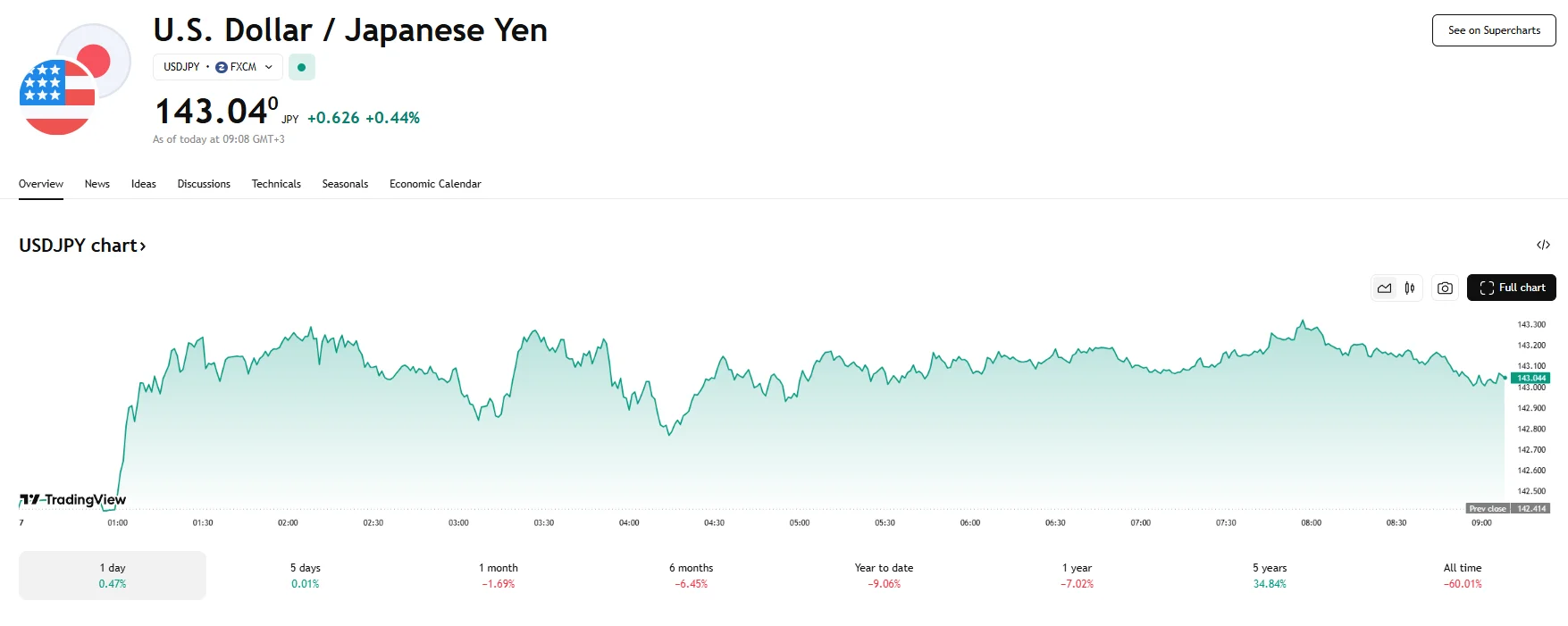

USD/JPY Up 0.44% to 143.04, Yen Pulls Back as Trade Optimism Lifts USD USD/JPY Up 0.44% to 143.04, Yen Pulls Back as Trade Optimism Lifts USD

Key Moments:USD/JPY climbed 0.44% on Wednesday, reaching 143.04.The US Dollar Index stayed above the 99.300 mark.Market enthusiasm improved on news that trade discussions between the US and China will

Key Moments:

- USD/JPY climbed 0.44% on Wednesday, reaching 143.04.

- The US Dollar Index stayed above the 99.300 mark.

- Market enthusiasm improved on news that trade discussions between the US and China will take place in Switzerland later this week.

Yen Weakens as Risk Sentiment Rises

The USD/JPY pair gained traction on Wednesday, with the greenback advancing 0.44% against the yen. This marked a several-day-long rally of the yen, and the change in market sentiment can be attributed to news of upcoming trade negotiations between Washington and Beijing. As global risk appetite grew, the appeal of safe-haven currencies like the JPY diminished.

According to the announcement, US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer are set to meet with Chinese Vice Premier He Lifeng in Switzerland. Bessent’s recent comments that several trade agreements could be announced soon added to the positive momentum, further boosting the USD and lending support to the USD/JPY pair. The US Dollar Index also saw movement on Wednesday, peaking just above 99.600 before declining, and it now hovers near 99.400.

Additionally, the Federal Reserve will disclose its monetary policy stance after its two-day meeting wraps up this Wednesday. For now, the prevailing market expectation is that rates will stay the same.

In contrast, expectations continue to build that the Bank of Japan will continue to implement rate hikes this year. This outlook reflects growing inflationary pressures in Japan and anticipated wage increases that could stimulate consumer spending. Moreover, the BoJ recently stated that it was prepared to widen rates if economic data aligned with its projections. These factors have added complexity to the outlook for the yen. However, geopolitical tensions continued to attract investor attention on Wednesday, and a decline in risk-on sentiment may serve to mitigate the yen’s downward movement.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.