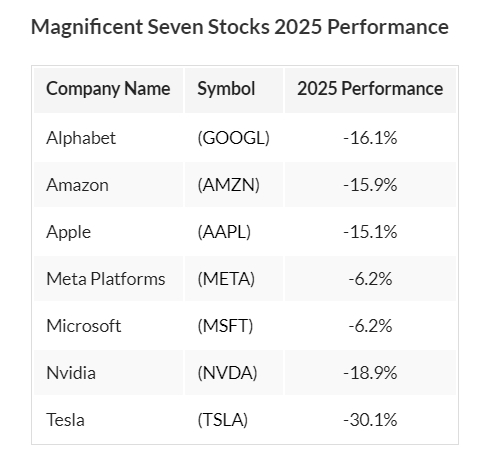

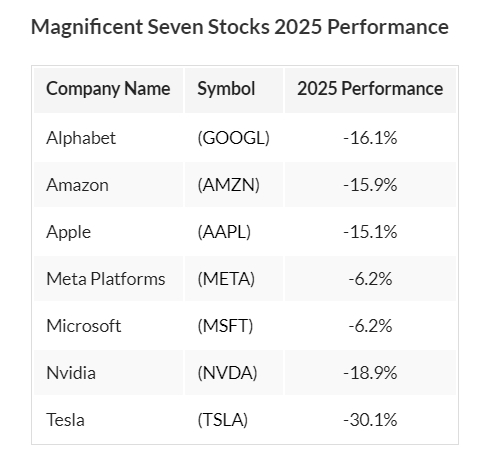

On May 26, after experiencing two "kill valuations", the valuation center of the Magnificent Seven has quietly fallen back to a historical low since 2018.As of May 2025, the premium of this group's forward P/E ratio to other S & P 500 stocks narrowed to 43%, which is in the 30th percentile of the valuation range over the past decade.

On this occasion, well-known investment bank Goldman Sachs released a research report, saying that the current "Big Seven" stocks have shown relative investment value.Although the valuations of these technology giants are not cheap, Goldman Sachs analysis found that compared with other S & P 500 components, the valuations of these technology leaders have fallen back to the most attractive levels in the past six years.

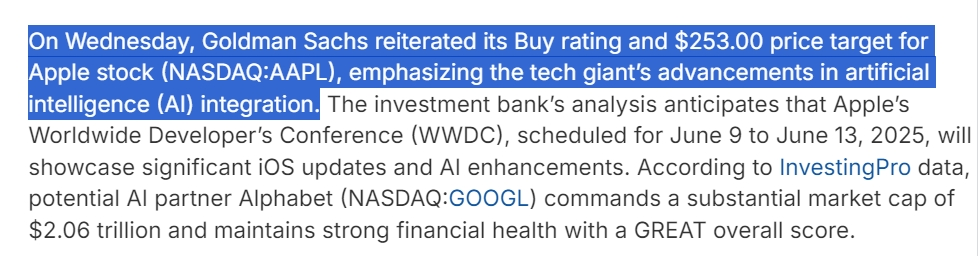

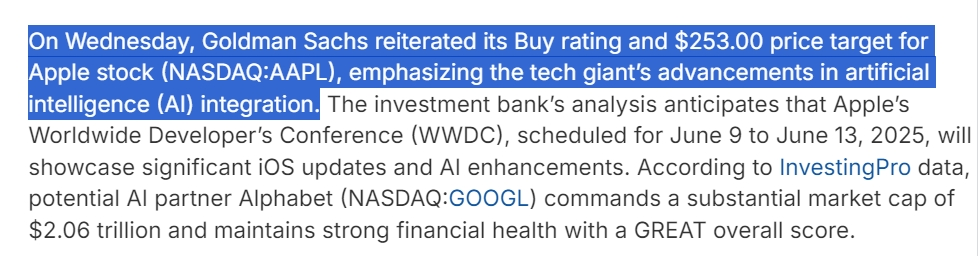

The Goldman Sachs strategy team recently listed Google and Apple as the "most promising targets", giving target growth spaces of 31% and 30% respectively.

From the perspective of industry fundamentals, although the profitability of technology giants is still significantly differentiated-in the first quarter of 2025, the overall profit of the seven giants increased by 28% year-on-year, far from the growth rate of 9% in the Super-Standard 500 Index, the internal growth engine has shifted from the past."All employees carnival" has shifted to "the strong always be strong."

Google Demonstrates Business Resilience Apple Power Ecosystem Iteration

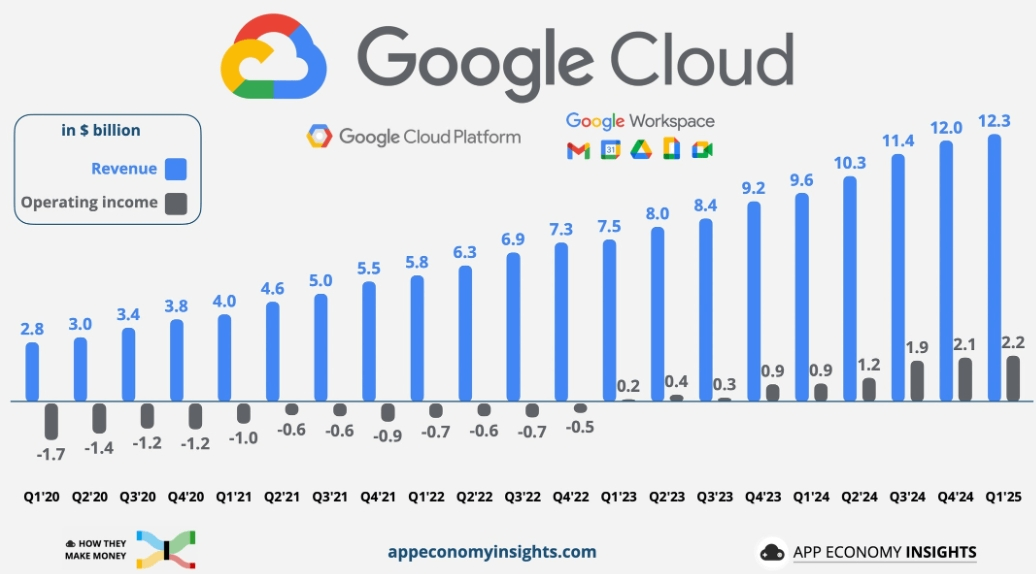

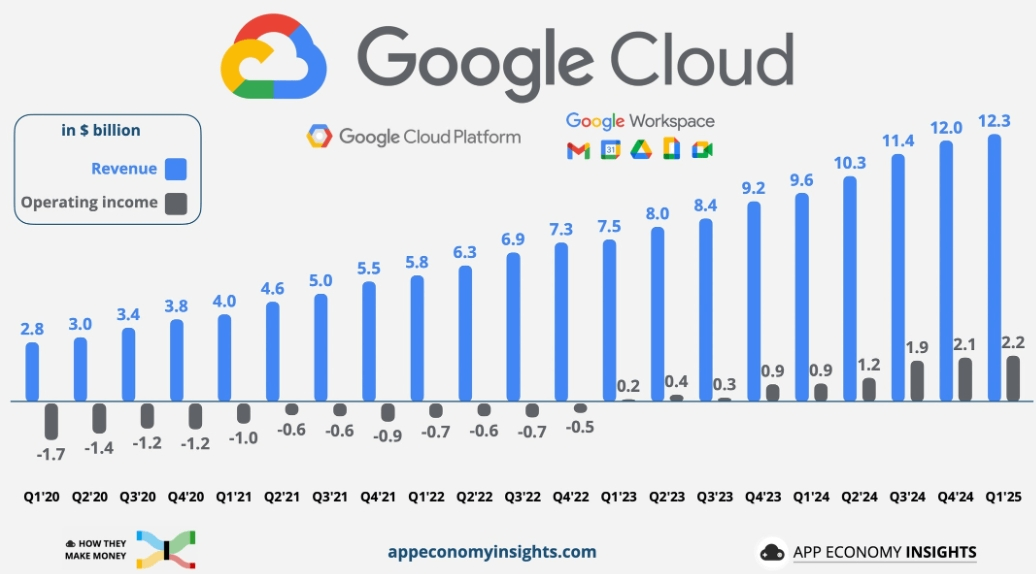

Google has shown rare business resilience in this competition: Despite facing allegations from the U.S. Department of Justice of monopolizing digital advertising, its cloud business revenue has increased by 28% year-on-year, and quarterly revenue of $12.3 billion has approached Microsoft Azure 2019. level.

What is more noteworthy is that Google Cloud's share of the generative AI infrastructure market is increasing at a rate of 3 percentage points per year. The energy efficiency of its customized TPU v5 chips in large language model training scenarios is 15-20% compared to competitors.This technical barrier is translating into business returns-42% of the Global Fortune 500 companies have adopted the Gemini model for marketing content generation, driving a 19% increase in single-customer revenue from Google's advertising business.

Apple's reshaping of valuation relies more on the self-evolution capabilities of its ecosystem.

Against the background of hardware sales growth slowing to 2%, the services business supported growth with a year-on-year growth of 12%. Quarterly revenue of US$26.6 billion not only hit a record high, but also pushed the gross profit margin to 72.4%. The peak of the industry.This evolution of business model echoes the "flywheel strategy" proposed by Cook five years ago: Through a super portal built by 1.7 billion active devices, Apple is transforming payment, streaming media, advertising and other service formats into continuous monetization."digital pipeline".

What is worth noting is the disturbance caused by geopolitical variables-if the Trump administration's proposed policy of imposing a 25% tariff on non-U.S. -made iPhones is implemented, it may reduce Apple's net profit by 4.2% in 2025, which may explain why its supply chain has accelerated its migration to India, Vietnam and other places in recent months.

Under the dual variations of technological disruption and regulatory games, investors need to re-understand the valuation coordinate system of technology giants.Traditional PE indicators are being replaced by a new paradigm of "computing power density × data value"-38% of Google's daily search queries have integrated AI-generated content, and its new generation multimodal model Gemini 2.5 will increase advertising click-through rate prediction accuracy by 27 percentage points.This deep integration of AI and core business has reduced the marginal customer acquisition cost of Google's digital advertising to its lowest level since 2019.

On the other hand, Apple's quietly deployed end-side AI strategy has begun to show results: the iPhone 16 series equipped with a neural engine supports localized model computing with a scale of 20 billion parameters, which not only alleviates user privacy concerns, but also opens up new charges in addition to device premiums. Charging scenarios.

Under regulatory pressure, the market focuses on growth certainty

The focus of divergence in capital markets is the art of balancing growth certainty and policy risk.

The antitrust lawsuit facing Google may force it to pay a fine equivalent to 5% of annual revenue, but the more far-reaching impact is the forced opening of the advertising technology stack. If the bundled sales model of DSP (demand-side platform) and SSP (supply-side platform) is dismantled, Google's share of the programmatic advertising market may lose 12-15%.In contrast, Apple's regulatory pressure comes more from the global digital services tax game, but its dual revenue structure of hardware + services provides a natural risk hedging.

It is worth noting that the two companies have unanimously increased investment in R & D: Google will increase its 2025 capital expenditure budget to US$48 billion, focusing on the construction of AI data centers; Apple plans to invest US$70 billion in the next three years. Self-developed chips and quantum computing technology.

From an asset allocation perspective, tech giants 'valuation corrections are creating rare "batting ranges."

Bloomberg industry research data shows that the free cash flow yield of the Big Seven has climbed to 4.2%, 1.5 standard deviations higher than the ten-year average. This cash generation ability is particularly valuable in an environment of high and volatile interest rates.For long-term investors, the current valuation depression may be an excellent window for laying out the next generation of technology-whether it is Google's 2000 patent reserve in the field of quantum computing or Apple's upcoming non-invasive blood sugar monitoring technology is reshaping the value coordinate system of the technology industry.

Faced with such a situation, how should ordinary investors participate in the market?

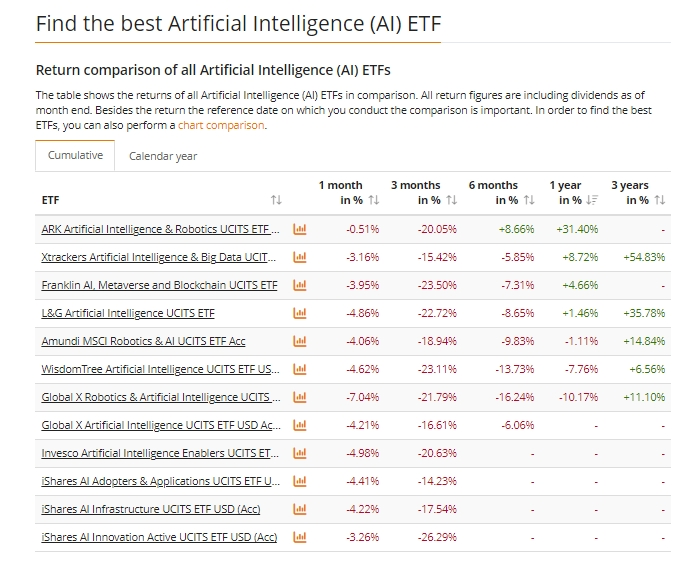

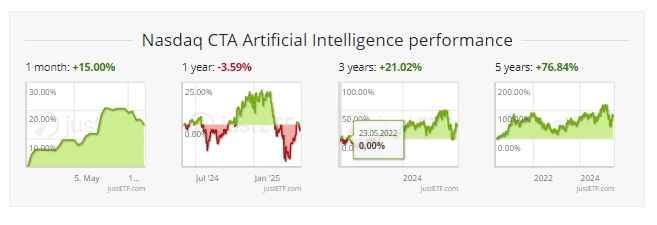

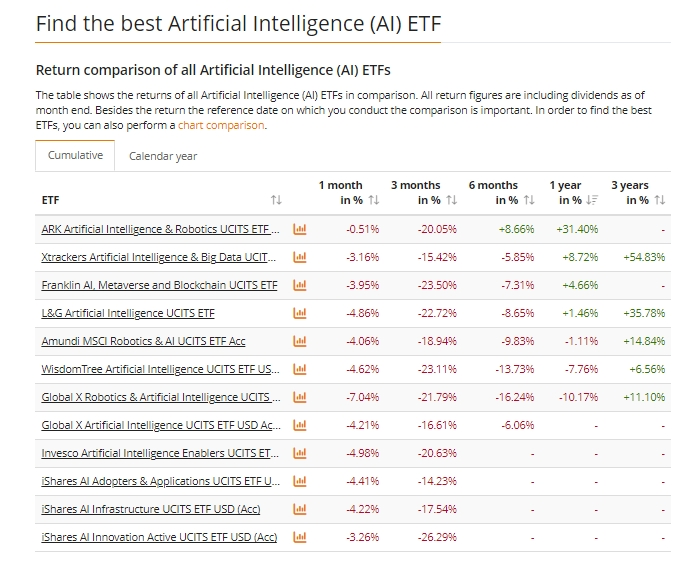

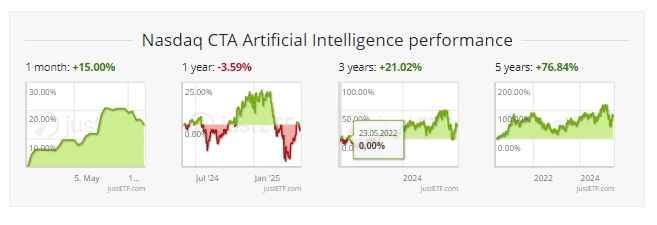

The stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc. The capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

Consider artificial intelligence-related ETF products.

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

I wish you all a smooth investment ~