BTC Whale Clash: Wynn’s $826M Long vs. Insider Bro’s $88M Short on Hyperliquid – What Traders Should Know

The cryptocurrency market in 2025 has been a battleground for high-stakes trading, with Bitcoin's price volatility fueling intense speculation. At the forefront of this drama is a gripping long-short

The cryptocurrency market in 2025 has been a battleground for high-stakes trading, with Bitcoin's price volatility fueling intense speculation. At the forefront of this drama is a gripping long-short battle between two prominent figures in the crypto space: James wynn, a well-known whale trader, and an anonymous trader referred to as "Insider Bro" (wallet address: 0x51d99a4022a55cad07a3c958f0600d8bb0b39921). Their high-leverage positions on Bitcoin, executed on the Hyperliquid platform, have captured the attention of the crypto community, sparking heated discussions on X and beyond.

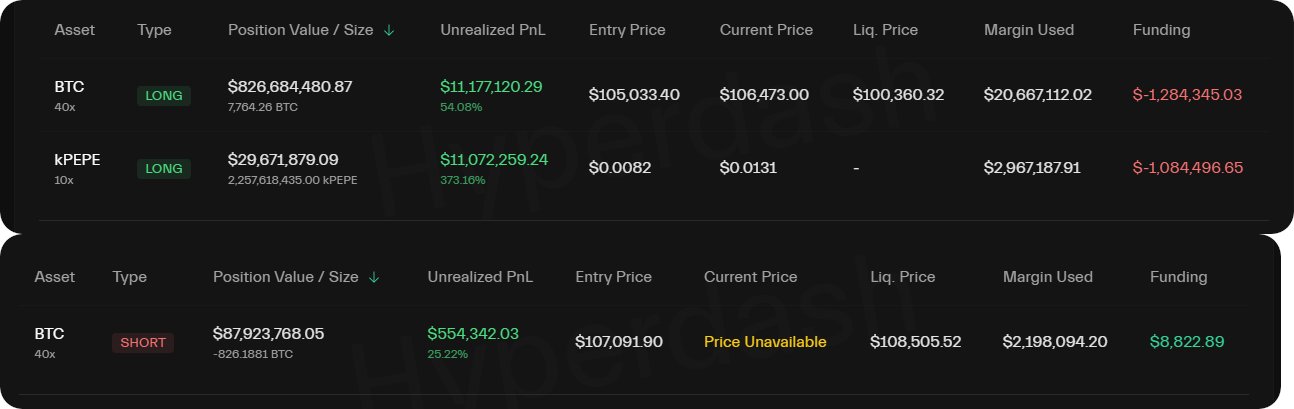

As of May 21, 2025, both traders have taken aggressive positions on Bitcoin using 40x leverage, showcasing their confidence and appetite for risk. Below is a detailed breakdown of their current holdings based on recent posts on X:

James Wynn (Long Position as of press time):

Leverage: 40x

Opening Price: $105,033.40

Liquidation Price: $100,360.32

Unrealized Profit: $11,177,120.29

Position Value: $826,684,480.87

Wynn's massive long position reflects his bullish outlook on Bitcoin, with a current unrealized profit indicating that the market has moved in his favor since opening the trade. His position, valued at over $825 million, underscores his significant capital base and willingness to embrace extreme volatility. However, the liquidation price of $100,370.39 looms as a critical threshold; a drop below this level could wipe out his position, resulting in losses in the hundreds of millions.

Insider Bro (0x51d99a4022a55cad07a3c958f0600d8bb0b39921, Short Position as of press time):

Leverage: 40x

Opening Price: $107,091.90

Liquidation Price: $108,505.52

Unrealized Profit: $554,342.03

Position Value: $87,923,768.05

The anonymous trader, dubbed "Insider Bro," has taken a contrarian stance, betting on a Bitcoin price decline with a 40x leverage short position. Given that Bitcoin's price is currently trading above the opening price of $107,091.90, this position is likely in a state of unrealized loss. The lack of a specified liquidation price adds uncertainty, but a sustained price rally could push the position toward liquidation, potentially costing the trader millions.

Background and Market Context

This high-profile showdown is unfolding against a backdrop of intense Bitcoin price volatility, with the cryptocurrency trading between $100,000 and $110,000 in May 2025. Recent market developments, including sustained institutional inflows, easing geopolitical tensions, and growing adoption by corporations like Metaplanet, have bolstered bullish sentiment. However, concerns about over-leveraged positions and potential regulatory headwinds keep bearish traders like Insider Bro in the game.

_83e4de331747810538546.jpg)

James Wynn, a veteran trader with a history of high-leverage bets, has become a crypto celebrity, boasting nearly 52,000 followers on X and a track record of turning small investments into millions. His previous successes include a $7,000 investment in the meme token PEPE that grew to $25 million, and he has earned $46.5 million on Hyperliquid since March 2025 through aggressive trading in Bitcoin and meme coins like TRUMP and FARTCOIN. Wynn's current strategy involves maintaining large long positions, capitalizing on Bitcoin's upward momentum, and publicly sharing his trades to influence market sentiment and promote Hyperliquid as a preferred exchange.

In contrast, Insider Bro remains an enigma. Identified only by their wallet address, this trader has garnered attention for their bold 40x leverage short position, suggesting access to significant capital and possibly insider knowledge or a contrarian market view. Speculation on X suggests Insider Bro could be a representative of a larger institution or a seasoned trader operating under anonymity to avoid market manipulation accusations. However, without verified information, their motives and background remain speculative.

Strategic Analysis

James Wynn's Long Strategy:

Rationale: Wynn's bullish stance aligns with market optimism driven by institutional adoption and technical indicators suggesting a potential breakout above Bitcoin's all-time high of $109,702.50, recorded on January 20, 2025. His $825 million position, backed by a $14.28 million margin, amplifies potential gains but also risks catastrophic losses if the market turns. Wynn's public updates on X, including his statement that Bitcoin is unlikely to fall below $100,000, aim to reinforce bullish sentiment and possibly deter short sellers.

Risks: The 40x leverage means a mere 2.5% price drop from the opening price could trigger liquidation. With Bitcoin's volatility, events like a surprise regulatory crackdown or a broader market correction could erase his position. Additionally, his high-profile status makes his trades a focal point, potentially attracting counter-trades from bears like Insider Bro.

Market Impact: Wynn's massive long position could create upward pressure on Bitcoin's price, especially if smaller traders follow his lead, amplifying the "herd effect."

Insider Bro's Short Strategy:

Rationale: The short position suggests Insider Bro anticipates a near-term correction, possibly driven by over-leveraged long positions or external factors like macroeconomic shifts or profit-taking after Bitcoin's recent rally. The $107,091.90 opening price indicates they entered the trade at a peak, betting on a pullback.

Risks: With Bitcoin trading above the opening price, Insider Bro's position is under pressure. A continued rally could lead to liquidation, especially given the 40x leverage. The anonymity of the trader limits their ability to influence market sentiment, unlike Wynn's public persona.

Market Impact: A large short position like this could contribute to downward pressure if liquidated, potentially triggering a cascade of sell-offs. However, its current scale is dwarfed by Wynn's long position, limiting its immediate market influence.

Community Sentiment and Market Outlook

The crypto community on X is abuzz with speculation about this duel. Bullish traders support Wynn, citing Bitcoin's strong fundamentals, including ETF inflows and corporate adoption. Bears, aligning with Insider Bro, point to the risks of over-leveraged positions, with Coinglass data indicating that a drop below $93,508 could liquidate $3.64 billion in long positions across exchanges. Neutral observers see this as a test of market resilience, with the outcome hinging on external factors like regulatory news or macroeconomic data.

Wynn's recent moves, such as reducing his position from $570 million to $190 million to lock in $6.57 million in profits before re-entering at $279 million, demonstrate his tactical approach to managing risk while maintaining a bullish outlook. Insider Bro's persistence with the short position, despite current losses, suggests confidence in a potential reversal, though their anonymity makes it harder to gauge their strategy's depth.

Conclusion

The long-short battle between James Wynn and Insider Bro is a microcosm of the high-stakes, high-reward nature of crypto trading. Wynn's $825 million long position, with over $10 million in unrealized profits, positions him as the frontrunner as Bitcoin hovers above $105,000. Meanwhile, Insider Bro's $87,923,768.05 short position faces mounting pressure but could pay off if the market corrects. This duel not only highlights the contrasting strategies of two crypto titans but also underscores the market's volatility and the risks of high-leverage trading. As Bitcoin approaches critical price levels, the crypto world watches closely to see who will emerge victorious—and what it means for the market's next move.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.