U.S. Court Blocks Trump’s Liberation Day Tariffs, Markets Rally in Response

In a landmark decision, a U.S. trade court on Wednesday blocked Trump’s ambitious "Liberation Day" tariff plan, ruling that the president exceeded his authority by imposing sweeping duties on imports

In a landmark decision, a U.S. trade court on Wednesday blocked Trump’s ambitious "Liberation Day" tariff plan, ruling that the president exceeded his authority by imposing sweeping duties on imports from countries with trade surpluses with the United States.

The ruling, delivered by the Manhattan-based Court of International Trade, has triggered a significant market rally, with oil prices, stock futures, and the U.S. dollar surging as investors breathed a sigh of relief.

U.S. Court Blocks Trump’s Sweeping Tariffs, Citing Overreach of Authority

The Court of International Trade’s three-judge panel ruled that Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose a 10% across-the-board tariff—along with steeper rates for nations like China—was unconstitutional.

The court emphasized that the U.S. Constitution grants Congress exclusive authority to regulate commerce with foreign nations, a power not superseded by the president’s emergency economic authority under IEEPA.

“The court does not pass upon the wisdom or likely effectiveness of the President’s use of tariffs as leverage. That use is impermissible not because it is unwise or ineffective, but because [federal law] does not allow it,” the panel stated in its decision.

The ruling stemmed from two lawsuits: one filed by the Liberty Justice Center on behalf of five small U.S. businesses—including a New York wine and spirits importer and a Virginia-based educational kit manufacturer—and another by 13 U.S. states. These plaintiffs argued that the tariffs would devastate their operations and the broader economy.

Trump’s tariff plan, announced on April 2, aimed to address the U.S. trade deficit by targeting nations that export more to the U.S. than they import. The administration invoked IEEPA, a law traditionally used to impose sanctions or freeze assets during national emergencies, marking the first time a U.S. president has leveraged it to justify tariffs. However, the court rejected this interpretation, prompting the Trump administration to file a notice of appeal within minutes of the ruling.

White House Deputy Chief of Staff Stephen Miller decried the decision on social media, labeling it a “judicial coup.” In contrast, Oregon Attorney General Dan rayfield, whose office is leading the states’ lawsuit, hailed the ruling as a victory for legal and economic stability. “This ruling reaffirms that our laws matter, and that trade decisions can’t be made on the president’s whim,” Rayfield said. At least five additional legal challenges to the tariffs remain pending, signaling ongoing uncertainty.

Oil Extends Gains, Stock Futures Jump, Dollar Strengthens After Ruling

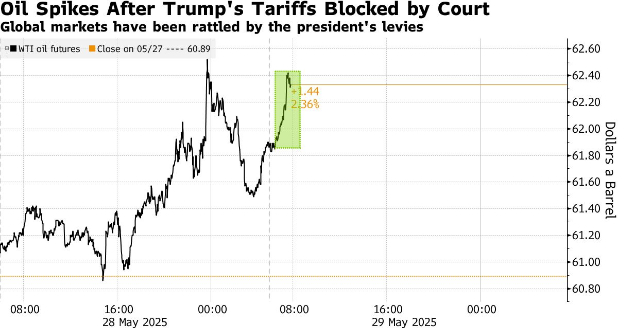

The court’s decision sent shockwaves through global financial markets, driving a swift and positive reaction. Oil prices surged, with West Texas Intermediate (WTI) climbing above $62 per barrel after a 1.6% gain in the prior session, and Brent crude closing near $65. The tariffs had loomed over oil markets since mid-January, raising fears of an economic slowdown exacerbated by increased OPEC+ production. The ruling lifted this pressure, boosting optimism among traders. Meanwhile, U.S. crude stockpiles dropped by 4.2 million barrels last week, according to the American Petroleum Institute, with official data due Thursday.

Stock futures also soared, with S&P 500 contracts rising 1.4% and Nasdaq 100 contracts gaining 1.7%. The rally was also bolstered by Nvidia Corp.’s shares, which jumped over 5% in post-market trading after a robust revenue forecast. The U.S. dollar strengthened against safe-haven currencies like the Swiss franc and Japanese yen, while spot gold prices dipped to around $3,262, down more than 0.7%. Asian markets followed suit, with equities in Japan and South Korea advancing at the open.

Trump’s on-again, off-again tariff policy had unsettled markets since its April announcement, sparking a “Sell America” trade as investors braced for disrupted global growth. Subsequent pauses and negotiations, including a 90-day tariff reduction agreement with China on May 12, had begun to stabilize sentiment. The court’s ruling further alleviated concerns, pushing the MSCI All Countries World Index closer to a record high.

Uncertainty Persists Amid Appeal

While the ruling marks a significant setback for Trump’s trade agenda, the administration’s appeal could prolong the uncertainty. Rodrigo Catril, a strategist at National Australia Bank, cautioned, “More details are needed—particularly whether there’s an injunction or if tariffs remain in place during the appeal process. The administration may have enough authority to bypass the ruling on alternative grounds.” The case could escalate to the U.S. Supreme Court, with far-reaching implications for executive power and U.S. trade policy.

For now, markets are savoring the reprieve. However, investors should remain cautious as the legal and political battle over Trump’s Liberation Day tariffs unfolds.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.