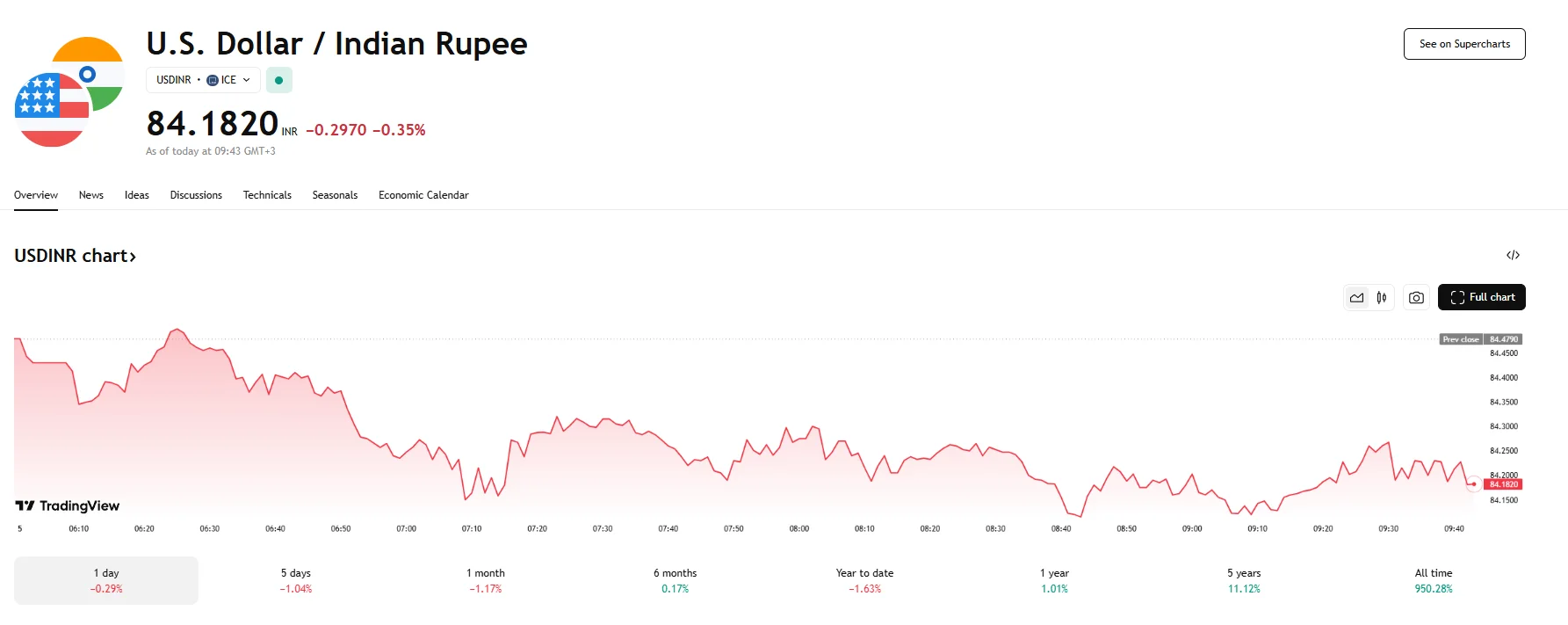

USD/INR Down 0.35% to 84.1820 as Rupee Strengthens Amid Trade Optimism USD/INR Down 0.35% to 84.1820 as Rupee Strengthens Amid Trade Optimism

Key Moments:The Indian Rupee gained on Monday, supported by declining oil prices and improving US-India trade prospects.The USD/INR pair dropped 0.35% to 84.1820, while the US Dollar Index retreated b

Key Moments:

- The Indian Rupee gained on Monday, supported by declining oil prices and improving US-India trade prospects.

- The USD/INR pair dropped 0.35% to 84.1820, while the US Dollar Index retreated by 0.25%.

- Geopolitical tensions between India and Pakistan may limit further appreciation of the Rupee.

INR Boosted by External Support, Faces Geopolitical Risks

The Indian Rupee advanced on Monday, buoyed by favorable developments in trade discussions among Indian and US officials and declining international crude oil prices. As a result, the USD/INR dropped by 0.35% on Monday, reaching 84.1820.

However, last week saw India assert that Islamabad had backed the recent attack against tourists in Kashmir. This was followed by news of Pakistan’s disclosure that it had conducted a surface-to-surface missile training launch with a 450-kilometer range. These escalating tensions between India and Pakistan could restrain further INR gains.

India’s Rupee and Reserves on a Bullish Trajectory

Both the INR and the country’s exchange reserves have climbed recently. During the week concluding on April 25th, India’s foreign exchange reserves saw an increase of $1.983 billion, reaching $688.129 billion. As highlighted by the Reserve Bank of India, this was the eighth in a series of weeks marked by accumulation. This upward momentum is expected to continue, as the RBI is set to purchase bonds totaling 750 billion rupees this week, equivalent to around $8.88 billion.

Given India’s status as the world’s third-largest oil consumer, recent cheaper energy imports have also provided tailwinds for the local currency. In addition, Deloitte has forecasted that India’s economy will expand by 6.6% throughout 2025 and the start of 2026, signaling stable economic momentum that may propel the INR further.

USD Pressured by Mixed Labor Metrics

The USD/INR currency pair remains under pressure, with the US Dollar Index continuing to trade below the 100 mark. Recent economic data has contributed to this trend. April’s US Nonfarm Payrolls rose by 177,000, lower than the revised March figure of 185,000 but higher than the expected 130,000. The unemployment rate stayed steady at 4.2%, while average hourly earnings recorded a year-over-year rise of 3.8%. Labor force participation slightly increased from 62.5% in March to 62.6% in April.

Traders are now awaiting the release of the US ISM Services Purchasing Managers Index (PMI) for April, scheduled for later on Monday. The outcome may influence market sentiment ahead of Wednesday’s Federal Reserve decision, where policymakers are anticipated to maintain interest rates at current levels. In addition, the market’s expectations of the Federal Reserve implementing an interest rate cut in June have almost halved, reaching 37%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.