AUD/USD Up 0.8% to 0.6483 as Australian Commodity Prices Rise 0.4% AUD/USD Up 0.8% to 0.6483 as Australian Commodity Prices Rise 0.4%

Key Moments:Australia’s commodity price index advanced by 0.4% in May.The AUD/USD pair rebounded 0.8% to 0.6483 following last week’s decline.US President Donald Trump is increasing steel and aluminum

Key Moments:

- Australia’s commodity price index advanced by 0.4% in May.

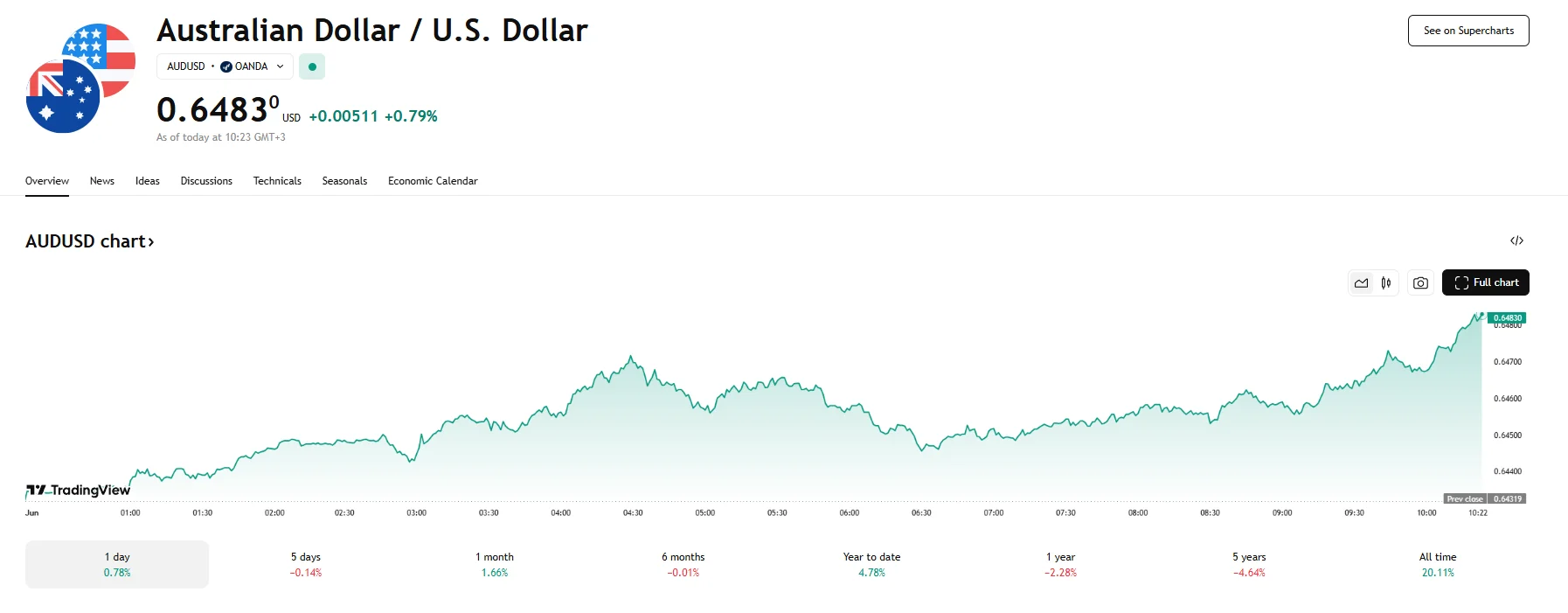

- The AUD/USD pair rebounded 0.8% to 0.6483 following last week’s decline.

- US President Donald Trump is increasing steel and aluminum tariffs to 50%.

Australia’s Commodity Prices Edge Higher

New data from the Reserve Bank of Australia showed that the Index of Commodity Prices increased by 0.4% in May when calculated in special drawing rights (SDR) terms. This served as a partial reversal of April’s 1.8% drop. All three subindices posted gains in May.

However, the data still indicated that over the past twelve months, the index has decreased by 7.7%. Pressure on iron ore and cooking oil was the primary cause. Moreover, when measured in Australian dollar terms, the index declined 1.5% compared to April and 2.9% year-over-year.

AUD/USD Jumps as Tariff News Sparks Volatility

Following the commodity price data’s disclosure, the AUD/USD advanced 0.8% to 0.6483. This jump followed the pair’s 1% retreat the week prior, which was fueled by disappointing domestic indicators and renewed support for the US dollar after President Donald Trump decided to ease trade pressure on Europe.

After markets closed Friday, President Trump announced plans to double tariffs on steel and aluminum imports from 25% to 50% starting Wednesday. This announcement contributed to a fresh bounce in the AUD/USD exchange rate as trading resumed.

In addition to developments on the trade front, the AUD/USD will likely respond to risk sentiment and upcoming US economic indicators. Traders will be monitoring upcoming key US releases, including ISM manufacturing and services PMIs. JOLTS job openings data is also due later this week, while Friday will see the publication of the non-farm payrolls report.

On the domestic side, investors are awaiting the release of the Reserve Bank of Australia’s meeting minutes on Tuesday. These minutes are expected to provide details on the recent policy debate surrounding a potential rate cut of 50 basis points. On Wednesday, the Australian market will also eye data surrounding Australia’s first-quarter GDP.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.