With monthly sales exceeding 40,000, Xiaopeng Automobile has entered a large-scale profit channel.

On August 19, Xiaopeng Automobile announced its second quarter financial report ended June 30.

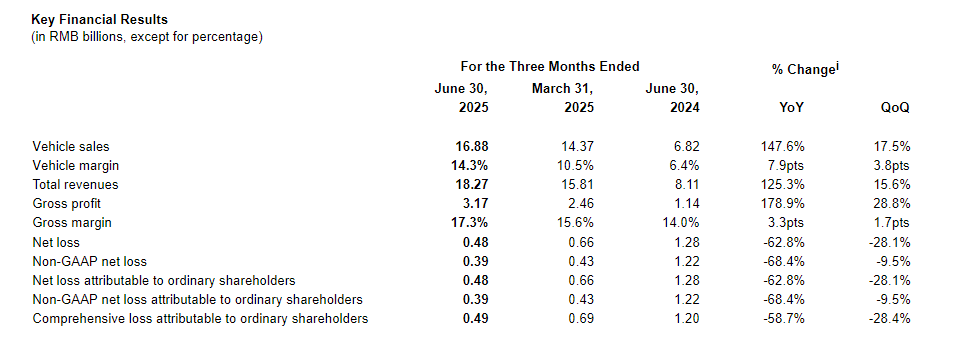

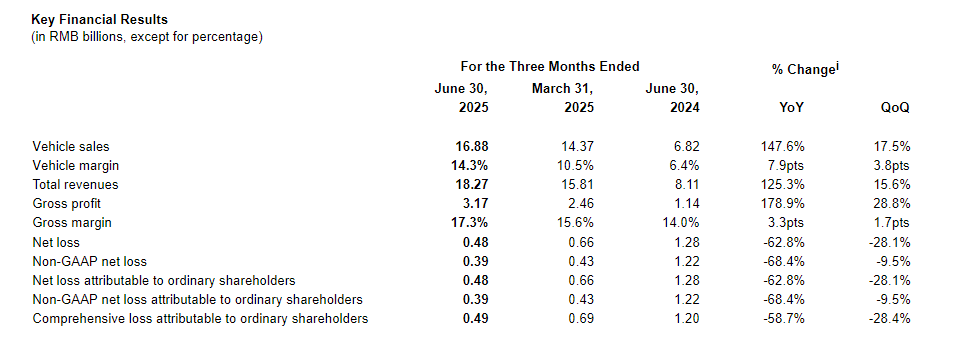

After several years of exploration and adjustment, Xiaopeng has gradually embarked on the track of steady growth and improved profitability.During the quarter, Xiaopeng Automobile achieved revenue of 18.27 billion yuan (RMB, the same below), a year-on-year increase of 125.3%. It not only set a record in the company's history, but also marked its successful achievement of a leap in revenue in the new car building power.

What is particularly eye-catching is that Xiaopeng Automobile's gross profit margin performance exceeded market expectations.The overall gross profit margin reached 17.3%, a year-on-year increase of 3.3 percentage points and a record high; among them, the gross profit margin of automobiles was 14.3%, a year-on-year increase of 7.9 percentage points, and has increased month-on-month for eight consecutive quarters.According to analysis by market research firm Counterpoint, against the background of intensified competition in the entire new energy vehicle market in China, there are only a handful of companies that can achieve sustained gross profit margin improvement. Xiaopeng's performance undoubtedly has strong industry signal significance.

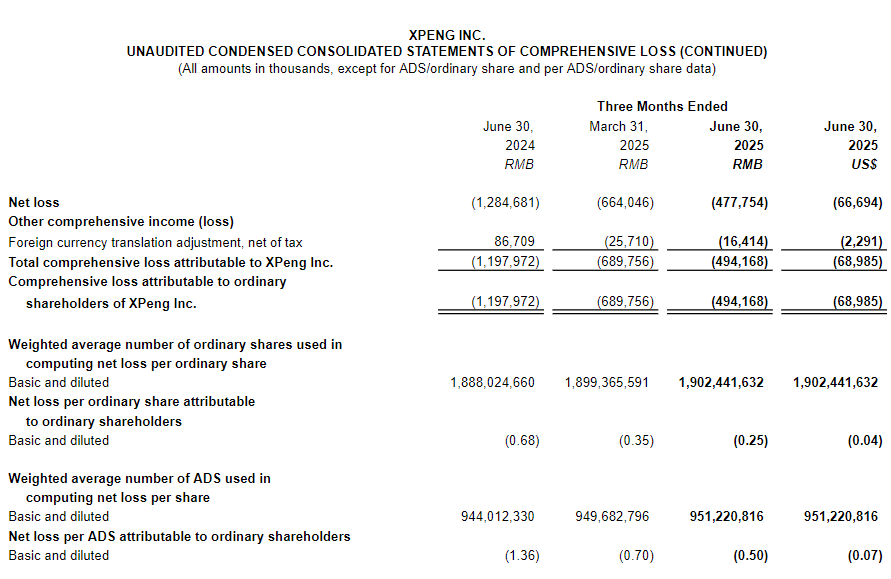

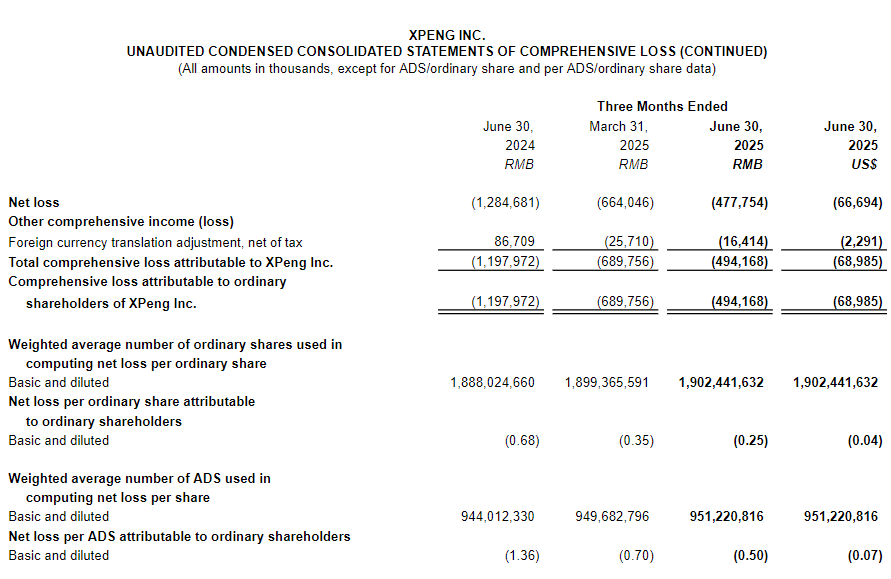

Loss has also been significantly improved.The net loss for this quarter was 480 million yuan, which was significantly narrower than the 1.28 billion yuan in the same period in 2024, indicating that the improvement of its operating efficiency is gradually absorbing the financial pressure brought by high investment in the past.Company management emphasized that this trend will continue to strengthen in the next few quarters and expects to officially achieve full profit in the fourth quarter.

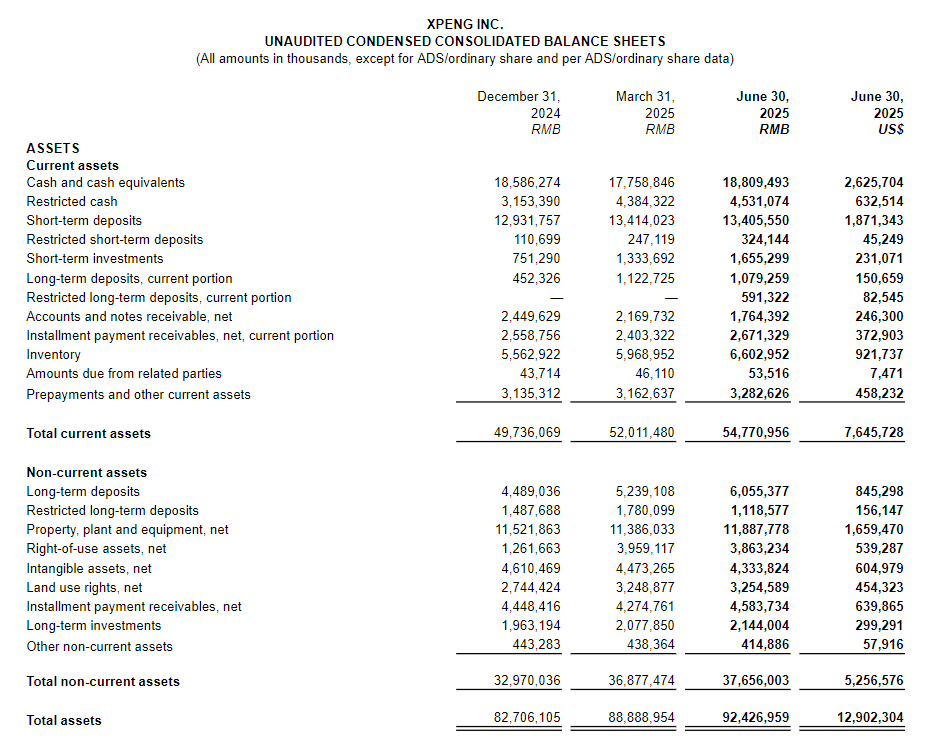

The funding level is equally stable.As of June 30, 2025, Xiaopeng held a total of 47.57 billion yuan in cash, cash equivalents, restricted cash, short-term investments and time deposits, a net increase of 2.29 billion yuan from the end of the first quarter.Analysts pointed out that at the stage of accelerating concentration in the new energy vehicle industry, capital reserves not only represent the company's viability, but also reflect the ticket for future competition.

On the sales side, Xiaopeng Automobile also delivered an eye-catching answer sheet.In the first half of 2025, Xiaopeng delivered a total of 197,200 vehicles, which not only set a new half-year sales record for the brand, but also exceeded the total for the whole year of 2024.The monthly delivery volume in July reached 36,700 vehicles, a year-on-year increase of 229%, a record high.With the intensive launch of new models, including MONA and the upcoming new P7, Xiaopeng has set a new goal of "delivering more than 40,000 vehicles per month" from September. The market is full of expectations for its sales to exceed 400,000 vehicles this year.

Xiaopeng's management further clarified the strategic rhythm at the earnings call.He Xiaopeng said that the new Xiaopeng P7 will be officially launched at the end of August, with the goal of becoming "the top three in the pure electric car market within 300,000 yuan."The "Kunpeng" super electric vehicle model, which is the biggest product of the year, will debut in the fourth quarter.It is understood that in the first half of this year, Xiaopeng has released five modified models, and the rapid pace of product updates is rare in the industry.

In addition to products, Xiaopeng is also actively building a moat of its intelligence and AI technology.In terms of autonomous driving, Xiaopeng proposed that in the next 18 months, the capabilities of the VLA model developed based on Turing AI chips will significantly surpass the industry's mainstream L2/L2+ urban driving assistance systems, approaching the L3 level in safety and full-scene applications, and strive to achieve L4 level mass production by 2026.The Robotaxi project will also begin pilot operations in some areas in 2026, and promises to adopt "front-mounted software and hardware integration" and "picture-free smart driving" technology to avoid the geographical limitations of existing autonomous driving technology.

Xiaopeng has also expanded in the direction of robots.He Xiaopeng revealed in a telephone conference that the company is accelerating the mass production of humanoid robots and plans to release mass-produced robots with preliminary L4 capabilities in the second half of 2026.

The expansion of overseas markets is also one of the highlights of Xiaopeng's strategy for the first half of 2025.At present, the company has officially entered European countries such as the United Kingdom, Italy, Ireland, Finland, Poland and Switzerland, and established a localized production base in Indonesia, becoming its first overseas localized market.Data shows that in the first half of 2025, Xiaopeng delivered a total of 18701 vehicles overseas, a year-on-year increase of 217%.As the adaptation of more right-hand rudder models is completed, Xiaopeng's future potential in markets such as the UK and Australia will be further released.

In terms of technology going abroad, Xiaopeng's cooperation with Volkswagen Group is continuing to deepen.On August 15, the two sides announced an expansion of the scope of strategic cooperation in electronic and electrical architecture technology, which will not only apply to Volkswagen's electric vehicle platforms in China, but also cover its fuel and plug-in hybrid models.Xiaopeng's management stated that cooperation-related income has been recognized since the first quarter of 2024. As the project progresses, this income will become a new profit growth pole for the company.

Investors are generally optimistic about Xiaopeng's prospects.Morgan Stanley released a research report in early August that Xiaopeng's product cycle is synchronized with the profit turning point, which will form strong support for its share price, maintain its "overweight" rating and raise its target price.Goldman Sachs pointed out that Xiaopeng is ahead of its peers in AI and autonomous driving and is expected to form a significant premium during the technology commercialization stage.