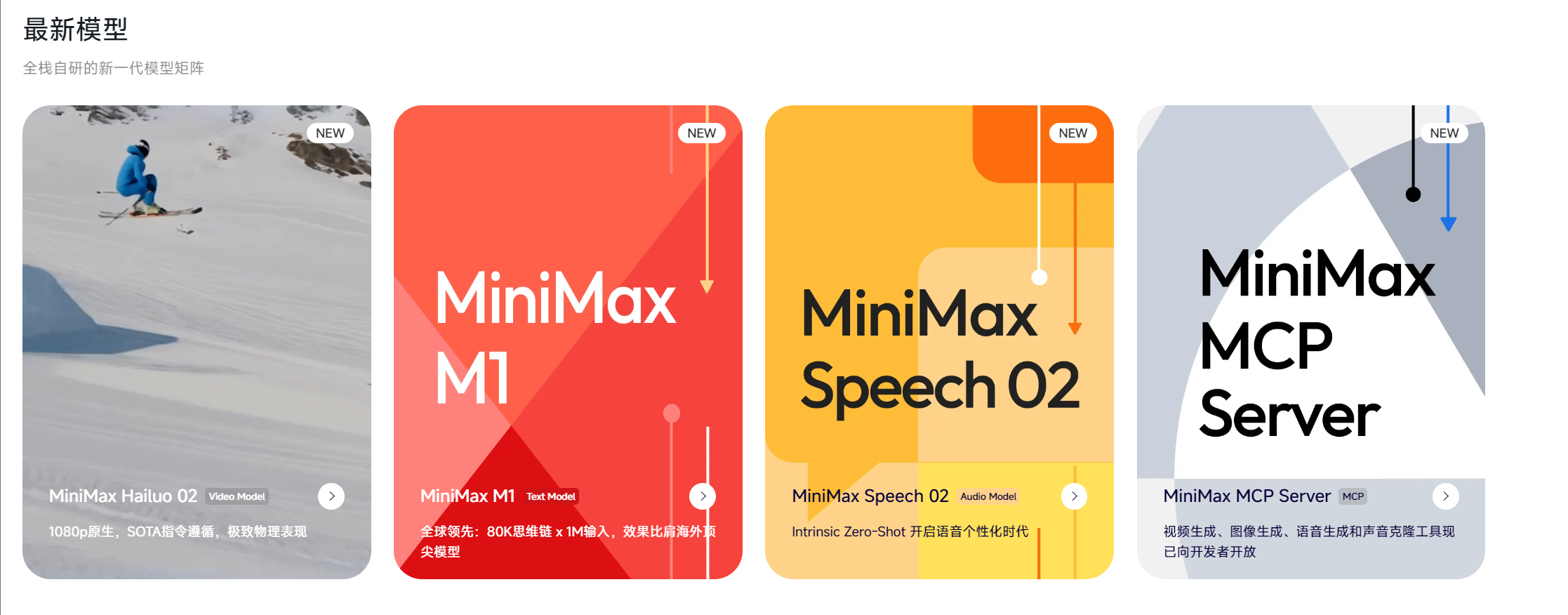

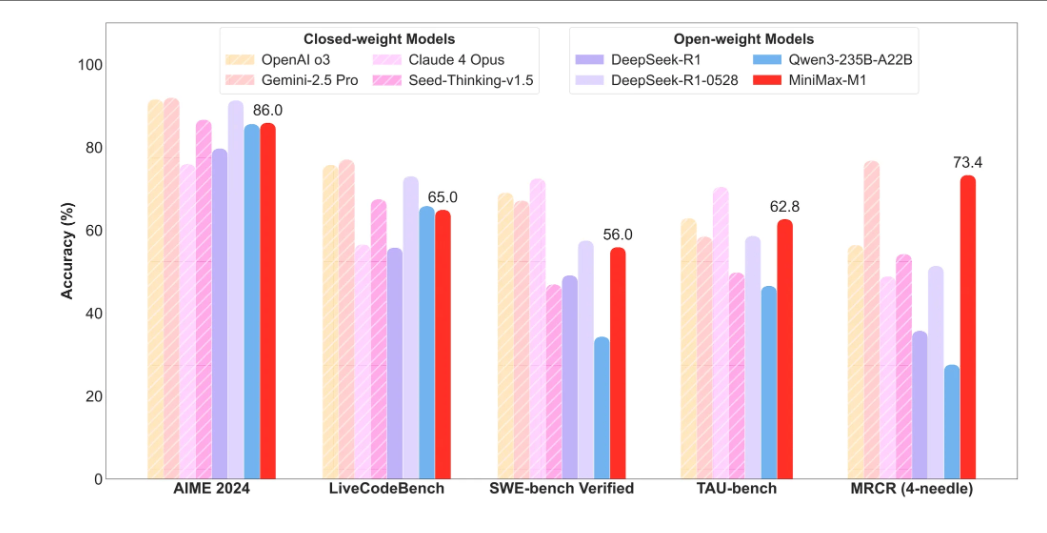

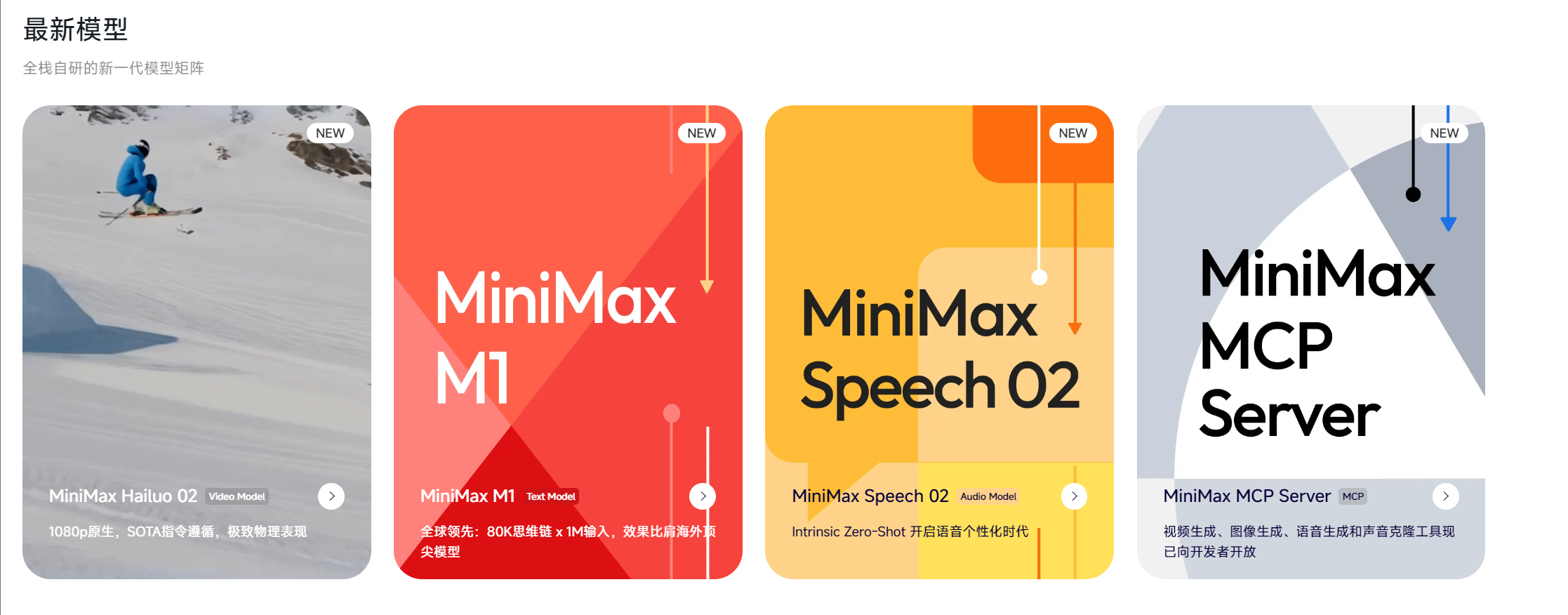

MiniMax's core competitiveness has always been based on its technological leadership in multimodal large models, especially in the field of open source models.The M1 inference model released in June 2025 supports 1 million Tokens context windows. In the 80,000 Tokens deep inference task, the computing power consumption is only 30% of that of DeepSeek-R1, and the cost when generating 100,000 Tokens is reduced to 25% of the opponent's.

This extreme price/performance ratio stems from its innovative hybrid architecture design (lightning attention mechanism), which significantly reduces the hardware threshold for long text processing.At the same time, the company ranks first in the world in the field of video generation. The Conch V2 model ranks second in the Artificial Analysis video list, surpassing Google Veo 3 Preview and Quick Hand 2.0, and can accurately simulate difficult movements such as gymnastics and acrobatics.

The management was very far-sighted and began to deploy globalization early: overseas API calls accounted for more than 60%, the monthly activity of the American social application Talkie exceeded 11 million (accounting for 50% of global users), and it was deeply embedded in productivity tools such as Jinshan WPS and Wanxing Meoying., forming a dual-track closed loop of B-side technology authorization and C-side traffic monetization.

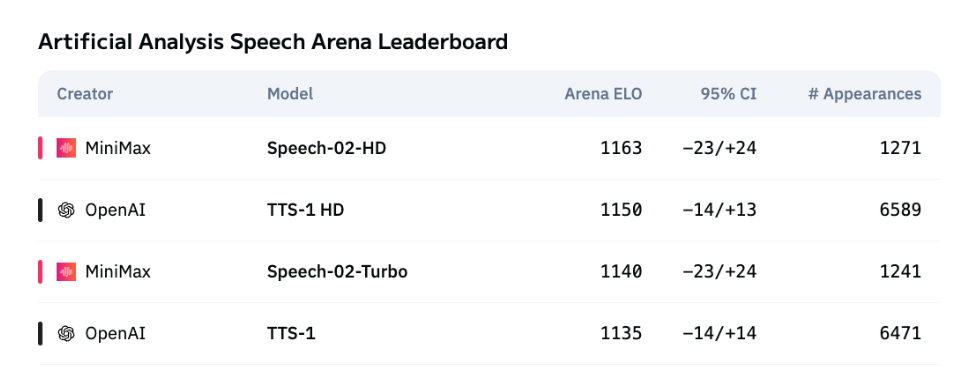

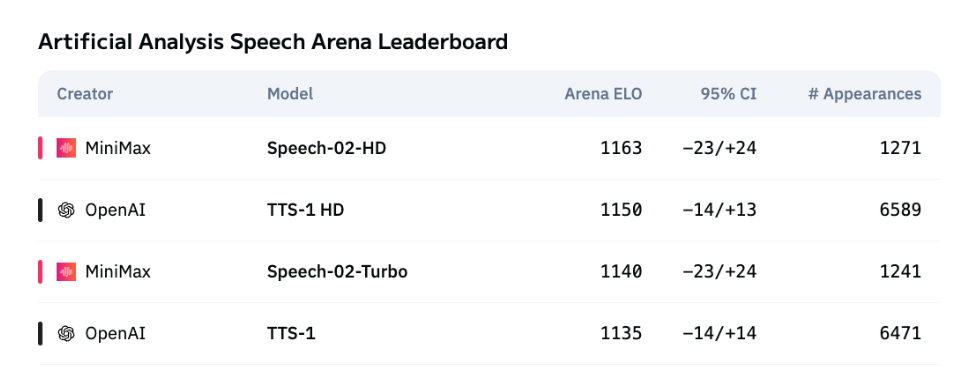

In the past month, MiniMax has intensively released three major modal self-research results: the text inference model MiniMax-M1, the video generation model Conch 02, and the speech model Speech-02.Among them, Speech-02 reached the top of the international evaluation, marking that MiniMax has become a rare China AI company with full-stack self-research capabilities for text, voice, and video.

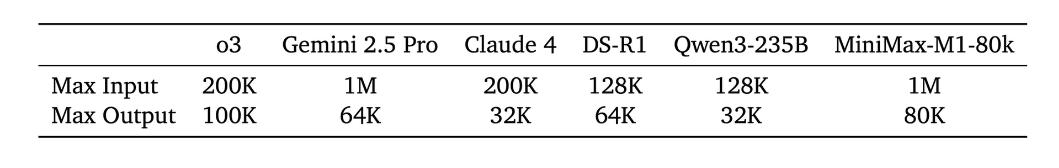

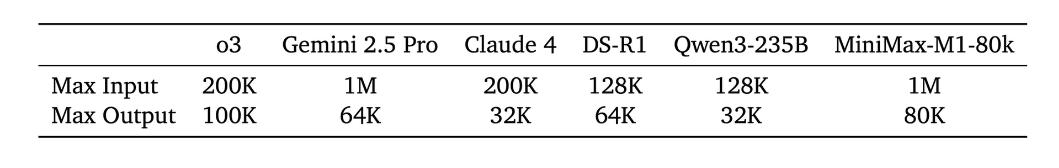

Judging from actual measurements, MiniMax's strongest feature is its ability to understand long contexts.The model's understanding at 1M input is close to that of the Gemini 2.5 Pro, and its 80K output surpasses Claude 4 Opus (32K).The shortcoming lies in mathematical ability, but it is also similar to DeepSeek-R1 (76.9% vs 81.5%).

Listing Outlook

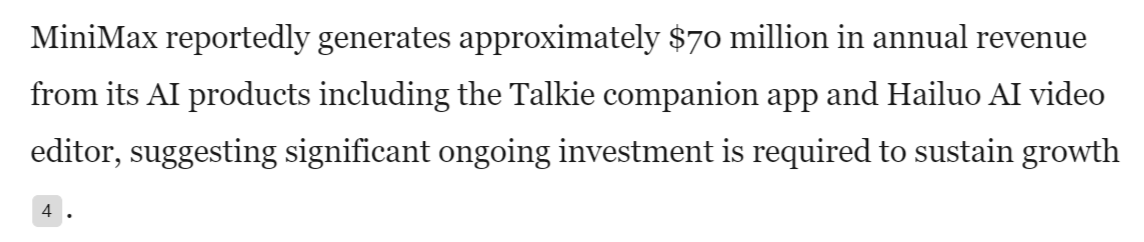

Despite outstanding technical strength, MiniMax's financial model has not yet crossed the profit turning point.

Several major issues.

First, the company's revenue in 2024 will be approximately US$70 million, but the losses will continue and no specific data will be disclosed. The cash flow will be highly dependent on financing blood transfusion.

Second, the revenue structure shows a double imbalance: on the one hand, overseas revenue is concentrated in the U.S. market, and the sudden removal of application stores in the United States and Japan in 2024 exposed policy vulnerabilities; on the other hand, although the B-end open platform covers 50,000 corporate customers, However, the depth of commercialization is insufficient, and the main revenue still comes from basic API calls rather than the premium of scenario solutions.

Third, the adjustment of strategic focus has brought financial pressure: founder Yan Junjie clearly proposed in 2024 to put "accelerating technology iteration" over growth and revenue, resulting in a surge in R & D investment, while the commercialization process slowed down during the same period.If the listing of Hong Kong stocks fails to meet expectations, it may aggravate the tight cash flow and even trigger a chain reaction of shareholders withdrawing.

For now, if MiniMax launches Hong Kong stocks during the year, its technological scarcity may still trigger new popularity.

However, in the long run, the subsequent value of MiniMax needs to anchor two major turning points.The first is when the gross profit margin will be corrected; the second is whether the open source ecosystem can replicate the DeepSeek path and attract more than 100,000 developers to form a technology moat.If these two points are achieved, MiniMax may be able to break out of the shadow of OpenAI and create a China AGI paradigm of "vertical scenarios + open source community."