As of 12:30 noon New York time, retail investors 'net purchases of U.S. stocks in a single day reached US$4.1 billion.

On May 20, the U.S. stock market staged a dramatic reversal.

Although Moody's downgraded the U.S. sovereign credit rating to Aa1 on May 16, triggering market concerns about debt sustainability and economic prospects, the S & P 500 index plunged 1.1% at the opening of Monday, but then collective action by retail investors quickly reversed the situation.As of the close, the three major stock indexes closed up across the board, with the S & P 500 index achieving six consecutive positive results, only 3% short of its historical high.

A historic explosion of retail power

According to data from JPMorgan's quantitative team, as of 12:30 noon New York time, retail investors 'net purchases of U.S. stocks in a single day reached US$4.1 billion, breaking through the US$4 billion mark before noon for the first time. The proportion of trading volume throughout the day soared to 36%, surpassing the peak at the end of April.Behind this data is retail investors 'rapid response mechanism to market fluctuations-they no longer hesitate to wait and see as in the past, but instead regard every correction as an opportunity to enter.Frank Monkam, head of macro trading at Buffalo Bayou Commodities, pointed out that retail investors have awakened from the lessons of history and no longer miss the rebound window brought by policy backing.

In terms of individual stock selection, retail investors have shown clear preferences: Tesla and Palantir attracted net inflows of US$675 million and US$439 million respectively, bitcoin-related ETFs also gained increased holdings, while Nvidia suffered continued selling.It is worth noting that retail funds are not blindly chasing hot spots. Vincent Lorusso, CEO of Clough Capital Partners, believes that against the background of falling inflation and solid corporate balance sheets, retail investors are optimizing allocation through the risk adjustment framework.

The market's reaction to the downgrade is also intriguing.

Although the U.S. sovereign rating lost AAA among the three major institutions, the 30-year U.S. bond yield only briefly hit 5% before falling back to 4.9%. Treasury officials even called rating agencies "lagging indicators."Bayer analyst Ross Mayfield pointed out that Moody's report did not provide incremental information, and short-term emotional shocks cannot change the medium-term bullish logic.This "selective neglect" may stem from the market's trust in policy tools: although Atlanta Fed Chairman Bostick emphasized inflation concerns, he still maintained his expectation of cutting interest rates once this year, implying that monetary policy flexibility still exists.

U.S. stocks rebounded significantly in May. How can ordinary people seize investment opportunities?

Since May 2025, the U.S. stock market has experienced a significant rebound, and the three major indices have strengthened across the board.The S & P 500 index rose 7.08%, breaking through 5900 points and standing on the 200-day moving average. The Nasdaq index rose more than 10%, entering a technical bull market range. The Dow Jones Industrial Average also rose 5.22% to above 42000 points.

The core driver of this round of rebound is the phased easing of trade tensions between China and the United States, which has alleviated market concerns about supply chains and economic recession, and directly boosted technology stocks and export-related sectors.The "Big Seven" technology stocks led by Tesla and Nvidia led the gains. Semiconductor and AI companies rose by as much as 44% in a single week due to favorable policies and rising industry prosperity.

However, the stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc. The capital cost for ordinary investors to hold multiple stocks is higher, which makes many investors discouraged.

In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

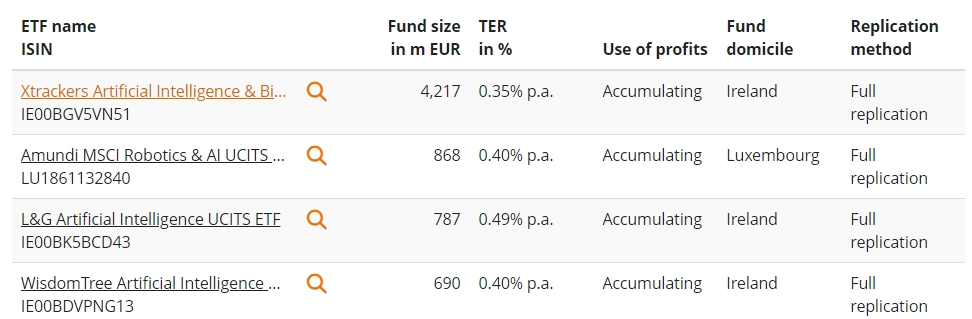

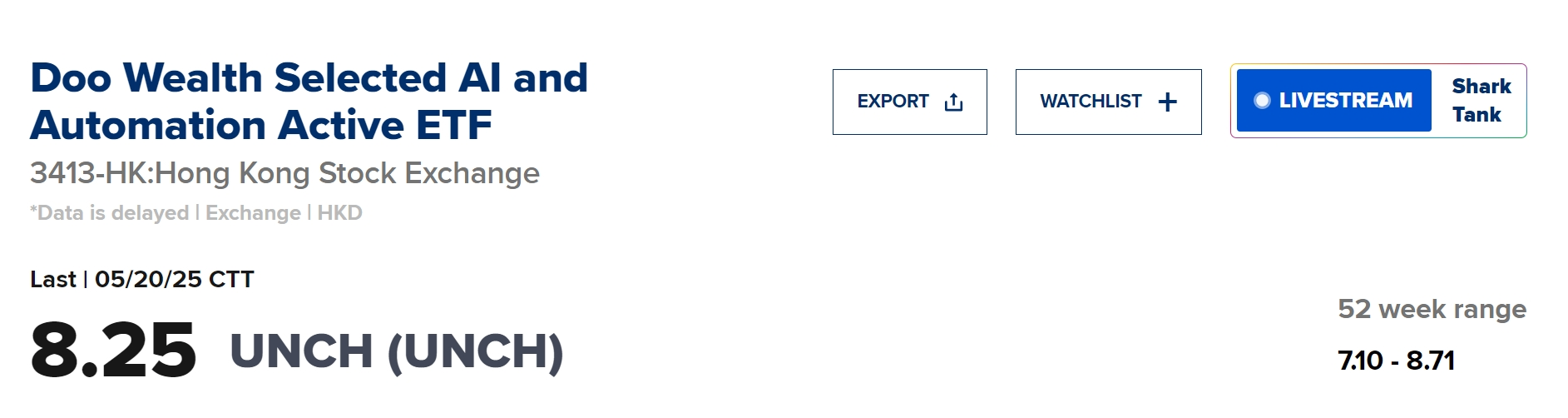

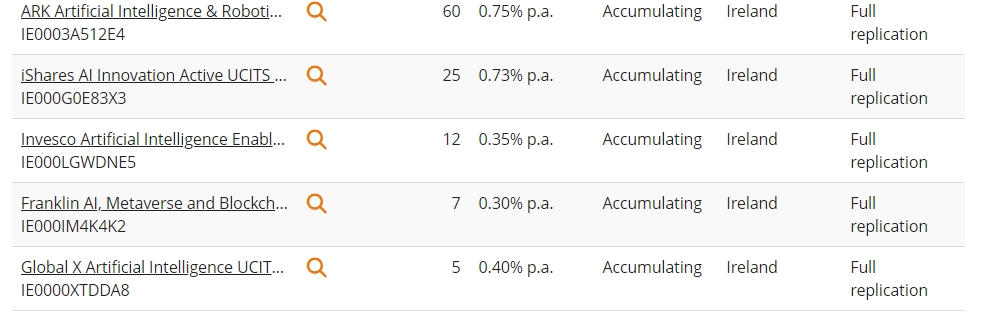

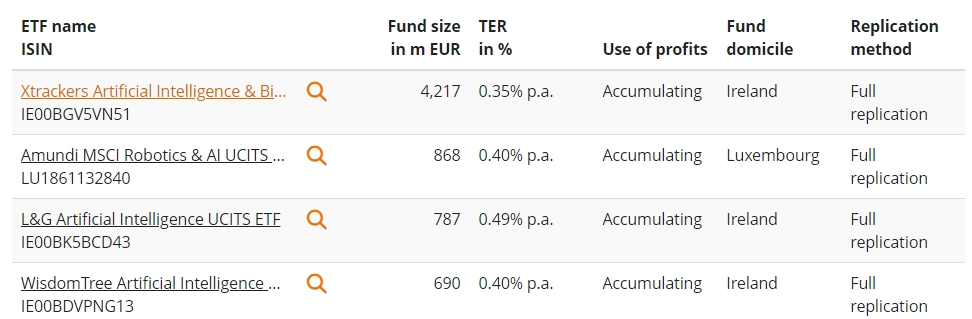

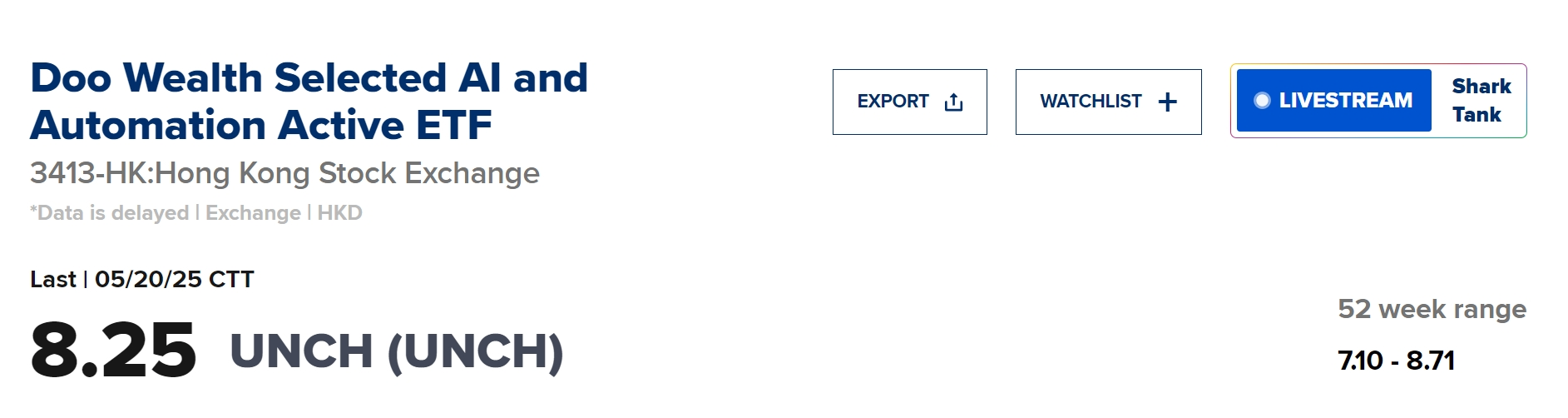

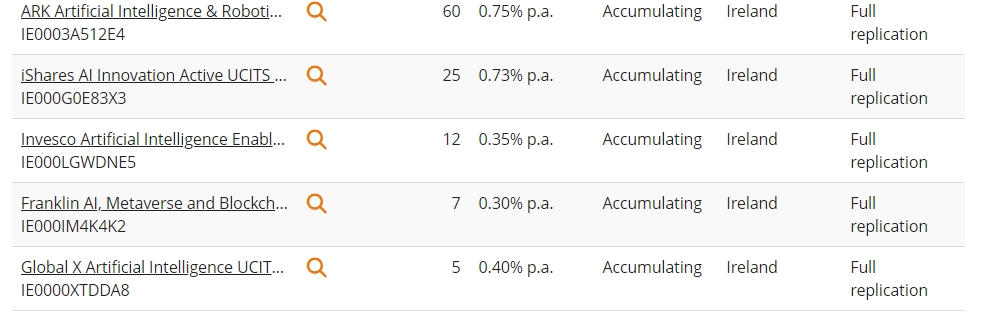

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

At the market demand level, global demand for AI computing power has entered an explosive period.

Nvidia's latest financial report shows that revenue from its data center business in fiscal year 2025 will reach US$130.4 billion, a year-on-year increase of 78%. Orders for Blackwell chip series have been placed until 2026. Huang Renxun said that "AI computing needs need to be millions of times current capabilities."The company's launch of the GB300 system, DGX Spark workstation and quantum computing investment plan further consolidates its full-stack AI ecosystem advantages from hardware to software.In addition, technology giants such as Microsoft and Meta have announced a billion-dollar AI infrastructure investment plan, which directly drives GPU procurement demand.InvalidParameterValue

Huang Renxun predicted that "AI will be everywhere" and that by 2030, robotics, industrial automation, biomedicine and other fields will fully rely on AI computing power.Despite geopolicy risks (such as repeated export controls) and competition from AMD and Broadcom ASIC chips, GPUs are still regarded by analysts as the "core asset of the AI revolution" due to their ecological stickiness, poor performance and first-mover advantage.