Best Trading Journal Software: 5 Top Tools for Forex and Stock Traders

What is trading journal software, and why do traders need it? This article explains its key features and benefits, reviews 5 top tools, and helps you choose the best option for your trading style.

Why Do You Need Trading Journal Software? For forex and stock traders aiming for long-term profitability, relying solely on instinct and memory isn't enough. Many traders struggle to analyze the causes of losses and lack tools to improve their strategies quantitatively.

By using professional forex journal software or trading journal platforms, you can clearly track profits and losses for each trade, analyze win rates, R-multiples, and drawdowns, and even manage trading emotions and taxes — making it the first step from retail to professional trading.

This article introduces five excellent trading journal tools, comparing features such as data import methods, mobile vs desktop experience, and helping you choose the best journal software for your needs.

Why You Must Record Your Trades (It's More Than Just Accounting)

Recording trades isn't just about noting profits and losses — it's the foundation for building a complete trading feedback system.

Top 5 Benefits of Keeping a Trading Journal:

1. Analyze trading data (win rate, risk-reward ratio, R-multiple)

2. Identify bad patterns (e.g., overtrading, adding to losers)

3. Quantify emotional impact (trading under pressure or mood swings)

4. Improve risk management (track drawdowns, equity curve)

5. Meet tax and compliance needs (especially for US stocks and forex)

Top 5 Trading Journal Tools Recommended

1. TraderVue (Best for High-Frequency Traders)

-

Markets Supported: Stocks, Options, Forex, Futures

-

Import Method: Automatic sync with major brokers (e.g., IB, TOS, Tradestation)

-

Key Features:

-

Multi-dimensional charts: P&L, win rate, R-multiple, time analysis

-

Custom tags and strategy grouping

-

Shareable journal entries and reviews

-

-

Platform Support: Web + Mobile browser

-

Ideal for: High-frequency day traders and strategy analysts

2. Edgewonk (Loved by Review-Oriented Traders)

-

Markets Supported: Forex, CFD, Stocks

-

Import Methods: Supports manual CSV import, compatible with multiple brokers

-

Key Features:

-

Emotion rating system (track trading state)

-

Strategy rating, self-assessment, thought journaling

-

Supports multi-currency and multi-account management

-

-

Platform Support: Desktop (Windows, Mac)

-

Best For: Traders who prioritize subjective review and self-analysis

3. Trademetria (Best Value)

-

Markets Supported: Forex, Stocks, Futures, Crypto

-

Import Methods: Automatic import + manual import

-

Key Features:

-

Profit/loss tracking for multiple accounts

-

Export tax reports

-

Profit/loss distribution and error analysis charts

-

-

Platform Support: Web + Mobile browser

-

Best For: Multi-account users, data-focused traders, tax-conscious individuals

4. Portfolio Performance (Free & Extendable)

-

Markets Supported: Stocks, ETFs, Forex, Crypto Assets

-

Import Methods: Manual import (CSV, HTML reports)

-

Key Features:

-

Track net asset value, exchange rates, and dividend income

-

Multi-currency support + visualized net worth chart

-

-

Platform Support: Desktop (Windows/Linux/Mac)

-

Best For: Portfolio managers, long-term investors

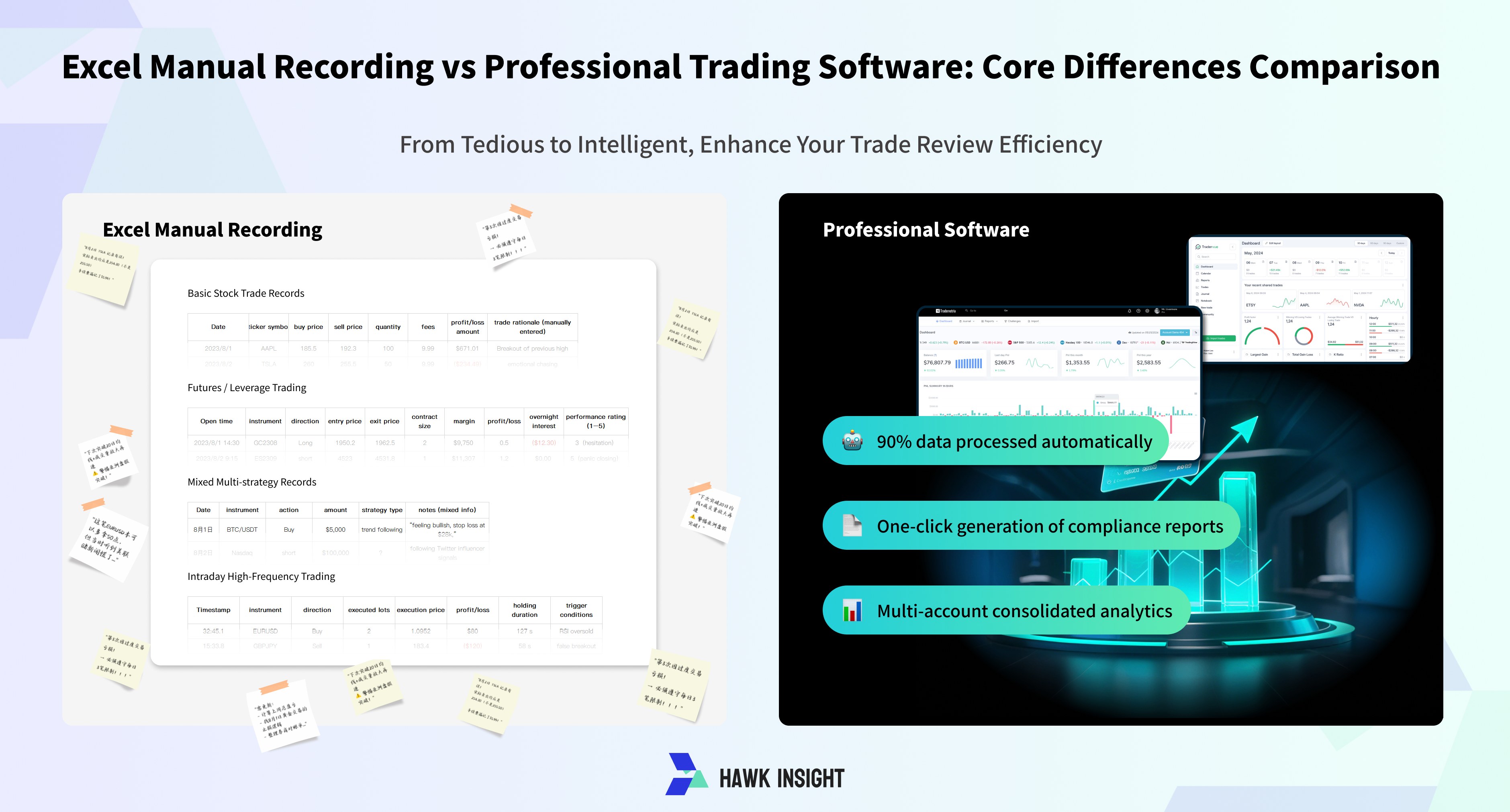

5. Custom Templates with Excel/Google Sheets

-

Markets Supported: All markets

-

Import Methods: Manual entry or via Google Forms

-

Key Features:

-

Fully customizable fields for P&L, take-profit/stop-loss, emotion tracking

-

Can generate P&L charts with chart plugins

-

-

Platform Support: Desktop + Mobile sync (via Google Drive)

-

Best For: DIY enthusiasts and budget-conscious traders

Example Screenshots & Import Methods

-

TraderVue Auto Import: Log into your Tradervue account → go to "Import Trades" at the top left of the dashboard → select your broker or trading platform from the list provided → follow the specific instructions shown on the right side of the page.

-

Edgewonk Import:

- Generic Excel Template Import: Go to “Settings” > “Import”, select “Generic” from the dropdown menu > Save; download the Excel template, fill in all required fields, and import your closed trades directly.

- Platform Data Import: Go to “Journal” > Click “Import Trades” > Select your platform from the dropdown > follow the on-screen steps to complete the process.

- Edgewonk supports over 60 platforms for fast import including MT4 (auto sync), MT5 (auto sync), IB, Oanda, Capital.com, cTrader, Forex.com, IG, and more.

-

Trademetria Import: Trademetria connects to 19 platforms including MT4/MT5/Webull/Charles Schwab via auto-sync API and supports fast import from 183+ platforms including Oanda, Moomoo, Plus500, IG, etc.

Mobile vs Desktop: User Experience Comparison

| Software | Mobile Support | Mobile UX Rating | Desktop UX Rating | Recommended Use Case |

|---|---|---|---|---|

| TraderVue | ✅ (Web) | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | High-frequency trading, trade review |

| Edgewonk | ❌ | ⭐ | ⭐⭐⭐⭐⭐ | Trade journaling, discipline tracking |

| Trademetria | ✅ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | Tax reporting + visual analysis |

| Portfolio Performance | ❌ | ⭐ | ⭐⭐⭐⭐ | Long-term investment management |

| Excel/Sheets | ✅ (requires internet) | ⭐⭐⭐ | ⭐⭐⭐⭐ | Flexible DIY tracking |

How to Choose the Right Trading Journal for You?

Your choice should depend on your trading habits, goals, and budget. Here's a quick reference guide:

1. By Trading Frequency:

-

High-frequency traders → TraderVue

-

Medium/low-frequency traders → Edgewonk / Excel

2. By Asset Type:

-

Mainly Forex → Edgewonk / Trademetria

-

Stocks + Options → TraderVue

-

Mixed Investments → Portfolio Performance

3. Based on feature preferences:

-

Prefer chart analysis → Trademetria

-

Prefer journaling reviews → Edgewonk

-

Require auto-import → TraderVue / Trademetria

-

Need a free plan → Portfolio Performance / Excel

4. Based on device usage:

-

Frequent mobile use → Trademetria / Google Sheets

-

Desktop only → Edgewonk / Portfolio Performance

Frequently Asked Questions (FAQ)

Q1: Can trade journaling tools sync automatically with MT4?

A: Most tools like Edgewonk and Trademetria support syncing by importing CSV files exported from MT4.

Q2: Are there any free tools for tracking Forex trades?

A: Portfolio Performance and Excel are free solutions for manual tracking of Forex trades.

Q3: Should I choose a desktop app or a mobile app?

A: If you mainly trade and review on a computer, go with a desktop app. If you prefer taking notes anytime, anywhere, Trademetria or Google Sheets would be better choices.

Q4: Will keeping Forex trading records affect my tax filing?

A: Yes. Especially for those trading U.S. stocks or offshore Forex, it’s important to keep detailed records for tax inspections. Trademetria supports tax report exports.

Conclusion: Use your journaling tool to trade like a pro

Keeping a journal is the first step toward improvement. A good trading journal is not just a tool—it becomes your “data coach” and your “psychological mirror.”

Start treating trading professionally today. You can begin with a free Excel template or invest in a premium tool. The key is to start recording and keep optimizing.

[Related Reading] 2025 US Brokerage comparison and recommendation guide | Essential Guide to Investing

[Related Reading] Best Forex Trading Platform Recommendations for 2025: Full Analysis of Regulatory Compliance and Trading Costs

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.