2025 Hong Kong Forex Platforms Review: Top 10 SFC-Licensed Brokers Compared

Exclusive analysis of Phillip Securities, HSBC, IG & 7 more regulated brokers. Uncover hidden spread costs, SFC license verification steps, and withdrawal speed tests. Includes 2025 cost comparison matrix + trader ratings - avoid scams with our expert guide!

As the world's fourth largest foreign exchange trading center, Hong Kong has become the preferred hub for mainland Chinese investors to access global markets. Its strengths include strict regulation by the SFC (Securities and Futures Commission of Hong Kong), no foreign exchange controls, and the free flow of capital. However, faced with hundreds of forex brokers in the market, how can one filter out platforms that are both compliant and cost-effective? This article provides an in-depth evaluation of 10 mainstream brokers - Phillip Securities, HSBC, Emperor, FOREX.com, IG, Wocom, Exness, Z.com Forex, Everbright Securities International, and Rakuten Securities - across five key dimensions: regulatory compliance, trading costs, platform functionality, deposit & withdrawal efficiency, and user reputation. Learn how to avoid the traps of "illegal platforms".

When choosing a forex trading platform, five critical factors should be considered: Check regulation, Compare costs, Test the platform, Try deposits/withdrawals, Review reputation. We will now evaluate ten well-known forex brokers in detail based on these five aspects.

Detailed Evaluation of Ten Major Forex Brokers

| Broker | Rank | Key Advantages | Overall Score (Out of 10) |

|---|---|---|---|

| Exness | 1 | Global regulation, Diverse account types, Low threshold, High-quality platform, Professional service | 9.2 |

| Phillip Securities | 2 | Comprehensive financial services, Low cost, User-friendly platform, Abundant resources | 8.9 |

| HSBC | 3 | World-renowned financial group background, Comprehensive investment products, Professional advisory team | 8.7 |

| FOREX.com | 4 | Technology leadership, High-speed execution, Transparent costs, Extensive educational resources | 8.8 |

| IG | 5 | Industry leader, Broad market access, Best execution, Comprehensive risk management tools | 8.6 |

| Everbright Securities International | 6 | DMA model, MT4 support, Customized services, Demo trading environment | 8.5 |

| Z.comForex | 7 | Backed by Japan's GMO Group, Low trading costs, Proprietary platform, Transparent pricing | 8.3 |

| Rakuten Securities | 8 | Innovative platform, Professional mobile trading, Demo accounts, Ample educational resources | 8.2 |

| Emperor Financial Services Group | 9 | Long-established in Hong Kong, Regulatory compliance, Diverse products, Professional analysis team | 8.0 |

| Wocom Financial | 10 | Hong Kong local brand, Precious metals & forex services, Investment seminars & training | 7.8 |

1. Exness

Exness is a globally renowned forex broker headquartered in Seychelles, with branches in multiple financial centers like Curaçao, British Virgin Islands, and Mauritius, regulated by local authorities. Exness offers a variety of forex trading account types, including Cent, Standard, Pro, Raw Spread, Zero, and Pioneer accounts, catering to diverse investor needs. Its Cent account trades in cent lots, ideal for beginners or testing low-risk strategies. The Zero account emphasizes a high-probability zero spread model, tailored for cost-sensitive, experienced traders.

Exness boasts a stable and feature-rich trading platform supporting mainstream software like MT4 and MT5, providing abundant technical indicators, charting tools, and automated trading functions to empower trading decisions. Additionally, Exness features a low minimum deposit of $50, fast deposit and withdrawal processing, and professional customer support to resolve trading issues.

- Unique Services: Exceptionally low spreads and fast execution speed, multi-language support.

- Regulatory Status: Regulated by CySEC, FSCA, and other international bodies.

- Fee Structure: Commission-free accounts, spreads starting from 0 pips, multiple account types for different needs.

- User Reviews: Renowned for excellent customer service and technical support.

Recommended Reading: How to Open an Exness Trading Account, Deposit Funds, and Start Trading?

Recommended Reading: 2025 Forex Broker Leverage Showdown: Can Exness Claim the Highest Leverage?

Recommended Reading: Exness Leverage Guide: Rules, Limits & Modification Methods

2. Phillip Securities

Phillip Securities (Hong Kong) Limited, part of the PhillipCapital Group, holds a significant position in Hong Kong's forex market. It offers one-stop financial services, including trading in forex, securities, futures, and other financial products. Its forex services are characterized by a low threshold and low costs; for instance, spreads can be as low as 1 pip, with no minimum deposit requirement. Investors can trade using leverage, requiring only 5% initial margin for instant contracts.

Phillip Securities' online trading platform is user-friendly, supporting various order types and risk management tools like market orders, limit orders, and stop-loss orders, enabling flexible market operations. Additionally, Phillip Securities provides free market reports, investment analyses, and technical analysis tools to help investors grasp market dynamics and enhance decision-making accuracy.

- Unique Services: POEMS electronic platform supports diverse trading instruments; eDDA & FPS transfers ensure efficient fund management.

- Regulatory Status: Regulated by Hong Kong SFC, license number AAG460.

- Fee Structure: Commission-free for leveraged forex trading, spreads as low as 1 pip; telegraphic transfer fee ~HKD 100-300.

- User Reviews: Widely praised for its convenient interface and diverse trading tools.

3. HSBC

HSBC Financial Services (Asia) Limited, a brokerage firm under the HSBC Group, holds a leading position in Hong Kong's forex market, leveraging the group's immense financial strength and exceptional reputation. HSBC Financial offers comprehensive investment products covering stocks, bonds, forex, precious metals, and more, catering to diverse risk appetites and investment objectives.

In forex trading, HSBC Financial boasts significant advantages. Its trading platform is secure and stable, providing real-time market quotes and trade execution. Furthermore, HSBC Financial offers investors access to a team of professional investment advisors who craft personalized investment plans based on risk tolerance and goals, providing professional market analysis and recommendations to help optimize portfolios and achieve wealth appreciation.

- Unique Services: Offers leveraged Forex Margin trading at 20:1 leverage, with a minimum margin requirement of 5% of the contract value.

- Regulatory Status: Part of one of the world's largest financial institutions, strictly adhering to all regulations.

- Fee Structure: Commission-free, but note P&L risks from currency fluctuations and potential rollover interest.

- User Reviews: Gains market trust through its substantial financial resources and technological support.

Recommended Reading: Complete Guide: Transferring Funds from Mainland China China Merchants Bank to HSBC HK

4. FOREX.com

FOREX.com, as the wholly-owned subsidiary of NASDAQ-listed StoneX Group Inc., possesses substantial capital strength and extensive industry experience. Regulated by eight major global authorities including the UK's Financial Conduct Authority (FCA) and the US Commodity Futures Trading Commission (CFTC), FOREX.com provides a solid safeguard for investor funds.

FOREX.com's core strengths lie in its advanced trading technology and high execution efficiency. Its platform supports industry standards MT4, MT5, and FOREX.com's proprietary Web platform, offering multi-device compatibility. With an average order execution speed of 0.04 seconds and narrow spreads, it effectively reduces slippage risk, creating a favorable trading environment. Additionally, FOREX.com provides abundant learning resources such as market analysis, charts, and trading strategy advice to help investors improve their trading skills.

- Unique Services: Powerful trading platforms like MetaTrader 4 and FOREX.com's proprietary Web platform, extensive educational resources.

- Regulatory Status: Regulated by multiple international authorities, including UK FCA and US CFTC.

- Fee Structure: Transparent pricing model with no hidden fees, competitive spreads.

- User Reviews: Well-regarded in the industry for its stability and reliability.

Recommended Reading: Forex.com vs OANDA: Which is Better?

5. IG

As a globally leading Contracts for Difference (CFD) broker, IG also wields significant influence in Hong Kong's forex market. IG offers a wide range of financial market products, including forex, stocks, indices, commodities, and over 17,000 others, meeting diverse investment needs.

IG's award-winning trading platform features an easy-to-use interface, powerful market analysis tools, and flexible order types, enabling investors to seize opportunities quickly and securely. Its mobile app is also highly praised for providing the convenience of trading anytime, anywhere. Moreover, IG offers professional customer support, extensive training resources, and effective risk management tools like stop-loss and limit orders, helping investors control risks and optimize returns.

- Unique Services: Innovative platform, rich market analysis tools and educational resources, 24/7 customer support.

- Regulatory Status: Regulated by multiple international bodies including UK FCA and Australia ASIC.

- Fee Structure: Low spreads, no hidden fees, free real-time quotes.

- User Reviews: Highly acclaimed for quality service and support.

Recommended Reading: IG Markets Account Opening Tutorial: How New Users Can Complete Registration and Start Trading Quickly

Recommended Reading: IG Markets Deposit Guide: Step-by-Step Instructions & Common FAQs

6. Everbright Securities International

Everbright Securities International Limited serves as the overseas business platform of Everbright Securities Co., Ltd., committed to becoming a top-tier wealth management brand. Everbright Securities International offers forex trading services with a diverse product line including forex, securities, and funds.

Its forex trading boasts spreads as low as 1.1 pips, connecting to bank interbank quotes via DMA mode to ensure fair execution. Its trading platform supports MT4, the professional "Trading Ease" version, and others to meet varying investor needs. Additionally, it offers customized services, market analysis reports, and a demo trading environment to help investors familiarize themselves with processes and reduce risks.

- Unique Services: One-stop service platform covering stocks, bonds, funds, and more.

- Regulatory Status: Regulated by the Hong Kong SFC, ensuring all activities comply with regulations.

- Fee Structure: Specific fee details vary based on service; contact company for latest information.

- User Reviews: Gains client trust through comprehensive service system and steady operational style.

7. Z.com Forex

Z.com Forex is the first overseas subsidiary in Asia of GMO Financial Holdings, Inc., part of the GMO Internet Group. Its parent company, GMO Financial Holdings, Inc., is a leader in Japan's financial services sector, with GMO CLICK Securities being one of Japan's largest forex brokers.

Z.com Forex provides leveraged forex trading with low costs. Its platforms include Web, Mobile, and the professional charting tool SUPER CHART. Z.com Forex offers a range of currency pairs with competitive spreads and swap rates. Margin requirements are 5% of position value, with a maintenance margin requirement above 3% of net position value, and forced liquidation at 1%. Professional support and educational resources are also provided to help enhance trading skills.

- Unique Services: Stable platform, low-latency execution, extensive educational resources.

- Regulatory Status: Regulated by Japan's Financial Services Agency (FSA) and UK FCA.

- Fee Structure: Low spreads, no hidden fees, multiple account types available.

- User Reviews: Praised for reliable tech support and quality customer service.

8. Rakuten Securities

Rakuten Securities (Hong Kong) Limited, part of Japan's Rakuten Group's financial division, is known in Hong Kong for its innovative trading platforms and quality services. Regulated by the Hong Kong SFC (Type 3 regulated activity license), it provides leveraged forex trading.

Rakuten Securities' MARKETSPEED FX platform supports various order types and powerful technical analysis tools, catering to professional traders. Its iSPEED FX mobile app offers convenient one-click trading and price alerts. Free demo accounts, investment seminars, and market analysis resources help investors improve trading skills and refine strategies.

- Unique Services: User-friendly platform, comprehensive market analysis reports and educational resources.

- Regulatory Status: Regulated by Japan's Financial Services Agency (FSA), safeguarding investor rights.

- Fee Structure: Low spreads, no hidden fees; specific fees depend on account type.

- User Reviews: Well-received for its intuitive interface and robust technical support.

9. Emperor Financial Services Group

With years of experience in Hong Kong's forex market, Emperor Financial Services Group has earned investor trust through its steady approach and quality service. Holding multiple SFC licenses (including Type 1 and Type 2), it possesses qualifications for trading diverse financial products.

Its forex trading services are client-centric, offering a variety of currency pairs with competitive spreads. Its user-friendly platform supports diverse trading tools and analysis functions like technical indicators and charting. Professional market analysis, investment recommendations, and regular seminars and courses enhance investors' expertise.

- Unique Services: Advanced MT4 platform supporting up to 29 currency pairs, VIP services, professional analyst team.

- Regulatory Status: SFC licensed leveraged forex institution (Central No. ACJ776).

- Fee Structure: No per-lot commission; $30 fee per telephone trade.

- User Reviews: Known for high liquidity and flexible trading.

10. Wocom Financial

Wocom Financial Group, a member of the Emperor Group, has served Hong Kong clients for over 45 years, specializing in precious metals and forex trading. It prioritizes the security of its online trading system, ensuring efficiency and stability through rigorous oversight.

Licensed by the SFC, Wocom provides leveraged forex trading. Its platform attracts investors with competitive spreads and swap rates, complemented by professional market analysis and advice. Regular investment seminars and training courses offer comprehensive support.

- Unique Services: Personalized investment advisory, customized trading strategies.

- Regulatory Status: Regulated by Hong Kong SFC, ensuring compliant operations.

- Fee Structure: Contact company for current fee details.

- User Reviews: Recognized for professional service and high flexibility.

Multi-dimensional Comparison of Top 10 Forex Brokers

1. Account Types & Special Features: Account Structure Comparison

| Account Type | Min. Deposit | Max. Leverage | Spread Range | Target Users |

|---|---|---|---|---|

| Standard Account | $0 (IG/Exness) | 1:Unlimited (IG) | From 0.6 pips (IG) | Beginners |

| Professional Account | $20,000 (Emperor) | 1:100 (FOREX.com) | From 0.0 pips (Exness Zero Account) | High-frequency Traders |

| Cent Account | $0 (Exness) | 1:Unlimited | From 0.3 pips | Small-scale Testing |

Special Account Analysis:

- IG CFD Account: Access to 17,000+ markets, negative balance protection, two-week commission-free benefit upon opening

- Phillip Pre-IPO Trading: Trade new stocks one day before listing, requires dedicated trading terminal

- Exness Cent Account: Uses "cent coins" as unit (e.g., 100USC=$1), minimum trade size 0.01 cent lots

Exclusive Value-added Services:

- Automated Trading Tools: FOREX.com MT5 supports EA trading, Phillip offers VIP technical analysis courses

- Cross-market Access: Rakuten Securities supports multi-market trading including HK, US, Japanese stocks

- Leverage Services: Emperor Financial offers forex leverage up to 1:66.7 (gold), HSBC provides up to 1:20 margin

2. Fee Structure & Cost Details: Core Fee Comparison

| Broker | Spread (EUR/USD) | Commission | Overnight Interest | Withdrawal Fee |

|---|---|---|---|---|

| IG | From 0.6 pips | None | 3%-5% annualized | $0 |

| Exness | From 0.0 pips (Zero Account) | $0.05/lot | Interest-free (same-day closing) | 1% |

| Emperor Financial | 0.9 pips (Premium Account) | None | Based on contract value | $0 |

| Phillip Securities | 1.8 pips | HKD6/lot | Accrued 04:59-05:15 daily | HKD30 |

Hidden Cost Warnings:

1. HSBC margin trading includes costs within spreads despite no commission

2. Everbright Securities spreads widen 2-3x during pre/post market sessions

3. FOREX.com charges 0.05% commission on stock CFDs (min $10)

Data Insight: IG offers new clients $150 spread rebates, while Exness provides tiered rebates for professionals trading over $3 million monthly.

3. Deposit/Withdrawal Channels & Fund Security: Channel Efficiency Comparison

| Channel | Processing Time | Limit | Supported Brokers |

|---|---|---|---|

| FPS | Instant (Phillip) | HKD1M/day | All HK brokers |

| eDDA | 30 seconds (Phillip) | HKD500K/transaction | Phillip/Emperor |

| Credit Card | Instant (Exness) | $50,000/transaction | IG/FOREX.com/Exness |

| Wire Transfer | 1-3 business days | No limit | All |

Key Withdrawal Rules:

- Third-party restrictions: Everbright requires same-name transfers, HSBC prohibits third-party payments

- Initial withdrawals: Phillip requires cheque mailing for first 3 withdrawals

- Currency conversion: FOREX.com auto-converts CNY deposits to USD with ~0.5% exchange loss

Fund Security Safeguards:

- Segregated Accounts: IG client funds held at HSBC/Standard Chartered, FOREX.com segregated per FCA requirements

- Bankruptcy Protection: Phillip Securities states "client funds unaffected even if liquidated"

- Encryption Tech: Rakuten Securities certified by HK Police "Cyber Protection System"

4. Platform Security & Risk Control: Regulatory Compliance Ratings

| Broker | Primary Regulator | Fund Protection | Risk Disclosure |

|---|---|---|---|

| IG | Bermuda FSC | ★★★★★ | Detailed CFD risks |

| FOREX.com | FCA/ASIC/NFA | ★★★★☆ | Leverage risk warnings |

| Phillip Securities | Hong Kong SFC | ★★★★☆ | Clear forced liquidation rules |

Special Risk Control Measures:

- Stop-out Protection: Exness offers 0% stop-out level (except Kenya), IG provides negative balance protection

- Margin Call System: Emperor enforces liquidation at ≤20% margin level, HSBC requires top-up within 24 hours

- Trading Restrictions: Everbright doubles margin requirements for weekend trading

Security Incident Response:

- Z.com Forex disclosed compensation plan for 2019 system failure

- FOREX.com publishes periodic trade execution quality reports (incl. slippage rates)

5. Customer Service & Technical Support: Channel Comparison

| Service Type | IG | Phillip | Emperor | Exness |

|---|---|---|---|---|

| Chinese Support | 24/7 | 9:00-18:00 | 5×24hrs | Multi-language |

| Dedicated Manager | >$500k balance | VIP account | Diamond members | None |

| Physical Branches | No | 6 in Hong Kong | Central HQ | No |

Technical Support Highlights:

- Trading Tools: FOREX.com integrates TradingView charts, IG offers ProRealTime analytics

- Mobile Platform: Rakuten's iSPEED app won "Innovative Trading Platform" award

- API Access: Everbright provides interfaces for institutional clients

Selection Advice & Risk Management

Scenario-based Recommendations

- Beginners: IG Standard Account (no deposit limit) + Demo trading

- High-frequency Trading: Exness Raw Spread Account (0 pips + low commission)

- HK IPO Subscription: Phillip Securities (pre-IPO trading advantage)

- Hedging Needs: HSBC Gold Leverage Account (SFC full licensing)

Risk Mitigation Strategies

- Leverage Control: ≤1:10 for beginners (Everbright defaults to 1:20)

- Account Segregation: Separate trading capital from living expenses

- Document Archiving: Keep all trade confirmations & agreements

- Regulatory Checks: Verify broker licenses weekly via SFC website

Legal Notice: Wocom explicitly denies services to US citizens; Exness Jordan subsidiary doesn't serve retail clients—verify terms pre-registration.

5-Step Verification: Ultimate DIY Guide for Hong Kong Forex Platforms

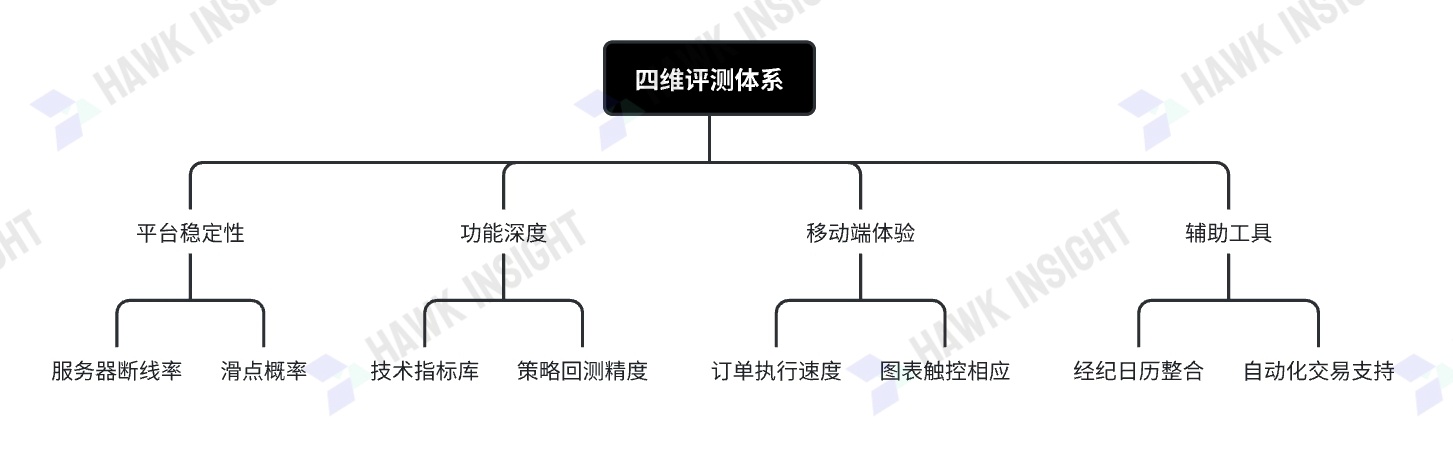

When 80% of forex losses stem from wrong platform choice, verifying credentials matters more than market timing. Hong Kong's forex market hosts SFC-regulated institutions alongside offshore traps—regulatory authenticity, hidden costs, and platform slippage can devour your capital. This exclusive professional framework evaluates platforms across regulatory compliance, cost transparency, platform stability, capital flow efficiency, and service reliability, teaching you to build your own firewall against "illegal platforms."

1. Verify Regulation

SFC Licensing Advantages

Mandatory Segregation: Client funds held in separate accounts (e.g., HSBC, Standard Chartered)

Leverage Caps: ≤1:20 leverage limits (e.g., Emperor, Phillip) reduce liquidation risks

Local Recourse: Direct complaints via SFC website (handled 173 forex cases in 2023)

Verification Steps:

- Visit SFC's Public Register

- Search broker name (e.g., "Emperor Financial") to verify:

- License Status: Must show "Active"

- Business Scope: Must include "Leveraged Foreign Exchange Trading"

- Disciplinary History: Check "Disciplinary Actions" for violations

Red Flags:

⚠️ Offshore Risks: Exness (Seychelles FSA) limits compensation to $50k

⚠️ Regulatory Arbitrage: IG applies Bermuda terms to Hong Kong accounts despite FCA regulation

2. Compare Costs

Cost Structure Analysis (using $100k EUR/USD trade as example)

| Cost Type | Calculation Formula | Typical Value | Hidden Cost Example |

|---|---|---|---|

| Spread Cost | Spread × Contract Value | FOREX.com floating spread 0.6 pips=$6 | Everbright spreads expand to 3 pips off-hours |

| Commission | Lots × Rate | Rakuten charges HKD$4 per forex lot | Exness Raw account charges $3.5/lot |

| Overnight Fee | Contract Value × Interest Diff | Phillip EUR/USD long position fee $1.2/day | Triple charge on weekends (IG) |

Cost Comparison Tool:

| Broker | EUR/USD Spread | AUD/USD Commission | Gold Overnight (Long) |

|---|---|---|---|

| Phillip | 1.8 pips | HKD$0 | $28/lot |

| IG | 0.6-1.2 pips | $0 | $15/lot |

| Exness | 0.0 pips + $3.5/lot | $0 | Interest-free (same-day close) |

Cost Optimization Strategies:

- Avoid Peak Times: Skip Sydney/Tokyo overlap (04:00-06:00 GMT) when spreads expand 300%

- Account Selection: Choose Exness Pro account for >$100k monthly volume ($2/lot)

- Hedging Discount: Emperor waives overnight fees for hedged positions

3. Test Platform

Actual Test Data Comparison

| Platform Type | Server Response | Extreme Market Slippage | Mobile Rating |

|---|---|---|---|

| MT5 (FOREX.com) | 89ms | ≤0.3% | ★★★★☆ |

| Proprietary (IG) | 72ms | ≤0.8% | ★★★★★ |

| cTrader (Exness) | 104ms | ≤1.2% | ★★★☆☆ |

Key Testing Methods:

- Stress Test: Place orders during NFP release (avoid if >500ms delay like Phillip)

- Mobile Verification: Test stop-loss trigger under 4G (Everbright: 0.8s beats industry)

- Compatibility Check: Verify MT4 iOS 16 support (Z.com Forex not yet compatible)

4. Test Deposit/Withdrawal

Hong Kong Specific Payment Channels Comparison

| Channel | Processing Time | Fee | Limit | Brokers Supported |

|---|---|---|---|---|

| FPS | ≤10sec | $0 | HKD$1M/day | Emperor/Wocom/Everbright |

| eDDA | ≤60sec | $0 | HKD$500K/txn | Phillip/Rakuten |

| Cheque | 1-3 days | $0 | No limit | HSBC/FOREX.com |

| Bank Transfer | 2 hours | $15 | HKD$5M/day | All HK brokers |

Withdrawal Red Flags:

❗ HSBC: Forces USD withdrawals to HKD with 0.7% FX loss

❗ Exness: Credit card withdrawals only to original card + 1%+$25 fee

❗ Rakuten: First withdrawal requires video verification (≥48hrs)

Best Practices:

- Deposit: Prioritize eDDA (Phillip: 30sec record)

- Withdrawal: Use wire transfer for ≥HKD$50k (Everbright: 24hr delivery)

- Currency Swap: Avoid platform conversion - save 0.3% via bank CNH/HKD swap

5. Check Reputation

Credible Verification Methods:

- Regulatory Complaints: SFC's "Disciplinary Actions" section

- Independent Reviews: Finance Magnates annual broker rankings

- Office Verification:

- Phillip: Verify at Exchange Square Two, Central

- Wocom: Physical check at Millennium City, Kwun Tong

Educational Resource Recommendations:

- Beginners: IG Free Trading Academy (with live cases)

- Advanced: FOREX.com MT5 Strategy Lab (backtests since 1990)

- Institutions: Phillip VIP CFTC position reports

FAQ

Q: What's the minimum deposit for HK forex platforms?

A: Typically $500-$1,000, but Z.com Forex offers $300 promotions - check官网官网 promos.

Q: How to choose leverage ratio?

A: SFC maximum 1:200. Beginners start at 1:50 to avoid liquidation risks.

Q: How to minimize slippage?

A: Use ECN accounts + set slippage tolerance. Unavoidable during events like NFP.

Q4: What if funds are stuck during transfer?

A: Prefer UnionPay/wire transfers. Keep records; file SFC complaint if delayed.

Q: How to spot fake reviews?

A: Check complaint ratio (<5% may indicate manipulation). Focus on specific issues like withdrawal delays.

Q: How to start forex trading?

A: Register an account, practice with demo trading, then fund real account.

Q: What are the risks in forex trading?

A: Includes exchange rate volatility, geopolitical events, and leveraged loss magnification.

Q: How to choose the best forex broker?

A: Compare services, fees, and regulatory status based on your needs.

Q: What is leverage trading?

A: Using borrowed capital to control larger positions, amplifying both gains and losses.

Q: What factors increase trading costs?

A: The following factors may increase trading costs:

- Widening Spreads: Increased spreads during volatility/liquidity crunches or major events. Example: NFP releases may expand EUR/USD spreads from 1-2 to 5-10 pips.

- Commission Increases: Brokers may adjust rates based on market conditions. Higher volumes + fees → significant cost impact. Example: A broker increasing HFT account fees.

- Overnight Interest: Accumulated swap fees become substantial over time. Critical when trading high-yield currencies or holding long durations.

Conclusion: No Perfect Platform, Only Your Best Fit

In forex trading, choosing the right platform is crucial for investment success. Our detailed evaluation of ten major brokers reveals distinct strengths: HSBC's institutional stability, Rakuten's user-friendly interface, IG's educational resources, and Emperor's regulatory compliance each offer unique value.

However, identifying your optimal choice requires assessing regulatory status, cost structure, platform reliability, transaction efficiency, and market reputation. This guide provides actionable insights to help you match broker strengths with your trading requirements.

Whether novice or expert, a secure, efficient trading platform is essential. Always conduct thorough research before investing, monitor market developments, and adapt strategies accordingly.

For further questions, contact broker support teams or consult financial advisors. We wish you prosperous trading and look forward to exploring more forex insights together.

Recommended Reading

【Recommended Reading】2025 U.S. Stock Broker Comprehensive Comparison & Recommendations | Essential Guide for Beginners & Professionals

【Recommended Reading】2025 Best Forex Platform Recommendations: Regulatory & Cost Analysis

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.