Must-see for Hong Kong and US stock investments! 2025 Longbridge Securities Singapore Deposit and Withdrawal Operation Manual: Lifetime Commission-free + SGD 218 Reward Strategy

2025 Longbridge Securities (Singapore) ultimate guide to deposit and withdrawal! Detailed analysis of the operation steps of 4 deposit methods including DDA, PayNow, online bank transfer, and Wise. Avoid the delay of third-party transfers. Master the instant arrival skills, currency exchange strategy, and limited-time benefits (lifetime commission-free + SGD 218 cash) in one article. A must-read for novices to avoid pitfalls!

Why choose Longbridge Securities (Singapore) for investing in Hong Kong and US stocks in 2025? In 2025, global investors' demand for brokers with low commissions and high security continues to heat up! As a broker licensed by the Monetary Authority of Singapore (MAS), Longbridge Securities (Singapore), with its ultra-fast account opening on the web, lifetime commission-free policy, and generous cash rewards, ranks first among popular investment platforms in Singapore!

Limited-time benefit upgrade in May 2025: Complete web account opening and meet the deposit requirement through the exclusive link at the end of the article, and you can enjoy lifetime commission-free for Hong Kong and US stocks. Additionally, you can receive a SGD 218 cash reward! This article provides a detailed analysis of the deposit methods, operation steps, and pitfall avoidance guide of Longbridge Securities to help you efficiently meet the requirements and steadily obtain the benefits!

I. How about Longbridge Securities (Singapore)? Is it safe?

Longbridge Securities (Singapore) is an internet broker established in 2019 with its headquarters in Singapore. It was founded by a founding team composed of senior financial managers and technical experts from global top technology companies and has received strategic investment of over 150 million US dollars. As a licensed entity regulated by the Monetary Authority of Singapore (MAS) (License number: CMS101211), Longbridge Securities holds a capital markets services license and has the qualification for financial advisor exemption. The company is committed to creating useful investment tools for new, US, and Hong Kong stocks for investors through the innovative application of financial technology, and assisting users to reduce investment thresholds and fees with intelligent decision-making. Its core advantages include:

1. Asset security guarantee: Customers' assets are independently deposited in custodian institutions such as DBS Bank, strictly isolated from the broker's own funds.

2. Margin trading flexibility: Provide trading accounts with margin functions and support leveraged trading to enhance investment purchasing power.

3. Multi-currency support and convenient deposit and withdrawal: Support deposit in Singapore dollars, US dollars, and Hong Kong dollars. Provide multiple methods such as DDA, PayNow, and telegraphic transfer. Some channels achieve instant arrival.

4. Cross-market trading experience: Integrate global market resources through financial technology to provide investors with one-stop investment services.

With compliant operation and innovative services, Longbridge Securities has become one of the leading digital brokers in Singapore, providing safe and convenient securities trading services for global investors.

II. Must-read before depositing: Conditions for claiming benefits of Longbridge Securities

-

Benefit rules (May 2025)

-

First net deposit of SGD 1,800: Enjoy lifetime commission-free + SGD 15 stock cash card.

-

First net deposit of SGD 3,400: Receive SGD 80 cash card + exclusive SGD 35 cash card for certified customers.

-

Transfer of SGD 13,000: Receive an additional SGD 88 cash card.

-

Total maximum reward of SGD 218.

-

5月福利_1018759503_736.png)

-

Prerequisites for claiming

-

Must open an account through the exclusive link.

-

The deposit must be transferred from an account with the same name. Transfers from third-party/joint accounts are rejected.

-

Net deposit = total deposit amount - withdrawal amount (for example: after depositing SGD 5,000 and withdrawing SGD 1,000, the net deposit is SGD 4,000).

-

III. Comprehensive analysis of the deposit methods of Longbridge Securities in 2025

Deposit methods and arrival time

| Method | Supported currencies | Arrival time | Fees |

| DDA authorization | SGD | Instant arrival | Free |

| PayNow | SGD | Within 5 minutes | Free |

| Online bank transfer | SGD/USD/HKD | 1-3 working days | Intermediary bank may charge fees |

| Wise remittance | SGD/USD | 1-3 working days | Wise charges a handling fee of 0.3%-0.7% |

Method 1: DDA authorization (instant arrival, 0 handling fee)

Suitable for: Users of local banks in Singapore (such as DBS/OCBC/UOB, etc.).

Supported banks:

- DBS Bank Limited

- Oversea-Chinese Banking Corp (OCBC)

- United Overseas Bank Limited (UOB)

- The Hongkong and Shanghai Banking Corporation Limited (HSBC)

- Standard Chartered Bank

- Maybank

Operation process:

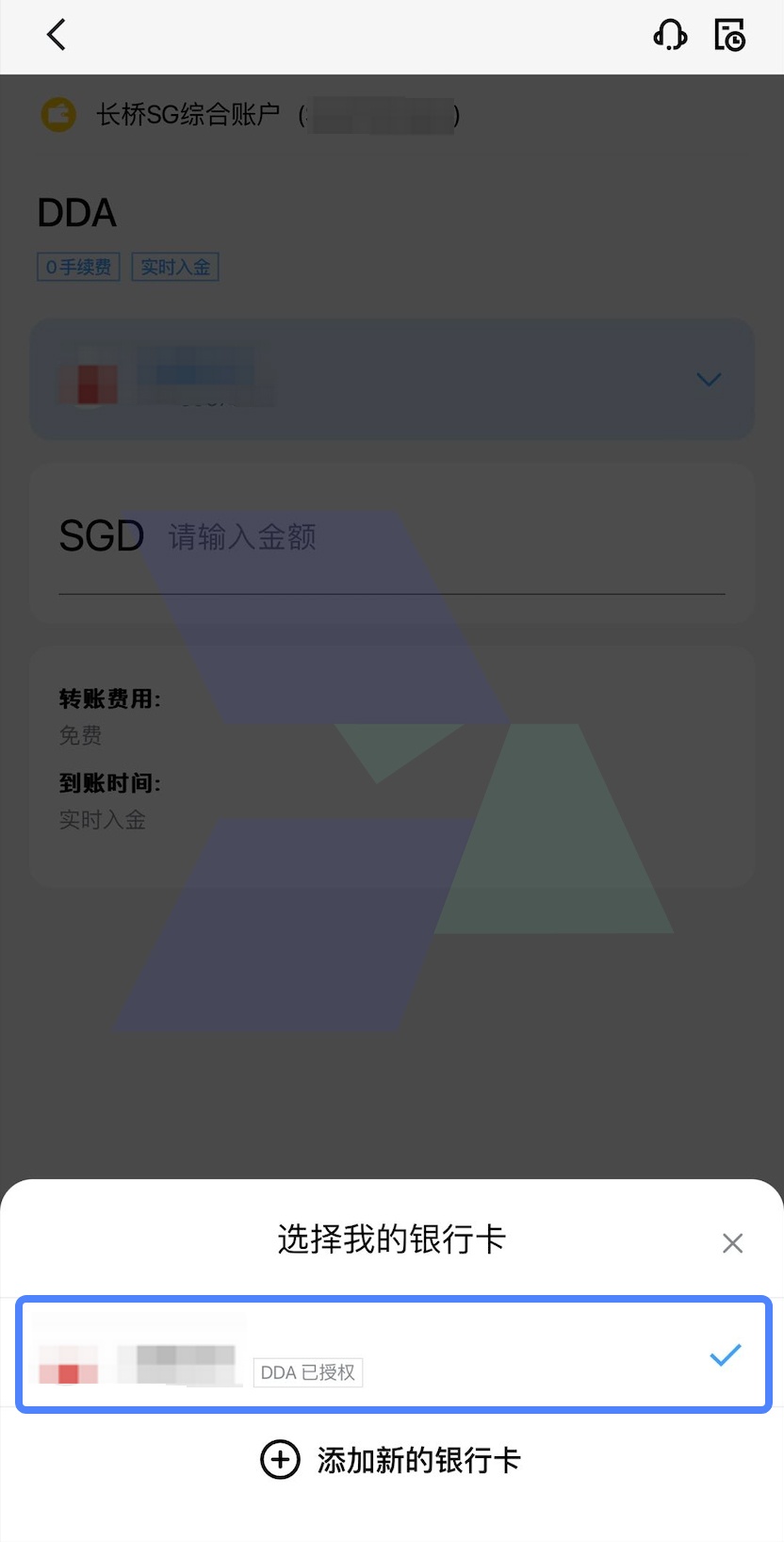

1. Log in to the Longbridge App → Select "Assets" → "Deposit Funds" → Select "DDA" → Select the depositing bank and bind your bank account.

2. After the bank account is bound and the binding status shows "DDA authorized", enter the deposit amount → Confirm and the funds will arrive instantly.

|

|

|

Method 2: PayNow (arrival within 5 minutes)

Supported currency: SGD.

Operation process:

1. Log in to the Longbridge APP → Select "Assets" → "Deposit Funds" → Select "PAYNOW".

2. Fill in → "Deposit amount" → Click to generate a QR code (each QR code is valid for 5 minutes).

3. Click "Save QR code".

|

|

|

|

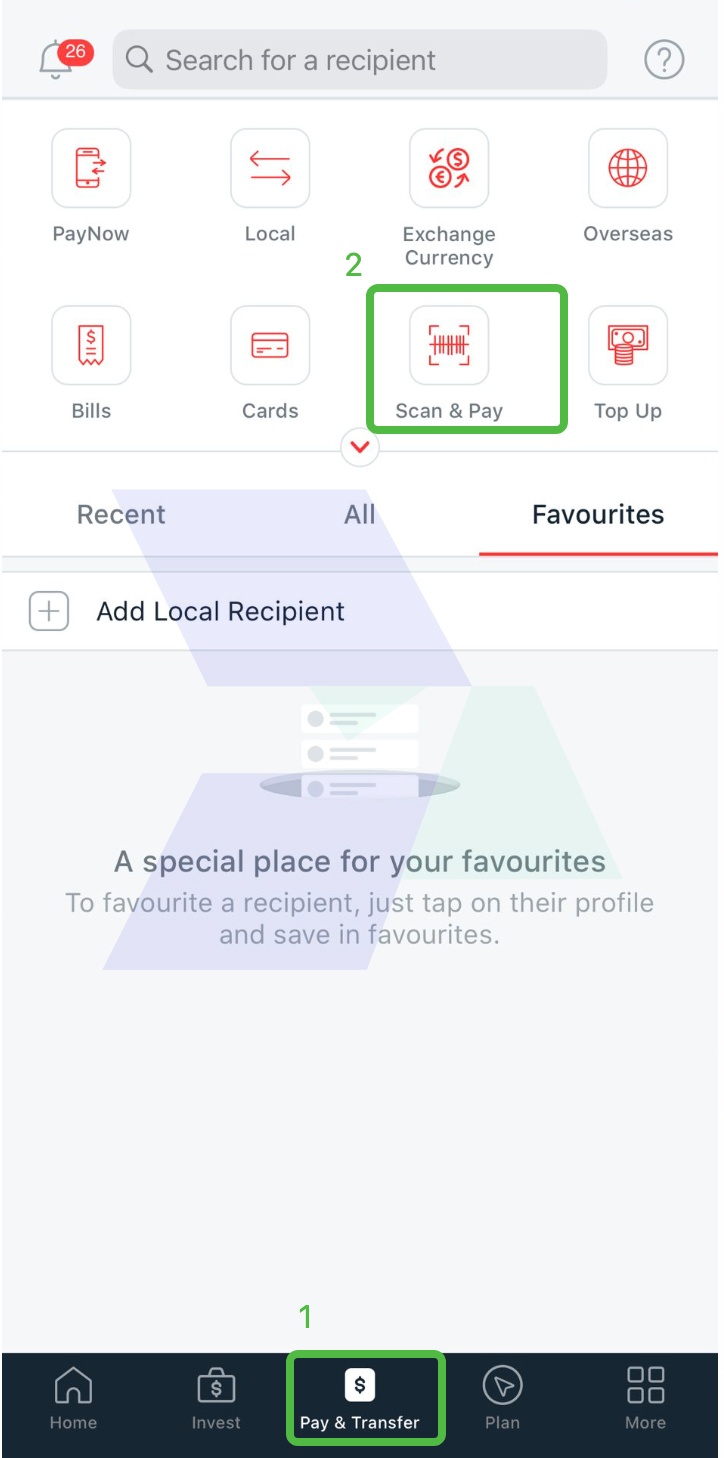

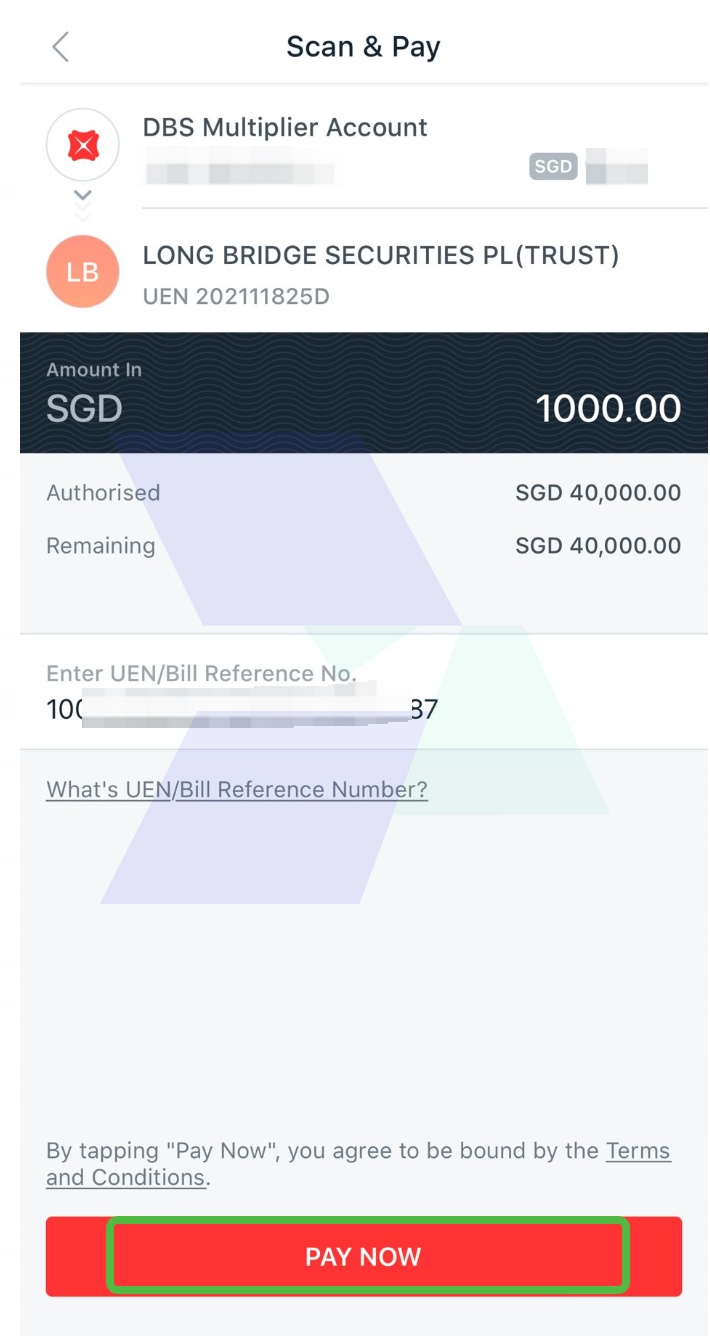

4. Log in to the bank terminal and upload your exclusive QR code (taking DBS as an example) → Enter the amount → Complete the transfer.

|

|

|

5. After the transfer is completed, return to the deposit page of the Longbridge APP → Check the deposit record in the upper right corner.

Notes:

- When using PayNow for a transfer each time, be sure to scan a new QR code to avoid repeated use. Each QR code is only valid for 5 minutes.

- Please ensure that you transfer from a personal bank account with the same name as your Longbridge Securities account. Deposits initiated from a non-personal account or a joint account will be rejected, and the funds will be returned to the original account. Any additional handling fees (if any) incurred will be borne by the customer.

- If the following special situations occur (such as the lack of a unique reference number, repeated use of the QR code, or the bank account name not matching the Longbridge account, etc.), the fund arrival time may be delayed. If the funds have not arrived within 1 working day, please contact our online customer service in a timely manner for further assistance.

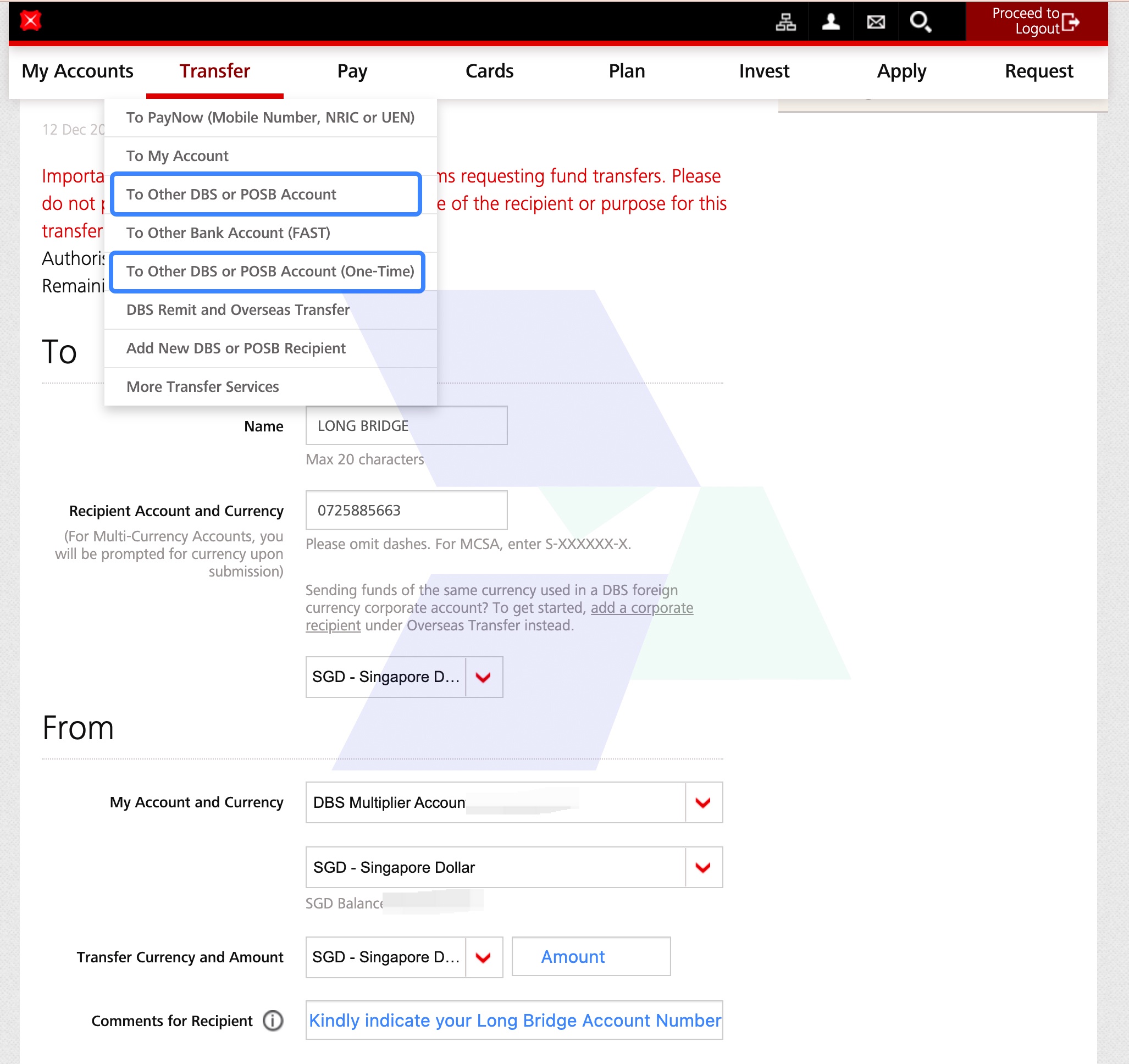

Method 3: Online Banking Transfer (Supports Multiple Currencies)

Applicable to: International users or large-amount deposits.

Supported Currencies: SGD/USD/HKD.

Operation Process:

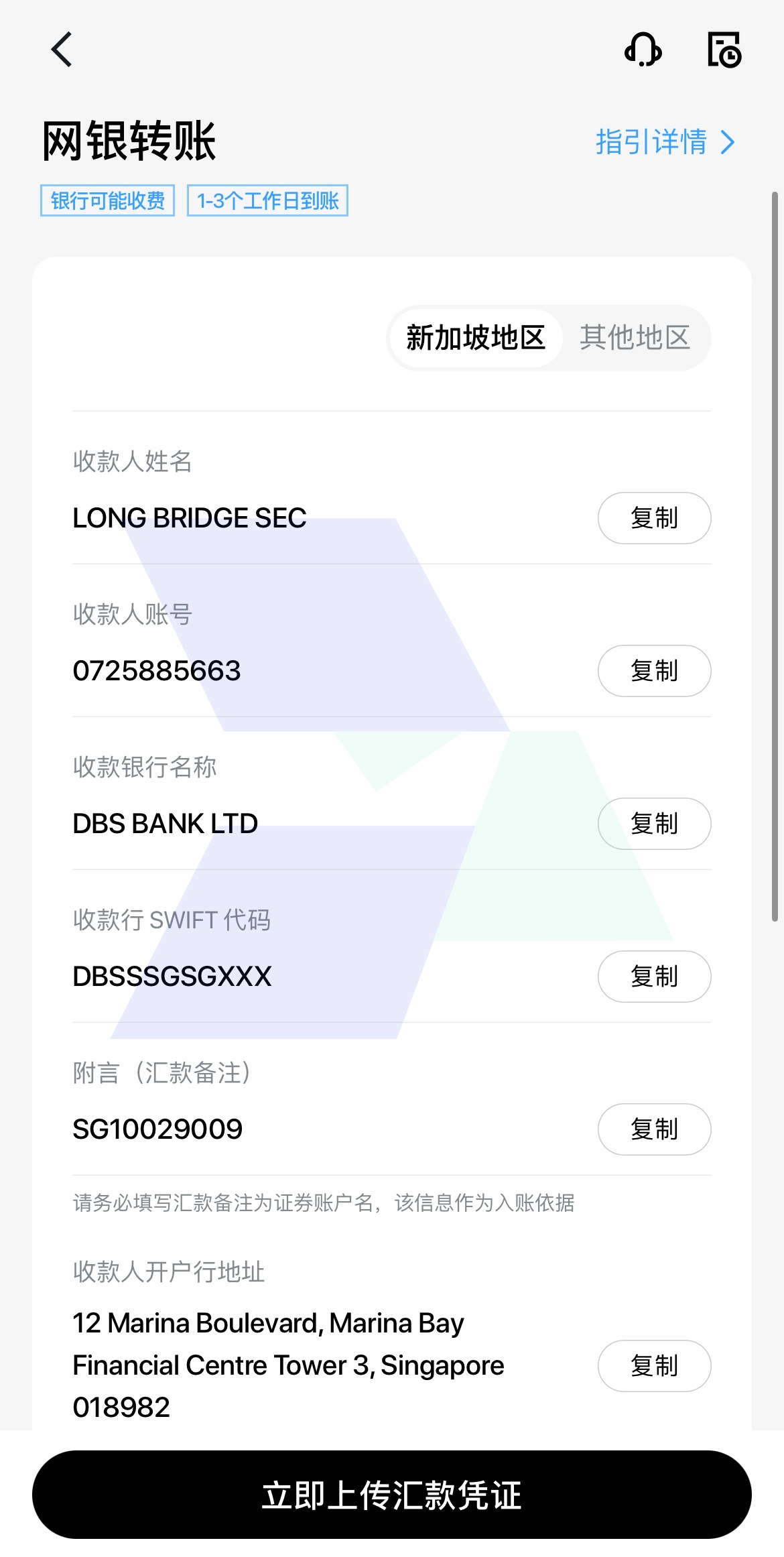

1. Log in to the App to obtain the Longbridge receiving account information

Example:

| Payee Name | LONG BRIDGE SEC |

| Payee Account Number | 725885663 |

| Receiving Bank Name | DBS BANK LTD |

| Swift Code | DBSSSGSGXXX |

| Payee Bank Address | 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982 |

| Remittance Currency | SGD, USD, HKD |

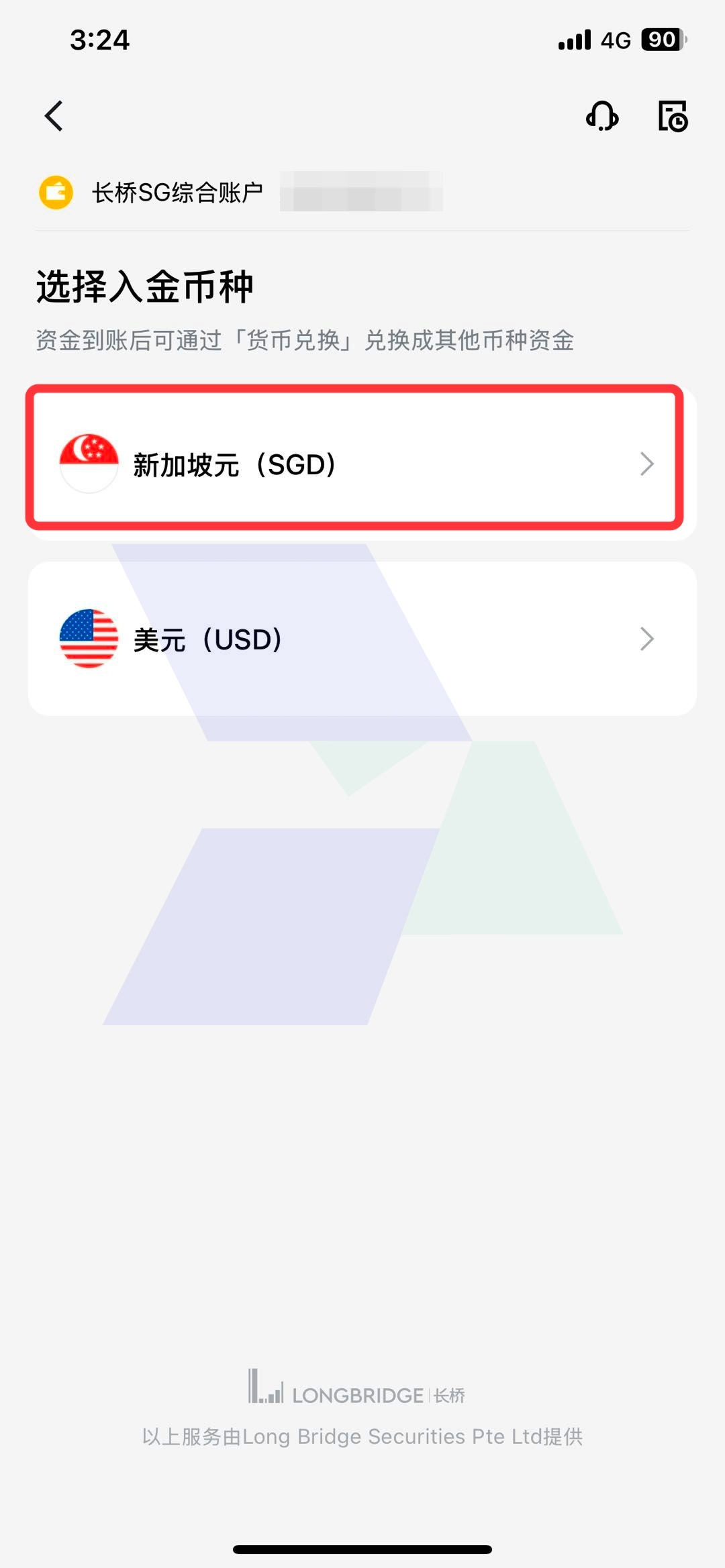

- Log in to the Longbridge APP → Select "Assets" → "Deposit Funds" → Select "Online Banking Transfer"

|

|

|

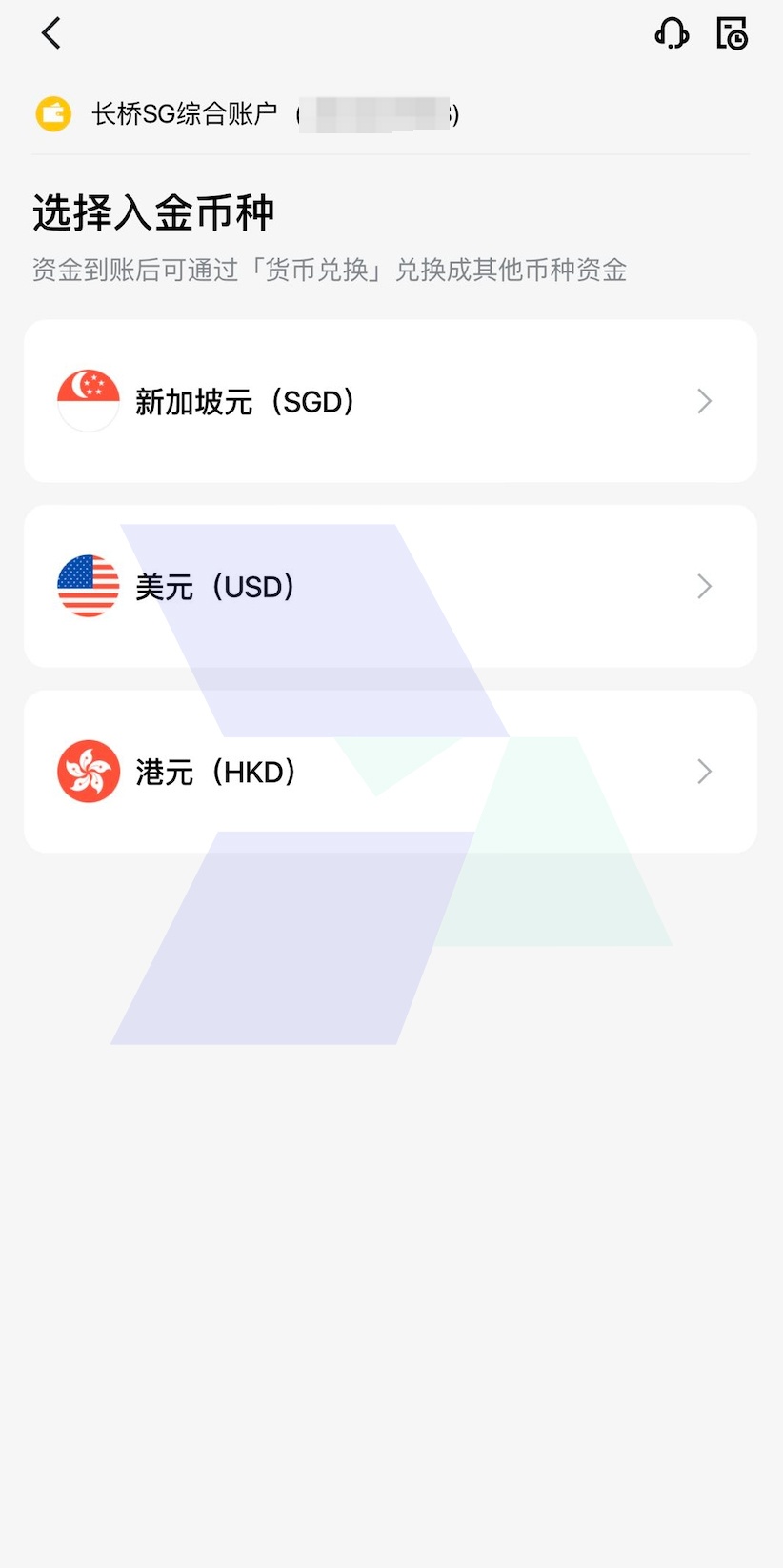

- Select the deposit currency (SGD/USD/HKD) → View and copy the corresponding payee account information

|

|

|

2. Conduct the fund transfer

Log in to the bank terminal for transfer and deposit. Please accurately enter your Longbridge account number in the "Remarks" column to ensure a smooth transfer and avoid deposit delays.

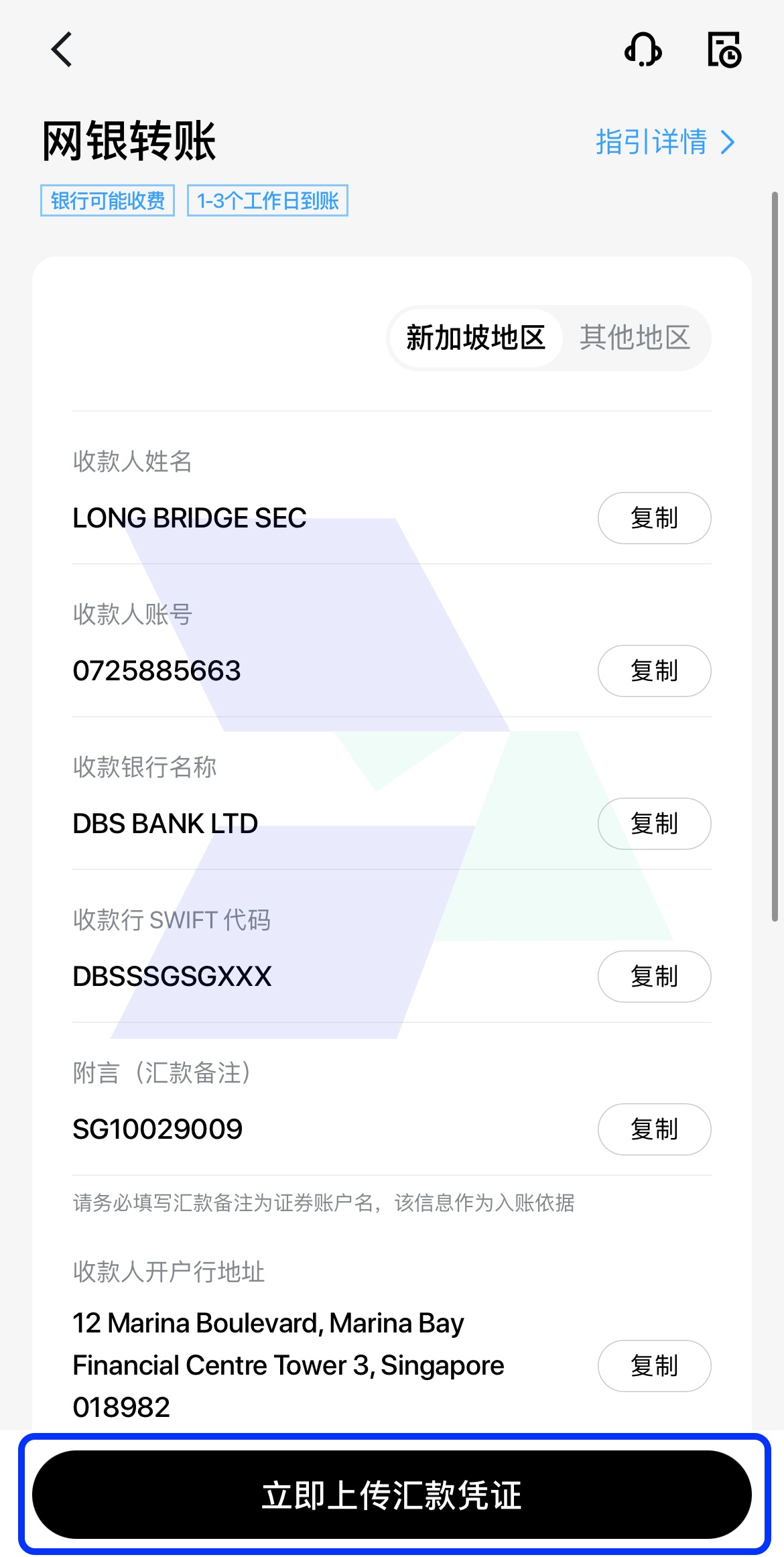

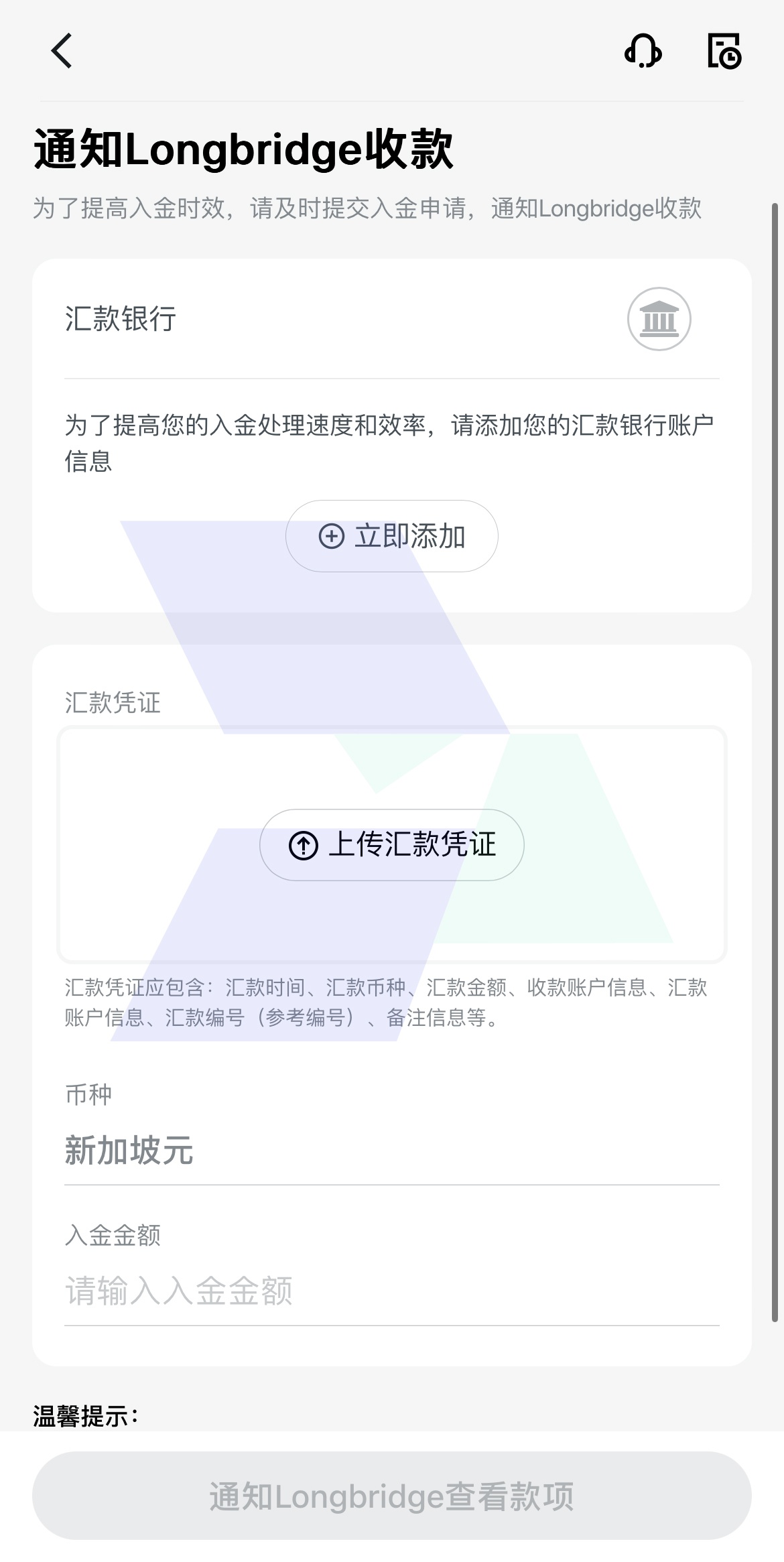

3. Upload the remittance receipt

After completing the transfer at the bank terminal, return to the Longbridge APP → Select "Assets" → "Deposit Funds" → Select the deposit currency → Select the depositing bank → "Internal Bank Transfer" → "Upload Remittance Voucher Immediately" → Fill in the detailed information → "Notify Longbridge to Check the Funds"

|

|

|

Notes:

- Funds transferred from a Singapore bank account will take approximately 1-3 working days to reach your Longbridge trading account. Funds transferred from bank accounts in other countries/regions will also take approximately 1-3 working days to arrive. You will be notified via email and the App upon the completion of the deposit.

- Open the Longbridge App → Select "Assets" → "Deposit Funds" → Check the status in "Remittance Certificate" in the upper right corner. You can also view the deposit history through "Assets" → "Funds Record".

|

|

|

Method 4: Wise Remittance (Low-cost Cross-border Transfer)

Applicable to: Non-Singaporean users who need to exchange and deposit funds.

Supported Currencies: SGD/USD.

Operation Process:

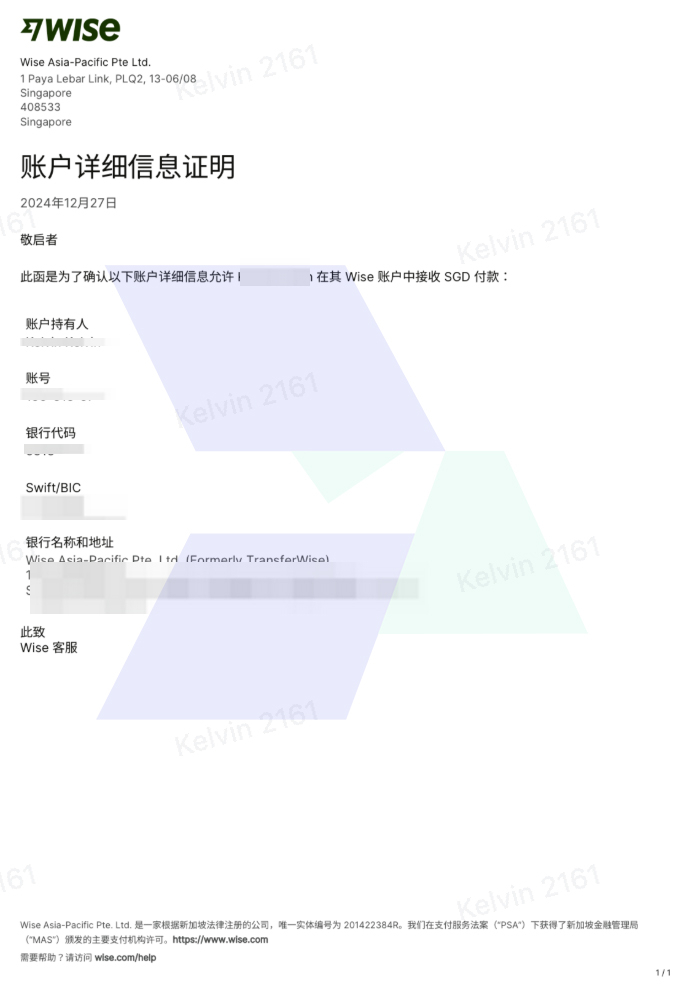

1. Obtain a valid Wise account certificate

- Log in to the Wise account

- Select the corresponding currency account (if there is no such account, please click the "+" button to add it)

- Click the three-dot menu in the upper right corner

- Select "Get Account Details Certificate" (if there is no such option, it means your account has not been verified. Please complete the account verification or contact Wise customer service for assistance)

|

|

|

|

Example of a valid account certificate:

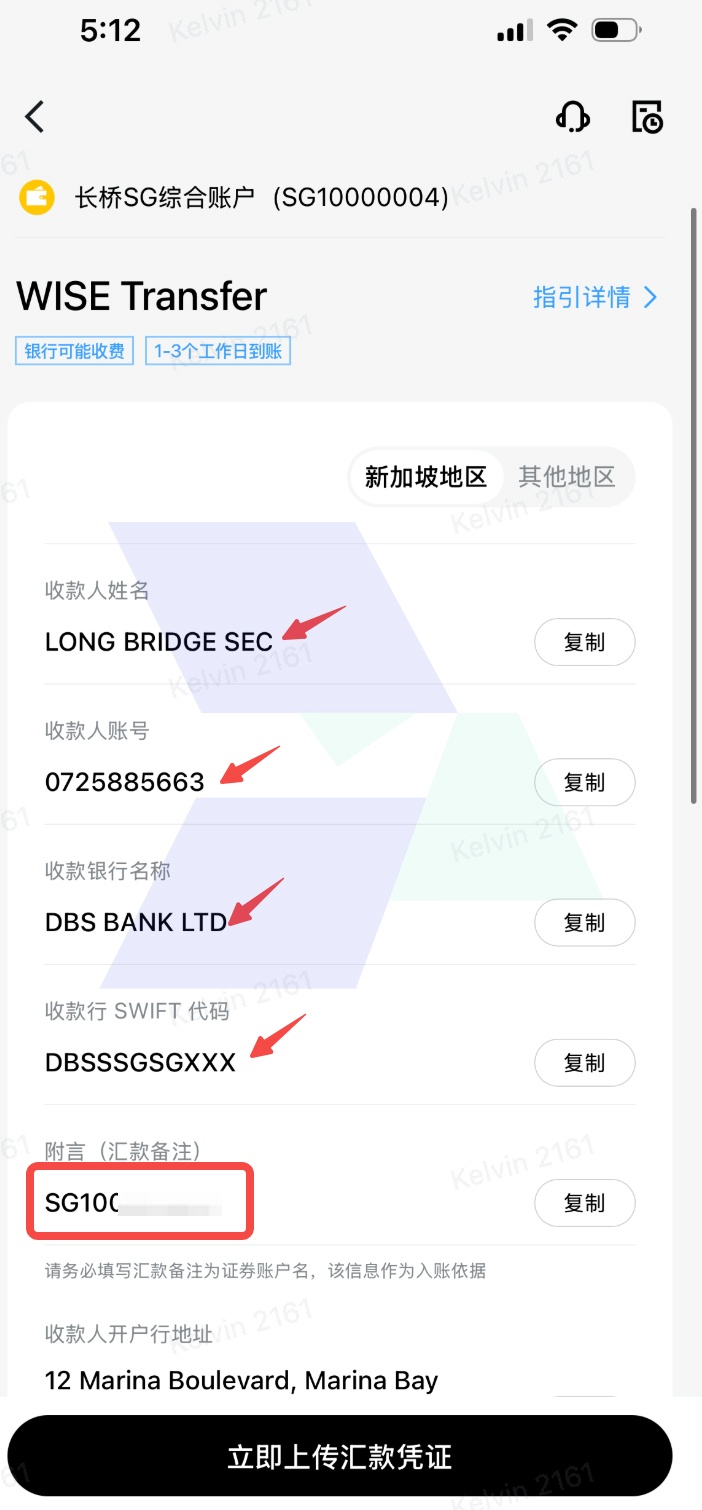

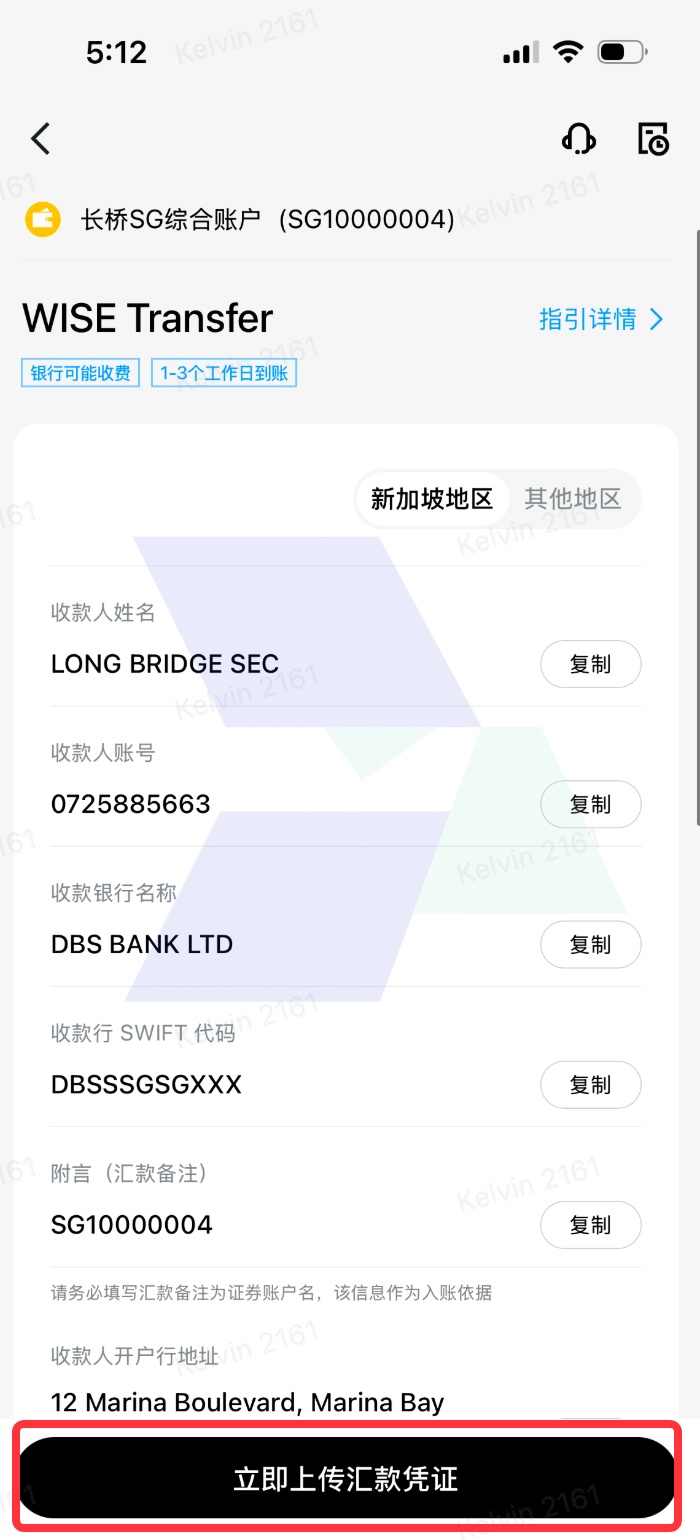

2. Obtain LongBridge bank account information

- Log in to the Longbridge APP → Select "Assets" → "Deposit Funds" → Select "WISE Transfer"

- Select the deposit currency (SGD/USD/HKD) → View and copy the corresponding payee account information

|

|

|

|

|

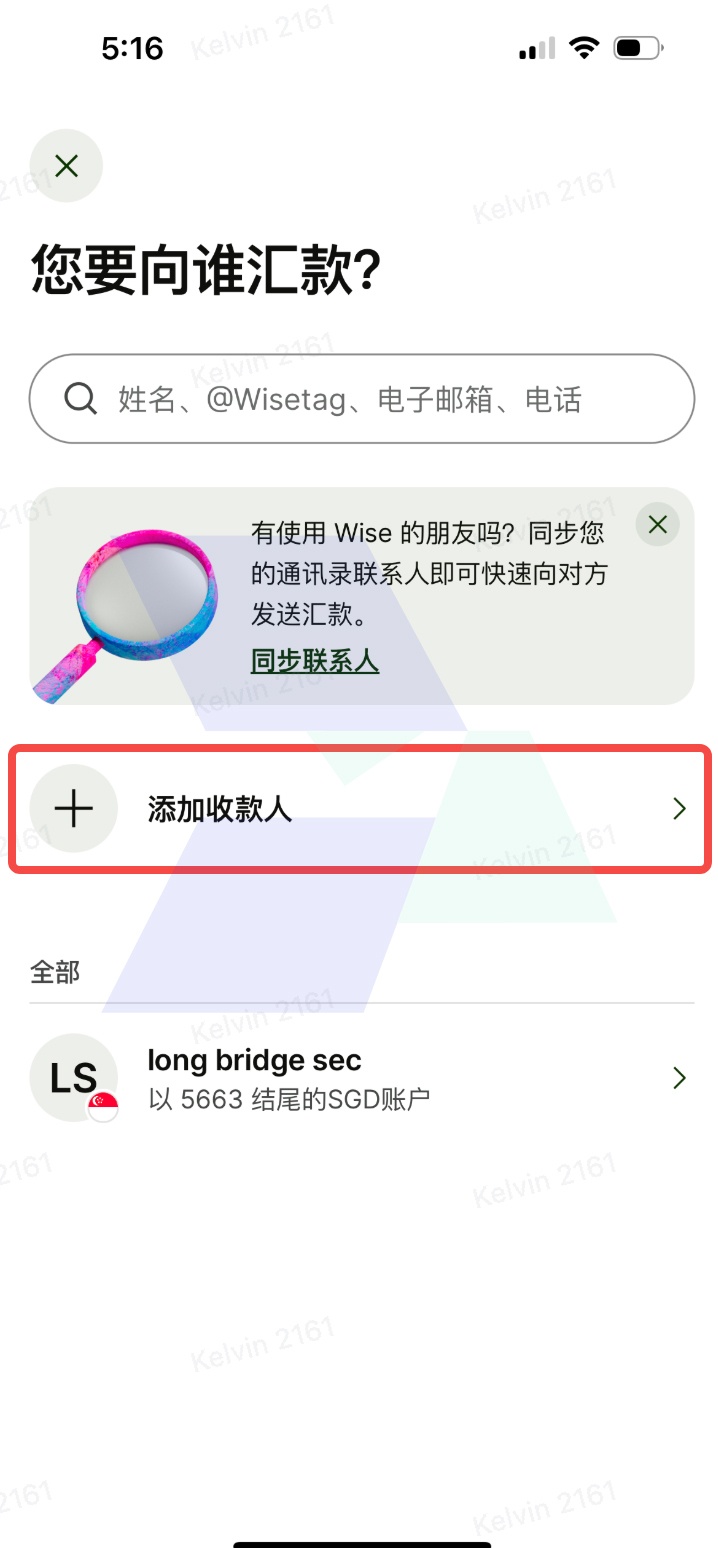

3. Initiate a Wise remittance

- In the Wise app, click "Remittance" → Add payee → Select the remittance currency

|

|

|

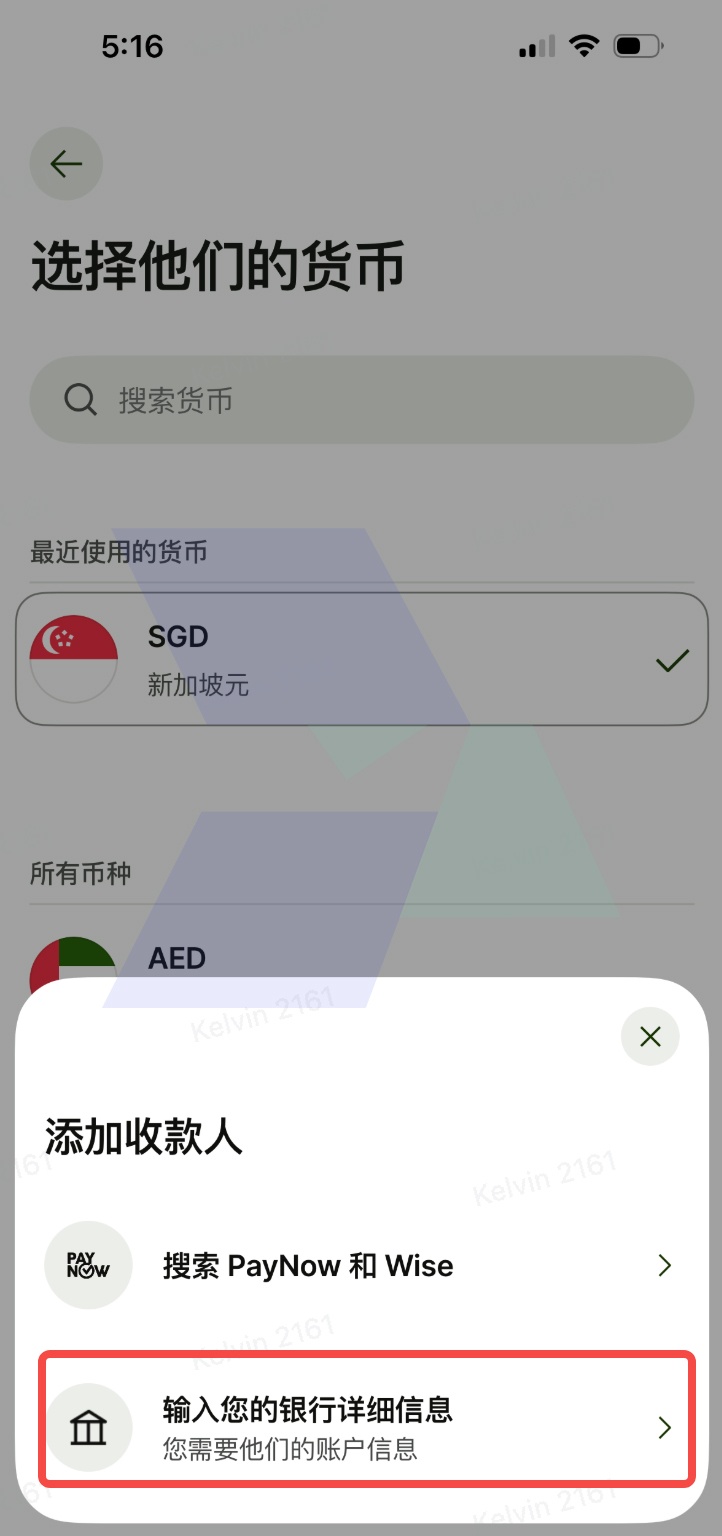

|

- Select "Enter your bank details" → Select "Business/Organization" → Fill in the LongBridge bank account information → Click Confirm

|

|

|

|

- Enter the remittance amount → Fill in the "Remarks" in the LongBridge bank account information in the "LongBridge sec Reference" field → Check the remittance information and click "Confirm and Remit"

|

|

|

4. Obtain the remittance voucher

- After the remittance is successful, return to the WISE homepage → Select the corresponding currency → Take a screenshot of the transaction record page that includes your WISE account number and the remittance to LongBridge as the remittance voucher.

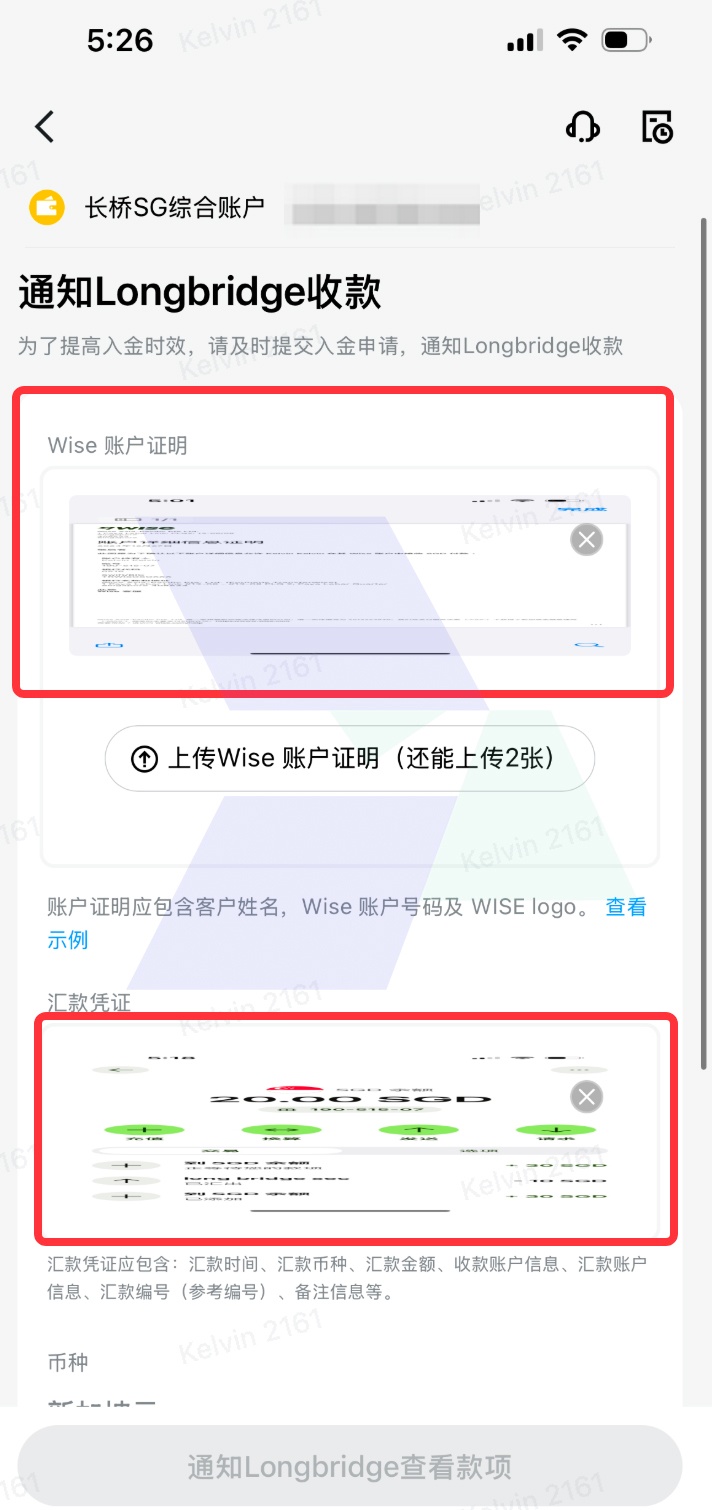

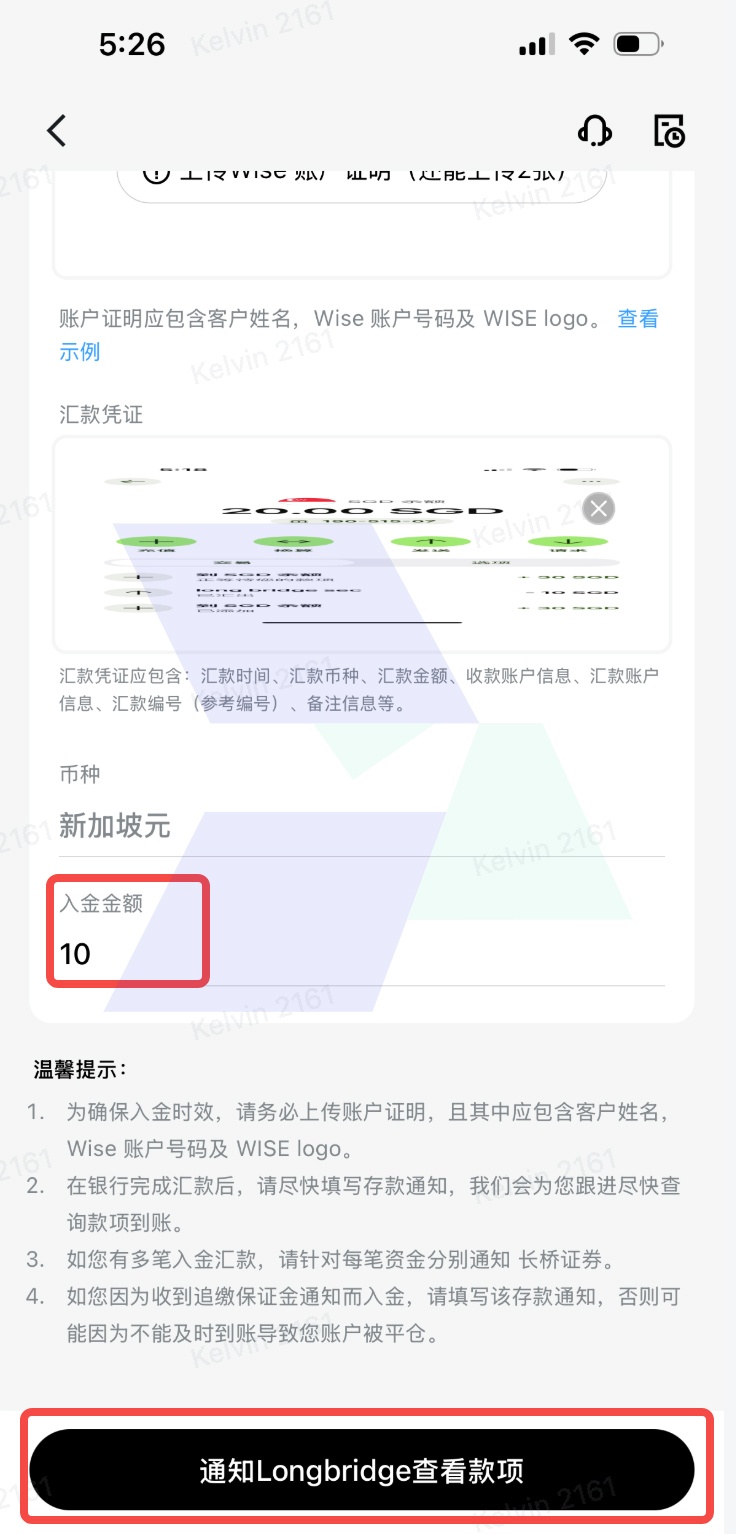

5. Submit the remittance voucher

- Return to the Longbridge APP → Select "Assets" → "Deposit Funds" → Select "WISE Transfer" → Click "Upload Remittance Voucher Immediately" → Upload the WISE account certificate and remittance voucher → Enter the deposit amount and click "Notify Longbridge to Check the Funds".

|

|

|

|

|

Notes:

- To ensure the timely arrival of the deposit, please upload the account certificate, which should include the customer's name, Wise account number, and Wise logo.

- Third-party remittances will be rejected, and any handling fees for the returned funds will be borne by you.

- The estimated arrival time: about 5 minutes to 3 working days, depending on the deposit currency.

- HKD deposit via Wise is not supported currently.

Deposit Avoidance Guide: 4 Common Problems and Solutions

Problem 1: Funds not received after deposit

-

- Reason: Remittance voucher not uploaded / Voucher information incomplete.

-

Solution: Upload the voucher within the App (should include remitter, amount, and time).

Problem 2: Third-party deposit rejected

-

-

Reason: Transfer from a non-matching name account triggers risk control.

-

Solution: Contact customer service to apply for a refund and make the deposit through your own account again.

-

Problem 3: Large currency exchange loss

-

-

Reason: Bank exchange rate difference + Intermediate bank fees.

-

Solution: Give priority to using currency exchange within Wise or the Longbridge App (with zero handling fees).

-

Problem 3: Benefits not automatically issued

-

-

Reason: Opening an account not through the exclusive link / Net capital contribution not meeting the standard.

-

Solution: Check the account opening link and deposit records, and contact customer service to reissue the rewards.

-

IV. Withdrawal Precautions

Log in to the Longbridge APP → Select "Assets" → Select "All Functions" → Select "Withdraw Funds"

1. Select the currency;

2. Select your receiving bank;

3. Enter the amount;

4. Submit the request.

Singapore Banks

| Currency | Withdrawal Amount | Receiving Bank | Estimated Arrival Time | Longbridge Handling Fee | Estimated Bank Fee |

| SGD | Below 200,000 | Singapore Banks (FAST Transfer) | 1 Working Day | Free | None |

| Others | 1-3 Working Days | Free | None | ||

| Above 200,000 | DBS / POSB Banks | 1-3 Working Days | Free | None | |

| Others | 1-3 Working Days | SGD 10 (Exempt) | Approximately SGD 10 | ||

| USD/HKD | Any Amount | DBS / POSB Banks | 1-3 Working Days | Free | None |

| Others | 1-3 Working Days | SGD 10 (Exempt) |

Approximately USD 35-60 Equivalent |

Non-Singaporean Banks

| Currency | Withdrawal Amount | Estimated Arrival Time | Longbridge Handling Fee | Estimated Bank Fee |

| SGD/USD/HKD | Any Amount | 1-3 Working Days | SGD 10 (Exempt) | Approximately USD 35-60 Equivalent |

Notes

- Please transfer the funds to a bank account with the same name as your LBS account. Funds cannot be withdrawn to other people's bank accounts, third-party payment platforms, or joint bank accounts.

- LBS supports withdrawals in SGD, USD, and HKD. Please ensure that your bank account supports the corresponding withdrawal currency.

- If your bank account is not authenticated, please add and complete the authentication of the bank account first.

- Only the settled amount can be withdrawn, and the net cash balance of the account needs to be greater than 0.

- The remittance fee is subject to change without prior notice.

- If any fees are incurred by the remitting bank, the receiving bank, and the intermediate bank, such fees will be borne by you.

- After the withdrawal is completed, an email and push notification will be sent to you.

V. Currency Exchange

Currency exchange refers to the conversion between different currencies. Longbridge Securities provides a convenient currency conversion service, aiming to help you easily trade Singaporean stocks, Hong Kong stocks, and US stocks.

Operation Guide:

- Exchange Process: Log in to the Longbridge App and click "Assets" > "All Functions" > "Currency Exchange" in sequence. On this page, you can view the exchange rate in real time and enter the amount and currency type to be converted.

- Supported Currencies: Longbridge Securities supports the mutual conversion of the following major currencies to meet your trading needs in different markets:

- Singapore Dollar (SGD)

- US Dollar (USD)

- Hong Kong Dollar (HKD)

- Fee Instructions: Longbridge Securities does not charge any service fees for the currency exchange service. However, please note that the exchange rate will change in real time due to foreign exchange fluctuations in the market, and the actual exchange rate shall be subject to the rate at the time of operation.

VI. Full Process of Opening an Account with Longbridge Securities in 2025

Recently, Longbridge Securities (Singapore) officially cancelled the “proof of existing funds” required for account opening. Users can successfully open an account without providing any asset screenshots, truly achieving “zero threshold” access to the Hong Kong and US stock markets.

This change greatly reduces the account opening threshold, especially benefiting ordinary retail investors and novice investors who have just started investing in Hong Kong and US stocks, making “free investment in Hong Kong and US stocks” within reach.

⚠️ Note: Longbridge Singapore must open an account through the exclusive registration link. Direct account opening through the App is not supported. Please be sure to use the link to complete the account opening process.

How to Quickly Open an Account with Longbridge Securities (Singapore)? Complete Guide to the Account Opening Process

The account opening process for Longbridge SG is very simple. It can be completed with just an identity card, and most users can complete the account opening within 10 minutes.

Account Opening Materials

-

Valid identification document (Mainland Chinese identity card is acceptable)

-

Proof of residential address (You can directly take a photo of the identity card, provided that the address on the identity card is the same as the current residential address)

-

Mobile phone & valid email

Account Opening Steps

1. Visit the registration link: Click the registration link (Mobile users please copy it and open it in a browser).

-

- If the link cannot be accessed, please check whether the overseas access permission is enabled, or confirm if the link is completely copied.

2. Choose the account opening method:

-

- It is recommended to choose “Other account opening methods”, which is more flexible and not limited by identity or occupation type.

3. Fill in the basic information:

-

- Name: Fill in in uppercase Pinyin (Format: Surname Space Given name).

- Company information: If you are an employee, please fill in the full company name and accurately fill in the address (including the house number).

- Tax identification number: Mainland Chinese residents can fill in their identity card number.

4. Upload identity documents for address verification

-

- If the address on the ID card is the current residential address, it can be directly used as legal proof.

5. Download the App to complete the account opening authentication

-

- The system will automatically guide you to download the Longbridge App for identity authentication and activation of the trading interface.

VII. FAQ

Q: Is Longbridge Securities a licensed brokerage firm? Which institutions regulate it?

-

- A: Longbridge Securities (Singapore) is a brokerage firm licensed by the Monetary Authority of Singapore (MAS), with the license number CMS101211. It is strictly regulated by the Securities and Futures Act, and customer funds are independently deposited with DBS Bank.

Q: How are customer funds protected? Will they be misappropriated?

-

- A: Customer funds are completely segregated from the brokerage's assets and are held in an independent custody account with DBS Bank. Even if the brokerage goes bankrupt, customer funds are protected by law and cannot be used to pay off the company's debts.

Q: Is there a fee for opening an account? Is there a minimum deposit requirement?

-

- A: Account opening is completely free, and there is no minimum deposit requirement. However, to receive the May benefits, the initial net capital injection requirement (such as SGD 1,800) needs to be met.

Q: Does it support third-party payment platforms (such as PayPal and Alipay) for depositing funds?

-

- A: No. Only transfers from bank accounts with the same name (including DDA, PayNow, wire transfer, etc.) are accepted to ensure the security and compliance of funds.

Q: Are there any restrictions on withdrawing funds? Are there any limits on the amount or frequency?

-

- A: Withdrawals are limited to settled funds, with a daily limit of SGD 50,000 (which can be applied for an increase). There is no limit on the frequency, but frequent operations may trigger risk control reviews.

Q: What should I do if there is a delay or failure in depositing funds?

-

- A: First, check whether the remittance voucher has been uploaded, and contact the online customer service through the App, providing the transaction number for verification assistance. Non-working days or international transfers may take 1-3 working days to process.

Q: Is the exchange rate of Longbridge Securities transparent? Are there any hidden fees for currency exchange?

-

- A: The exchange rate is synchronized with the market price in real time, and there are zero fees for currency exchange. All fees are clearly displayed on the operation page, with no hidden costs.

Q: How does Longbridge Securities respond if an account is stolen or there is an abnormal login?

-

- A: It provides a two-factor authentication (2FA) function, and abnormal logins will trigger SMS/email alerts. If an account is stolen, the account can be frozen immediately, and you can contact the customer service to recover the funds.

Q: Why is Longbridge Securities more reliable than other brokerages?

-

- A: Its MAS licensing qualification, independent fund custody, lifetime commission-free policy, and zero record of user fund security incidents in 2025 all reflect its security and reliability.

Q: How do I switch to a margin account after opening an account through the welfare link?

-

- A: Log in to the App → [Account Management] → [Switch Account Type] → Submit an Ace account application (financial information needs to be supplemented).

Q: Does it accept electronic bills as proof of address?

-

- A: PDF utility bills and electronic bank statements (which need to show the name, address, and a date within 2025) are accepted.

Q: Is a Singapore tax identity required for the welfare activities?

-

- A: No, but you need to open an account through the exclusive link and complete the specified amount of capital injection.

Q: What is the financing interest rate of the Ace margin account?

-

- A: The annualized interest rate is 4.5%-6.8%, which fluctuates according to the market (displayed in real time within the App).

Q: Can the cash reward be used to subscribe for new shares?

-

- A: Yes, the cash card can be directly used to offset transaction fees or withdraw cash.

Q: When does the welfare activity in 2025 end?

-

- A: May 31, 2025. The capital injection needs to be credited before this date.

Conclusion: Limited-time benefits are counting down. Seize your spot now!

Longbridge Securities (Singapore), with the features of "ultra-fast account opening on the web, lifetime commission-free trading, and MAS-guaranteed fund security", has become the preferred platform for global investors in 2025.

⏳ There are only 30 days left until the benefits expire!

🚀 Complete the web account opening immediately through the exclusive link and enjoy a SGD 218 cash reward!

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.