AUDUSD Technical Analysis – The pair continues to mostly range

Fundamental Overview . . The USD hasn’t done much since the FOMC decision as the market awaits something new to push into either direction.

FundamentalOverview

The USD hasn’t done muchsince the FOMC decision as the market awaits something new to push into eitherdirection. The Fed delivered on expectations with no surprises whatsoever. Thecentral bank kept rates steady, reduced the QT pace, revised growth lower andinflation higher, and kept the dot plot mostly unchanged.

Fed Chair Powellacknowledged the current uncertainty around Trump’s policies and the inflationoutlook but confirmed that the economy remains healthy, and the Fed is in agood position to wait for more clarity.

The only noteworthy commentwas the dismissal of the rise in the long-term inflation expectations in theUniversity of Michigan Consumer Sentiment survey as he labelled it as anoutlier given that other metrics show long term expectations stable or even slightlylower.

On the AUD side, the AustralianEmployment report today was much weaker than expected and weighed on theAussie Dollar. The market pricing didn’t change much though as the marketcontinues to expect around 64 bps of easing by year end compared to 60 bps beforethe data.

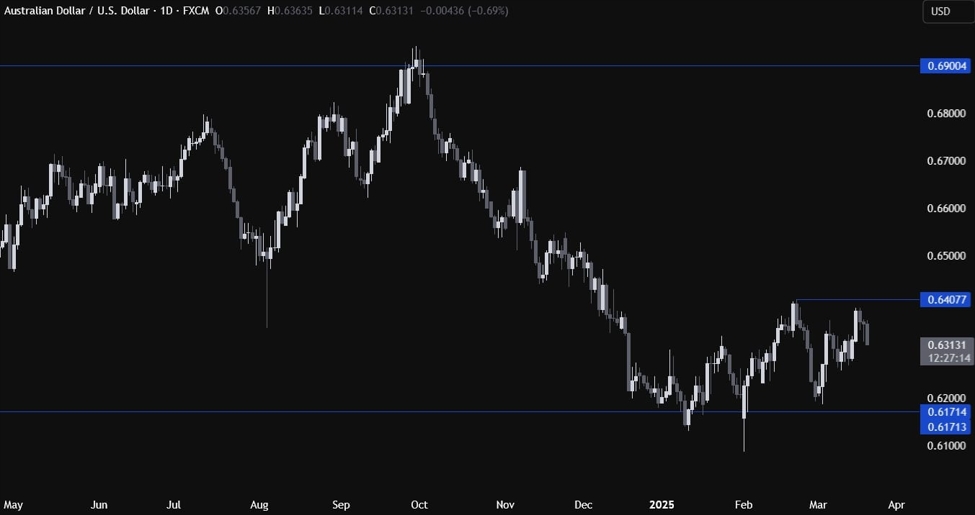

AUDUSDTechnical Analysis – Daily Timeframe

On the daily chart, we cansee that AUDUSD couldn’t extend the recent rally above the 0.64 handle. Thebuyers will want to see the price breaking to a new high to start targeting the0.65 handle next. For now, there’s not much we can glean from this timeframe asthe pair continues to mostly range.

AUDUSD TechnicalAnalysis – 4 hour Timeframe

On the 4 hour chart, we cansee that we had an upward trendlinedefining the bullish momentum. As the price broke below the trendline, thesellers piled in for a drop into the 0.6270 level. The buyers, on the otherhand, will look to buy the dip around the 0.6270 level with a defined riskbelow the level to position for a rally into the 0.65 handle next.

AUDUSD TechnicalAnalysis – 1 hour Timeframe

On the 1 hour chart, we cansee that we have a minor downward trendline defining the current pullback intothe 0.6270 support zone. If the price rallies into the trendline, we can expectthe sellers to lean on it to position for the drop into the 0.6270 support witha better risk to reward setup. The buyers, on the other hand, will look for abreak higher to start targeting new highs. The red lines define the average daily range for today.

Upcoming Catalysts

Today we get the latest US Jobless Claimsfigures.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.