White House Backs Down? Trump Denies Intent to Oust Powell; Bessent Says Trade War with China Unsustainable

On Tuesday, financial markets exhibited a rare calm, bolstered by indications from the White House of a more conciliatory approach to trade policies as well as domestic politics.This stability followe

On Tuesday, financial markets exhibited a rare calm, bolstered by indications from the White House of a more conciliatory approach to trade policies as well as domestic politics.

This stability followed months of uncertainty driven by high tariffs and tense negotiations. Two key developments underscored this shift: U.S. Treasury Secretary Scott Bessent's remarks on the unsustainability of the trade war with China and Trump's claim that he has no intention of firing Fed chair Powell, easing concerns about the Fed's independence.

Treasury Secretary: Trade War with China Not Sustainable

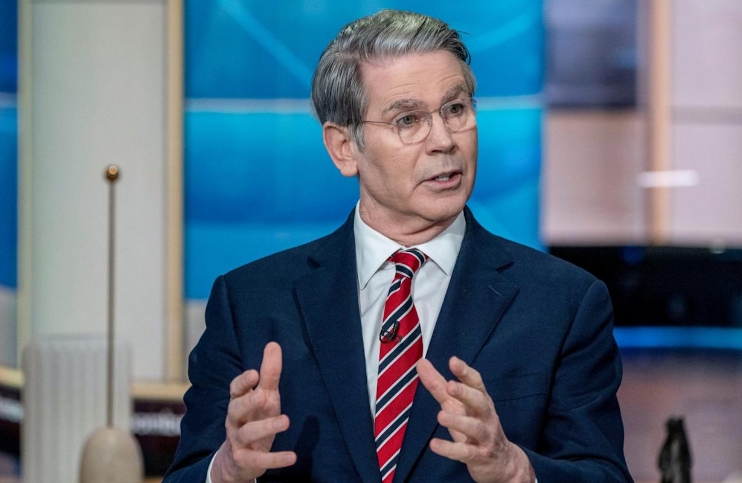

Speaking at a private investor summit hosted by jpmorgan chase & co. in Washington, Treasury Secretary Scott Bessent delivered a frank assessment of the ongoing trade conflict with China.

Addressing a closed-door audience of financial leaders, Bessent declared the current tariff standoff, marked by 145% tariffs on Chinese goods by the U.S. and 125% retaliatory tariffs on American products by China, as unsustainable. "The tariff standoff with China cannot be sustained by both sides," he said, likening the situation to a trade embargo.

Bessent expressed hope that de-escalation could begin soon, potentially easing market pressures in the coming months. However, he tempered expectations, noting that a comprehensive trade agreement might take two to three years to negotiate. He stressed that decoupling from China is not the U.S. goal, but rather a rebalancing of trade dynamics. Bessent criticized China for prioritizing manufacturing over its consumer economy, suggesting that any future deal must allow the U.S. to strengthen its own manufacturing base.

Trump echoed this softer tone later that day. When asked about Bessent's comments, he told reporters, "We're doing fine with Beijing, and I don't anticipate a 'hardball' negotiation." He predicted that the final tariff rate on Chinese goods would fall far below the current 145%, adding, "We're going to be very nice. They're going to be very nice, and we'll see what happens." Trump emphasized that China would need to strike a deal to maintain access to U.S. markets.

The market responded positively, with the S&P 500 climbing 2.5% by the close of trading. The White House also highlighted broader trade efforts, with Press Secretary noting that 18 nations had presented trade offers and the president's team was engaging with 34 countries on potential agreements. While details remain vague, these moves signal an intent to diversify trade partnerships beyond China.

"No Intention" Firing Powell, Easing Concerns About the Fed's Independence

In a separate but equally significant development, Trump addressed speculation about he is privately discussing firing Federal Reserve Chair Jerome Powell.

Despite his repeated vocal frustration and public criticism of Fed's reluctance to cut interest rates more aggressively, Trump dismissed rumors of Powell's dismissal. "Never did," he told reporters. "I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates."

Trump's comments followed a turbulent period marked by his sharp criticism of Powell, including a social media post declaring, "Powell's termination cannot come fast enough!" The president has argued that faster rate cuts are needed to counter global economic pressures, such as the trade war's fallout. His economic advisor had previously hinted that Trump was exploring options to remove Powell, a suggestion that unsettled markets.

The Federal Reserve, however, has maintained a steady hand. After reducing rates by a full percentage point in late 2024, the Fed has kept them unchanged this year. With inflation lingering above the 2% target for four years, Fed officials argue that the current policy strikes the right balance. Last year, the U.S. economy grew at a robust 2.8%, but economists warn that persistent tariffs could slow growth in 2025, potentially forcing the Fed to choose between stimulating the economy and curbing inflation.

After Trump's changed tone about the Fed chair, treasuries and the dollar showed greater stability later on Tuesday. While the 10-year Treasury yield barely budged, two-year yields rose to 3.82% after lackluster demand for an auction. The dollar index held around 99.5 on Wednesday after surging more than 1% in the previous session

Looking Ahead: Cautious Optimism

Tuesday's events offered a reprieve from the volatility that has defined recent months.

The White House's softened stance on trade, coupled with Trump's reassurance on Powell's tenure, fostered a sense of stability that resonated with investors. Yet, challenges loom large. A lasting resolution with China remains distant, and the Fed faces a delicate balancing act as tariff policies threaten both growth and inflation.

For now, the markets—and the public—await further clarity. The coming months will reveal whether this calm is a stepping stone to meaningful progress or a fleeting pause before renewed uncertainty.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.