2025 Futu Securities Hong Kong IPO Guide: Complete Tutorial from Account Opening to Allotment for Beginners

Learn Hong Kong IPO investment from scratch with Futu! This guide covers account opening steps, deposit tips, subscription process, strategies to boost allotment odds, fee breakdown, and dark pool trading insights. Your 2025 ultimate roadmap to navigate risks and profit from Hong Kong new stock investments.

Recently, the Hong Kong stock market has witnessed a boom in new stock listings, with a large number of high-quality enterprises listing on the Hong Kong Stock Exchange. Investment opportunities in the primary market have attracted significant attention. As a low-threshold way to participate in the listing dividends of high-quality enterprises, Hong Kong IPO subscription has become a popular investment choice among ordinary investors due to its relatively high success rate and flexible operation. Among numerous securities firms, Futu Securities has become a popular choice for Hong Kong IPO subscription due to its strong compliance, preferential fees, and convenient operation.

Futu Securities (Nasdaq: FUTU), as a digital financial technology company listed on Nasdaq, its subsidiaries hold all Type 1/2/3/4/5/7/9 licenses issued by the Hong Kong Securities and Futures Commission (Central Number: AZT137), so there is no need to worry about compliance. For subscription users, Futu not only offers 0 handling fee for ordinary subscriptions and transparent financing interest rates but also realizes the entire process of new stock tracking, subscription, allotment inquiry, and dark pool trading online through the Futu Niuniu APP, making it easy for beginners to get started.

This article will comprehensively analyze Futu's Hong Kong IPO subscription skills from basic rules, Futu's advantages, account opening and fund deposit to practical processes, helping you avoid 90% of beginner pitfalls and efficiently seize new stock investment opportunities.

I. Basic Knowledge of Hong Kong IPO Subscription

1. What is Hong Kong IPO Subscription?

Hong Kong IPO subscription refers to participating in the initial public offering (IPO) of Hong Kong-listed companies. Investors subscribe for new shares through the primary market and can sell them for profit on the first day of listing or in dark pool trading after being allotted. Unlike secondary market trading, subscription takes place before the company is listed, and the profit logic mainly relies on the stock price rise after the new stock is listed.

2. Core Rules of Hong Kong IPO Subscription

- Issuance Structure: Hong Kong IPO is divided into international placing (accounting for more than 90%, for institutional investors) and public offering (for retail investors). There is an over-allotment mechanism — when the over-subscription multiple of the public offering meets the standard, some quotas will be reallocated from the international placing to retail investors, which can account for up to 50% of the total issuance, increasing retail investors' chances of getting allotments.

- Allotment and Refund: Allotment results are usually announced on the trading day before listing, and allotted shares will be credited to the account on the same day; funds for unallotted shares or the difference between the subscription amount and the final offering price will be returned to the account on the same day.

- Subscription Unit: The minimum subscription quantity is "one lot", and the specific number of shares per lot is specified in the prospectus (such as 100 shares per lot, 200 shares per lot). Investors must choose the quantity according to the "subscription combinations" listed in the prospectus, and applications beyond the scope will be rejected.

- Pricing Methods: There are three types: fixed price (offering price determined before subscription), price range (price range determined before subscription, and the final price is determined by institutional subscription situation), and flexible pricing (can be issued at a 10% discount from the lower limit of the range). The specific method is subject to the prospectus.

- Public Offer: The allocation ratio for retail investors, usually accounting for 10%-20% of the total issuance.

- Institutional Offer: The allocation ratio for institutional investors, accounting for a higher proportion.

-

Core concepts involved in Hong Kong IPO subscription include:

- Clawback Mechanism: If the public offering is undersubscribed, funds from the international placing will be clawed back to the retail portion.

- Green Shoe Protection Period: Within 30 days after listing, if the stock price is lower than the offering price, the issuer can use the over-allotment option to stabilize the stock price.

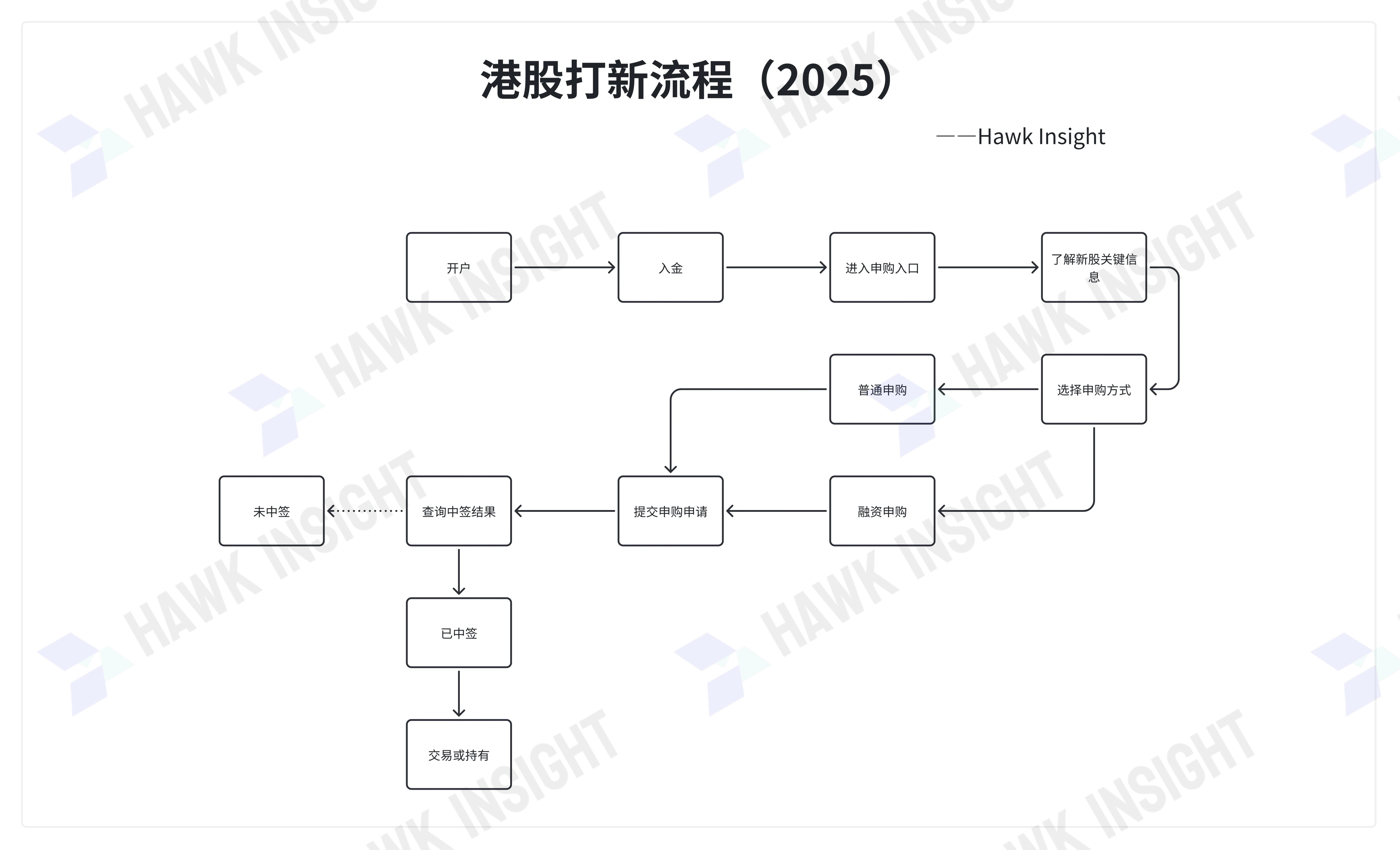

3. Overview of Hong Kong IPO Subscription Process

Hong Kong IPO subscription is divided into the following stages:

1. Subscription Stage: Investors submit subscription applications through securities firms, which requires locking funds or financing limits.

2. Pricing Stage: The Hong Kong Stock Exchange determines the final offering price according to market conditions.

3. Allotment Stage: The Hong Kong Stock Exchange announces the allotment results after the subscription deadline.

4. Listing and Trading: New shares are officially traded on the Hong Kong stock market, and investors can choose to hold or sell them.

4. Hong Kong IPO Subscription vs A-share IPO Subscription: Key Differences

| Comparison Item | Hong Kong IPO Subscription | A-share IPO Subscription |

| Allotment Rate | Relatively high (retail proportion can be increased through clawback) | Extremely low (intense competition, pure probability game) |

| Threshold | Low (starts from one lot, accessible with thousands of yuan) | High (requires holding A-share market value; higher value means more quota) |

| Risk | Possibility of breaking issue price (need to screen targets) | First-day gain is limited, low probability of breaking issue price |

| Trading Flexibility | Supports dark pool trading (can trade before listing) | No dark pool, can only trade after listing |

‼️ Risk Warning: Hong Kong IPO subscription is not a risk-free arbitrage. Attention should be paid to the risk of breaking the issue price (the first-day break rate of Hong Kong IPOs has been about 40% in recent years) and the leverage risk of margin subscription.

II. Advantages of Futu IPO Subscription: Why Choose Futu Securities?

1. What is Futu?

Futu Securities is an integrated financial service provider headquartered in Hong Kong, offering trading services for Hong Kong stocks, US stocks, A-shares, and cryptocurrencies. Its one-stop platform supports the entire process of account opening, fund deposit, IPO subscription, and trading. It particularly excels in Hong Kong IPO subscription, providing new stock calendars, margin subscription tools, and risk control functions to help users efficiently participate in IPOs.

moomoo is an English trading platform under Futu, designed specifically for international investors. It focuses on the US stock market, supports zero-commission trading and multilingual services, and also covers Hong Kong stocks and A-shares (through Shanghai-Hong Kong Stock Connect / Shenzhen-Hong Kong Stock Connect). The two platforms work synergistically to help users flexibly manage global assets and lower the threshold for Hong Kong IPO subscription.

2. Compliance Assurance: Full License Coverage, Worry-Free Fund Security

Futu Securities International (Hong Kong) Limited holds Type 1/2/3/4/5/7/9 licenses issued by the Hong Kong Securities and Futures Commission, enabling it to legally provide full-range services such as securities trading, futures contracts, and asset management. It is also a participant in core institutions like the Stock Exchange of Hong Kong and Hong Kong Securities Clearing Company. Fund custody and trading processes are strictly regulated, so users do not need to worry about compliance risks.

3. Fee Advantages: Low-Cost Participation, More Savings and Peace of Mind

- Subscription Handling Fee: 0 handling fee for ordinary subscriptions (applicable to new stocks offering after October 24, 2024). Bank margin subscription only costs HK$100 per transaction (charged regardless of allotment result), which is more advantageous compared to hundreds of yuan charged by some securities firms.

- Financing Interest Rate: The annualized interest rate for Hong Kong stock financing is 6.8%, calculated based on actual financing days, with on-demand borrowing and repayment, and transparent costs.

- Other Fees: 0 fee for fund subscription and redemption, commission-free trading for Hong Kong stocks (during the commission-free period), and dark pool trading fees are the same as ordinary Hong Kong stocks without additional markup.

4. Convenient Operation: One-Stop APP Process, Easy for Beginners

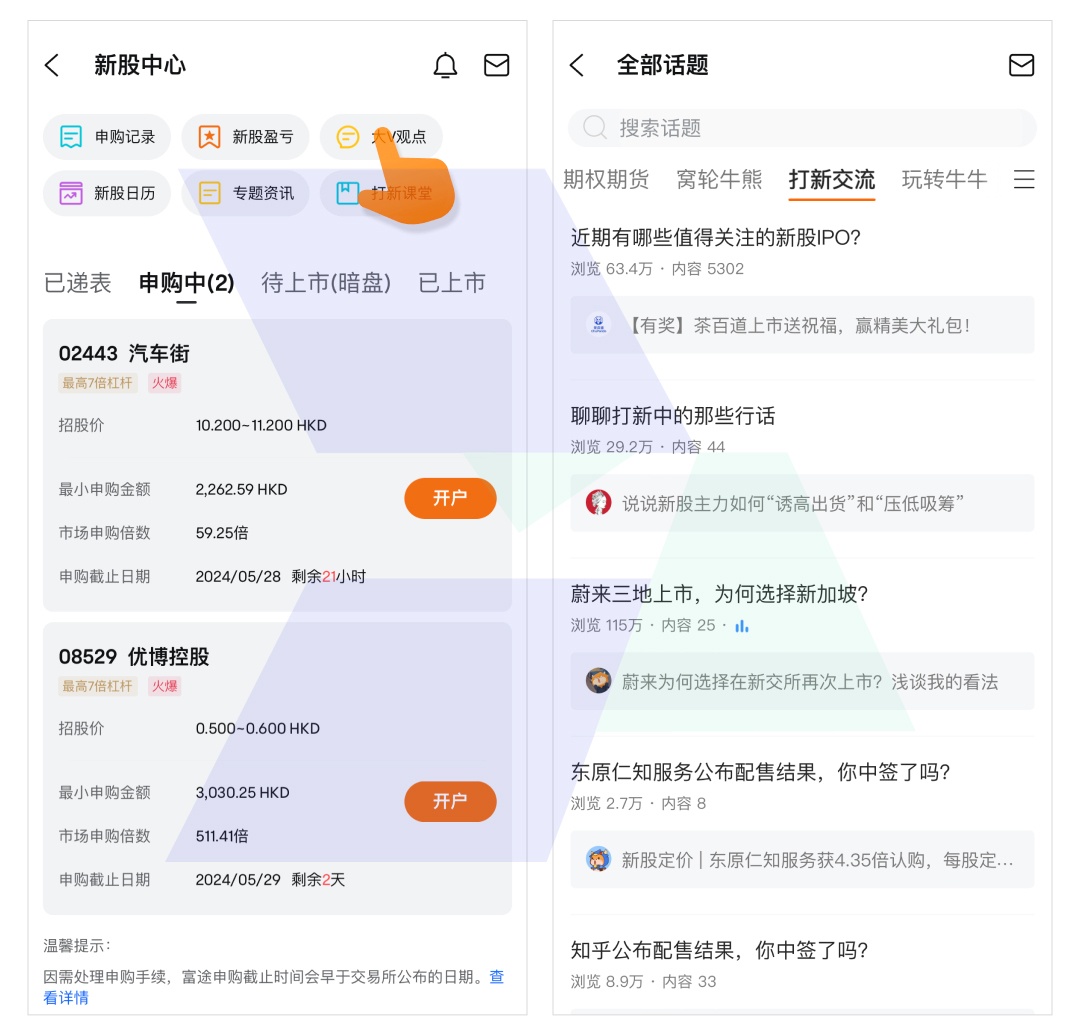

- New Stock Center Function: The "New Stock Center" in the Futu Niuniu APP displays all stages of new stocks in real-time, including "Filed, Subscribing, Pending Listing, and Listed". It supports viewing key information such as offering price, subscription multiple, and sponsor, with one-click access to the subscription page.

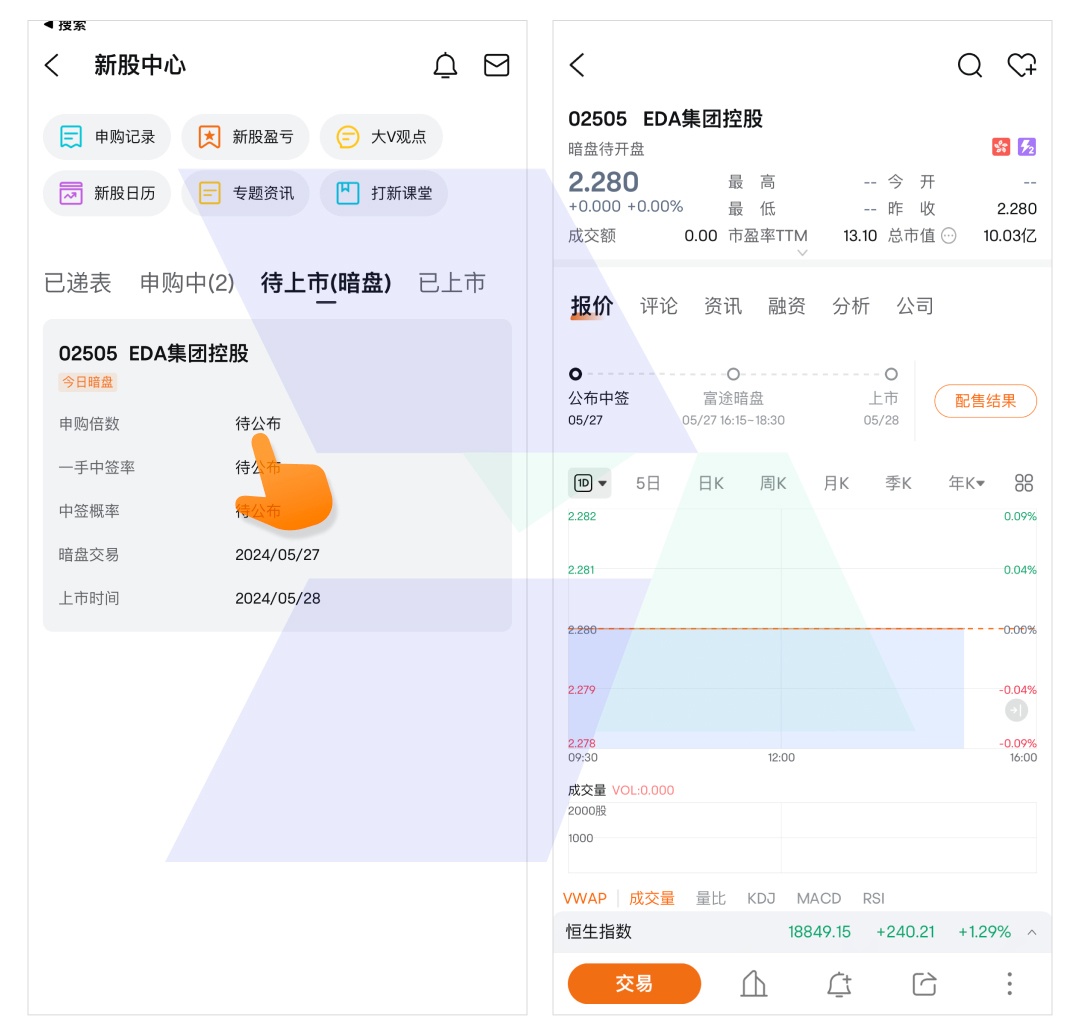

- Dark Pool Trading Support: Dark pool trading is available from 16:15 to 18:30 on the trading day before listing, allowing early profit locking or stop-loss to avoid first-day listing volatility risks.

- Process Visualization: The entire process of subscription records, allotment results, and fund changes can be tracked, with clear operation steps that require no complex learning.

5. Flexible Fund Management: Multi-Currency Support, Efficient Cross-Market Utilization

- Multi-Currency Deposit: Supports deposits in HKD, USD, offshore RMB, JPY, and other currencies to meet the needs of users in different regions.

- Real-Time Currency Exchange: Funds can be exchanged into the target currency in real-time after deposit. Efficient cross-market fund transfer for Hong Kong stocks, US stocks, and A-share Connect avoids exchange rate losses.

- Diverse Deposit Methods: Hong Kong users can use eDDA instant deposit (5-minute arrival, 0 fee), FPS transfer, etc., for quick fund arrival. Mainland and overseas users support online banking transfer with a simple process.

III. Preparations for Futu Securities Hong Kong IPO Subscription

1. Account Opening and Preparation

To participate in Hong Kong IPO subscription, opening a Futu Hong Kong stock trading account is the first step. The process is as follows:

1.1 Online Account Opening (Recommended)

- Applicable Users: Users from all regions, complete account opening without leaving home

- Required Documents:

- Identity document (Hong Kong residents provide permanent/non-permanent identity card; residents of other regions provide passport or local identity card);

- Address proof (issued within the last 3 months, including name, address, institution name, and date, such as utility bills, bank statements, phone bills, etc.).

- Attachment: Detailed Document List

- Process Steps:

- Download the Futu Niuniu APP, register an account, and enter the "Hong Kong and Overseas User Account Opening" page;

- Select "Online Transfer Account Opening", upload identity documents and address proof, and fill in information such as occupation, financial status, and investment experience;

- Complete risk disclosure, identity verification (SMS verification), and electronic signature, then submit and wait for review (1-2 working days).

1.2 Offline Witnessed Account Opening (For Hong Kong Local Users)

- Applicable Users: Hong Kong residents or users in Hong Kong

- Two Methods:

- Online Reservation: Select "Offline Witnessed Account Opening" through the Futu APP, reserve a witness point at Tsim Sha Tsui, Causeway Bay, etc., and the time, then bring documents to the site for processing;

- Visit Headquarters in Person: Go directly to Futu's headquarters at 34th Floor, United Centre, 95 Queensway, Hong Kong, no reservation required, submit documents on-site to open an account.

1.3 Account Opening Notes

- Users opening an account online in Hong Kong for the first time need to deposit at least HK$10,000 for the first time; other account opening methods have no mandatory deposit threshold;

- Identity documents and address proof must be clear and complete, avoiding reflections, blurriness, or missing corners (otherwise, review may be rejected);

- Tax information must be filled in truthfully; Hong Kong tax residents need to provide a tax identification number.

2. Fund Deposit Guide: Multiple Options, Quick Arrival Without Pitfalls

After completing account opening, depositing funds is a key step to participate in Hong Kong IPO subscription. So how to deposit funds in Futu? Futu provides a variety of convenient deposit methods, supporting HKD, USD, RMB, and other currencies to meet the needs of different users.

2.1 Supported Deposit Methods and Comparison

| Deposit Method | Applicable Users | Arrival Time | Handling Fee | Operation Difficulty |

| eDDA Instant Deposit | Hong Kong Bank Card Users | 5 minutes | Free | Simple (In-APP Authorization) |

| FPS Transfer | Hong Kong Bank Card Users | 2 hours | Free | Medium (Online Banking + Notify Futu) |

| Securities-Bank Transfer | Hong Kong Bank Card Users | 5 minutes | Free | Simple (Initiated in APP) |

| Online Banking Transfer (Hong Kong) | Hong Kong Bank Card Users | 2 hours for same bank / 1-3 days for inter-bank | Free for Futu, bank may charge | Medium (Online Banking Operation + Notify Futu) |

| Online Banking Transfer (Overseas) | Users in USA / Taiwan / Other Regions | 3-5 trading days | Free for Futu, bank may charge | Relatively complex (Need to obtain Futu's receiving account) |

2.2 Key Tips for Fund Deposit

- Same-Name Account Requirement: The name of the bank account for transfer must be consistent with the name of the Futu account. Transfers from third-party accounts will be refunded, and the fees shall be borne by the user;

- Holiday Rules: Banks and Futu do not process remittances on Hong Kong public holidays. Please reserve 1-3 working days as a buffer;

- Prohibited Channels: Cash, e-wallets, and third-party payments (such as overseas money changers) are not accepted for deposit. Such funds may be rejected and returned;

- Notify Futu: For some methods (such as FPS and online banking transfer), you need to initiate a "deposit notification" through the APP after the transfer. Otherwise, if no notification is made within 20 days, the bank may refund the money.

3. Account Type Selection: Choose the Right Account for More Flexibility

- Margin Account (Recommended): Supports multi-market trading including Hong Kong stocks, US stocks, and A-share Connect. It allows margin leverage for IPO subscription and enjoys the margin limit of held stocks, resulting in higher capital utilization.

- Cash Account: Only supports trading of Hong Kong stocks, funds, and bonds, with no margin function. Suitable for users with low risk tolerance who only need basic trading functions.

IV. Practical Process of Futu Securities Hong Kong IPO Subscription

1. Initiate New Stock Subscription via App

Step 1: Enter the Subscription Entry

- Path: Futu Niuniu APP → Market → Hong Kong Stocks → Highlight Tools → New Stock Center → "Subscribing" list, select the target new stock and click "Subscribe";

- Note: Ensure the APP version is v13.47.14108 or higher; otherwise, some functions may be missing.

Step 2: Understand Key Information of the New Stock

In the Futu Niuniu App, view new stock details through the following path:

Market Page > Hong Kong Stocks > New Stock Center > Filed / Subscribing / Pending Listing.

Key information includes:

- Offering Price Range: For example, the offering price of a new stock is HK$10-12 per share.

- Cornerstone Investors: If well-known institutions (such as Goldman Sachs, Morgan Stanley) participate in cornerstone investment, it usually indicates strong market confidence.

- Sponsor Background: The qualification of the sponsor affects the stability of the IPO, and large investment banks are usually more reliable.

Step 3: Select Subscription Quantity

- The system displays default subscription combinations specified in the prospectus (such as 1 lot, 2 lots, 5 lots, etc.). To customize the quantity, click [Subscribe Other Quantities] to choose;

- Note: The subscription quantity for each new stock must strictly comply with the scope specified in the prospectus. Applications beyond the scope will be rejected by the exchange.

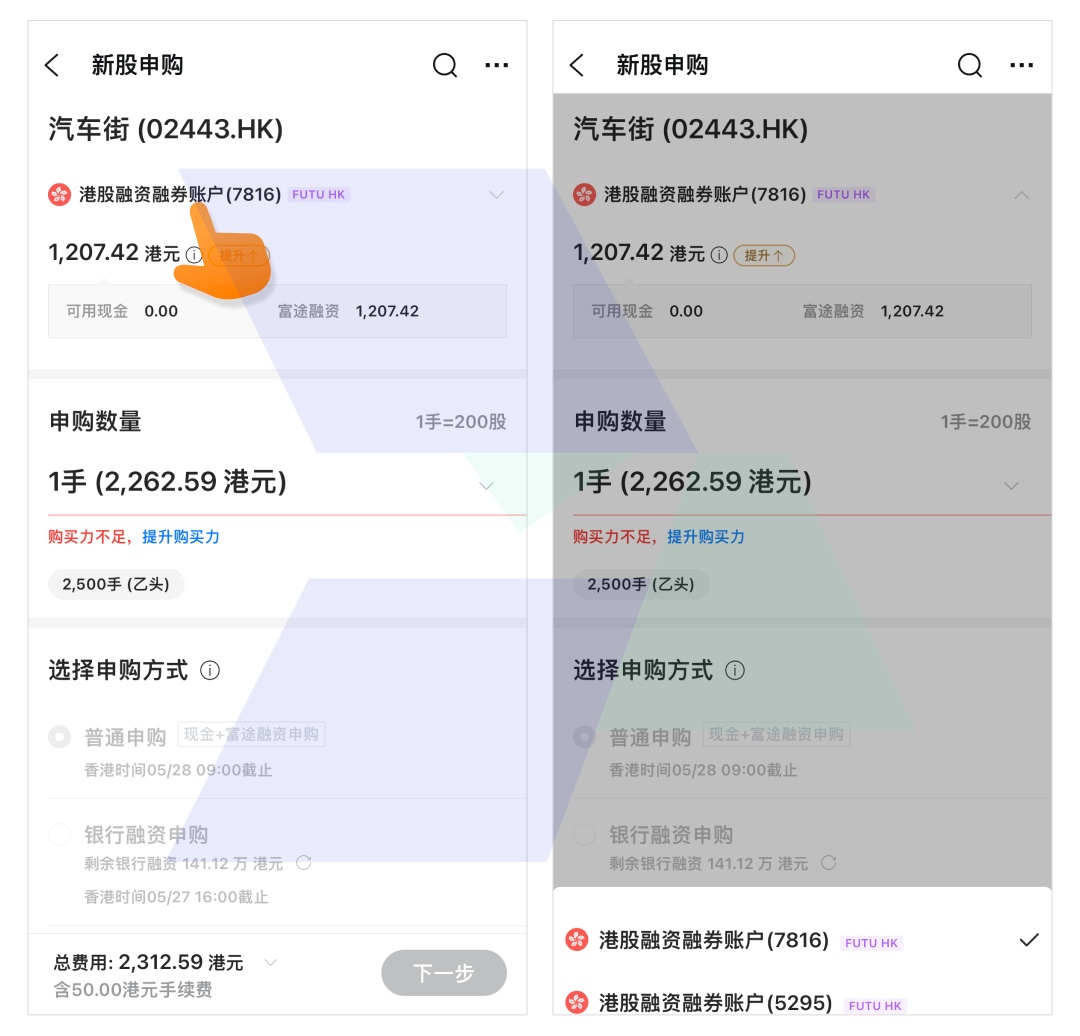

Step 4: Select Subscription Method (Choose One)

- Ordinary Subscription: Funds are sourced from the cash available for withdrawal in the account or the Futu financing limit secured by held assets. Maximum subscribable amount = available principal, 0 handling fee;

- Bank Margin Subscription: In addition to own funds, bank financing amount can be added (leverage ratio is subject to the display on the page). Maximum subscribable amount = available principal × leverage ratio, handling fee is HK$100 per transaction (charged regardless of allotment result).

Step 5: Confirm Information and Submit

- Verify the subscription quantity, method, total fees (including handling fees) and subscription statement, check "I have read and agree to the terms", and click "Submit Subscription Application";

- After submission, funds will be frozen in real-time (no interest is accrued during freezing). You can check the status in "New Stock Center → Subscription Records".

- Operation Details:

- Subscription deadline: 9:00 AM (10:30 AM for some projects).

- The subscription quantity must be an integer multiple of the minimum unit (e.g., 1000 shares).

- Notes:

- Subscriptions cannot be canceled after submission. Ensure the account balance or financing limit is sufficient.

2. Allotment Result Inquiry and Fund Handling

Allotment results are usually announced at 17:00 on the trading day before listing (subject to the announcement of the Hong Kong Stock Exchange).

Inquiry Methods:

- In-App Inquiry: Market > Hong Kong Stocks > New Stock Center > Subscription Records > Click "Details".

- Email Notification: Users who are allotted shares will receive an official email notification from Futu.

Fund Change Rules:

- Not Allotted: Subscription funds will be returned within 1-3 working days after the allotment announcement.

- Allotted: The subscription amount (including financing interest) will be deducted, and the position will be updated automatically.

- Financing Interest Deduction: Interest will be calculated based on the actual financing days on the allotment announcement date.

3. Trading Options

- Dark Pool Trading: From 16:15 to 18:30 on the trading day before listing, operate in "New Stock Center → Pending Listing (Dark Pool)" to lock in profits or stop losses in advance;

- First-Day Trading: Enter the position page on the listing day of the new stock and sell directly to enjoy the first-day volatility gains.

- Dark Pool Trading Rules:

- Applicable Users: Only professional investors (users meeting the asset threshold).

- Trading Hours: 16:00-18:00 on the trading day before listing (not all new stocks have dark pool trading).

- Notes: Dark pool prices do not predict the first-day performance after listing; operate with caution.

- First-Day Operation Suggestions:

- Selling Strategy:

- Stocks Breaking Issue Price: It is recommended to sell immediately after opening to stop losses.

- Stocks with Gains: Decide whether to hold based on the subscription success rate (e.g., allotment rate × profit probability).

- Risk Control:

- For margin subscriptions, monitor the account's maintenance margin ratio to avoid Margin Call (example: if the margin ratio is below 130%, additional margin is required).

- Selling Strategy:

V. Fee Details: How Much Does Futu IPO Subscription Cost?

Although Hong Kong IPO subscription seems to have a low threshold, it actually involves multiple fees. Investors need to understand the cost structure in advance and plan funds reasonably. The following are the core fee details and comparative analysis of Futu Securities' Hong Kong IPO subscription:

1. Ordinary Subscription Fees

- Subscription Handling Fee: Free (for new stocks offering after October 24, 2024).

- Trading Fees After Allotment: If you participate in dark pool or listing trading after being allotted, the following fees apply (taking Hong Kong stocks as an example):

- Commission: 0.03% of the transaction amount, minimum HK$3 per transaction (not charged during the commission-free period).

- Platform Usage Fee: HK$15 per order.

- Clearing Fee: 0.002% × transaction amount, minimum HK$2, maximum HK$100.

- Stamp Duty: 0.1% × transaction amount, less than HK$1 is calculated as HK$1.

- Transaction Fee: 0.00565% × transaction amount, minimum HK$0.01.

Example: If you are allotted 1000 shares and sell them at HK$10 per share on the first day of listing, with a total transaction amount of HK$10,000, the fees are as follows:

- Commission: 10,000 × 0.03% = HK$3.

- Platform Usage Fee: HK$15.

- Clearing Fee: 10,000 × 0.002% = HK$2.

- Stamp Duty: 10,000 × 0.1% = HK$10.

- Transaction Fee: 10,000 × 0.00565% = HK$0.57. Total Fees: 3 + 15 + 2 + 10 + 0.57 ≈ HK$30.57.

2. Margin Subscription Fees

-

Bank Margin Subscription:

- Handling Fee: HK$100 per transaction (charged regardless of allotment result).

- Financing Interest: 0 (directly charged by the bank, not collected by Futu).

- Futu Margin Subscription:

- Interest: Annualized 6.8% (calculated daily, charged monthly).

- Formula: Interest = Financing Amount × 6.8% × Actual Financing Days ÷ 365

- Applicable Scenario: If the account funds are insufficient, Futu automatically uses the financing limit to complete the subscription.

- Example: If you subscribe for HK$1 million through Futu financing for 3 days: Interest = 1,000,000 × 6.8% × 3 ÷ 365 ≈ HK$556

3. Other Potential Fees

- Dark Pool Trading Fee: If participating in dark pool trading (limited to professional investors), the fee is the same as ordinary Hong Kong stock trading, but an additional dark pool platform usage fee of HK$15 per transaction is required.

- Margin Call: If the account's maintenance margin ratio is below 130% after margin subscription, additional margin is required; otherwise, Futu has the right to liquidate part of the positions.

4. Fee Comparison and Optimization Suggestions

| Fee Type | Ordinary Subscription | Bank Margin Subscription | Futu Margin Subscription |

| Subscription Handling Fee | 0 | HK$100/transaction | 0 |

| Financing Interest | 0 | 0 (Directly charged by the bank) | Annualized 6.8% |

| Trading Fees After Allotment | Same as ordinary Hong Kong stock trading (see example) | Same as ordinary Hong Kong stock trading (see example) | Same as ordinary Hong Kong stock trading (see example) |

| Suitable Users | Users with sufficient funds | Users needing high leverage with limited funds | Users with insufficient funds but accepting financing interest |

- Users with sufficient funds: Prioritize ordinary subscription to avoid financing interest costs.

- Users with high leverage needs: Bank margin subscription has a fixed handling fee, suitable for short-term capital needs.

- Users with insufficient funds: Futu margin subscription is flexible, but attention should be paid to interest costs (calculated daily).

VI. Tips to Improve Allotment Rate: Proven Strategies by Futu Users

1. Subscription Strategy: Flexibly Choose Based on Capital Amount

- One-Lot Subscription Method: Suitable for beginners with limited funds (tens of thousands of yuan). Hong Kong IPO subscription has a "inclusive mechanism" for retail investors. Subscribing one lot has a relatively balanced allotment probability, avoiding "empty-handed" due to scattered funds.

- Margin Subscription for Popular Stocks: For new stocks with high over-subscription multiples and high market attention (such as technology and consumer stocks), bank financing can be used to increase the subscription quantity (e.g., 10x leverage) to improve allotment chances. Note: After clawback for popular stocks, the retail proportion increases, making margin subscription more cost-effective.

- Avoid "Top Lot" Crowding: "Top lot" refers to subscribing the maximum allowed quantity. Although it may get more allotments, competition is fierce, suitable for users with huge capital; ordinary users can choose "Second Top" (subscription amount of HK$500,000 - HK$1,000,000) for a more balanced allotment probability and cost.

2. Timing Selection: Avoid Peaks, Improve Efficiency

- Subscribe in Advance: The new stock subscription period is usually 3-4 days. It is recommended to submit the application 1-2 days after the subscription starts to avoid system congestion in the last hour and reduce subscription failures due to network issues.

- Pay Attention to Deadline: Ordinary subscriptions close in batches. Try to submit in the first batch (before 09:00) to avoid impact from insufficient quota or system delays in the second batch.

3. Fund Arrangement: Flexible Cross-Market Allocation

- Use "Unified Purchasing Power": After enabling Futu's unified purchasing power, cash and stock assets in US stock/A-share Connect accounts can be used as collateral to increase Hong Kong IPO subscription limits. Example: US$100,000 cash in a US stock margin account can generate approximately HK$770,000 subscription purchasing power at an exchange rate of 1:0.13 (HKD to USD).

- Stagger Fund Freezing Periods: Check the subscription and unfreezing times of multiple new stocks through the "New Stock Calendar" to avoid simultaneous fund freezing and improve capital utilization. Example: New Stock A is frozen for 3 days; you can subscribe for New Stock B after it is unfrozen.

4. Other Practical Tips

- Family Account Diversified Subscription: Subscriptions by the same person using different accounts may be canceled. It is recommended to open independent accounts with family members' identities for diversified subscriptions to improve the overall allotment probability.

- Priority to New Stocks with Green Shoe Mechanism: The green shoe mechanism (over-allotment option) allows underwriters to buy stocks to stabilize prices if they break the issue price, reducing the risk of breaking issue price. Such new stocks are more reliable for subscription.

Conclusion: Start Your Futu Hong Kong IPO Subscription Journey

Hong Kong IPO subscription is an opportunity to participate in the growth of high-quality enterprises with low thresholds, but it is not "risk-free arbitrage". Choosing Futu Securities, you can efficiently participate in subscriptions with its compliance guarantees, fee advantages, and convenient operations. However, remember to "respect the market and choose rationally" — select targets based on your risk tolerance, use financing leverage reasonably, and avoid overvalued and high-risk new stocks. New user action list:

- Download the Futu Niuniu APP and complete account opening (prepare identity documents + address proof);

- Make the first deposit (Hong Kong users are recommended to use eDDA instant deposit, arriving in 5 minutes);

- Enter the "New Stock Center" to follow the offering time of recent popular new stocks;

- Start with one-lot ordinary subscription, accumulate experience, and gradually use margin strategies.

Final Reminder: The stock market is risky, and investment needs to be cautious. The tools and benefits provided by Futu can improve the subscription experience, but the final return depends on market conditions and target selection. It is recommended to make decisions based on professional analysis and your own situation.

Frequently Asked Questions (FAQ): Solving 90% of Users' Subscription Doubts

Hong Kong IPO subscription involves complex rules and various fees, and users often have questions. The following are high-frequency questions and answers about Hong Kong IPO subscription on the Futu platform to help you quickly grasp the key points.

1. Where is the entry for Futu's Hong Kong IPO subscription?

Answer: Futu Niuniu APP → Market → Hong Kong Stocks → Highlight Tools → New Stock Center → "Subscribing" list, select the target new stock and click "Subscribe".

2. Can ordinary subscription and bank margin subscription be applied for the same new stock simultaneously?

Answer: No. Only one subscription method can be chosen for the same new stock. Ordinary subscription and bank margin subscription cannot be submitted simultaneously.

3. Can I modify or cancel the application after subscription?

Answer: It depends on the subscription method and deadline:

- Ordinary subscription: Can be modified/canceled before the first batch deadline (09:00), not after; the second batch (for some new stocks) can be operated before 09:00-10:30, not after.

- Bank margin subscription: Can be modified/canceled before the deadline (09:00), not after.

4. How long does it take for unallotted funds to be returned to the account?

Answer: On the allotment result announcement date (the trading day before listing), unallotted subscription funds (excluding handling fees) will be automatically returned to the account and can be immediately used for other investments.

5. Does Futu support Hong Kong stock dark pool trading? What are the trading hours?

Answer: Yes. Dark pool trading hours are 16:15-18:30 on the trading day before the new stock listing. Path: APP → New Stock Center → Pending Listing (Dark Pool), where you can trade allotted stocks in advance.

6. Are there special requirements for Hong Kong SPAC IPO subscription?

Answer: Yes. Professional investor certification is required, with a minimum subscription amount of HK$1,000,000 per lot. There is no dark pool trading, and attention should be paid to the SPAC merger deadline (must announce the merger target within 24 months of listing and complete the merger within 36 months).

7. What to do if "insufficient funds" is prompted after subscription?

Answer: It can be solved in the following ways:

- Deposit funds: Deposit through eDDA, FPS, etc. After arrival, funds will be automatically unfrozen for subscription;

- Release purchasing power: Sell held stocks to release cash available for withdrawal;

- Enable unified purchasing power: Use US stock/A-share Connect assets as collateral to increase subscription limits.

8. What Should Be Noted for SPAC Subscription?

Answer:

- Confidentiality Agreement: Subscribing to SPAC requires signing a Confidentiality Agreement, and some projects are limited to professional investors only.

- Merger Uncertainty: SPAC must complete a merger within 24 months of listing. If it fails, funds will be refunded, and the risk is relatively high.

- Lock-up Period Rules: Class B shares held by SPAC sponsors must be locked up for 12 months after the merger is completed.

Recommendation: Carefully evaluate the background of SPAC sponsors and the potential of merger targets, and prioritize projects sponsored by top investment banks.

9. What is a Margin Call? How to Avoid It?

Answer:

- Definition: If the account's maintenance margin ratio falls below 130% after margin subscription, Futu will notify you to add margin; otherwise, it has the right to force liquidation.

- Prevention Methods:

- Reserve sufficient cash before subscription (it is recommended to set aside 20% of the financing amount as a safety cushion).

- Choose low leverage ratios (e.g., within 2x).

- Avoid subscribing to new stocks with a high probability of breaking the issue price.

Example: If you finance HK$1 million to subscribe for a new stock, the account's market value must be ≥ HK$1.3 million (HK$1 million × 1.3).

10. Do I Need to Pay Attention to Exchange Rate Fluctuations for Hong Kong IPO Subscription?

Answer:

- Deposit Currency: Futu supports deposits in USD, RMB, and HKD. Exchange rate fluctuations may affect the actual financing limit.

- Settlement Currency: Hong Kong stock transactions are denominated in HKD. If you deposit in RMB, you need to pay attention to the RMB-to-HKD exchange rate (approximately 1 HKD ≈ 0.91 RMB).

- Hedging Strategy: Users with large financing amounts can lock in exchange rate costs through foreign exchange forward contracts.

Recommendation: Exchange rate fluctuations can be ignored for small-amount subscriptions. For large-amount financing, prioritize depositing in HKD.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.